Dependent Proof Documentation Requirements

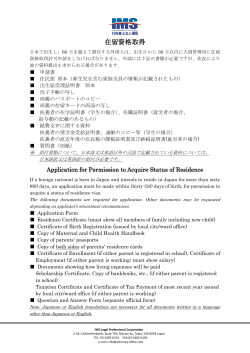

DEPENDENT PROOF DOCUMENT REQUIREMENTS FOR MEDICAL COVERAGE Effective April 1, 2015, Human Resources is partnering with Aon Hewitt Dependent Verification Services to verify eligibility of dependents enrolled in the UNM Medical Plan. All benefits-‐eligible employees and Pre-‐65 retirees with dependents (spouse, domestic partner, and/or children) enrolled in a UNM Medical Plan will be required to provide documents validating that the dependents they are covering are eligible. Aon Hewitt will provide details about the required documentation via a home-‐mailed letter. In accordance with new IRS reporting requirements, Aon Hewitt will also collect dependent Social Security Numbers on UNM’s behalf during the dependent verification process. Through this transition, please call the HR Service Center with any questions at 505-‐277-‐MYHR (6947) during business hours, Monday -‐ Friday, 8:00 am – 5:00 pm. The list below is not all-inclusive Spouse (Legally Married) Government-Issued Marriage Certificate and Federal Tax Return within the last two years. Domestic Partner Notarized UNM Affidavit of Domestic Partnership form and Proof of Joint Ownership issued within the last six months. Biological Child Government-Issued Birth Certificate of biological child Adopted Child or Child Placed for Adoption Documentation depends on stage of adoption process. Adoption Placement Petition or Agreement or Adoption Certificate Stepchild Government-Issued Child’s Birth Certificate stating the child’s parent is the employee’s spouse, and Government-Issued Marriage Certificate for legal marriage between employee and the child’s parent Legal Guardianship (Ward) Government-Issued Child’s Birth Certificate and Court Ordered Document of Legal Custody Child of Domestic Partner Government-Issued Child’s Birth Certificate showing the child’s biological or adoptive parent, and Notarized UNM Affidavit of Domestic Partnership form and Proof of Joint Ownership issued within the last six months. Must be your Domestic Partner’s child. Disabled Child Age 26 or Older (the disabled dependent must be enrolled prior to turning age 26) Government-Issued Birth Certificate plus Federal Tax Return within the last two years claiming child.

© Copyright 2026