citizen_s_charter_-passo - Misamis Occidental Official Website

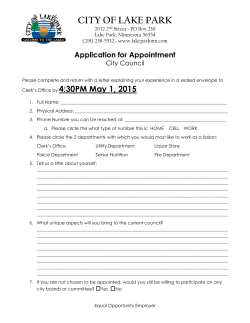

Republic of the Philippines Province of Misamis Occidental OFFICE OF THE PROVINCIAL ASSESSOR Capitol Drive, Oroquieta City CITIZEN’S CHARTER I. ASSESSMENT OF REAL PROPERTIES A. Frontline Service Schedule of Availability of Service : : Who may avail of the Service : What are the Requirements : TRANSFER OF REAL PROPERTY OWNERSHIP FOR LAND, BUILDING AND MACHINERY MONDAY TO FRIDAY 8:00 am to 5:00 pm without noon break a. b. c. d. e. f. g. Duration : Accomplished Transaction Request Form (to be secured from the Public Assistance and Complaint Desk In-Charge) Duly Registered Deed of Conveyance Sworn Statement of Real Property Market Value Certificate Authorizing Registration Transfer Tax Current Realty Tax Proof of Payment [Official Receipt from the Provincial Treasurer’s Office (PTO)] * 54 minutes to 1 hour HOW TO AVAIL OF THE SERVICE: Steps 1 2 Applicant/Client Client signs client logbook Secure Transaction Request Service Provider Duration of the Activity Public Assistance and Complaint Desk In-Charge readies the Transaction Request Form to be accomplished by the client Public Assistance Desk In-Charge 2 minutes Person in Charge Public Assistance and Complaint Desk In-charge Fees Form -none- Transaction Request Form Form (TRF) from the Public Assistance and Complaint Desk In-Charge, fill-up and give the accomplished form back to the in-charge. 3 4 6 7 Client presents supporting documents to the assessment in-charge for the processing of the request for transfer of ownership Client brings the Order of Payment to the PTO and pays the corresponding amount as computed by the assisting clerk at the Provincial Treasurer’s Office (PTO), collects the official receipt and head back to the Provincial Assessor’s Office (PASSO) Client submits the official receipt to the assessment clerk in-charge as proof of payment, and settles at the waiting area while the request is being processed Client receives the duly accomplished and approved document of transfer examines the accomplished TR Form and refers the client to the appropriate Assessment Clerk for the processing of request for transfer of real property ownership Assessment Clerk examines the documentary requirements as to completeness, authenticity and appropriateness, advises the client to complete missing documents if any and issues an Order of Payment (OP) to the client for the transaction Assessment Clerk In-Charge prepares documents of transfer and submits the prepared documents to the Provincial Assessor or to this Assistant for review and approval. Assessment Clerk In-Charge records and releases the documents of transfer after review and approval of the Head of Office 2 minutes Public Assistance and Complaint Desk In-charge -none- - 5 minutes Assessment Clerk In-charge -none- Order of Payment 45 minutes to 1 hour Assessment Clerk In-charge Depends on the Market Value and Zonal Valuation of the Property Field Appraisal and Assessment Sheet (FAAS) 1 minute Assessment Clerk In-charge None None Assessment Clerk files duplicate copies/office copies of the document for future reference. END OF TRANSACTION B. Frontline Service Schedule of Availability of Service : : Who may avail of the Service : What are the Requirements : REVISION OF REAL PROPERTY ASSESSMENTS FOR LAND, BUILDING AND MACHINERY MONDAY TO FRIDAY, 8:00 am to 5:00 pm (no noon break) a. b. c. Duration : Current Year Real Property Tax Receipts Municipal Assessor’s Reports of Actual Ocular Inspection Sworn Statement of the Fair and Current Market Value of the Real Property (To be secured from the Municipal Assessor’s Office of the locality where the property is located) 56 minutes to 1 hour HOW TO AVAIL OF THE SERVICE: Steps 1 2 3 Applicant/Client Service Provider Public Assistance and Complaint Desk In-Charge readies the Transaction Request Form to be accomplished by the client Secure Transaction Request Public Assistance Desk In-Charge Form (TRF) from the Public examines the accomplished TR Assistance and Complaint Form and refers the client to the Desk In-Charge, fill-up and appropriate Assessment Clerk for give the accomplished form the processing of request for the back to the in-charge. revision of real property assessments Client presents supporting Assessment Clerk examines the documents to the documentary requirements as to assessment in-charge for the completeness, authenticity and processing of the request for appropriateness, advises the revision of real property client to complete missing assessments