Discover how to like the banks do... Special Report

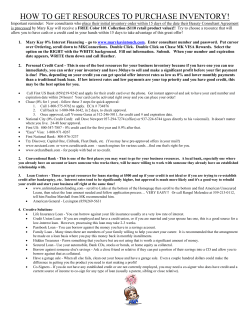

Discover how to like the banks do... Special Report Building Wealth Through Private Lending presented by... www.HuberPropertyGroup.com Disclaimer This is not a Security nor an offer to sell Securities. The information provided herein is not intended to be for the purpose of soliciting a Security under State or Federal regulations. The information is intended to give the private investor alternatives to stock market investments, but is not intended to be a solicitation of a Security under SEC rules and definitions. This is intended to be a private borrowing transaction with the individual loans secured by real estate title to benefit an individual. Huber Property Group, LLC, and its affiliates are not licensed securities dealers or brokers and as such do not hold themselves to be. This presentation should be construed as informational and not as an advertisement soliciting for any particular purpose. Reproduction or translation of any part of this work without permission of the copyright owner is unlawful and strictly prohibited. Huber Property Group, LLC Phone: 616.730.3355 [email protected] www.HuberPropertyGroup.com Copyright 2013, Huber Property Group, LLC All Rights Reserved Huber Property Group, LLC • 616.678.2727 • www.HuberPropertyGroup.com Table of Contents Introduction Congratulations ........................................................................................................... 1 Bank = Middleman ...................................................................................................... 3 Middleman Security ..................................................................................................... 3 Eliminate the Middleman and Prosper ......................................................................... 4 Is this a Scam? Why Have I Never Heard About this Opportunity Before??? ................. 5 Using Private Money Lending to Your Advantage The Middleman is Gone - Now What? ........................................................................... 7 Don't Panic: Use a 3rd Party ........................................................................................ 8 Protection Tools ........................................................................................................... 9 The Equity Cushion ................................................................................................... 11 Security Tools ............................................................................................................ 13 The Story of Bob and Betty Background ............................................................................................................... 15 The "Traditional" Choices ........................................................................................... 16 Time/Hassle Management: Active vs. Passive ............................................................. 21 Finding Comfort Level ................................................................................................ 22 Screening the Investor ............................................................................................... 24 Their Results ............................................................................................................. 30 Conclusion Final Comments & Thoughts ..................................................................................... 32 Huber Property Group, LLC • 616.678.2727 • www.HuberPropertyGroup.com Introduction You’ve worked hard for your money. You’re also a good saver. So why is it so hard to earn a decent return on your money? An investment option that is in your control and secure, but more importantly, a whole lot better than the "stealing rates" banks are currently paying. Perhaps "stealing" is a bit harsh; however, when you consider the majority of saving account and CD interest rates are below the rate of inflation, "stealing" is basically what it is. Sure, there is The Uncertainty Market (whoops, we mean The Stock Market), but you've got to be prepared to "roll-the-dice" to enter that arena. You can also consider bonds that are backed by the government, but again, settling for these "stealing" returns just isn't ideal. The conventional mind-set is just that. I have three options. I can put my money in the bank, stock market (mutual funds) or bonds. Have you ever found yourself thinking, "I wish I had more options?" The good news is this... There is another wealth generation strategy that the main stream media and your financial advisor don't like to talk about since it does not benefit them. This is a strategy that anyone can do. It is a 100% legitimate/legal option you can use to help diversify your funds and build financial wealth! The even BETTER news, perhaps, is that you can diversify your IRA and/or 401k retirement funds towards this strategy. Congratulations! We'd first like to congratulate you for breaking away from conventional thought and expanding your wealth generation boundaries. Too many people are herded like sheep by the mainstream financial media. You, on the other hand, are reading this, which hopefully means you are sick and tired of the "typical" choices you are given to grow your wealth. You are taking your financial future into your own hands, and for that, we applaud you! Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 1 - We'd now like to welcome you to the world of Private Mortgage Lending – which, when done properly, is a highly lucrative way to build wealth! Lucrative, because you get to play the traditional part of the bank! Meaning, you are in total control of your money and will have the control needed to avoid making the same mistakes that banks did which led to many of their failures. The ironic part is, the banks had (and STILL "has") a great strategy to make money. As long as they made good choices, there was a steady stream of profits. Their problems arose when they got greedy, made bad choices, and then strayed off the path of "what worked." By straying from the path, they made money for a while, but as we all now know, there business model of lending money backfired on them. Many look at banks as evil and greedy, but, regardless of how you personally perceive them, we have to give credit where credit is due: banks have a solid profitable business model (assuming, of course, they make good choices and stay on the path "that works"). What most people don't realize is that they can use this EXACT SAME business model with their own finances to generate their own personal wealth. If having control of your finances and the ability to generate profits like the banks do sounds worth learning more about, then we are confident you will find this report extremely valuable. Not only are we going to show you 'how' to use the bank's strategy, but we'll show you 'how' to stay on the profitable path and avoid the dumb mistakes the banks made. In order to understand the concept of Private Mortgage Lending, we're going to first talk about the strategy that banks use to not only generate profits, but also to protect the money they loan out. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 2 - Bank = Middleman Banks are not stupid. There is a reason they hire the brightest minds. They understand the relationship between risk and return. The greater the risk, the greater the return. The opposite is also true, if the risk is low, so is the return. With this in mind, when banks promise to pay you a fixed rate on your money, they want to be extremely confident that they can deliver. Remember though, they still need to make a profit. They are in business too. Banks make their money by borrowing from small investors like you at low rates and then in return, loan YOUR money out to SOMEONE ELSE at much higher rates. The difference is their profit. For example, if the bank is offering you 2% interest and you deposit money with them, they will then lend YOUR money to someone else and charge that person/company 5% interest. The bank in return makes 3% profit on YOUR money. So, in reality, the banks are just middlemen, borrowing from you at low interest rates and then loaning your money to someone else at higher rates. The security you’re offered in return depends on what type of bank investment you make. Some may be insured by the Federal Government, while others may be more risky. Middleman Security We have now identified two key concepts: 1) The banks are loaning your money out to someone else. 2) The banks don’t like risk. With these two concepts in mind, this brings up a very obvious question: How do the banks establish security in order to protect themselves from the possibility that the borrowers they loan your money to will not repay those loans? The banks simply obtain collateral for the loans they give. They take an interest in an asset that has a value greater than the loan they are giving. In many cases, the best asset they can find is a borrower’s physical home. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 3 - Picture this (maybe you've experienced it first hand). A person walks into the bank to borrow money, the bank says, "No problem, we’ll give you a loan as long as you have something you can give us. We need this asset so that we can sell it to get our money back, just in case things don’t work out and you can’t pay us back." This agreement is what is known as a “s secured loan.” This practice is by no means a 'new' or 'ground-breaking' business model. The bank simply puts a lien on the person's house (mortgage) and then makes a loan to them. If the loan is not paid back, the bank takes the house and sells it to get their money back. We can all agree that this concept is not rocket science. Sounds easy, right? Well, in all actuality, it is. In fact, there are numerous people who are buying and selling real estate, and many of them would be thrilled to pay you a higher return than your bank is in exchange for you lending them money. We're not talking about "hand shake" agreements either. We're talking "secure loans" where you'll be given a lien (via legal documentation, NOT a hand shake) on their house. With the lien in place, you are now in the same position as the bank. You have something of value owned by the borrower, where in the event they do not repay the loan, you can seize the asset and sell it for yourself in order to recoup your loan (and in some cases, perhaps profit even more). Eliminate the Middleman and Prosper By doing what was talked about in the previous section, you eliminate the middleman and put yourself in a position to prosper as you will earn the higher rate of return that the bank would, instead of the lower rate of return the bank would pay to you. When you eliminate the middleman, you "become the bank" and begin to prosper just as they do. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 4 - In order to kiss the middleman bank "goodbye", you need to locate an individual (most likely will be a real estate investor) that matches these four pieces of criteria. 1) They are in need of a loan. 2) They are willing to pay a high interest rate to obtain the loan. 3) They have a physical asset (piece of property) that is worth more than the amount they want to borrow. 