wire HOW TO BE A WINNER CSC

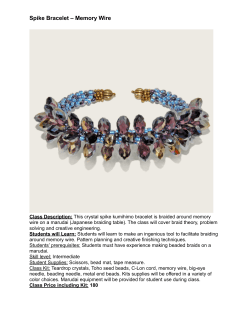

Clearwater’s TMT sector commentary Winter 2013 the wire Deal focus Private equity Cloudex awards Interview Review of 2013 Exit opportunities The cream of the crop Rivo Software HOW TO BE A WINNER The ingredients for success in the cloud CSC Exclusive interview after sale to Trimble the wire | Winter 2013 2 welcome Welcome Welcome to the latest issue of Clearwater’s commentary on the TMT sector. We were recently delighted to host our inaugural Cloudex 20:20 awards, where we showcased the very best talent in UK cloud technologies. Our individual winners Fourth, Acturis, Livebookings and Skyscape are all undoubtedly names to watch in the future, as are all those on our shortlist. As you can read in this issue, there are key attributes that run through all our winners. They are pure cloud companies with no the technology but your entire approach and model, with a continuing focus on recurring revenue paramount. But amid the advice there are words of warning. As another winner reminds us, one should never forget that end-users don't really care all that much about fancy cloud-based technology. What they care about is whether the technology makes their working day easier. “The fact that CSC was able to ride out the UK recession speaks volumes for the quality of its products and people, alongside its global strategy.” decade ago; a transaction which also happened to be Clearwater's very first deal. Just as we have grown since that day, so we have been delighted to assist CSC in its growth ever since, culminating in its recent sale to Trimble. The fact that CSC was able to ride out the UK recession speaks volumes for the quality of its products and people, alongside its global strategy. We hope you enjoy this issue and if you want to read more or get in touch, follow us on Twitter at @CCFtech and visit our blog at http://extranet.clearwatercf.com/ blogs/techblog Carl Houghton Partner legacy mindset; analytics is the bedrock of their businesses; and, crucially, their software is designed for very specific business tasks. Most of our winners now have global ambitions, taking advantage of the fact that the UK remains very much at the frontier of the cloud industry. The thoughts of our winners on what makes a successful cloud business are fascinating. As Ben Hood, CEO of overall winner Fourth tells us, it's not just about Indeed, global ambition was exactly what construction modelling software provider CSC had in spades when it set out to grow its business in the wake of a buyout a The wire is published by Clearwater Corporate Finance LLP Editors: Jim Pendrill and Sarah Fernandez Design: www.creative-bridge.com Subscription: [email protected] No part of this publication may be reproduced or used in any form without prior permission of Clearwater Corporate Finance LLP the wire | Winter 2013 Contents Meet the team 3 contents 4 6 news cloudex +44 (0)845 052 0344 carl.houghton@ clearwatercf.com f f Carl Houghton Emma Rodgers Partner Director, TMT Market Intelligence +44 (0)845 052 0359 emma.rodgers@ clearwatercf.com 10 Helen Lowe interview Assistant Director f +44 (0)845 052 0363 helen.lowe@ clearwatercf.com 12 16 research deals f z Omar Mahmood Manager +44 (0)845 052 0363 omar.mahmood@ clearwatercf.com James Hales Deal Origination Director +44 (0)845 052 0354 james.hales@ clearwatercf.com Adam Philippsohn Deal Origination +44 (0)845 052 0354 adam.philippsohn@ clearwatercf.com the wire | Winter 2013 4 news Game plan A global vision helped construction software specialist CSC through the UK recession, leading to its subsequent sale to Trimble, a leader in positioning technology. CSC Managing Director Mark Roberts says it was the quality of both the products and people that got his company through the recession. That, and the foresight a few years before the crash to broaden its base. “Although we had built up a reasonable position in the UK construction market, we knew that if we caught a cold then there could be issues so we went looking for new global markets.” The fact that bigger players were shedding jobs would work to CSC’s advantage. As Roberts explains: “Lots of industry specialists in their 30s and 40s who had lost their jobs ended up setting up their own consultancies. These people were lean, mean and hungry with many contacts in the industry so what we did really fitted the bill for them. The growth of our business in the UK has really come from these emerging new businesses.” “What we hadn’t reckoned was how the MBO would actually give us all a real buzz for the business, we really started enjoying it again.” The result today is a software business spanning the globe with offices in Singapore, Malaysia, Australia, South Africa, India and the US. As he continues: “I wouldn’t say our global expansion saved us from the UK