documents if any and issues an Order of Payment (OP) to the Duration of the Activity Client signs client logbook 2 minutes 2 minutes 5 minutes Person in Charge Public Assistance and Complaint Desk In-charge Public Assistance and Complaint Desk In-charge Assessment Clerk In-charge Fees -none- Form Transaction Request Form -none- -none- Order of Payment 4 6 7 Client brings the Order of Payment to the PTO and pays the corresponding amount as computed by the assisting clerk at the Provincial Treasurer’s Office (PTO), collects the official receipt and head back to the Provincial Assessor’s Office (PASSO) Client submits the official receipt to the assessment clerk in-charge as proof of payment, and settles at the waiting area while the request is being processed Client receives the duly accomplished and approved document/s of revision of real property assessments client for the transaction Assessment Clerk In-Charge prepares documents for the revision of real properties and submits the prepared documents to the Provincial Assessor or to this Assistant for review and approval. Assessment Clerk In-Charge records and releases the documents of revision of real property assessments after review and approval of the Head of Office Assessment Clerk files duplicate copies/office copies of the document for future reference. 45 minutes to 1 hour 1 minute 1 minute END OF TRANSACTION Assessment Clerk In-charge Assessment Clerk In-charge Depends on the Market Value and Zonal Valuation of the Property Field Appraisal and Assessment Sheet (FAAS) None None C. Frontline Service Schedule of Availability of Service : : Who may avail of the Service : What are the Requirements : DECLARATION OF NEWLY DISCOVERED REAL PROPERTY FOR LANDS BUILDINGS AND MACHINERIES MONDAY TO FRIDAY 8:00 am to 5:00 pm without noon break 1. For Newly Acquired Land: a. DENR certification as to the A&D of the property b. Municipal Assessor’s Reports on Actual Ocular Inspection c. Sworn Statement of the Fair and Current Market Value of the Real Property 2. For Newly Acquired Building: a. Building Permit 3. For Newly Acquired Machinery a. Acquisition Cost Receipts Duration : 56 minutes to 1 hour HOW TO AVAIL OF THE SERVICE: Steps 1 2 3 Applicant/Client Client signs client logbook Secure Transaction Request Form (TRF) from the Public Assistance and Complaint Desk In-Charge, fill-up and give the accomplished form back to the in-charge. Client presents supporting Service Provider Public Assistance and Complaint Desk In-Charge readies the Transaction Request Form to be accomplished by the client Public Assistance Desk In-Charge examines the accomplished TR Form and refers the client to the appropriate Assessment Clerk for the processing of request for the Declaration of Newly Discovered Real Property Assessment Clerk examines the Duration of the Activity 2 minutes 2 minutes Person in Charge Public Assistance and Complaint Desk In-charge Public Assistance and Complaint Desk In-charge Fees Form -none- Transaction Request Form none- documents to the assessment in-charge for the processing of the request for declaration of newly discovered real properties 4 6 7 documentary requirements as to 5 minutes completeness, authenticity and appropriateness, advises the client to complete missing documents if any and issues an Order of Payment (OP) to the client for the transaction Client brings the Order of Assessment Clerk In-Charge Payment to the PTO and pays prepares documents for the the corresponding amount as declaration of newly discovered 45 minutes computed by the assisting real properties and submits the to 1 hour clerk at the Provincial prepared documents to the Treasurer’s Office (PTO), Provincial Assessor or to this collects the official receipt and Assistant for review and approval. head back to the Provincial Assessor’s Office (PASSO) Client submits the official Assessment Clerk In-Charge receipt to the assessment records and releases the clerk in-charge as proof of documents of declaration of newly 1 minute payment, and settles at the discovered real properties after waiting area while the request review and approval of the Head of is being processed Office Client receives the duly Assessment Clerk files duplicate accomplished and approved copies/office copies of the document of declaration of document for future reference. 