Section 5: Creating a volunteer development

Volunteer Development

Strategy

A strategy template to support a credit union and its

nominating committee in attracting suitable volunteers

Disclaimer

This document does not represent legal advice or purport to be a legal interpretation of legislation or standard rules.

Whilst every effort is made to ensure the information is accurate, responsibility cannot be accepted for any liability

incurred or loss suffered as a consequence of relying on any material published herein. Appropriate professional advice

should be taken before acting or refraining to act on the basis of this document.

© Irish League of Credit Unions. No part of this document may be copied without written permission from the Irish

League of Credit Unions.

The Irish League of Credit Unions

Contents

INTRODUCTION..................................................................................................................... 3

SECTION 1: STRATEGY OVERVIEW .............................................................................................. 4

Volunteer development checklist ........................................................................................... 5

SECTION 2: THE KEY ROLE OF THE NOMINATING COMMITTEE............................................................ 6

The core responsibilities of the nominating committee......................................................... 6

Issues facing the nominating committee ................................................................................ 7

SECTION 3: CREATING THE RIGHT ENVIRONMENT FOR NEW VOLUNTEERS .......................................... 11

Send out the right message .................................................................................................. 11

Long-term vs. short-term approach...................................................................................... 12

Volunteer policy .................................................................................................................... 13

Volunteer support ................................................................................................................. 13

SECTION 4: RECRUITING POTENTIAL VOLUNTEERS ........................................................................ 14

Member survey ..................................................................................................................... 14

Volunteer information booklet ............................................................................................. 14

Utilising volunteer centres .................................................................................................... 16

Boardmatch Ireland .............................................................................................................. 17

Community liaison officer ..................................................................................................... 18

Youth officer & youth committee ......................................................................................... 18

Third-level education & training institutions ........................................................................ 19

Other media resources ......................................................................................................... 19

SECTION 5: CREATING A VOLUNTEER DEVELOPMENT STRATEGY ....................................................... 20

Step 1: Develop internal structures ...................................................................................... 20

Step 2: Identify suitable members for volunteer positions .................................................. 21

Step 3: Selecting volunteers.................................................................................................. 22

Step 4: Election & induction of volunteers ........................................................................... 22

Step 5: Ongoing monitoring of volunteer performance and future vacancies..................... 23

Conclusion ............................................................................................................................. 23

APPENDIX A: SAMPLE EXTRACT OF ANYTOWN CREDIT UNION’S VOLUNTEER DEVELOPMENT STRATEGY .... 24

Background ........................................................................................................................... 24

Anytown CU Volunteer Development Strategy 2008 - 2012 (extract) ................................. 24

Anytown Credit Union Task Schedule 2008 .......................................................................... 26

2|Page

April 2008

The Irish League of Credit Unions

Introduction

The credit union movement is built upon the efforts of thousands of volunteers who give freely of

their time and skills to their credit unions in the spirit of cooperation. Every volunteer can

remember the transition from member to volunteer. It is this transition that is the key to the

future success of the credit union movement.

Each credit union has a team of volunteers with the skills and knowledge to lead and manage that

credit union. It is vitally important that these skills are passed on to new volunteers so that credit

unions continue to develop. The nominating committees must bring in skilled and experienced

individuals so that the good work of directors, supervisors and committees can be continued

through new volunteers.

This strategy template aims to assist credit unions in safeguarding their future by ensuring that

quality volunteers are lined up to succeed those that are ready to step down. This task is the

responsibility of the whole credit union and should have a proactive nominating committee at its

core.

Due to changes in society in recent times, it has become increasingly difficult to encourage

members to volunteer in the credit union. In order to attract quality volunteers, the nominating

committee must be operating 12 months of the year. The board of directors must develop a

coherent long-term strategy to develop volunteering in their credit union. Most of all the credit

union must move away from the “nominations from the floor” approach, as it is no longer a

viable means of volunteer recruitment.

The strategy outlined in this document will require planning and effort. Every year that the credit

union proactively addresses the recruitment of new volunteers, the easier the process will

become. For every quality volunteer that is brought onto a committee or board, the stronger the

credit union will be.

April 2008

3|Page

The Irish League of Credit Unions

Section 1: Strategy overview

The strategy template aims to give the nominating committee and board of directors in a credit

union a step by step approach to attracting a greater quantity and quality of volunteers in the

credit union. This can only be achieved by developing a long-term strategy which includes several

recruitment methods. The nominating committee must be active for the full 12 months leading

up to the credit union AGM. Ultimately the credit union should aim to have a number of suitable

members nominated for each director and supervisor position which exceeds the number of

vacant positions. Committees such as the membership committee, the credit committee, the

marketing committee, the planning & development committee, the nominating committee and

the IT committee should consist of a number of non-director volunteers.

The strategy for attracting volunteers involves five steps:

4|Page

April 2008

The Irish League of Credit Unions

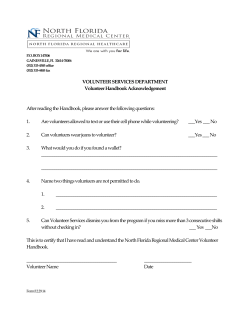

Volunteer development checklist

In developing and implementing this strategy the credit union should consider the following:

Internal issues

1. Do we have an up-to-date volunteer

policy?

