HOW TO DEVELOP A ROBUST ONLINE SELLING STRATEGY IN CHINA?

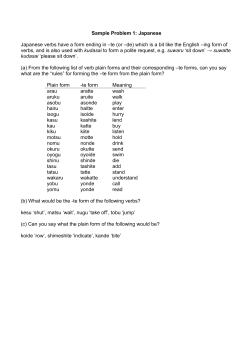

IN COOPERATION WITH HOW TO DEVELOP A ROBUST ONLINE SELLING STRATEGY IN CHINA? 09 April 2013 A project funded by the European Union Please continue to submit your text questions and comments using the Questions Panel www.eusmecentre.org.cn [email protected] Purpose • The EU SME Centre in Beijing is a project funded by the European Union • To assist European SMEs to export to China and establish, develop and maintain commercial activities in the Chinese market • Free, confidential information and advice, and practical support services Services Information and advice • • • • • Support services BD Enquiries Publications Training Legal S&C networking Webinars Databases • Hot desks • Briefings • Matchmaking and HR & Training Selling Online in China Trends Models for Selling Online Key Players Consumer Behaviour Logistics Diagnostic kit Are you ready for China? • Includes four reports and an online quiz • Covers all aspects of early market entry in China • Includes lists of national and European support organisations • Includes a multitude of links to further sources of information • Freely available on our website www.eusmecentre.org.cn Online portal • Register for free on our website and access our: • Ask-the-expert service for any question you might have • Knowledge Centre for upto-date publications • www.eusmecentre.org.cn Events and webinar calendar • Hot-desking service Presentation Content 1. Why Sell Online? 2. Who’s Buying? 3. How to Sell Online? 4. Case Studies: Best Practices and Challenges E-commerce in China Why Sell Online? Internet and Mobile Internet Users Increasing Rapidly 600 564 513 500 457 419 384 400 355 298 300 302 210 233 200 100 117 50 0 2007 Mobile Internet Users source CNNIC, 2013. 2008 Internet Users 2009 2010 2011 2012 Internet Penetration in China Room for Further Expansion 1,600,000,000 90 80 1,343,239,923 78,1% 70 1,400,000,000 63,2% Percentage 60 1,000,000,000 50 40 1,200,000,000 820,918,446 40,1% 800,000,000 Population 600,000,000 30 400,000,000 313,847,465 20 200,000,000 10 0 0 China source Internet World Stats, 05/2012 Penetration United States Europe Increasing Market Value Will Reach 176 Billion US$ by 2014 120 105 • B2C will be 40% of market by 2014 • E-commerce will represent 7.4% of the country’s total retail value by 2015 (now 3.3%) 100 80 88 72 71 57 60 57 42 40 41 28 20 7 26 12 13 5 1 0.6 0 2007 C2C B2C source AT Kearney, 2011 2008 2009 2010 2011 2012 2013 2014 M-Commerce, the Rising Star +333% y-o-y 2011-2012 M-Commerce Sales 45 41.4 40 35 27.1 30 31 25 20 15.7 15 7.8 10 1.8 0.4 5 3.5 23.7 17.2 11.6 6.7 0 2010 USA China source New Media Trend Watch. 2011 2012 2013 2014 2015 Advantages of an E-Shop • Allows 24H business operations; • Helps reaching customers in small cities in a costeffective way; • It serves as a strategic tool for retaining the most valued customers; • It represents an effective marketing tool (shoppers rely heavily on web searches and reviews) source Bain & Company, 2012 China E-Commerce Who’s Buying? The Chinese Online Shopper Who’s Buying? Online Buyers in China 450 423.4 400 374.9 350 322.1 300 270.9 250 200 User profile 219.8 178.4 150 100 50 0 source China Internet Watch Nearly 60% Taobao (淘宝) Shoppers Between 25-35 Year-old; Come from urban areas (over 70%) and have a monthly income of under CNY 5000 (Euro 575); They are most likely students (28.6%), managerial and non-managerial white collar staff (18.2%), selfemployed/freelance (16.4%) and professional technicians (10.8%); Women account for 45% of all internet users from only 20% ten years ago. source Access Asia, CNNIC, China Internet Watch 2012 Internet Penetration in China Differences Amongst Regions source The Economist The Chinese Online Shopper Buying What? The Chinese Online Shopper Changing Behaviours Early Stage of Development Currently Price Sensitive