YuMe. Digital Video Audience Platform. March 2015.

YuMe. Digital Video Audience Platform. March 2015. 1 ©2013 YUME. ALL RIGHTS RESERVED. FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements. All statements other than statements of historical fact contained in this presentation are forward-looking statements. These statements are only current predictions and are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause our results or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements. These forward-looking statements are subject to a number of risks, including those described under the heading “Risk Factors” in our periodic reports filed with the U.S. Securities and Exchange Commission, including our annual report on Form 10-K for the year ended December 31, 2014 and our quarterly report on Form 10-Q for the quarter ended September 31, 2014, and in our future filings and reports with the SEC. Moreover, new risks emerge periodically. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. Except as required by law, we are under no duty to update or revise any of the forward-looking statements, whether as a results of new information, future events or otherwise, after the date of this presentation. In addition to the U.S. GAAP financials, this presentation includes certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, and not a substitute for or superior to measures of financial performance prepared in accordance with U.S. GAAP. See reconciliations between each non-GAAP measure and the most comparable GAAP measure contained in our prior reports filed with or furnished to the SEC. This presentation also contains statistical data that we obtained from industry publications and reports generated by third parties. Although we believe that the publications and reports are reliable, we have not independently verified this statistical data. 2 ©2015 YUME. ALL RIGHTS RESERVED. LEADING END-TO-END DIGITAL VIDEO AD PLATFORM COMPANY Delivering Audiences That Matter to TV Brands Unlocking Audience Value Combining the reach and frequency of TV with the software of digital Embedded Software + Data Sciences = Cross-screen, brand-safe campaigns to attentive & receptive audiences 3 Massive Global Market in Transition TV VIDEO ADVERTISING 2 $ IN BILLIONS $173.7B1 $15.1 $5.3 DIGITAL $133B1 1 Global entertainment and media outlook 2014-2018, PwC, Informa Telecoms & Media 2 Global Online Video Advertising Platforms Market, Frost & Sullivan, 2013. 4 2012 2016 Radical Shifts are Causing Audience Fragmentation Content Screen Devices Per Person TV 1-5 Cable 5-500 Internet >10,000 2000 Data 5 2014 Technology Audience Fragmentation Presents Brand Challenges Fragmentation Our embedded software, buyer and seller audience software and data sciences solve three key audience problems TV brand advertisers face in digital video: 6 Advertiser Challenges Inefficient reach & frequency Less attention & receptivity Greater brand safety risk CONSUMER BEHAVIOR YuMe Opportunity: Extend TV Audiences to Digital ONE SCREEN AT PRIMETIME 7 MULTI-SCREEN VIDEO ALL THE TIME CONSUMER BEHAVIOR YuMe Opportunity: Extend TV Audiences to Digital ONE SCREEN AT PRIMETIME MULTI-SCREEN VIDEO ALL THE TIME Is changing the way advertisers plan. Convergence in ad spend is already happening. “Video Neutral” Planning 8 The Challenge: Television ≠ Digital Video ≠ Audience Efficiency Still provides efficient scale for branding, in spite of cable and OTT fragmentation Data & Targeting Data & targeting considered imperfect, but sufficient for branding metrics Audience Attention Primarily long-form content on one screen: less audience distraction Brand Safety Inherently brand-safe: closed ecosystem, curated content Massive content and device fragmentation = inefficient scale for TV brand advertisers Content and device fragmentation = data fragmentation Legacy cookie-based targeting: built for browserbased direct response/display campaigns, but not viable in app & CTV video environments Primarily short-form content across multiple screens = more audience distraction No inherent brand safety: open ecosystem, low barriers to entry Serving TV brand advertisers’ needs in digital video requires a TVcentric approach The YuMe Platform – A Complete Audience Ad Solution Publisher Benefits YuMe provides the software and tools for publishers to identify, segment and measure their digital video audiences. Data sciences allow publishers to extract more value from their audiences. 