2. Is the nominating committee operating 12

months of the year?

3. Do we have an induction programme

for new volunteers?

4. Do we have a succession plan for the credit

union?

5. Does the credit union regularly rotate

committee positions amongst

volunteers?

6. Are we committed to introducing nondirector volunteers to committee

positions?

Developing the strategy

1. Have we set goals for this strategy?

2. Is the strategy achievable in the timeframe

set?

3. Are all involved personnel and

committees named in the strategy?

4. Have we set out a task schedule for the

coming year?

5. Do we have a clear communication

structure detailed in the strategy?

6. Are all relevant personnel agreed on the

strategy?

Recruiting volunteers

1. Have we produced a volunteer

information booklet?

2. Is the Community Liaison Officer

promoting volunteerism in our common

bond?

3. Have we conducted a member

survey?

4. Do we provide information on volunteer

positions on our website?

5. Have we registered with our local

volunteering centre?

6. Is there a designated person to maintain

communication with those members

interested in volunteering?

Selecting and electing volunteers

1. Do we provide our members with a

choice of candidates at the AGM?

2. Is a meeting held with all potential

volunteers before they take on their role?

3. Are all new volunteers given adequate

training and support to help them in

their new role?

4. Are all volunteers given an opportunity to

agree a personal development plan?

April 2008

5|Page

The Irish League of Credit Unions

Section 2: The key role of the nominating

committee

The core responsibilities of the nominating committee

The nominating committee is appointed by the board of directors of the Credit Union at the first

regular meeting following the Annual General Meeting (AGM). Thus, they are answerable to the

board of directors.

“The board of directors shall, at least 30 days prior to each annual general meeting,

appoint a nominating committee of three members of the credit union who shall ensure

that there is at least one candidate for each vacancy for which an election is being held.”

{Standard Rules for Credit Unions (NI) Rule 73}

“The Nominating Committee shall consist of three members, at least one of whom shall

be a director.”

{Standard Rules for Credit Unions (ROI) Rule 136 (2)}

“The nominating committee shall ensure at least one candidate for each vacancy for

which an election is to be held at the subsequent annual general meeting.”

{Standard Rules for Credit Unions (ROI) Rule 136 (3)}

Although directors are usually elected only once a year at the annual general meeting, planning

for the board's succession is actually a year round activity. By approaching board and supervisor

recruitment in a systematic, proactive manner, the board will avoid scrambling for new members

at the last minute, and will ensure that all the necessary skills, backgrounds, knowledge and

perspectives are represented on the board of directors and committees. The nominating

committee and board of directors need to tap all of the resources they can in identifying and

recruiting the best candidates available to serve on the board of directors and supervisory

committee.

The primary function of any nominating committee is to provide suitable candidates for director

and supervisor positions within the credit union. In doing this, the nominating committee is in a

position to identify members who may also be suitable for a committee position within the credit

union. A proactive nominating committee should facilitate the recruitment of such volunteers in

cooperation with the board of directors and ensure a training plan is drawn up and implemented

to ensure the necessary skills are gained by the new candidate.

6|Page

April 2008

The Irish League of Credit Unions

Issues facing the nominating committee

Volunteerism in modern Ireland and Northern Ireland

It is now commonly accepted within the credit union movement that it is becoming increasingly

difficult to attract volunteers to participate in the operation of a credit union. This is due to a

number of factors, including:

•

the increased time pressures associated with modern life

•

an increased number of charities and volunteer organisation looking for people to

volunteer their time

•

the increasing complexity of the director and supervisor roles within credit unions due to

extensive regulatory pressures

•

a shift in how credit unions are perceived by members in their common bond, and

•

social and demographic changes within communities.

It would be a mistake to assume that volunteerism is in decline amongst credit union members.

Many people are currently contributing their time and skills through a number of volunteer

organisations. The credit union movement in Ireland and Northern Ireland currently has 9,250

volunteers. The National Census for the Republic of Ireland, conducted in 2006, found that 1 in 6

(500,000) Irish adults volunteer on a full-time or part-time basis. The majority of these people are

middle aged and 25% of volunteers come from professional or managerial occupations.

An individual can develop both personally and professionally by volunteering as well as benefiting

from social interaction with other volunteers. In credit unions, the membership base offers a

large pool of potential volunteers with whom the credit union is in regular contact. This presents

the perfect environment for the proactive recruitment of volunteers.

Succession planning

Credit unions have built up a wealth of talented and experienced volunteers. They are the

backbone of the credit union. It is vital that credit unions are in a position to replace this talent

and experience when directors, supervisors and volunteers decide to step down.

Ultimately the members decide those who should occupy the director and supervisor positions.

At AGM the nominating committee should have a list of experienced volunteers to choose from.

The members can then make the decision as to whether to choose these nominated individuals

or other credit union members. It is important that the members have this choice.

The nominating committee must ensure that there is a suitable pool of potential volunteers ready

to move into a vacant role when it becomes available. This requires the board of directors to

develop a long-term strategy which puts defined processes in place for the identification,

recruitment, selection, induction and education of suitable members. The benefit of this

approach is that it relieves the pressure on existing volunteers and the credit union to retain

directors and supervisors.