1 minute newly discovered real properties. END OF TRANSACTION Assessment Clerk In-charge -none- Assessment Clerk In-charge 150.00/copy Assessment Clerk In-charge None Order of Payment Field Appraisal and Assessment Sheet (FAAS) None D. Frontline Service : Schedule of Availability of Service: What are the Requirements ISSUANCES OF ASSESSMENT RECORDS AND VARIOUS CERTIFICATIONS a. Certified True Copy of Tax Declaration b. History of Property Origin and Tax Declaration c. Certification of Landholdings d. Certified True Copy of Deed of Conveyance MONDAY TO FRIDAY 8:00 am to 5:00 pm without noon break : a. Official Receipt / Proof of Payment from PTO Transaction Fee : a. b. c. d. e. Duration : Certified True Copy of Tax Declaration History of Property Origin and Tax Declaration Certification of Landholdings Certified True Copy of Deed of Conveyance Various/Other Certifications : : : : : 50.00 per copy 100.00 per page 75.00 per page 50.00 per page 50.00 per page 56 minutes – 1 hour HOW TO AVAIL OF THE SERVICE: Steps 1 2 Applicant/Client Client signs client logbook Secure Transaction Request Form (TRF) from the Public Assistance and Complaint Desk In-Charge, fillup and give the accomplished form back to the in-charge. Service Provider Public Assistance and Complaint Desk In-Charge readies the Transaction Request Form to be accomplished by the client Public Assistance Desk In-Charge examines the accomplished TR Form and refers the client to the appropriate Assessment Clerk for the processing of request for the issuance of assessment records and various certifications Duration of the Activity Person in Charge 2 minutes Public Assistance and Complaint Desk In-charge 2 minutes Public Assistance and Complaint Desk In-charge Fees none -none- Form Transaction Request Form - 3 4 6 7 Client presents supporting documents to the assessment incharge for the processing of the request for declaration of newly discovered real properties Assessment Clerk examines the documentary requirements as to completeness, authenticity and appropriateness, advises the client to complete missing documents if any and issues an Order of Payment (OP) to the client for the transaction Client brings the Order of Payment Assessment Clerk In-Charge prepares to the PTO and pays the the assessment documents and corresponding amount as computed records requested and submit the by the assisting clerk at the prepared documents to the Provincial Provincial Treasurer’s Office (PTO), Assessor or to this Assistant for collects the official receipt and head review and approval. back to the Provincial Assessor’s Office (PASSO) Client submits the official receipt to Assessment Clerk In-Charge records the assessment clerk in-charge as and releases the documents after proof of payment, and settles at the review and approval of the Head of waiting area while the request is Office being processed Client receives the duly Assessment Clerk files duplicate accomplished and approved copies/office copies of the document assessment records and/or for future reference. certifications END OF TRANSACTION 5 minutes Assessment Clerk In-charge -none- Order of Payment 45 minutes to 1 hour Assessment Clerk In-charge - - 1 minute Assessment Clerk In-charge None None 1 minute E. Frontline Service : REPRODUCTION OF TAX MAPS a. Sketch Plan b. Section Maps Schedule of Availability of Service : MONDAY TO FRIDAY 8:00 am to 5:00 pm without noon break What are the Requirements : a. Official Receipt / Proof of Payment from PTO Transaction Fee : a. Bond Paper Size : b. Section Map Size : c. Base Map Size : Duration : HOW TO AVAIL OF THE SERVICE : Steps 1 2 3 Applicant/Client Client signs client logbook Secure Transaction Request Form (TRF) from the Public Assistance and Complaint Desk In-Charge, fillup and give the accomplished form back to the in-charge. Client presents details of the request to the tax mapping incharge for the processing of the request for tax maps, may present P 50.00 per page 100.00 per copy 150.00 per copy 56 minutes to 1 hour Service Provider Public Assistance and Complaint Desk In-Charge readies the Transaction Request Form to be accomplished by the client Public Assistance Desk In-Charge examines the accomplished TR Form and refers the client to the appropriate Assessment Clerk for the processing of request for reproduction of tax maps Taxmapping in-charge examines the documentary requirements and issues an Order of Payment (OP) to the client for the transaction Duration of the Activity Person in Charge 2 minutes Public Assistance and Complaint Desk In-charge 2 minutes Public Assistance and Complaint Desk In-charge Fees Form -none- Transaction Request Form -none- 5 minutes Taxmapping Clerk In-charge -none- Order of Payment 4 6 7 other supporting documents (TD, Title, etc.) for easy reference and reproduction of requested