recession, but when we were seeing big construction players shedding hundreds of jobs on virtually a weekly basis it was quite a scary place to be. Yes, some of our clients went out of business but the majority stuck with us and were very loyal.” CSC provides software for all aspects of structural engineering including technical calculations and analysis, structural design, 3D modelling, drawing and information management. Adds Roberts: “Our products help design buildings, whether multi-storey offices, retail centres, schools or hospitals. It is all very automated and we are very BIM (Building Information Modelling) friendly. Our clients also know that we continue investing in our products.” This focus on R&D has been at the core of CSC’s success since a debt-funded buyout 10 years ago which saw Roberts, then sales director, take the helm. “To be honest, at that time we had all been with the business so long that our game plan was to grow it for four or five years and then exit. What we hadn’t reckoned was how the MBO would give us all a real buzz for the business, we really started enjoying it again. The debt was paid off within the term and we invested heavily in R&D to make our products flashier, more suitable and more appealing to a wider reach of people.” Such was the team’s renewed zeal that five years on from the buyout the talk was of securing further investment rather than exiting, and a deal was struck with PE investor ISIS. “Our attitude changed. When the time came to look at our options again the recession was beginning to bite, although we were still performing well, so we thought it would be a good time to take some cash out of the business while introducing a new investor to further support our product development and geographic expansion.” The company’s can-do attitude, and particularly its move into the US, would ultimately prove key to the later sale of the business. As its US operations grew, one company that took particular notice was Trimble, a multi-billion dollar software player best known for its GPS technology. Roberts says Trimble had been continuously expanding its presence in the construction space and the companies began working together, especially after Trimble’s purchase of the Finnish Tekla Corporation in 2011. As CSC began integrating its own software with Tekla’s, so the genesis of a sale to Trimble emerged. Adds Roberts: “The possibility of a trade sale to a US player was the wire | Winter 2013 always there, but we also knew it would be a three to five year journey to get to where we wanted to be. When it was time to initiate the sale process we drew up a number of buyers in the US and Europe, and against all criteria Trimble were top of the list.” 5 news Roberts believes that for any UK company thinking of a trade sale to the US, it is fundamental to build up close relationships across the Atlantic first. “You have got to do some serious homework. There is no point just planting a flag over there with no clear plan. You need a really good game plan and to be thinking long term. “You really need to understand the market and what you need to do to your products, and also how to motivate your people to get there.” BIM software The Building Information Modelling (BIM) software and services market is growing rapidly, as companies and organisations embrace solutions to help them reduce carbon emissions and conserve energy. Forecasts from Pike Research suggest that annual worldwide revenue for BIM products and services solutions will grow to almost $6.5bn by 2020, as the next generation of buildings becomes increasingly ‘intelligent’ and energy-efficient. Meanwhile, expect plenty more M&A activity in the sector. Pike says small firms with an innovative BIM solution quickly become the focus of larger players keen to enhance their own product portfolios and monitor technology advancement in areas such as BIM to field solutions, cloud-based solutions, and mobile capabilities. The sale of CSC caps a decade-long relationship with Clearwater. The company's 2003 buyout was the first ever deal completed by Clearwater, following its own buyout from Tenon, while we then advised the company on its investment from Isis Equity Partners in 2008 and subsequent sale to Trimble. CSC Managing Director Mark Roberts stresses that the relationship was never just about doing the next deal. “It was about keeping in touch all the way through our journey. Doing a deal can be emotional and Clearwater are particularly good at managing emotion in the process.” the wire | Winter 2013 6 cloudex Rising stars The cream of UK talent in the cloud technology arena joined us for our inaugural Cloudex 20:20 awards in London. Earlier this year Clearwater launched Cloudex 20:20, our search for the UK’s leading independently-owned cloud technology businesses. Having drawn up a shortlist, we then invited a