April 2008

7|Page

The Irish League of Credit Unions

The governance issue

A “closed-shop” credit union

Fig 1.1: Credit Union Governance Model A

The governance model detailed in Fig.1.1 represents a “closed-shop” credit union, one which has

committees which consist entirely of directors. This approach creates a number of governance

issues for the credit union. Primarily the board of directors are simply reporting to themselves via

their respective committees.

In addition to this a number of other governance issues are raised by a closed-shop governance

model. Three scenarios to illustrate such issues are described below.

Governance Scenario A

The treasurer of Anytown Credit Union sits on three of the credit union committees –

the nominating committee, the marketing committee and the P&D committee. Every

month she is required to attend three committee meetings, a board meeting and an

executive board meeting. In addition to these meetings the treasurer must regularly

meet the credit union manager and be available for ILCU events.

Analysis: The time pressures imposed by the committees are taking their toll on the

treasurer. Despite the many long hours of credit union work, she is so busy with

committee reports that she does not have time to complete the treasurer’s report. On

several occasions she could not be present at the board meeting as other Anytown Credit

Union business had eroded her available time. Personally the treasurer feels that she is

not able to give 100% to this key credit union role as they are often pre-occupied with

urgent committee business.

8|Page

April 2008

The Irish League of Credit Unions

Governance Scenario B

Due to a low number of volunteers in Anytown Credit Union, the chairperson of the board

of directors holds four committee posts including the credit committee and membership

committee. The board of directors make decisions at their monthly board meetings based

on recommendations from committee reports. These decisions are decided democratically

through a vote which regularly result in a tied vote. In these instances the chairperson must

use their casting vote to make a final decision.

Analysis: One of the key functions of the chairperson position is to use their casting vote to

resolve tied votes at board meetings. As this chairperson sits on so many committees in

Anytown Credit Union, they are likely to be using a casting vote on decisions relating to

committees that they work on. It is most likely that they will vote in favour of their

committee recommendation which presents a governance issue.

Governance Scenario C

A new director has been appointed to the Board of Directors in Anytown Credit Union. A

long time member, he was approached at the last AGM to fill a vacant board position

and since this has also taken up two committee positions to make up numbers. At the

last board meeting he expressed concerns regarding his lack of credit union experience

as it is affecting his ability to make informed decisions during board and committee

meetings. He is a secondary school teacher, with no previous experience of working in a

credit union or in the financial services sector. Since he started several issues have arisen

in the area of lending, money laundering, data protection, membership and human

resources which required him to vote. He has felt uncomfortable voting on these

matters as he feels he is making uninformed decisions.

Analysis: Anytown Credit Union are encountering a common problem of credit unions

that take on new directors with very little previous experience of working in a credit

union. Due to increased regulatory control over the financial service sector, the

responsibilities of directors in credit unions have never been greater. It can be difficult for

new directors to operate effectively in their first few months, thus putting them in a

compromising position when having to vote on committee and board matters. If

volunteers sit on committees before moving up to board level, this pressure is greatly

reduced. It will also give volunteers an opportunity to attend relevant training and

education such as the Advance Certificate in Credit Union Practice (ACCUP).

April 2008

9|Page

The Irish League of Credit Unions

An “open-shop” credit union

Fig. 1.2: Credit Union Governance Model B

The governance structure in Fig. 1.2 represents a more effective committee structure. Each

committee consists of a mixture of directors, non-director volunteers and staff. The credit union

benefits from having non-directors involved at committee level. This increases the independence

of each committee and also reduces the workload of directors allowing them more time to focus

on strategic issues at board level. In addition to this, the volunteers working in committees gain

experience and knowledge which will greatly assist them if they move into a director role in the

future. The directors can still maintain a majority director presence on certain key committees.

In order to create a similar structure to the one illustrated in Fig. 1.2, the credit union must create

a long-term strategy for the proactive recruitment and selection of volunteers. This may include

the setting up of a youth committee. Once this strategy is agreed, the credit union and

nominating committee have a clear direction and plan for the future. Creating such a strategy is

covered in the section five of this document.

10 | P a g e

April 2008

The Irish League of Credit Unions

Section 3: Creating the right environment for

new volunteers

One of the first issues that face the credit union is that there may be a perception from some

existing volunteers that their own position in the credit union is in jeopardy if new volunteers

come on board. Others may be reluctant to rotate to a particular committee or move into a

different role within the credit union.

In reality this perception could not be further from the truth. New volunteers offer the

opportunity for others to reduce the number of committees that they sit on, so that they can

focus on their primary role within the credit union as a director or supervisor. Also, the increased

number of volunteers will allow the rotation of committees which will offer individuals a more

varied and challenging experience during their term with the credit union. Ultimately new

volunteers will bring fresh ideas, new approaches and flexibility which will benefit all those

involved in the credit union. The board of directors and committees should be representative of

their membership; this allows more informed decision making which is based on actual rather

than perceived needs.

It is recommended that all volunteers and possibly some key staff members sit down and discuss

any issues that individuals may have with implementing a proactive volunteer recruitment

strategy. This should offer all volunteers an opportunity to voice any concerns and have them

dealt with at the meeting. This may seem unnecessary at first, however, it is vital to the success of

the strategy. The board of directors and nominating committee must have the full support and

cooperation of the credit union when the time comes to recruiting new volunteers.

