Dependent Verification FAQs

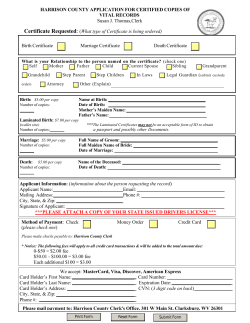

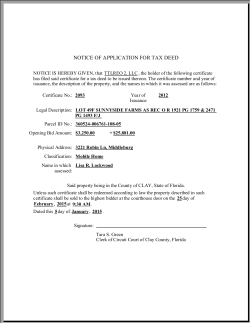

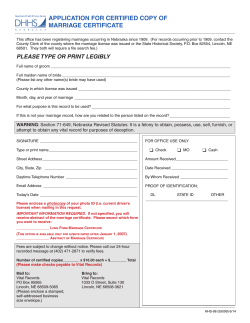

Dependent Verification FAQs This document contains answers to frequently asked questions. The documentation requirements and dependent eligibility rules are available on PeopleHUB. You may also contact the Dependent Verification Center toll-free at 1-800-725-5810 starting April 1, 2015. General Questions What is a Dependent Eligibility Verification? Dependent eligibility verifications are a common practice for organizations to ensure compliance within their benefit plans. Employees will be asked to provide appropriate documentation to prove their relationship to the dependents enrolled in their medical, dental and vision plans. Why is Reed Elsevier doing a dependent verification? Claims and health care management of dependents account for about 45 percent of our health care costs. One way to help manage these costs is to make sure we are only covering eligible dependents. Asking our employees to provide documentation helps ensure that eligible medical plan participants are not unfairly bearing the cost of covering ineligible individuals under our plans. In addition, we are legally required to ensure that our plans are administered properly. When Will the Verification Take Place? The dependent eligibility verification period is from April-May 2015. Who Will Conduct the Verification? Aon Hewitt will conduct the verification. They will send a packet to employees’ homes to request documentation, provide a hotline for customer support and access to a web portal to check the status of your verification. Aon Hewitt will also ensure your information is kept confidential by utilizing encryption technology to protect sensitive data. In addition, once your documentation is received, the hard copy is destroyed to ensure confidentiality. Will everyone be subject to the dependent verification? All employees who cover dependents under a Reed Elsevier medical, dental or vision plan must respond to the dependent verification. What if I already completed the Dependent Verification process as a new hire this year? If your dependent(s) were previously verified in 2015 as a newly hired employee, you will not be included in the ongoing dependent verification. However, if you add additional dependents due to a qualifying event, you will be asked to verify their eligibility at that time. Verification Information – What to Expect Employees with covered dependents on their medical, dental and vision plans will receive a packet to their homes from Aon Hewitt in early April. The packet will provide a list of covered dependents and the documentation that can be submitted as proof of eligibility for each type of dependent. Depending on the type of dependent, you may be required to provide more than one document to verify your dependent is eligible. As an example, a spouse requires a state or federal tax return and a marriage certificate to verify eligibility. We are verifying all of our current dependents to ensure we are offering coverage only to those that are eligible. Since January 2015, documentation is required for each dependent added to coverage throughout the year and during open enrollment to ensure we’re proactively verifying eligibility. Important To-Do’s and Dates Employee To Do’s A packet will be sent to employees requesting documentation for eligible dependents. Documentation needs to be sent to Aon Hewitt to prove eligibility for dependents. Non-responders and ineligible dependent coverage will be terminated. Dates Sent 1st week of April 2015 Within 45 days of receipt of packet/enclosed deadline date May 31, 2015 Once appropriate documentation is sent to Aon Hewitt and approved, a letter will be sent to the employee notifying them that they have successfully completed the verification. Reminder notices and termination notices will only go to employees who have not successfully completed the verification. Employees not providing appropriate documentation within the specified timeline will receive a letter from Aon Hewitt notifying them that their dependents’ coverage will be cancelled. Documentation Required for Dependents Added after April 1, 2015 Employees will be required to provide the same documentation for any dependents added after April 1, 2015 at the time of enrollment. Dependents without the appropriate documentation will not be considered eligible to be enrolled in benefits. Employees will have 30 days from the date the dependent became eligible to provide the documentation. I can’t seem to find the fax number or address to send my dependent verification documents. You may submit your documentation by: Online Upload: www.yourdependentverification.com/plan-smart-info Secure Fax: 1-855-965-9555 Mail: Dependent Verification Center P.O. Box 1414 Lincolnshire, IL 60069-1414 Please note that faxing or uploading is encouraged to ensure your documents are received prior to the deadline. Do not forget to include the signed and dated Dependent Verification Cover Sheet. It must be completed and returned with your documentation to successfully verify your dependent(s). I never received or misplaced the package that was sent to me for providing my documentation. Can you send me an additional copy? You can contact the Dependent Verification Center at 1-800-725-5810 in order to request another package to be mailed to you. Dependent Eligibility How do I know if my dependent is eligible? We encourage you to research the dependent eligibility rules