distinguished panel of industry experts to adjudicate on a final top 20 who were invited to our inaugural awards where the top three were announced. so dominated by US headlines that we wanted to celebrate innovation in the UK and we saw these awards as a fantastic opportunity to unearth innovation in the home market.” Judges based their selections on a broad range of criteria. How innovative and special were the companies? Were they a “There were certain attributes that ran through all our winners. They were naturally born cloud companies with no legacy mindset, while analytics was the bedrock of their business.” “After completing a number of deals in the cloud space, we initially set up the Cloudex index three years ago looking at the stock performance of cloud companies. In the early days we were mostly tracking US companies, but having met so many interesting UK businesses in this area we decided we needed to redress the balance. The market has been Our panel Neville Davis Chairman - SecureData; Trustmarque Angela Eager Research Director - TechMarketView Angela Eager Emma Rodgers, Director of TMT Market Intelligence at Clearwater, explains the rationale for the awards. Judge Stephen Warshaw said the awards showed that the UK had a fantastic track record for innovation. “Cloudex is putting companies that were below the radar above it. However one of the most striking features that came out of these awards is that investors have to be patient, especially when companies are transitioning their model.” first mover in their market and did they have the potential to be a leader? How cloud pure were they - i.e what percentage of their business was really cloud or had the business been re-engineered? Judges also looked at the customer base of the entrants and the extent to which their products were a 'must-have' for their customers. In addition they took into account growth trajectory, concentrating more on revenue than profit growth. Stephen Warshaw Portfolio Director - Hg Capital & Chairman, TeamSystem Steve Garnett European Chairman - Salesforce.com Emma Rodgers Director - TMT Market Intelligence, Clearwater Corporate Finance the wire | Winter 2013 Judge Angela Eager echoed Warshaw’s comments on innovation. “There were certain attributes that ran through all our winners. They were naturally born cloud companies with no legacy mindset, while analytics was the bedrock of their business. They offered multiple functions but their software was designed for very specific business tasks. This is an absolutely fundamental point as the sector moves towards industry specific solutions.” Eager said the overall winner Fourth stood out for the way it was tackling business issues that really needed addressing. “The link with business outcomes is so important and key. Likewise, with Livebookings what impressed was their ability to analyse data. Meanwhile, Acturis' insurance management sector is rife for automation and there is real scope to disrupt the market with a low-cost, low-risk platform.” Announcing the winner of the One to Watch category, Clearwater TMT partner Carl Houghton said he was very excited about the prospects for Skyscape, a supplier to the government’s G-Cloud framework. “Half their revenues are coming out of the G-Cloud and unlike many companies they are making a viable business out of this programme.” Ben Hood, Fourth cloudex Fourth is a pure play Softwareas-a-Service (SaaS) provider of management systems to the restaurant, hotel and leisure sectors. What has been the key to your success? Rigorous focus and an absolute understanding of what we do and who we do it for. It is then possible to get extremely good at whatever it is you do. The business is led by that focus and we make decisions with that backdrop always in mind. Are there particular characteristics that make a successful cloud business today? It’s about technology, approach and the model. A great cloud business needs to have a brilliant method of rapidly and safely deploying features and functionality to a well maintained code base. Focus on recurring revenue is key. Your client base needs to buy into that and go on the journey with you. Never compromise that contracted monthly recurring revenue with chunky one-off service fees. Winners What are the biggest opportunities for you now? 1st: Fourth Global expansion and doing exactly the same thing with the same focus. 2nd: Acturis What are the biggest challenges that you have faced? 