Send out the right message

While your credit union may be very keen to introduce new volunteers, the majority of members

may be completely unaware that they can volunteer. There are hundreds (if not thousands) of

members in the common bond who have relevant skills that could benefit the credit union. The

only problem is that they have never been asked to volunteer!

It is important that all existing volunteers and staff are promoting the benefits of volunteering

when they are in contact with a member. They must show that the credit union welcomes new

ideas and new volunteers. Section four of this document provides a number of methods for

promoting the credit union to potential volunteers.

The way in which volunteering is “sold” to members will have a significant impact on the number

of interested members you attract. Many studies in Ireland and the UK have shown that while

“giving something back to the community” is one of the main reason for volunteering, it is not the

primary reason. Often the primary reason for volunteering is “personal and professional

development”.

April 2008

11 | P a g e

The Irish League of Credit Unions

Volunteering in a credit union provides an individual with great opportunities to work at a high

level in a professional environment in the financial services sector, which is one of the most

dynamic in the economy. Many people would be very willing to volunteer their time if they were

informed that they would gain such quality experience.

Credit unions often approach members to volunteer because they are “stuck” for numbers. The

nominating committee should carry out a skills-needs-analysis to establish the quality of the skills

required by the volunteers to be effective and actively recruit the individuals with these skills and

experience. Anecdotal evidence shows that once these members become volunteers, they are

surprised at the positive experience that they have, and the nominating committee should be

using these positive experiences and other benefits as the basis to “sell” the idea of volunteering

in a credit union.

Long-term vs. short-term approach

In the past, there has been a tendency to have members of credit unions elected directly onto the

board of directors or supervisory committee. This may be due to pressure to fill vacancies in the

week leading up to an AGM. If a credit union wants to become more effective in its recruitment

of volunteers, a more long-term strategy for recruiting and inducting volunteers should be

adopted.

The credit union committees offer an excellent starting point for new volunteers. These

committees provide experience, learning and an active role within the credit union. The learning

curve of this role is not as steep as that of a director or supervisor position and also the initial

time commitment is not as onerous for new volunteers. It is much easier to “sell” a committee

position to a potential volunteer than it is a director or supervisor position.

A volunteer can be appointed to a committee position at any stage during the year, providing the

ILCU (and Financial Regulator in the Republic of Ireland) are notified within 14 days of the

appointment.1

Once the volunteer has served the credit union at committee level for a period of time, and

training needs have been identified and addressed, they can move into a director or supervisor

position. This will result in more volunteers in situ in the credit union over the long-term, leading

to more experienced directors and supervisors. It will also facilitate the rotation of positions at

committee and board level. Ultimately the credit union should aim to consistently have more

nominees than vacant positions for the board of directors and supervisory committee, at their

AGM. This benefits both the credit union and the development of the volunteers.

The nominating committee should work closely with the board of directors to create a cohesive

strategy that recruits members to the various committee positions. The nominating committee

can then monitor the progress of these volunteers and work with them to facilitate their

movement into a director or supervisor role.

1

Standard Rules for Credit Unions (ROI) Rule 89 (4); Standard Rules for Credit Unions (NI) Rule 55

12 | P a g e

April 2008

The Irish League of Credit Unions

Volunteer policy

“Volunteers who have a positive experience will share this with friends, as do

unhappy volunteers.....”

Volunteer Centres Ireland

It is important for every credit union to have a comprehensive and up-to-date volunteer policy.

The policy protects both the volunteer and credit union as it defines the parameters in which

volunteers operate. Volunteer rights, responsibilities, development and support should be

covered in the policy. A good policy becomes the fundamental protection for a credit union if a

disciplinary or conflict issue arises. A copy of the guidelines for producing a volunteer policy,

produced by the ILCU Human Resources Department, is available in the Human Resources section

of the ILCU website – www.creditunion.ie

The development of the volunteer policy does not fall within the direct remit of the nominating

committee. However, it is important that the committee take the initiative and liaise with the

board to ensure that the policy exists and is up to date. A volunteer will be more likely to have a

positive experience with the credit union if clarity exists on their rights and responsibilities from

the start of their relationship with the credit union.

Volunteer support

The performance of a volunteer is enhanced if they are given the proper developmental supports.

It is all too common for a new director or supervisor to spend the first years of their term with no

role specific training. A proactive credit union training officer will ensure that all new volunteers

are provided with adequate induction and development training. If potential volunteers are

aware that training will be provided, they will be more confident about the prospect of taking on

a credit union role.

Experienced volunteers should make themselves available to provide mentoring and advice to

new volunteers. It is recommended that the credit union board identifies an appropriate mentor

who is responsible for answering any queries that the new volunteer may have. This should be an

experienced director who is willing to make himself/herself available. The mentor can meet with

the volunteer outside of the boardroom to discuss any issues that they may have. The new

volunteer will benefit from having one point of contact for any queries in the first few months of

their term.

April 2008

13 | P a g e

The Irish League of Credit Unions

Section 4: Recruiting potential volunteers

Member survey

A very effective method of volunteer recruitment which has been already utilised by a number of

credit unions is a member survey. This is generally coordinated by the nominating committee in

cooperation with the membership committee, the marketing committee and the board of

directors.

The questionnaire generally addresses areas such as quality of services and quality of service

delivery. In addition to this, a section on volunteering should be included. This section could

include questions such as:

•

Have you ever volunteered for a credit union?