before the verification begins. You can view the dependent eligibility rules on PeopleHUB. You also will receive a list of your dependents covered under the plan and a list of the dependent eligibility rules when the verification begins. This information will help you determine whether your dependents are eligible. Who are considered eligible dependents under the Reed Elsevier medical, dental and vision plans? The following dependents are eligible for coverage under the Reed Elsevier medical, dental and vision plans: Your spouse/domestic partner. o If you are divorced and are required to cover your ex-spouse, your ex-spouse is not eligible. You/your domestic partner's children up to age 26 -- for medical coverage only. You/your domestic partner's unmarried children up to age 23 – for all other coverage, up until the end of the month he/she turns 23 if he/she is a full-time student. Your/your domestic partner's unmarried children of any age incapable of self-support due to mental/physical disability that commenced before age 19 (or age 26 for medical coverage). Proof of disability is required for disabled dependents. Examples of Documentation That May Be Requested (not a complete list) State or federal tax returns (within the last two years) showing married filing jointly or married filing separately (first page only, blacking out social security numbers and financial information) Marriage certificates Birth certificates Divorce Decrees What information do I need to cover my Domestic Partner? In order to cover your domestic partner your relationship with him/her must meet all of the following criteria: You and your partner currently reside together; You and your partner are jointly responsible for basic living expenses; You and your partner are not married to anyone else either pursuant to statutory law or common law; You and your partner are both 18 years or older; You and your partner are not related by blood closer than allowed for by marriage (per state code) You and your partner are the other’s sole domestic partner and; You must complete an Affidavit of Domestic Partnership or provide documentation from a Government Registry Documentation I have misplaced my child’s birth certificate and my marriage certificate. What should I do? To obtain a copy of a birth or marriage certificate, please contact the vital records department of the state in which the event took place. You may also request copies of these documents from VitalChek, a Reed Elsevier company. Reed Elsevier will waive the processing fee applied to obtaining these documents when you use the link provided on the Dependent Verification secured website www.yourdependentverification.com/plan-smart-info. However, other fees (including agency fees or shipping fees) will be applicable when requesting certificates or licenses from local governments. I was married in a different country and I can’t get a copy of the marriage certificate. What can I supply as my proof of marriage? A marriage certificate that was provided in a foreign country as proof of marriage or your naturalization paperwork are acceptable documents to provide. Please contact the Dependent Verification Center at 1-800-725-5810 before the deadline shown on the notice for alternative forms of documentation that will be accepted. I have a birth registration card that lists my child’s information, but not the name of the parents. Will that work? No. Birth certificates are requested so that we can verify the parents of the child. Unfortunately, the birth registration card does not list the parents and, therefore, cannot be used to verify the child’s eligibility for coverage. My name is not on the birth certificate for my stepchild. Is this going to be a problem? No, as long as we have a copy of your marriage certificate and the child’s birth certificate that lists you or your spouse as the parent of the child. I did not keep a copy of my prior year’s tax return. What should I do? If you do not currently have a copy of your prior year’s tax return, please visit www.irs.gov/taxtopics/tc156.html and follow the instructions to request a copy from the Internal Revenue Service (IRS). Protecting my Personal Information I am concerned about identity theft and sharing my personal information with a third party, Aon Hewitt. We understand and share your concern for the security of personal information. Reed Elsevier complies with federal and state mandates regarding data security and our vendors are held to the same standard. All health-related vendors are held accountable in their contract with Reed Elsevier to protect the privacy and security of Protected Health Information (PHI) disclosed to them and to comply with the Health Insurance Portability and Accountability Act (HIPAA) as amended. How do I know that my confidential information will be secure? All Dependent Verification Center employees and contractors are held to the highest standard of conduct regarding the processing of personal information and documents. Strict security measures are in place to ensure the integrity of the personal data warehoused at the Benefits Choice Center and to maintain legal compliance with relevant privacy regulations. To view the Benefits Choice Center (Hewitt Employees) Data Privacy Statement., visit www.hewitt.com, scroll down to the bottom of the page and click on “Privacy Statement.” Why do I need to provide tax documents, bills, and account statements? I don’t feel comfortable providing my financial information. Be sure to black out any financial information, account numbers