3rd: Livebookings Cash and funding is the obvious one. It takes time and a lot of money to build strong monthly recurring revenues and a platform that does everything that it needs to in order to service its marketplace. Secondly, One to Watch: Skyscape 7 scaling and keeping up with the growth. You have to be able to evolve and adapt areas of the business on an ongoing basis. Looking back, is there anything you would have done differently? Upon proving the business and generating healthy profits, we should have invested more into R&D. The road map is always healthy but full. Fourth always want to do more, quicker. Have you found the UK a conducive environment/market in which to grow your business? It evolved alongside Fourth. The business and model were ahead of their time and the market needed time to understand it. That was a difficult period, but we got there and it’s fairly grown up now. The industry wants SaaS and it’s understood widely. Tell us more about your global ambitions. We acquired a business just over 12 months ago in the US and are building on that, as well as ‘Fourthifying’ it. It is a cloud business currently offering some of the same services Fourth offers, for some of the same clients. By acquiring, we not only got a great product and client base but real people, offices and contracts in the US. This has given us a great head start. the wire | Winter 2013 8 cloudex Thomas Stuart, Acturis Joe Steele, Livebookings Livebookings operates a webbased restaurant reservations and marketing service. Acturis is a SaaS platform for the general insurance industry. Are there particular characteristics that make a successful cloud business today? Both track record and depth of functionality for a cloud solution needs to be high. Track record needs to reflect a high degree of reliability and resilience over a number of years. Remember that the customer is placing a lot of responsibility in your hands, especially in a vertically-oriented cloud solution, and the resilience and reliability of the platform needs to be beyond question. What are the biggest opportunities for you now? We are expanding into international geographies and derivative areas in the UK market. These are both major areas that will allow further UK growth. What are the biggest challenges that you have faced? Initial credibility is always a key challenge for new cloud services, especially when they perform key mission critical backoffice functions. This is especially true for vertical SaaS offerings versus horizontal ones since the vertical offers are generally ‘mission critical’. What has been the key to your success? A single, proven, vertically-oriented solution for full end-to-end backoffice functions in the insurance industry, without the need for extensive IT involvement. For many What has been the key to your success? customers, IT is a necessary but distracting part of their business so being able to have this managed by a reliable third party simplifies things. Do you have global ambitions? We are actively expanding into territories around the world. Since so much of the now well-proven functionality is relevant around the world, there is a great opportunity to leverage our knowledge and technology into these markets. What advice would you give to a start-up business in the sector today? Choose technologies and architectures carefully, as these choices are hard to unpick. Secondly, it is down to people. Without the right team, it is difficult to deal with the inevitable challenges along the way. Thirdly, reality is never as planned so the linear spreadsheet revenue model you developed should go out the window. The reality is that these businesses have a kind of network effect that is hard to model and is slightly exponential in nature. You have to plan for this and colleagues have to understand that there will be ups and downs along the way. Recognising ahead of our competitors the potential of cloud-based technologies to create a scaleable marketplace for restaurants. With such technologies, we can develop market-leading technology without the need to install software in restaurants and offer a real-time marketplace to intelligently connect supply and demand. Are there particular characteristics that make a successful cloud business today? Firstly, a very clear understanding of the problem you are trying to fix and the unique role the cloud has to play. In our case, delivering a platform that can be evolved and scaled in a highly fragmented and decentralised market such as restaurants can only be achieved long term with cloudbased technology. Secondly, you need a very strong culture of product innovation within an established and structured product development framework. What are the biggest opportunities for you now? Geographic expansion into other markets and creating the most vibrant and active restaurant marketplace in Europe; further optimising the intelligence of our platform for connecting supply and demand, thus yielding optimisation for our restaurant partners; and responding fully to the needs and expectations of diners, driven by their increased mobility. the wire | Winter 2013 Phil Dawson, Skyscape 9 cloudex Skyscape is a supplier to the government’s G-cloud framework developing services designed