•

Have you ever considered volunteering in the credit union?

•

What were your reasons for volunteering / not volunteering in the credit union?

•

What benefits, if any, do you think volunteering in the credit union could provide you

with?

•

What area of the work carried out by the credit union interests you most?

•

How much time per month would you be available for?

•

Please give details of when you would be available?

In addition to these questions you could include:

•

If you would like more information on volunteering in the credit union please provide us

with your name and contact phone number / email or contact (name of contact person)

for more information.

When producing any member survey it is important to respect the personal information of

members. The credit union should only use the information in such a way that would be deemed

appropriate by the member. Individual questionnaires should only be available to those directly

involved in the member survey. Therefore only the details of those members who express an

interest in volunteering should be passed onto the nominating committee2.

Volunteer information booklet

One of the most effective ways of reaching a high percentage of your members is to create a

volunteer information booklet. This would be similar to the new member booklet provided by

many credit unions.

2

For more information on data protection issues visit www.dataprotection.ie (ROI) or www.ico.co.uk (NI).

14 | P a g e

April 2008

The Irish League of Credit Unions

Often when we are speaking to potential volunteers we end up overloading them with

information in trying to explain the role. Other times we give them a copy of the Standard Rules

for Credit Unions which, to a lay member, can look very daunting!

A volunteer information booklet provides enough information about volunteerism and the credit

union to allow a member to decide whether they would like to pursue this opportunity. In

addition it shows that the credit union is professional about recruiting new volunteers. While

outlining how they can contribute to their community (or common bond) it should also outline

the personal and professional benefits associated with volunteering in a credit union.

Below are suggested areas to be covered in the volunteer information booklet:

•

History of the credit union: A brief description of the origins and achievements of your

credit union. The credit union ethos and operating principles can be covered here.

•

Structure of the credit union: This section should describe the functions of the board,

supervisors, committees and key staff. It should also provide a graphical representation of

the structure of the credit union. It may also be useful to detail the services offered to

members here.

•

Volunteering in the credit union: This section provides the members with a clear

understanding of what contribution they could make to the credit union through

volunteering. It could offer a description of the various voluntary positions available and

the skills that are used in each role. This section should also make reference to your

Volunteer Policy and any other particulars in relation to HR policies and procedures.

•

Benefits of volunteering: This is a key section of the Volunteer Information Booklet. It

should promote the benefits of volunteering with a credit union. These benefits should

focus on the benefits to the individual more so than the social benefits as these would

have been covered in section one. The benefits of credit union volunteering include:

Gain skills and experience in a senior role of a professional financial service

provider

Education and training

Personal development

Meet new people from the community

Work on developmental and business projects

Give something back to the community

It is also useful to include testimonies from current and previous volunteers who had a

positive experience in your credit union. These testimonies personalise the benefits of

volunteering and the reader will be able to relate to the experiences.

As mentioned in section 2 of this document, it is important for the credit union to push

the many benefits of volunteering rather than adopting a charity approach to the

recruitment of a volunteer.

April 2008

15 | P a g e

The Irish League of Credit Unions

•

The next steps for a volunteer: This section lays out a clear step by step procedure for

becoming a volunteer in your credit union. In reading this, a member should have a clear

understanding of how he/she can approach a volunteering role. This demonstrates the

professional approach that the credit union has with their volunteers. Here is a guide to

the steps involved:

1.

2.

3.

4.

Register your interest by contacting the relevant individual in the credit union.

Submit a CV outlining any relevant experience, education and skills.

Attend a meeting with a selected panel of credit union personnel.

Receive a formal letter of approval from the board of the credit union (in relation

to director and supervisor roles, this letter will inform the member that they will

be put forward for the role at the next AGM).

5. Attend induction & training.

6. Six month review with relevant individual in the credit union.

The information booklet can be circulated to members in a mailing and also displayed in a

prominent area of the credit union public space. All staff should become familiar with the

contents so that they are equipped to answer any queries from members.

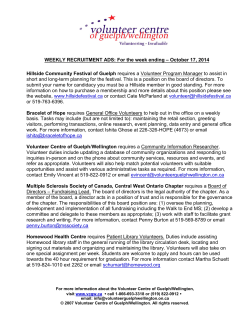

Utilising volunteer centres

Throughout Ireland there are a number of volunteer centres who recruit volunteers on behalf of

local voluntary organisations. These centres specialise in promoting voluntarism and providing

information to potential volunteers. The credit union can register and advertise any volunteer

positions through their local volunteer centre.

The volunteer centres tend to operate on a county basis, so they will cover several common

bonds. As each credit union can only accept a volunteer who is a member of their credit union, it

is more effective if a chapter or cluster of credit unions approach the local centre through a

cooperative project. Once an individual contacts the centre, they can be referred on to the

relevant credit union. All advertisements of volunteer positions should clearly state that only

members of a specific credit union can hold a voluntary position in that credit union.

Volunteer Centres Ireland (VCI) began in the year 2000 when some of the earliest volunteer

centres in Ireland (including what is now the Tallaght Volunteer Centre and Volunteering Ireland),

came together to discuss common issues that affected them all. They represent 16 volunteer

centres in the Republic of Ireland.

