Marie-Luise Schmitz, Ph.D.

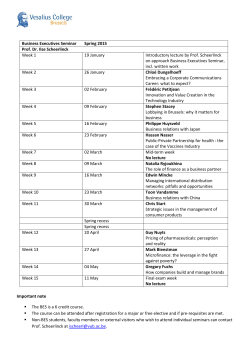

Marie-Luise Schmitz, Ph.D. Curriculum Vitae A highly analytic, disciplined economist in the field of micro-econometrics and public finance with working experience in relevant political institutions. My excellent methodological education together with my versatile language skills allow me to conduct sound empirical research in a broad variety of contexts. I have worked in an intercultural academic environment, am skilled at conducting quantitative data analysis, managing information flow, and presenting research at international conferences. Academic Training 10/2010–12/2014 Ph.D., Graduate School in Public Economics (with full scholarship) Catholic University Milan and University of Milan-Bicocca, Italy Thesis: Essays in Applied Microeconometrics (excellent) Supervisors: Prof. Massimo Bordignon and Prof. Gilberto Turati 10/2002–09/2010 M.Sc. in Economics (Diplom-Volkswirtin) University of Cologne, Germany Thesis: Detecting Soft Budget Constraints Empirically. The Case of Italy (excellent) Supervisor: Prof. André Kaiser Working Experience 10/2012–12/2013 Teaching Assistant to the Institute of Economics and Finance Catholic University of Milan 01/2007–02/2009 Student Assistant to the Chair of Comparative Politics Prof. André Kaiser, University of Cologne 08/2007–09/2007 Internship at the European Parliament, Brussels Office of Dr. Klaus Hänsch, MEP and Former President of the European Parliament 02/2007–04/2007 Internship at the Ministry of Economic Affairs and Energy, North RhineWestphalia, Düsseldorf Department of Regional Economic Policy, Industries, Services and Cluster Policy 08/2005–09/2005 Internship at the Federal Statistical Office, Bonn Department of Services, Agriculture and Environment Conferences 09/2013 General Conference, European Consortium for Political Research, Bordeaux Paper: Strategic and Attitudinal. Patterns of Judicial Assertiveness in Italy [email protected] Marie-Luise Schmitz Curriculum Vitae 06/2014 Defap/Laser Summer School in Applied Microeconometrics 2014, Milan Paper: Does Fiscal Devaluation really work? Evidence from an Italian Experiment Teaching Experience Winter term 2013–2014 Exercises for the lectures Public Economics (BA), Prof. Paolo Balduzzi and Public Finance (BA), Prof. Massimo Bordignon, Catholic University Milan in Italian language Summer term 2013 Exercise for the lecture Public Finance (MA), Prof. Paolo Balduzzi, Catholic University Milan in Italian language Winter term 2012–2013 Exercise for the lecture Public Finance (BA), Prof. Massimo Bordignon, Catholic University Milan in Italian language Winter term 2008–2009 Tutorial for the lecture Comparative Political Systems (BA), Prof. André Kaiser, University of Cologne in German language Language Skills German English Italian French Spanish native fluent fluent advanced advanced Computer Skills Stata (expert), E-Views (basic), SPSS (basic), MS Office (expert), Latex (advanced) References Prof. Massimo Bordignon Department of Economics and Finance Catholic University of Milan Phone: E-mail: +39 02 7234 2976 [email protected] Prof. Gilberto Turati Department of Economics and Statistics University of Turin Phone: E-mail: +39 011 670 6046 [email protected] Prof. André Kaiser Cologne Center for Comparative Politics University of Cologne Phone: E-mail: +49 221 470 2852 [email protected] Dormagen, April 1, 2015 [email protected] Marie-Luise Schmitz Curriculum Vitae Job market paper Does fiscal devaluation really work? Evidence from an Italian experiment (with Massimo Bordignon and Gilberto Turati) Abstract. The empirical assessment of the effectiveness of tax reforms along the lines of fiscal devaluation is a highly relevant issue in crisis-ridden Europe. Fiscal devaluation is considered as one of the few options left for Eurozone countries with severe fiscal and unemployment problems to regain competitiveness and to accelerate the consolidation process. Though the theoretical case for fiscal devaluation is strong, empirical evidence lags behind. To address the effects of tax shifts on employment and growth, we exploit a regionally differentiated tax reform implemented in 2007 as quasi-experiment. Enhancing a geographic regression discontinuity design through matching, we investigate the effects of a labour tax wedge reduction on employment, average plant size, and net firm inflow. We find positive significant employment effects of both conditionally and unconditionally granted deductions but no evidence of firms’ self-selection into high-deduction areas. [email protected]

© Copyright 2026