tax maps Client brings the Order of Payment to the PTO and pays the corresponding amount as computed by the assisting clerk at the Provincial Treasurer’s Office (PTO), collects the official receipt and head back to the Provincial Assessor’s Office (PASSO) Client submits the official receipt to the assessment clerk in-charge as proof of payment, and settles at the waiting area while the request is being processed Client receives the duly accomplished and approved assessment records and/or certifications Taxmapping Clerk In-Charge prepares the tax maps requested and submit the prepared documents to the Provincial Assessor or to this Assistant for review and approval. Assessment Clerk In-Charge records and releases the documents after review and approval of the Head of Office Assessment Clerk files duplicate copies/office copies of the document for future reference. END OF TRANSACTION 45 minutes to 1 hour Taxmapping Clerk In-charge - - 1 minute Taxmapping Clerk In-charge None None 1 minute F. Frontline Service : CONDUCT OF OCULAR INSPECTIONS / INVESTIGATIONS Schedule of Availability of Service : MONDAY TO FRIDAY 8:00 am to 5:00 pm without noon break What are the Requirements : a. Written request for ocular inspection b. Official Receipt / Proof of Payment from PTO Duration : 1 hour HOW TO AVAIL OF THE SERVICE: Steps 1 2 3 Applicant/Client Service Provider Public Assistance and Complaint Desk In-Charge readies the Transaction Request Form to be accomplished by the client a. Client presents his oral request Public Assistance Desk In-Charge for ocular inspection; or examines the request and the accomplished TR Form and refers b. Client presents/submits his the request to the Head of Office written request for ocular or to the Assistant Head of Office inspection for the assignment of ocular inspectors and scheduling of the c. Secure Transaction Request ocular inspection Form (TRF) from the Public Assistance and Complaint Desk In-Charge, fill-up and give the accomplished form back to the in-charge. Client settles at the waiting area Assessment Clerk in-charge and wait for instructions as to the secures instructions from the details of the schedules and head of office as to the approval availability of ocular inspectors and details of the schedules of Duration of the Activity Person in Charge Fees Form 2 minutes Public Assistance and Complaint Desk In-charge -none- Transaction Request Form Client signs client logbook 10 minutes Public Assistance and Complaint Desk In-charge -none- - 5 minutes Assessment Clerk In-Charge As indicated in the Order of payment Order of Payment 4 6 7 Client brings the Order of Payment to the PTO and pays the corresponding amount as computed by the assisting clerk at the Provincial Treasurer’s Office (PTO), collects the official receipt and head back to the Provincial Assessor’s Office (PASSO) Client submits the official receipt to the assessment clerk in-charge as proof of payment, and settles at the waiting area while the request is being processed Client confers and acknowledges the details and schedules of the ocular inspection, awaits for the actual ocular inspection by the ocular inspection team ocular inspection. When the request is approved, the assessment clerk in-charge issues an Order of Payment (OP) to the client for the transaction Assessment Clerk confers with the Provincial Assessor or the Assistant Provincial Assessor in organizing a team of ocular inspectors, processing of travel orders and finalization of schedules. 45 minutes to 1 hour Assessment Clerk In-Charge instructs the client as to the details of the ocular inspection, 1 minute introduces the team to conduct ocular inspection and finalizes the date and time of the inspection Assessment Clerk records the schedules and confers with the Administrative Division for the 2 minutes preparation of the necessary travel documents. END OF TRANSACTION Assessment Clerk In-Charge 300 per parcel - Assessment Clerk In-charge None None None none Assessment Clerk In-Charge G. Frontline Service : Schedule of Availability of Service : What are the Requirements : ANNOTATIONS/CANCELLATION OF LOANS/MORTGAGES, BAIL BONDS AND OWNERS NOTICES TO OFFICE MONDAY TO FRIDAY 8:00 am to 5:00 pm without noon break a. b. c. Duration : Latest Tax Declaration Mortgage/Bail bond documents; and/or cancellation of loans and bail bond papers duly registered in the Register of Deeds (ROD) Official Receipt / Proof of Payment from PTO 30 minuets HOW TO AVAIL OF THE SERVICE: Steps 1 2 3 Applicant/Client Client signs client logbook Secure Transaction Request Form (TRF) from the Public Assistance and Complaint Desk In-Charge, fill-up and give the accomplished form back to the in-charge. Client presents supporting documents to the assessment in-charge for the processing of the request for declaration of newly discovered real properties Service Provider Public Assistance and Complaint Desk InCharge readies the Transaction Request Form to be accomplished by the client Public Assistance Desk In-Charge examines the accomplished TR Form and refers the client to the appropriate Assessment Clerk for the processing of the request for the Annotations/cancellation of Loans/Mortgages, bail bonds and owners notices to office, etc Assessment Clerk examines the documentary requirements as to completeness, authenticity and appropriateness, advises the client to complete missing documents if any and issues an Order of Payment (OP) to the client for the transaction Duration of the Activity Person in Charge Fees Form 2 minutes Public Assistance and Complaint Desk In-charge none Transaction Request Form 2 minutes Public Assistance and Complaint Desk In-charge -none- - -none- Order of Payment 5 minutes Assessment Clerk In-charge 4 6 7 Client brings the Order of Payment to the PTO and pays the corresponding amount as computed by the assisting clerk at the Provincial Treasurer’s Office (PTO), collects the official receipt and head back to the Provincial Assessor’s Office (PASSO) Client submits the official receipt to the assessment clerk in-charge as proof of payment, and settles at the waiting area while the request is being processed Client receives the duly accomplished and approved documents of annotations and cancellations Assessment Clerk In-Charge prepares the necessary annotations and/or cancellation of loan/mortgages bail bonds and notices and other necessary documents, and submits the prepared documents to the Provincial Assessor or to this Assistant for review and approval. Assessment Clerk In-Charge records and releases the documents after review and approval of the Head of Office Assessment Clerk files duplicate copies/office copies of the document for future reference. END OF TRANSACTION 10 to 15 minutes Assessment Clerk In-charge 50.00/copy - 1 minute Assessment Clerk In-charge None None H. Frontline Service : PROCEDURE FOR THE RESOLUTION OF REDRESS / COMPLAINTS AND GRIEVANCES Schedule of Availability of Service : MONDAY TO FRIDAY 8:00 am to 5:00 pm without noon break What are the Requirements : Written Complaint (if any, otherwise, oral complaint is sufficient) Duration : 30 minutes to 1 hour HOW TO AVAIL OF THE SERVICE: Steps Applicant/Client 1 Client signs client logbook 2 a. Client submits his written complaint or redress or calls the attention of the Public Assistance Desk In-Charge for any irregularity, dissatisfaction, complaints or any grievances; or 3 b. Client may drop a written note of his dissatisfaction, complaints and grievances at the suggestion box provided near the entrance of the Provincial Assessor’s Office a. Client settles at the waiting area and wait for instructions Service Provider Public Assistance and Complaint Desk In-Charge discusses and gets the details of the grievance from the client The Public Assistance Desk In-charge shall record the document and refers it to the Assistant Provincial Assessor for possible resolution. Duration of the Activity 2 minutes Fees Form Public Assistance and Complaint Desk In-charge -none- - 2 minutes Public Assistance and Complaint Desk In-charge -none- - 30 minutes to 1 hour (or as long Head of Office -none- - If the complaint, redress or grievances are not resolved at this level, the Assistant Provincial Assessor shall forward the same to the Provincial Assessor for resolution The Provincial Assessor or the Assistant Provincial Assessor shall discuss with the client his complaints, redress, grievances and dissatisfaction Person in Charge 4 b. Client is summoned for a conference with the head of office to personally air his issues, and discuss a peaceful resolution of his dissatisfactions and grievances Client goes home with all his redress, grievances and dissatisfaction addressed to the last detail to reach a mutually desired resolution of the issue The Provincial Assessor introduces the necessary reforms to prevent or minimize the occurrence of irregularities in the processes or systems of the office that cause dissatisfaction, redress and grievances of clients, maintain efficient and effective processes and systems and strengthen internal controls END OF TRANSACTION as it mattered) - Head of Office - -

© Copyright 2026