16 | P a g e

April 2008

The Irish League of Credit Unions

Volunteer centres act as ‘brokers’ between individuals who want to undertake voluntary activity

and organisations that seek to involve volunteers. Their primary function is to match individuals

and groups interested in volunteering with appropriate volunteering opportunities and to offer

advice and support to volunteers and organisations through a range of services. Local volunteer

centres provide an invaluable link between volunteer-involving organisations and individual

volunteers and are a vital element of the volunteering infrastructure of any country.

If you would like your credit union to register with a local volunteer centre, visit

www.volunteer.ie (ROI) or www.volunteering-ni.org (NI) for more information.

Boardmatch Ireland

Another volunteer recruitment option available to credit

unions is Boardmatch Ireland (www.boardmatchireland.ie).

This organisation has strong links with personnel in the

corporate sector who are looking to apply their expertise in a

voluntary capacity. They provide a link for people interested in volunteering at board level to

positions in voluntary and community organisations. Boardmatch achieves this primarily through:

•

Developing civic leadership with a focus on new leaders on voluntary boards.

•

Building links between corporate, public and non-profit sectors, by recruiting people from

corporate and public sectors to work on non-profit boards.

•

Enhancing skills sets on non-profit boards through the recruitment of people with specific

skills (e.g. accounting, legal, strategic planning, marketing, IT) onto non-profit Boards.

•

Building the governance capacity of non-profit boards.

The first phase of development of Boardmatch Ireland will provide a web-based matching service

where people may register their interest in working on non-profit boards. These candidates are

then matched, based on location, skills and preferred area of interest, to organisations who have

also registered their board opportunities.

It is important to note that volunteers must be members of the credit union and fall within the

common bond. If the credit union wishes to avail of the Boardmatch service, they must ensure

that the person is eligible to volunteer. This should be made clear to any candidates and also on

any position descriptions placed on the website.

For further information, please contact Miriam Enright on:

t: +353-1-6715005

m: +353-87-2720087

e: [email protected]

April 2008

17 | P a g e

The Irish League of Credit Unions

Community liaison officer3

The new position of community liaison officer in the credit union offers a very effective member

recruitment resource. The community liaison officer is responsible for building relationships with

local community groups and will have regular contact with members. This role will make them

ideally positioned to promote volunteering throughout the common bond. The board of directors

and nominating committee should cooperate with the community liaison officer to ensure that

volunteerism is being promoted in any dealing with members and local community groups.

Youth officer & youth committee

“Youth are the people who are going to carry on what we have started. They are

going to sit where we are sitting, and when we are gone, attend to those things

which we think are important.”

Abraham Lincoln

It is important that the diversity of your membership base is reflected in the volunteers that serve

in the credit union. Many credit unions in Ireland have put a huge emphasis on developing links

with their younger members as it brings many benefits:

•

Young people can bring fresh perspectives, new ideas and increased capacity to your

credit union.

•

Services for young people can be designed, delivered and evaluated based on actual

rather than perceived needs.

•

Young people can raise awareness and promote the work of the credit union movement

amongst their peers i.e. young people are more likely to get involved in the local credit

union if they see their peers playing an active role.

The youth officer in a credit union is likely to have strong links to various youth groups and

organisations in the community. The credit union can utilise these links to promote volunteering

opportunities within the credit union.

Many credits unions establish youth committees (also called Youth Advisory Councils) to provide

guidance to the credit union in tailoring its services for the youth market. One of the many

benefits of having an active youth committee is that the credit union is up-skilling a potential pool

of future volunteers. Youth committee members learn about the function and role of the credit

union and also how a committee operates. When a vacancy arises in the credit union, the current

and past members of the youth committee should be made aware of the vacancy.4

3

This position is only relevant to credit unions in the Republic of Ireland

4

If you would like more information on establishing a youth committee, visit www.cu4youth.ie

18 | P a g e

April 2008

The Irish League of Credit Unions

Third-level education & training institutions

One of the major benefits of volunteering in a credit union is the experience gained from working

in a professional financial environment at a senior level. No other volunteer organisation can

provide a person with such financial business experience.

Throughout Ireland and Northern Ireland there are hundreds of third-level education and training

institutions that are providing courses to thousands of people looking to further or begin their

career. These people could be return-to-work parents, semi-retired professionals, young

undergraduate students or people just looking for a change in their career. By volunteering in a

credit union, they could obtain vital experience to complement their training/education and help

them get ahead in their career. Many of these people are members of a credit union!

Education and training institutions regularly hold talks and information sessions for their students

on career and placement opportunities. In addition to this, the institutions often form strategic

partnerships with local businesses and organisation to offer work experience and placement

opportunities.

It would be very beneficial to look at developing a strategic relationship with any training and

education institutions that fall within your common bond. They could become a good source of

potential volunteers to take up committee posts.

Realistically many of these volunteers will only serve 12 – 24 month terms, while they are

completing their studies. During this time they will bring many new ideas and skills to their

committee, while also gaining vital experience for their CV. However, over the longer term it is

possible that these individuals could return to be future directors, supervisors, volunteers and

staff members.

Other media resources

The credit union can utilise other media resources to promote volunteering positions in the credit

union. These would include:

•

the credit union’s website

•

local print media

•

credit union open-days, and

•

local community radio.