and/or Social Security numbers when submitting documentation per the instructions in the notice. My financial information is private and I do not want it provided. Reed Elsevier has no interest in your financial records. The purpose for requesting the top page of your tax return is to provide proof of an existing marriage. We suggest you remove all financial information and SSNs with the exception of the last four digits from the document before you submit it. Ineligible Dependents I never sent in documents for the dependent verification, will my dependents be dropped? Your dependents will be removed from current coverage elections, including medical, dental and vision by May 31, 2015. Will my ineligible dependents be dropped from all coverage? For dependents determined to be ineligible, current coverage elections for the dependents will at the end of the month in which they are deemed ineligible. Employees will be notified that their dependent is ineligible through a letter sent to their home from Aon Hewitt. Employees with employee + spouse, employee + child(ren) or family coverage that have an ineligible dependent removed from a plan causing a change in coverage tiers, will result in the new coverage tier becoming effective the first pay period after the ineligible dependent’s coverage is cancelled. Dependents found to be ineligible will not be offered COBRA. COBRA is the ability to continue health insurance after coverage is terminated due to a status change. COBRA is offered only to eligible dependents that terminate from coverage due to a status change. Appeals Process There will be an appeals process for employees with extenuating circumstances that prevent them from being able to provide the required documentation within the specified timeline. Employees with special circumstances should contact the Dependent Verification Center as soon as possible to ensure they are notified prior to the deadline. More information about the appeals process will be provided in the packet mailed to your home. If an appeal is denied or if documentation is provided after the deadline, the dependents will be terminated as of May 31, 2015. Where can I buy health insurance for my dependents if they are terminated from the Reed Elsevier health plan(s)? If you decide to shop for coverage for your dependent(s) elsewhere, HealthCare.gov can guide you through the process. How Do I Verify My Dependents? STEP 1: Review the list of dependents you have enrolled and match each of them to a dependent type listed in the "Eligibility Rules and Documentation Required" section. STEP 2: For each dependent type you will find the eligibility requirement and a list of document options required to verify that particular dependent type. STEP 3: Once you have matched your dependents to types, gather all the necessary documents and forward them to the Dependent Verification Center by: Online Upload: www.yourdependentverification.com/plan-smart-info Secure Fax: 1-877-965-9555 Mail: Dependent Verification Center, P.O. Box 1414, Lincolnshire, IL 60069-1414 If you have questions or need assistance, please call the Dependent Verification Center at 1-800-725-5810. Representatives are available Monday through Friday, from 7 a.m. to 10 p.m. Central Time. DOCUMENTATION REQUIREMENTS AND THINGS TO REMEMBER SEND COPIES ONLY! Black out Social Security numbers appearing on any documents submitted. Only send the first page of your prior year federal tax return (Form 1040) that shows your dependents. Black out all monetary amounts appearing on federal tax returns (example: earnings listed on your 1040) Documents proving joint ownership are: mortgage statements, credit card statements, bank statements, property tax statements, and current, non-expired residential leasing agreements listing both parties' names as co-owners. The joint ownership may be established prior to the current year; however, the statement provided must be issued within the last six months, or still current if a residential/ease. Proof of marriage must be a government-issued marriage license or marriage certificate including the date of your marriage. Church-issued certificates are NOT acceptable. Birth certificates must be government-issued birth certificates listing parent names. Hospital-issued certificates are NOT acceptable. VITAL RECORDS REQUEST: If you need to request vital records from a state or local public records office, please order your documentation early in the verification process to ensure timely receipt. Some state and county offices can take several weeks to issue a vital record. PHOTOCOPYING VITAL RECORDS: If photocopying of your vital record is prohibited, we recommend that you obtain the non-certified vital record and submit your documentation via the United States Postal Service. BIRTH CERTIFICATES LISTING PARENT NAMES: Short form government-issued birth certificates that do not contain parent names are NOT acceptable. Please obtain the long form that includes the parent names (the same used to obtain a passport). ELIGIBILITY RULES AND DOCUMENTATION REQUIRED Below is a list of eligibility rules and documents required to verify the eligibility of each dependent. In some cases, at least TWO forms of documentation are required. Please read carefully. ID LS Dependent Type Age Legal Spouse N/A Eligibility Requirements • Your husband or wife under Federal Law Document Options for Verifying Eligibility: Government-Issued Marriage Certificate and Federal Tax Return Within Last 2 Years Listing Spouse OR Government-Issued Marriage Certificate