10 Both win. Publishers maximize their audience value by clearly defining the audience for advertisers who benefit from having distilled audiences at scale that meet their marketing objectives. Advertiser Benefits Provides advertisers with marketing software and automation tools to find, target and deliver digital video ads to aggregated, qualified audiences in brand safe environments. TURNKEY PLATFORM + SERVICES Purpose Built Video Audience Tech Stack YuMe Supply Platform YuMe Demand Platform • Ad serving: Online, Mobile and Smart TV • Multiple buying channels – Direct, programmatic, private marketplaces, exchanges • SSP Integrated with RTB 2.2 compliant exchanges and demand side platforms • Full suite of campaign management, creative, targeting and reporting capabilities • Universal SDKs - Support for AS3, iOS, Android, HTML5 and Embedded C SDKs, MRAID, VPAID and VAST standard compliant • Targeting and reporting across all screens YuMe Data Platform First Party data collection through embedded SDK in video delivery environment Targeting and reporting across all screens. Integration with advertisers and publishers DMP Audience Modeling and Targeting Capability • DSP enabling programmatic procurement of YuMe SDKenabled inventory as well as third-party SSP inventory • Deal ID management • RTB 2.2 Support • Bidding engine to optimize deals • RFP/IO Workflow Automation • 450+ brand advertisers: global, regional, local • 150+ Ad Sales & Ad operations people in NA, APAC and Europe 11 POWERING AUDIENCE DISCOVERY AND MEASUREMENT How Our Data Sciences Work Data Sciences YuMe Audience Segments Machine Learning Algorithm YuMe technology unifies data and audience fragmentation 12 Leverages disparate audience data silos via advanced data sciences Delivers highly targetable, segmented audiences at large scale YUME AUDIENCE SEGMENTS Data Science Driven Insights TV Viewership Ad Receptivity VCR Light 55% Heavy 46% CTR 0.11% 0.16% Ad Receptivity by Show Light 31% Comedy Genre Heavy 69% Other Comedy Programs 54% 65% The Millers 75% Two Twoand and a Half Man Men Modern Family % Who Viewed Shows Big Bang Theory 25% Other How I Met Comedy Your Mother Programs 77% How I Met Your Mother Two and aa Two and HalfMen Man Half Modern Family 56% Big Bang Theory 45% VCR The Millers 19% Performance by Age 13% 15% 9% 10% 6% 5% 3% 1% Age 18-34 35-54 55+ Gender 22% 72% 6% Male Female 38% 62% VCR 0% 70% 60% 50% 40% 30% 20% 10% 0% 0.19% 0.15% 0.20% 0.16% 0.12% 0.12% 0.08% 0.04% 43% 52% 59% 18-34 35-54 55+ VCR CTR 0.00% CTR 20% 13 41% BEHIND THE INFLUENCE Measuring Brand Impact YuMe partnered with a third-party research partner to measure increases in: attitude, awareness, favorability, intent and preference based on the exposures to YuMe placements More than 145 brand studies across 9 categories completed since 2010 RESULTS 1 Brand Awareness 72.5% Overall CPG Brand Lift 1 Purchase Intent 7x 71.2% Norm 1 Data from Nielsen Online Brand Effect (formerly Vizu Ad Catalyst) 14 1 The Power of Television – Magnified Cross-platform exposure drives superior brand-lift compared to TV alone for AdAge 100 Advertisers. 26% 43% 34% 60% 100% 67% 24% 100% 20% 15% 15% 10% General Recall Brand Recall Message Recall Exposed To YuMe Campaign + TV 15 9% Likeability Exposed to TV Ads Only 12% 6% Purchase Intent The Multi-Screen Multiplier Measuring brand lift across screens on an ongoing basis shows that single platform offerings simply leave performance on the table for brands. 2% 14% 25% 36% AD RECALL BRAND X OPINION CHANGE 50% 61% 51% More negative (Net) 41% Neutral - No change in opinion 39% More positive 25% CONNECTED TV 16 ©2015 YUME. ALL RIGHTS RESERVED. 