Each credit union should use the recruitment methods which best suit their own circumstances. It

is important to note that the greater the number of methods used, the greater the number of

potential volunteers attracted.

April 2008

19 | P a g e

The Irish League of Credit Unions

Section 5: Creating a volunteer development

strategy

Fig 4.1 details the 5 key steps involved

in the recommended strategic

approach to volunteer recruitment and

development in a credit union. This

approach aims to address both shortterm goals (filling vacant board and

supervisor positions) and long-term

goals (building up a pool of skilled

volunteers) of modern credit unions.

While many of the tasks involved in the

strategy do not fall within their direct

remit, an effective nominating

committee should play a central role.

For any activities, such as selection

interviews, the nominating committee

can act in a consultative role to support

the board of directors and/or relevant

committee.

Fig4.1: The Volunteer Development Strategy

Step 1: Develop internal structures

Before any work is done on developing the volunteer development strategy, it is important to

address any internal issues that may become a barrier to its implementation. As mentioned

already in this document, the Volunteer Policy must be reviewed and updated. The policy should

offer clarity on the details of volunteering as well as offering adequate protection to both the

credit union and volunteer.

Secondly, a meeting should be held with all existing volunteers to discuss the proactive

recruitment of new volunteers. The tone of the meeting should be open and honest to encourage

all persons to air grievances, concerns or queries that they have on the matter. This meeting

should address all concerns and seek a consensus from the group to pursue this initiative.

20 | P a g e

April 2008

The Irish League of Credit Unions

Writing a volunteer development strategy5

This is the plan that will drive the proactive recruitment of volunteers in your credit union (a

sample is available in Appendix A). The strategic plan should cover the following areas:

•

A long-term vision: This is the final goal of the entire strategy; it provides a direction for

all proceeding goals and tasks. This vision should be qualified by a specific timeframe, e.g.

“By 2013 Anytown Credit Union will......”

•

Volunteer development strategy sponsor: These are the assigned person or persons who

are ultimately responsible for the delivery of the volunteer development strategy. It

makes sense for this to be a number of directors, if not the entire board. The sponsor(s)

has the final decision making authority on any issues arising from the strategy.

•

Short-term and long-term goals: These are an agreed list of goals that the credit union

must achieve in order to fulfil the long-term vision. Immediate volunteer requirements

should be addressed in the sort-term goals, while the development of a skilled pool of

volunteers is a more long-term goal. An agreed timeline should be attached to each goal.

The target number of new volunteers, including directors, supervisors and committee

members for the next 12 months should be set here.

•

Strategy tasks: Each goal should be broken down into a list of achievable tasks which

must be undertaken by the credit union. Each task should have a deadline within the

timeline of its parent goal. The person or committee responsible for the delivery of each

task should be detailed here.

•

Communication structure: This part of the strategy clarifies the reporting structure for all

personnel involved, e.g. “..all consultations with potential volunteers should be noted in

the bi-monthly nominating committee report”.

•

Milestone reviews: The sponsors and relevant personnel should meet at scheduled

intervals during each year to track whether the deadlines for tasks are on-track. Also any

issues that have arisen can be addressed at these meetings.

Step 2: Identify suitable members for volunteer

positions

In this step the nominating committee must decide on the recruitment methods that they will use

in order to attract potential volunteers. The strategy will have outlined the number of target

volunteers that is required. This will influence the number of different recruitment methods that

is adopted.

If the committee decide on methods such as member surveys, information booklets or strategic

partnerships with local education institutes; adequate time should be provided for the

development work involved in each. For example, if a nominating committee has only two

available months to recruit, it is not advisable to undertake a member survey in that year. The

member survey could become a task for the following year.

5

A sample volunteer development strategy is available in Appendix A of this document.

April 2008

21 | P a g e

The Irish League of Credit Unions

Once interested members begin to present themselves, the nominating committee should

compile a list of potential candidates. Remember volunteers can be appointed by the board of

directors onto credit union committees at anytime in the year providing the ILCU (and Financial

Regulator in the Republic of Ireland) is notified within 14 days of their appointment.

Step 3: Selecting volunteers

Once a member expresses an interest in volunteering a person within the credit union should be

appointed to maintain contact with the member and develop their understanding of the role. This

can be done through regular informal conversations or by providing them with a copy of the

latest CU Focus magazine and other relevant material.

Before any volunteer is accepted onto a committee or nominated at an AGM, it is strongly

recommended that a meeting is arranged with a panel of credit union personnel. This meeting

will allow the credit union to confirm suitable candidates and match them with a suitable

position. In addition, it is an opportunity for the member to increase their knowledge of the role.

This meeting should meet the same standards of a selection interview for a paid position. Below

are some guidelines to conducting an interview:

•

A panel should be selected consisting of at least three credit union personnel (preferably

mixed gender).

•

All candidates should be asked the same set of agreed questions.

•

An evaluation sheet should be filled in; all meeting notes should be kept.

More information on standards at selection interviews/meetings is available in the HR section of

the ILCU website: www.creditunion.ie

Step 4: Election & induction of volunteers

Based on the results of the selection interview the nominating committee can put forward the

names of the persons for election, by the members, at the next credit union AGM. Ultimately the

long-term goal of the credit union is to put forward a number of suitable candidates for director

and supervisor positions that exceeds the number of available seats on the board and supervisory

committee.