and Proof of Joint Ownership Issued Within Last 6 Months OR Government-Issued Marriage Certificate Only (if married within the last 12 months) DP Domestic Partner Age 18 and over Your same-sex or opposite-sex domestic partner registered with a state that allows for same-sex or opposite-sex domestic partner relationships and meets the following requirements: • Must be capable of consenting to the domestic partnership • Must be each other's sole domestic partner in a long-term committed relationship and intend to remain so indefinitely • Must share a common residence • Must not be related by blood in a way that would prevent you from being married to each other • Must be financially interdependent • Must not be legally married to someone else or be a member of another domestic partnership Document Options for Verifying Eligibility: Certificate of Domestic Partner Registration and Proof of Joint Ownership Issued Within Last 6 Months OR Affidavit of Domestic Partnership and Proof of Joint Ownership Issued Within Last 6 Months BC Up to age 26 Biological Child • Must be your biological child • • • • Must be your biological child Document Options for Verifying Eligibility: Government-Issued Birth Certificate (including parents' names) DBC Disabled Biological Child Age 26 and over Must be unmarried Must be medically certified as disabled Must be financially supported by you Document Options for Verifying Eligibility: Government-Issued Birth Certificate (including parents' names) and Federal Tax Return Within Last 2 Years Claiming Child ID AC Dependent Type Age Up to age 26 Adopted Child Eligibility Requirements • Must be your adopted child Document Options for Verifying Eligibility: Adoption Placement Agreement (including child's date of birth) or Petition for Adoption (including child's date of birth) OR Adoption Certificate (including child's date of birth) DAC Disabled Adopted Child Age 26 and over • • • • Must be your adopted child Must be unmarried Must be medically certified as disabled Must be financially supported by you Document Options for Verifying Eligibility: Adoption Certificate (including child's date of birth) and Federal Tax Return Within Last 2 Years Claiming Child SC Up to age 26 Step-Child • Must be your spouse's child Document Options for Verifying Eligibility: Government-Issued Birth Certificate (including parents' names), Government-Issued Marriage Certificate and Federal Tax Return Within Last 2 Years Listing Spouse OR Government-Issued Birth Certificate (including parents' names) and Government-Issued Marriage Certificate (if married within the last 12 months) OR Government-Issued Birth Certificate (including parents' names), Government-Issued Marriage Certificate and a Proof of Joint Ownership Issued Within Last 6 Months DS Disabled Step-Child Age 26 and over • • • • Must be your spouse's child Must be unmarried Must be medically certified as disabled Must be financially supported by you and your spouse Document Options for Verifying Eligibility: Government-Issued Birth Certificate (including parents' names), Government-Issued Marriage Certificate and Federal Tax Return Within Last 2 Years Listing Spouse & Claiming Child OR Government-Issued Birth Certificate (including parents' names), Government-Issued Marriage Certificate, Proof of Joint Ownership Issued Within Last 6 Months and Federal Tax Return Within Last 2 Years Claiming Child DPC Domestic Partner Child Up to age 26 • Must be your same-sex or opposite-sex domestic partner's child Document Options for Verifying Eligibility: AMEODKENFLCOEJEIEK AJAJFAGDDOEOFMFCLK AEIPJGOHGPJFLPBOGK AJDMMBCGAAOIJPJEPK DDDDLDDLLDLLLLLDLL Government-Issued Birth Certificate (including parents' names), Affidavit of Domestic Partnership and Proof of Joint Ownership Issued Within Last 6 Months OR Government-Issued Birth Certificate (Including parents' names), Certificate of Domestic Partner Registration and Proof of Joint Ownership Issued Within Last 6 Months ID DPD Dependent Type Domestic Partner Disabled Child Age Age 26 and over Eligibility Requirements • Must be your same-sex or opposite-sex • • • Must be unmarried domestic partner's child Must be medically certified as disabled Must be financially supported by you and your domestic partner Document Options for Verifying Eligibility: Government-Issued Birth Certificate (including parents' names), Affidavit of Domestic Partnership, Proof of Joint Ownership Issued Within Last 6 Months and Federal Tax Return Within Last 2 Years Claiming Child OR Government-Issued Birth Certificate (Including parents' names), Certificate of Domestic Partner Registration, Proof of Joint Ownership Issued Within Last 6 Months and Federal Tax Return Within Last 2 Years Claiming Child LW Legal Ward Up to age 26 • Must be your legal ward as ordered by the court Document Options for Verifying Eligibility: Government-Issued Birth Certificate and Court Ordered Document of Legal Custody DW Disabled Legal Ward Age 26 and over • Must be your legal ward as ordered by • • • Must be unmarried the court Must be medically certified as disabled Must be financially supported by you and your spouse Document Options for Verifying Eligibility: Government-Issued Birth Certificate, Court Ordered Document of Legal Custody and Federal Tax Return Within Last 2 Years Claiming Child The above benefit descriptions describe the plan(s) generally, and in summary form only. In the event of a conflict between what is stated in this document and the governing plan document(s), the plan document(s) will control.

© Copyright 2026