for the UK public sector. What has been the key to your success? What are the biggest challenges that you have faced? The disaggregated and varied marketplace in which we operate has meant we’ve needed a considerable local sales presence in each market. Also the fast pace of technology change, both in terms of future compatibility of systems and platforms and the broad spectrum of partner technologies to integrate with. Looking back, is there anything you would have done differently? We have grown organically and also by acquisition, therefore the sum of our parts now is not an overall singular design. We have spent the past year ensuring the performance of our cloud-based merchant and consumer platforms are as competitive and scalable as they need to be to realise the intelligent marketplace model. We are now very well placed to accelerate our proposition and growth. Have you found the UK a conducive environment/market in which to grow your business? Yes. The UK is right on the frontier when it comes to the evolution of cloud businesses and we have benefited without question from having our headquarters here. The G-Cloud framework has made remarkable advancements in successfully opening up the previously stagnant public sector IT market, making it possible for companies of all sizes to compete for and win government contracts. Are there particular characteristics that make a successful cloud business today? Understanding customers’ motivations for cloud adoption, as well as any hesitations and misconceptions they might have, is an essential part of being successful. While professionals in the cloud space can easily understand the benefits for public sector organisations transitioning to the cloud, there’s still a fair bit of education to be done when it comes to public sector employees understanding the improvements that could be made by adopting a cloud strategy. What are the biggest opportunities for you now? There is still a lot of potential with the market still in its infancy. Some central government departments are already successfully embracing the cloud, but many are yet to implement cloud solutions and local government departments are lagging further behind still. What are the biggest challenges that you have faced? Lack of understanding continues to be the biggest challenge and education is key. In order to really capitalise on the significant momentum achieved by the G-Cloud framework, and to achieve the full potential benefits for the UK taxpayer and citizen, there is still considerable work to be done to continue the process of awareness and encourage further adoption. It is vital that those organisations that are already successfully using the cloud are empowered to talk about their experiences. Have you found the UK a conducive environment/market in which to grow your business? The UK is truly leading the way when it comes to shaking up how the public sector uses and procures IT. The Public cloud First policy has played a major role in encouraging central government organisations to move away from legacy technology and consider the benefits offered by a host of assured and cost-effective cloud services. As a result, Skyscape is currently working on more than 100 projects across central government, local authorities, police, healthcare and other publicly funded bodies. As departments see the benefits, momentum continues to build across the UK public sector. the wire | Winter 2013 10 interview Managing reputations When big business runs into trouble, Rivo Software is on hand to help. Rivo Software’s chief executive Simon Hook can offer a pretty blunt raison d’être for his business. “When you run a big organisation you know that something will go wrong, the problem is you just don’t know where. We are about helping to mitigate those problems.” In an age when organisations have no choice but to proactively manage their reputation, Rivo - which helps businesses manage compliance and business risk through its cloud-based software Safeguard - has found itself neatly positioned in a fast-growing market. internet. At the same time people have become empowered by social media. They are quick to form their own perspective of brands and can be quick to help evaporate brand value too. Our technology allows companes to handle it, allows them to be prepared.” Hook cites the horsemeat scandal as a case in point. “The impact from a brand perspective on Tesco was huge, even though the problem was further down the supply chain. But this misses the point. It was up to Tesco to ensure that the supply “Rivo is in a great marketplace and I don’t think it has fully appreciated in the past just how good a market this is.” Steve Husk Hook especially points to the huge shift towards off-balance sheet value in recent years. “Twenty years ago as much as 80% of a company’s value was probably in tangible