It is important that the credit union develop an induction programme which will allow new

volunteers to become more familiar with the operation and structure of the credit union. This

should be done in a timely fashion so that the volunteer is not months into their tenure before

they get this introductory training. The induction programme should include:

•

structure of the credit union;

•

services of the credit union;

•

legal framework;

22 | P a g e

April 2008

The Irish League of Credit Unions

•

health & safety policy and procedures;

•

volunteer policy;

•

a meeting with the training officer to identify initial training needs;

•

a buddy system; and

•

any other relevant items.

Step 5: Ongoing monitoring of volunteer performance

and future vacancies

By this stage the credit union should have a number of new volunteers in place. It is important

that these new volunteers and existing volunteers have regular one-to-one meetings with a

selected contact, in the same way that staff should have regular performance review meetings

with the manager.

A one-to-one interview gives the individual an opportunity to address any personal or

professional issues that they may have. The volunteer will feel better supported in their position

if they know that the issues raised are being addressed.

The board of directors must also work with the nominating committee to create a succession plan

for the credit union. The succession plan should balance the need to retain the experience built

up at committee level with the need to develop the skills and knowledge of the volunteers. This

plan maps out the potential routes of volunteers and how skill gaps will be addressed if a director

or supervisor steps down. Part of the succession plan should be the rotation of committee

positions on an annual or bi-annual basis. This will prevent a committee becoming too stale and

will also build up the skills of all volunteers.

Conclusion

Every credit union has a responsibility to its members to ensure the continuation of the high

standard of volunteers occupying key positions. Part of this responsibility is the proactive

identification and induction of suitable new volunteers from the common bond.

If a credit union wants to become more effective at attracting the sufficient quality and quantity

of new volunteers they must be willing to put in the time and effort. The strategy proposed in this

document is not a one-year-fix; it should become a permanent feature of the credit union’s

strategic operations. A carefully considered strategic plan is required to ensure positive results.

By investing in its volunteers, a credit union can expect to reap the rewards through better

governance and decision making, diversity of experience, reduced workload on individuals, a

succession plan for the future and ultimately a better service for the member.

The ILCU recognises the importance of succession planning in credit unions and will respond to

any requests for support in implementing this strategy.

April 2008

23 | P a g e

The Irish League of Credit Unions

Appendix A: Sample extract of Anytown

Credit Union’s volunteer

development strategy

Background

Anytown Credit Union is a medium sized; community based credit union with 11,000

members (8,000 active members). It currently employs 12 staff and has 13 directors

and 3 supervisors. All committees consist of three directors, with no staff or nondirector volunteers. Increased time pressures on volunteers and a growing need to

implement a succession plan has meant that Anytown Credit Union must become more

proactive in recruiting new volunteers.

In January 2008 the board of directors in cooperation with the nominating committee

formulated the “Anytown Credit Union Volunteer Development Strategy 2008 – 2012”.

Below is an extract from the strategy for 2008.

Anytown CU Volunteer Development Strategy

2008 - 2012 (extract)

Project Sponsor:

The Board of Directors of Anytown Credit Union

Strategy Stakeholders:

The following bodies and persons will play an active role in the implementation of the

strategy:

•

Board of Directors;

•

Nominating Committee;

•

Training & Education Committee;

•

Anytown Credit Union Manager;

•

Marketing Committee; and

•

Chapter Officers.

Vision:

By 2012 Anytown Credit Union will have expanded their pool of experienced volunteers

from 16 to 22. In addition, we will have the capability to fill any vacancy on the Board of

Directors and Supervisory Committee internally with an experienced volunteer working

at committee level.

24 | P a g e

April 2008

The Irish League of Credit Unions

Strategic Goals:

Long-term (2 – 4 year duration)

1. Have 22 volunteers working in the credit union by 2010, consisting of 13

Directors, 3 Supervisors and 6 non-director committee members.

2. By 2011 all nominations for director or supervisor positions, from the

nominating committee, shall be volunteers with a minimum of 18 months

credit union experience.

3. By 2012 the following committees will consist of at least one non-director

volunteer or member of staff:

o The Membership Committee

o The Nominating Committee

o The Marketing Committee

o The I.T. Committee

o The Staff Liaison Committee

o The Education & Training Committee

Short-term (1 year duration)

4. Ensure the proper internal structures exist in Anytown Credit Union to

facilitate volunteer recruitment and development. (June 2008)

5. Establish and implement three new effective methods of volunteer

recruitment (February 2009):

o A volunteer Information Booklet

o A strategic partnership with Anytown Institute of Technology (AIT)

o Register with the local Volunteer Centre (Cooperative initiative

through Chapter)

6. Fill upcoming vacancies on the board of directors (1) and supervisory

committee (1) for next AGM (November 2008)

7. Create a formal selection and induction process for all potential / new

volunteers of Anytown Credit Union (September 2008)

Communication Structure:

The nominating committee will include an update of their progress in their bi-monthly

Nominating Committee Report for the Board of Directors. All other committees and

involved personnel will provide a progress update upon written request from the

Secretary of Anytown Credit Union.

April 2008

25 | P a g e

The Irish League of Credit Unions

Anytown Credit Union Task Schedule 2008

26 | P a g e

April 2008

© Copyright 2026