Service Sensitive Top Reasons Why Chinese Consumers Shop Online Anytime Shopping 28% Low Price 25% Convenience 18% Easy to Compare Prices 7% Variety 4% Free Delivery 1% Detailed Product Info 1% Easier to Find Favourite Brand 1% 0% source Bain & Company, 2012 5% 10% 15% 20% 25% 30% source China Internet Watch E-commerce in China How to Access the Market? E-commerce in China Step by Step ICP License, Language Select Platform Open Shop (B2C or C2C) How? Promotion / Sales Regulation & Standard Inspection & Certification • Direct Export • Local Storage Local Storage Custom Clearance Ship Product to China How? Ship product to Customer Payment Collection How? Aftersales Services Online Selling Models Outside No ICP Shipping Cost/Risk Shipping & Payment Issues Language Custom Consumer Trust Payment After Services Third Party Platform Stand-alone Consumer Trust Faster Delivery Better Shipping ICP Licence & After Services Website Design & Maintenance Easier Payment Licences & Certifications Inside Select the Platform Biggest B2C Platforms in China, 2012 Others 26% Tmall 44% Yi hao Dian 1% Vancl Gome 1% 1% Dang Dang 1% Amazon 2% Suning 4% Tencent B2C 4% source China Internet Watch Jing Dong 16% Select the Platform Biggest C2C Platforms in China, 2012 Q3 Pai Pai 5.46% Eachnet 0.01% Taobao 94.53% source iResearch • C2C (90.7% market share) • Chinese Guarantor • Individual • Free • Grading system 阿里巴巴集团 阿里巴巴集团 T Mall vs Taobao Shop • B2C (51% market share, 360buy: 18.5%) • Registered Company • 50,000RMB+ • Annual service charge (30,000RMB60,000RMB) • Grading system B2C Parcel Delivery Large networks offering basic services. Follow franchise model Rely on speed and price Wide network coverage E.g. EMS, 20,000 locations Smaller networks offering more complex services. Compete regionally Offer warehousing, collect-ondelivery, scheduled returns Select cities with most volume E.g. Topname, Fedex, TNT Logistics 40kg package from Beijing to Chengdu Cost 300RMB to 700 RMB Time 2 to 3 days Third-party logistics support • Many delivery companies are able to cover lower tier cities / counties • Shipping of some goods (Temperature, high value, strange shape etc.) is still a challenge • Short of hands in holiday seasons, especially Chinese New Year, resulting in delay on delivery • Many of the significant players have invested heavily to build their own logistics system Case Studies A creative and marketing business “whose designs happen to be on the front of a T-shirt”. •Dominic Johnson-Hill established Plastered 8 in China in 2006. •10 employees •Targets young Chinese white collar workers, expats and foreign tourists •One bricks and mortar store; one Tmall store; own website B2C channel of TORRES China •300 employees •Number of Everwines’ members reached over 20 000 in 2011 •Developed its own courier service, money handling and wine appreciation. •Deliveries within 24h •Everwines seeks to reduce the amount of competition by targeting niche markets. Challenges and Best Practice IPR: Limited control over Intellectual Property Rights. Price sensitivity: Increased price sensitivity and intensified price competition. Logistics: Chinese customers expect fast deliveries. Licenses: Especially hard to obtain for medical devices, pharmaceuticals and food products. Labour intensive: Requires constant updating. Language: Brand names and marketing must be adapted. Feedback Negative feedback will greatly effect the grade of the seller Do everything you can to avoid it!!!! CRM Carefully manage existing customers Send out promo info via sms or email Think end-to-end Including after sales services Full force If you ‘do online’, do it full force; dedicate the right resource to it Online portal • www.eusmecentre.org.cn /content/documentation www.eusmecentre.org.cn • Online Selling Report • Plastered 8 Case Study • Everwines Case Study IN COOPERATION WITH A project funded by the European Union

© Copyright 2026