assets. Today up to 70% of that value is in off-balance sheet items, whether it’s knowledge, brand, reputation or culture. The more your value is in intangible areas, the more you need risk management in your business.” He adds that changing society expectations adds to the mix. “Consumers are demanding ever more social responsibility from businesses, an awareness fuelled by the chain was completely standardised, so that they knew exactly where everything was being sourced from. Standardisation drives control and visibility.” It was this mantra that gave Hook and business partner Matt Duckhouse the original idea for Rivo. “We used to work in a business selling web services to automotive dealers and saw the challenges that distributors had in getting control and visibility across their operations. Dealers would have the same operating procedures, but local interpretation meant that you were getting different sets of information across the business. We saw an opportunity to help companies manage risk and standardise their business by using technology. We also noticed that this was a bigger problem the bigger the business.” Although at the time risk management was quite an immature market, Hook says big businesses did understand the concepts behind it. “The problem was that they were not very good at controlling it. We knew we could deliver a technology platform to manage risks across all domains. From a technical point of view, there is a lot of commonality across risk whether it’s financial, operational or insurance. There are a lot of common characteristics.” But Hook says as a fledgling company Rivo also knew it could not be all things to all people. “We needed to focus on one particular area, so we chose health and safety. We knew we couldn’t choose a business critical function because of our size so it had to be something important enough and regulated enough so that a company took it seriously.” In the early years, Hook says one of the biggest challenges was the lack of a defined purchasing channel for what Rivo was offering. “There was no obvious person to sell to because it wasn’t business critical. We ended up selling to all sorts of people: HR directors, operations directors, sometimes CEOs themselves. However, as we grew we found we didn’t have to particularly market the wire | Winter 2013 ourselves. Middle management would often identify the problem, google for help and come across us.” In the wake of Rivo’s recent acquisition by technology growth investor Kennet Partners and Fidelity Growth Partners Europe, Hook can look back at a number of key decisions which have contributed to its success. “One that really stands out was our decision to provide a hosted solution,” he recalls. “At the time it was not an obvious thing to do and we were often met by a fair degree of scepticism from business owners, but it turned out to be one of the best things we ever did. Having a single platform built on a suite of Microsoft products was another key decision, because it ensured that everyone was always on the latest version of the product. The client gets resilience and security that they could not hope to put into their own systems.” Offering its first multi-lingual service was another landmark, as was the first global roll-out of services for a client. In 2010, Rivo also opened an office on the US East Coast. “We wanted to plant the flag somewhere and we have been able to build on the back of some big contracts in the US,” adds Hook. Expanding that global footprint now forms a key plank of the investment from Kennet and Fidelity, who have taken an 85 per cent stake in the business for an undisclosed sum. Serial technology investor Steve Husk, brought in by Kennet as executive chairman of Rivo, says the business is perfectly positioned to build up its global presence. “Kennet was very interested in this market and had been looking at a number of different companies. Rivo is in a great marketplace and I don’t think it has fully appreciated in the past just how good it is. The market is very fragmented so if we play our cards right and hire the right people we will do very well.” Husk says growth will be both organic and non-organic. “I always think it is good to have a mix of the two. Rivo is the foundation platform and we can now put acquisitions on top to really expand the breadth of the business. Within five years I am looking for at least a $50m company, a five-fold increase on today. We want to get up to 200 staff too, with half of those here in the UK and the rest across the world.” Expanding the breadth of the business means moving the business away from just health and safety. “We will now be talking to clients about their supply chains, account management, reputation and social media too. The full mix,” adds Husk. Hook echoes the global potential. “Our products get languages, get time zones, get different currencies. We have the architecture we need and it is about providing an overlay of technology across the different elements of a business. To get to this next stage, we had known for some time that we needed new investment. We had grown the business as far as we could on our own.” He says that although the company ran a twin track investment process, the preference was always for a PE deal over trade. “We were very wary that we didn’t want to lose the culture of the business and knew that a PE buyer would be more open-minded on that front. A trade player is far more likely to say ‘we hear what you are saying but this is the way we do it', which was not what we wanted.” 