21% MOBILE 26% 11% ONLINE MULTI-DEVICES Much more positive The Multi-Screen Multiplier Measuring brand lift across screens on an ongoing basis shows that single platform offerings simply leave performance on the table for brands. TOTAL POSITIVE AD RECALL 87% 2% 14% 76% 25% 36% 62% AD RECALL BRAND X OPINION CHANGE 50% 50% 61% 51% More negative (Net) 41% Neutral - No change in opinion 39% More positive 25% CONNECTED TV 17 ©2015 YUME. ALL RIGHTS RESERVED. 21% MOBILE 26% 11% ONLINE MULTI-DEVICES Much more positive CONTINUING TO PAVE THE WAY From Innovation to Industry Standard First video solution to: 2007 2008 2009 2011 2013 2014 Launch dynamic ads Run interactive InVideo overlay ads Introduce iGRPs via Mindshare partnership Be embedded into internetconnected TVs Integrate 1st party data targeting and measurement capabilities Launch a Programmatic Video Branding SolutionTM--Video Reach FROM DAY 1 2007 2008 2009 2010 2011 2012 2013 2014 100% In-Stream Placements 100% Visibility 2006 to 2008 Offer cross-platform ad solutions 18 2009 2010 2012 2014 Introduce a unit that synchronizes an instream video ad with an in-banner ad as well as the first to pull in a XML feed into an ad unit Offer volume video ads in iPhone apps Launch an inventory grading system that identifies optimal ad placements Establish industryfirst Traffic Quality Unit focused on creating best-inbreed practices Professionally Produced Content Always Brand-Focused INTRODUCTION YuMe Company Profile Clients and Partners FOUNDED IN 2004 PUBLIC COMPANY LISTED ON NYSE ORIGINAL INVESTORS ACCEL Partners BV Capital Intel Capital West Summit Capital DAG Ventures Menlo Ventures Samsung Venture Investment Khosla Ventures Translink Capital YuMe operates the largest independent digital video brand advertising platform across four screens: smartphones, tablets, PCs and Connected TVs. Operations in North America, Europe and Asia. Expanded to China and Latin America in 2014. 500+ Employees AWARD WINNING TEAM AND TECHNOLOGY Connected TV Awards 2013 Digiday 2012 Best Video Ad Network Advertiser Perceptions Highest Rated Media iab Rising Stars Award 19 Global brands and media companies relying on YuMe technology in video ad serving, targeting, audience sciences, creative services and brand strategy. INTRODUCTION Traction with Large Advertisers Clients and Partners Long-Standing Relationships: • 106 advertisers with >$1 million in lifetime spend Low Churn - • 18 advertisers with >$5 million of lifetime spend ’13 Advertisers Spending in ’14: • 19 of top 20 advertisers • 44 of top 50 advertisers Campaigns over $250,000: • 60% of total Q4 revenue • Mid-teens Y/Y growth 20 Global brands and media companies relying on YuMe technology in video ad serving, targeting, audience sciences, creative services and brand strategy. COMPANY OVERVIEW Global Offices and Ongoing Expansion Offices: Redwood City HQ New York, Chicago, Los Angeles, Boston, Dallas, Detroit, Atlanta, Miami, Toronto, Mexico City, Pune, Chennai, London, Paris, Madrid, Hamburg, Stockholm, Hong Kong, Shanghai 21 2014 Total Headcount: 500+ Employees Financial Highlights Strong Advertiser Growth Sustained Gross Margin Operational Leverage R&D Advantage Proven Business Model 22 Early days of ad dollars from TV to digital video Seeding the clouds for long-term growth Illustrates platform’s strength & differentiation Already consistently within the long-term operating model Sales team investments expected to peak in 2014 Efficient R&D operations from India-based tech centers Strong & efficient R&D operations India-based technology development center US business profitable on an adjusted-EBITDA basis Revenue and aEBITDA Trend 23 Gross Margin Trend 48.8% 48.4% 47.5% 45.8% 45.3% 48.6% 48.1% 47.3% 45.9% 45.6% 44.6% 42.8% Q1'12 24 Q2'12 Q3'12 Q4'12 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 Long-Term Operating Model FY 2011 FY 2012 FY 2013 FY 2014 Target Model 2 Gross Profit 38% 46% 47% 48% 46%-48% Sales & Marketing 34% 27% 31% 37% 17%-18% General & Administration 15% 11% 12% 12% 9%-10% Research & Development 4% 2% 3% 3% 5%-6% (11%) 10% 6% 1% 18%-22% % of Revenue 1 Adjusted EBITDA 2 1 GAAP-based, except adjusted EBITDA 2 Target model assumes stock-based compensation and depreciation and amortization expense of 5%-6% of revenue 25 Thank you. 26 ©2013 YUME. ALL RIGHTS RESERVED.

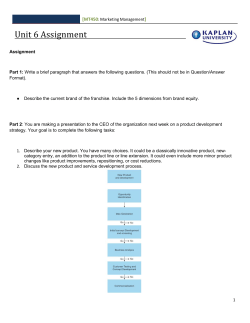

© Copyright 2026