11 interview the wire | Winter 2013 Heading for exit Private Equity (PE) houses are finally seeing a good window to exit assets as trade buyers return to the market. As we head into 2014, there is undoubtedly an increasingly positive market sentiment. Corporates are back at the bank asking for debt to finance new transactions; PE houses have raised some impressive new funds and are looking for ways to splash the cash; and, as our Cloudex 20:20 initiative demonstrated, the UK technology scene feels more vibrant than ever. Of course, the economy is still making life tough for many and a tendency towards reserve in M&A still persists, but our statistics tell a positive story. In the first three quarters of 2013 there were 147 announced transactions in the TMT space compared to 113 over the same period in 2012. This puts us well on course to top the 197 deals completed in 2012, although with the proviso that 2012 did end with something of a flurry of activity. globally during 2013. Both Salesforce and Adobe paid large prices to take a position in the fast moving marketing automation segment – ExactTarget for £1.6bn and Neoline for £390m respectively – and Microsoft finally made a move to address its weak position in the mobile market, announcing the acquisition of Nokia’s devices and services business for £3.2bn. The defining trend of the year has been the surge of strategic buyers returning to the market, evident in some of the largest deals The same driver has enabled UK PE houses to explore exit opportunities for assets that they have held onto for longer than they ordinarily would have, driving further activity in the market. UK PE exits over 2013 were up around 40% whilst exits to strategic purchasers were about 50% up compared to 2012. Deal volumes by month 250 200 Number of deals 12 research 150 100 50 0 - 2010 Jan Feb - Mar 2011 Source: Clearwater research Apr May - 2012 Jun Jul - 2013 Aug Sep Oct Nov Dec A typical example was the exit by ISIS Equity Partners from Micro Librarian Systems (MLS), the leading provider of library and resource management systems to the UK education sector, which the PE house had held since 2006. ISIS has now sold the company to Capita, the most prolific acquirer in the public sector technology market, which will continue to operate the business on a standalone basis. Since originally investing in MLS, ISIS has the wire | Winter 2013 UK mid-market PE exits - Jan-Sept 2013 Company Vendor Acquirer 4Projects Holdings August Equity Coaxis, Inc Micro Librarian Systems ISIS Equity Partners Capita plc CSH Holdings HgCapital Advanced Computer Software plc Aepona Amadeus Capital Intel Corporation Civica 3i OMERS Private Equity Clinisys ECI Partners Montagu Private Equity Avelo FS Holdings LDC Iress Ltd Actix Summit Partners Amdocs, Inc Ascribe Group ECI Partners EMIS Group plc Amor Group Growth Capital Partners Lockheed Martin, Inc Matrix Energy Solutions LDC E.ON almost doubled turnover as the company has taken market share and started building an all-important global footprint. The exit yielded a multiple of 2.8x and an IRR of 20%. is a case in point and a great example of an asset which proved itself during the downturn. Despite operating in a difficult market segment CSC is now reaping the rewards. solutions for the energy, transport and public services sectors, by US group Lockheed Martin. Another deal was the sale by HgCapital of Computer Software Holdings (CSH) to Advanced Computer Software (ACS), a provider of business management and healthcare software and services, for £110m. CSH is a leading provider of accounting and back office software to the UK professional services market and the acquisition marked ACS’ largest transaction to date, as well as providing a good exit for HgCapital which has actually acquired the business twice in its lengthy history under PE ownership. August Equity sold 4Projects Holdings, a provider of secure, online collaboration solutions for the building and infrastructure sectors, to US-based software development and management company Coaxis. 4Projects software has been used on large scale projects such as the Olympic Park and Emirates Stadium in London. August invested in the MBO of the business back in 2007 and under its ownership the business has thrived, developing a presence in key construction markets around the world. There were plenty of PE sales to overseas trade players during the year too. The sale by ISIS of CSC World to Trimble Navigation One of the most eye-catching sales of the period was the acquisition of the Amor Group, which specialises in IT services and Lockheed said the deal was aligned with its strategy of expanding its capabilities and expertise in international IT and civil government services, as well as with its growth in the energy market. Amor, backed by Growth Capital Partners, is one of a very small number of IT services businesses in the UK market to have successfully exited to an overseas trade purchaser in recent years, and this could be the start of a trend. 2013 also saw its fair share of secondary buy-outs. OMERS Private Equity acquired Civica, a specialised software systems and business process services provider which primarily supplies public sector organisations, from 3i in a £390m transaction. Also Montagu Private Equity acquired CliniSys, 13 research the wire | Winter 2013 14 research a pan-European supplier of IT systems to clinical laboratories, from ECI Partners. PE players continue to be major participants in auction processes, in spite of the fact that they are beginning to face more and more competition from strategic buyers. On the global stage, for example, PC giant Dell was finally sold in a $24.9bn buyout to a team including PE investors Silver Lake and Dell's original founder Michael Dell. The deal underlines the fact that PE still sees enormous opportunities across the TMT sector. Our data on valuations in the sector offers even more reason to be cheerful. Compared to our data from the same point in 2012, based on listed company multiples, we have seen EV/EBITDA values rise across the board: 35% in the telecoms services market, 6% for software vendors and around 11% for IT service providers. Some of this impact is due to generally improving market conditions, but strategic purchasers will also have a significant impact. Whilst PE investors have paid some strong multiples for assets over the past few years, it will always be difficult for them to compete on price against a true strategic purchaser with synergies to realise and compelling reasons to outbid rivals for an asset. What now remains to be seen is whether this growing positive sentiment will be enough to enable us to overcome some considerable issues in the UK today. There is no doubt, however, that optimism is a key ingredient in lifting any economy out of recession or low growth period and we, and our contacts and colleagues across the TMT market, are finding more and more reasons to be cheerful. Buyers of UK TMT companies (Jan-Sept 2012) n UK n North America n Europe n Rest of World Source: Clearwater research Buyers of UK TMT companies (Jan-Sept 2013) n UK n North America n Europe n Rest of World Source: Clearwater research Average enterprise value multiples (UK tech companies) Sector EV/Revenue Current Forecast EV/EBITDA Current Forecast Telecoms Services 1.4x 1.4x 7.7x 8.1x Software 2.7x 2.4x 12.8x 10.3x IT Services 1.7x 2.1x 10.3x 9.8x Source: Thomson One Global presence, Global expertise Want proof? Our global technology team has completed over 100 deals in the last three years. NEW YORK • LONDON • PARIS • MILAN • MADRID TOKYO • MUNICH • MUMBAI • SHANGHAI/BEIJING Kirona Solutions Eque2 J2 Retail LDC ISIS Private Equity Aures Technologies Acquisition of leading B2B mobile application software developer MBO of a provider of ERP software to the construction industry from Sage Group plc Disposal of a provider of touchscreen electronic point of sale terminals and systems Clearwater Corporate Finance advised the management team Clearwater Corporate Finance advised the management team Clearwater Corporate Finance advised the vendors Rivo Software Exentra Transport Solutions CSC (World) Kennet Partners/Fidelity Growth Partners Europe Descartes Systems Group Inc Trimble Navigation Limited Disposal of a provider of SaaS model governance, risk and compliance solutions Disposal of a SaaS model provider of driver compliance solutions Disposal of a developer of 3D CAD solutions for the structural engineering market Clearwater Corporate Finance advised the vendors Clearwater Corporate Finance advised the vendors Clearwater Corporate Finance advised the vendors www.clearwatercf.com 9 Colmore Row Birmingham B3 2BJ 62-65 Chandos Place London WC2N 4HG 50 Brown Street Manchester M2 2JT 16 The Ropewalk Nottingham NG1 5DT Tel: +44 (0)845 052 0360 Fax: +44(0)845 052 0361 Tel: +44 (0)845 052 0300 Fax: +44(0)845 052 0303 Tel: +44 (0)845 052 0340 Fax: +44(0)845 052 0341 Tel: +44 (0)845 052 0380 Fax: +44(0)845 052 0381

© Copyright 2026