4) They are willing to give you a lien on the asset to secure the loan. If criteria 3 and 4 are not possible, then this is a deal breaker! Finding someone interested in receiving these types of loans is NOT like searching for a needle in a haystack; therefore, there is no need to work with someone who is not able to accomodate criteria items 3 and 4. We will go into more details about this in future sections, but at least wanted to introduce you to the basic concept of how "becoming the bank" works and can benefit you in generating wealth. Is this a Scam? Why Have I Never Heard About this Opportunity Before? In short, NO, nothing we have introduced you to is illegal or impossible to perform. We know there are lots of jokes regarding "banks being crooks", but everything we have discussed thus far is one of the primary business models the bank uses to generate profit, which they've been doing for a long time, so rest assured, everything is legit. So why haven't you heard about this opportunity before? To put it bluntly, one of the main reasons you haven't heard about this opportunity from an investment advisor is that there are generally no commissions for them to earn from this type of transaction. Because there is no money in it for them to make, they, along with the main stream financial media, choose to remain silent about it. Investment advisors generate profits through fees and commissions. With this being their business model, many mutual funds, insurance, stock and investment companies pay investment advisors large commissions for getting their clients to invest in their investment products. On the flip side of the coin, the average real estate investor isn’t a large Wall Street company or investment advisor. Add to this the fact that they may also be prohibited by state or federal securities Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 5 - or other laws from paying any kind of commission without first securing certain licenses. When you combine these two points, it becomes obvious that real estate investors make money from real estate, not fees and commissions. Real estate investors operate under a different business model. They simply want to borrow money to invest in below market value real estate, and they are willing to pay you higher interest rates to do so. And as we mentioned, because their profits are generated from actual real estate, they don't need nor are they looking to charge you a bunch of commissions. This is a great benefit for you as a “private lender” (someone who invests in these types of transactions) because the investment is in your direct control, and along with this, your returns have the potential to be that much greater since you will not be required to pay fees and commission to the investor. Greater returns mean your wealth will be able to grow that much more efficiently. In a few words, you usually don’t hear about these deals because there’s nothing in it for the middleman investment advisor to make money! Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 6 - Using Private Money Lending to Your Advantage In the previous section, we provided an overview of private money lending and how it can be used to provide you with much better rates of return than if you walked into your local bank. Specifically, we reviewed how private money lending eliminates the middleman (the bank) and puts you in their place where you can earn two to three times the rate of return you would most likely be paid as a traditional certificate of deposit holder ("bank CD") or with a money market account. Since you have now learned the basic concept of private money lending, we'll explore the terms and tools that private lenders need to have in their tool belt in order to profit from this lucrative opportunity. And of course, we'll cover how private lenders can use key tools to hedge themselves against the risk of losing the funds they loan. The Middleman is Gone - Now What? You've made the profitable decision of eliminating the middleman, but now what? You've got money ready to lend, but no one to lend it to. Finding people to loan money to will change very quickly if you take the proper steps. In all reality (and probably not a surprise), there are lots and lots of people who would like to borrow money from you. The challenge is finding deals that "make sense", that can be secured by a physical asset and that give a good cushion of equity to protect your loan. As we briefly mentioned earlier, one of the most efficient ways to find these types of deals is to locate real estate investors. Investors are constantly looking for private lenders who will loan them funds at a rate that is two to three times what the bank is paying. To go along with this, assuming they are operating a reputable business, they will offer a physical/tangible piece of real estate to secure the loan. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 7 - There are a multitude of ways you can locate real estate investors. You can usually find real estate investors at real estate groups, real estate investment clubs, on the internet/social media (Facebook, Twitter, LinkedIn) and many other places. You know what? You've already found one real estate investor by reading this eBook: us! For a detailed packet on our (Huber Property Group, LLC) private lending opportunity program, call (616.730.3355) or write us ([email protected]). We would be happy to share the details of our program with you along with helping to educate you in how these type of programs work. Don't Panic: Use a 3rd Party First things, first. The next few sections may seem overwhelming and complicated. In order to generate the best return on your loan, you need to do some homework and make sure you are loaning money on a good deal. We know no one likes homework, but when it comes to private loans, if you know "what" you're looking for (which the next sections will cover), making the loans does NOT take much time at all! How can this be the case? The real estate investor you are working with needs to be working with a 3rd party. Depending on which state you live in, this will either be a real estate attorney or a title company. In the state of Michigan, where we invest for example, title companies are the traditional means to use as a 3rd party. Like anything involving money (especially when it is YOUR hard earned money), there needs to be documentation and insurances put into place to protect it. As you go through the next sections, do not panic and start to think, "this is sounding way too complicated and time consuming." The point behind the next sections are to ensure that you know what documents of the deal need to "be there". By using a 3rd party, you will not need to worry or spend your time "getting them there." Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 8 - As a quick example. If the real estate investor is telling you none of the documentation needs to be publically recorded, that is a deal breaker. After reading the following sections, you will understand that public recording needs to "be there" (a part of the deal). However, on that same note, you personally do not need to do the recording. This task would be in the hands of the 3rd party. Perhaps now you're thinking, "Well this is great I don't need to spend a ton of time with all the documentation, but how much is this 3rd party going to cost me???" A very valid question, but in all actuality there should be zero cost to you. Any reputable investor or company will pay for the 3rd party. We won't go quite as far as saying if they refuse to pay for the fees that are associated with using a 3rd party, then it is a deal breaker; however, this is something we as a company pay for. Finally, a friendly warning. We will be repeating ourselves over and over again in regards to the 3rd party. We just want to be sure that you understand there is no need to get overwhelmed or think the process is too complicated. Protection Tools When you decide to enter into a private lending deal with a real estate investor, before you invest a penny, you need to be sure you are protected! Case in point, the banks became lazy in this regard, and we all know where that got them... in a world of hurt! While the following list may seem like a major hassle, the 3rd party we discussed in the previous section will take care of the obtaining and verifying of these items (no need to panic). In the list below you will find the "tools" that should be used to construct your private money loan. We will talk about a few of them in detail, including The Equity Cushion which will have its very own section (that is how important it is!). Copy of the deed to the property This will tell you who actually owns it. Recent Title search Makes sure the deed is still accurate. Title insurance policy Will insure against ownership challenges. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 9 - Hazard insurance policy Will insure casualty losses (fire, water, etc.) The Equity Cushion (will talk about in next section) Property inspection (if available) Repair Estimates (if repairs are needed) Investor’s plan of action Need to be sure the investor has an exit plan. When the 3rd party puts all these pieces together for you, it accomplishes two key elements. First, it helps protect your loan and secondly, ensures that you are dealing with a real estate investor who has a game plan and knows what they are doing. If you can’t get this type of information (or the investor refuses to use a 3rd party for the transaction), then you should seek out a different real estate investor. Title Insurance Title insurance protects you against loss arising from problems connected to the title of the collateral (the house) you have a vested interest in. Prior to making the private loan to a real estate investor, the house may have gone through several ownership changes, and the land on which it stands likely went through many more. There may be a weak link at any point in that chain that could emerge to cause trouble. For example, someone along the way may have forged a signature in transferring title. Or there may be unpaid real estate taxes or other liens. Title insurance covers the insured party for any claims and legal fees that arise out of such problems. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 10 - Hazard Insurance Title insurance is only half of the insurance protection that you need in place. The other half of the insurance protection is obtained via Hazard insurance. This is important as you need to be certain that your loan on the house is protected in the event that the house suffers some sort of damage or destruction during the period of the loan. With this in mind, you should also require your private money borrower to maintain hazard insurance on the house protecting against loss from fire, theft or similar circumstances. In the event something does happen that causes your borrower to default, you want to be sure that the value of the property is sufficient to make you whole on your loan. In other words, if the borrower defaults and then hands you a house that has burned to the ground with no hazard insurance policy in place, you'll quickly find yourself in a spot you do not want to be. The Equity Cushion We don't want to diminish the importance of the tools we have noted on the previous page as they are all important; however, in order to make private lending lucrative for yourself, there is one standard that needs to be met: the equity cushion. Remember, in our introduction section we talked about how banks use this "equity cushion" to protect themselves against the borrower not being able to pay them back. In this event, the bank can take the physical asset secured against the loan (the actual property) and sell it to recoup their money. You must do the exact same. In order to gain this cushion, you must be sure that the property you are making the loan on is worth substantially more than the amount you are lending. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 11 - Loan-to-Value Ratio (LTV) The Loan-to-Value (or "LTV") is a term you must learn to love and utilize. By using it properly, the LTV acts like a compass leading you to favorable Risk vs. Reward deals. Due to the importance of the LTV, we are going to spend quite a bit of time explaining it so that you have a solid understanding. Because YOU ARE THE BANK, you dictate what type of LTV you are comfortable with for your loans. You are the boss of your money. Not your financial advisor, not your stock broker, not your personal banker... YOU ARE! The lower the LTV, the greater your security cushion. The LTV is calculated by dividing the amount of the loans (other than yours) on the property against the real current value of the property if it were to be sold. LTV, % = All Outstanding Loans, $ Value of Property, $ x 100 For example, if you find out that all the loans outstanding against a property total $80,000 and the property is worth $100,000, then the property would have a loan to value ratio of 80%. LTV = $80,000 x 100 $100,000 = 80% Because of its importance, we're repeating... The lower the LTV, the greater your security cushion. Continuing with our example, knowing the LTV is 80% grants you the "cushion" of knowing that the property could decline 20% in overall value and yet you would still be able to sell it and recover money you loaned on it. This is what got the banks in trouble. When they started doing the no money down mortgages, they were putting themselves at a 100% LTV. Their only hope for a "cushion" was based on market appreciation. When the appreciation stopped, they had no shield in place to protect their loans. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 12 - For some 'real life' perspective, we as a company strive to offer our private lenders deals with LTV's at absolutely no higher than 80%. With the majority of our deals, you would have an LTV of 70% (some even as low as 50%!!!). Again, YOU ARE THE BOSS, so you get to decide whether or not the LTV an investor is offering you meets your personal criteria. To reiterate the point above, if you loaned us money on a deal that gave you a 70% LTV, the market could decline 30% and you would still be in a spot to recoup your original loan. For comparisons sake and to give you something to think about, ask yourself, What happens to your original investment in the stock market if the market drops 30%? Yikes! We'll get more into that in later sections. Security Tools So you've got a deal that has a LTV which meets your standards of comfort. Excellent! You're not done yet though. You've established some protection for your loan in the form of an "equity cushion" and insurances; however, your loan still isn't 'secure'. This section will cover the documents ("security tools") the 3rd party will put into place in order to "secure" your loan to the physical asset that is providing collateral. Out of all the documents the 3rd party will use, there are none more important to you as the lender, than these two: 1. The Promissory Note (Evidence of the debt) 2. The Recorded Mortgage (Security for the debt) The Promissory Note This document is essential since it provides evidence of the debt, also known as the "IOU on the property." The promissory note is just that, a "promise". Within the note, the borrower (real estate investor) acknowledges the debt and promises to repay it under a certain set of terms. These terms include the interest rate, the length of time he has to repay the note, the periodic payment, and whether or not it is fully amortized or paid interest-only. It can contain any other bits of information you'd like, but the aforementioned items are the bare essentials. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 13 - This document is NOT filed as public record – you should view it as a personal “IOU” and keep it in your records. The Mortgage / Deed of Trust In sticking with the theme of "tools", this is the document that would be the equivalent of the sledge hammer. This piece of paper places a lien against the physical asset. With the lien in place, it then gives the lender (you) the right to take possession of the physical asset (the property) if the borrower ever stops making the loan payments to you. This paper is notarized and filed as public record. Getting this document on public record ensures that, should the property ever sell, the lender (you) is the first person to get money before anyone else. If you've ever gone through the house selling experience before, you know how this feels. Before ANY money could go into your own pocket, you first needed to remove the lien on your house by paying off the person who owned the mortgage: the bank. In this transaction, before the investor can gets any money, they legally need to remove the lien from the property by putting money into the pocket of the owner of the mortgage: YOU! To be clear, when we refer to the term “mortgage”, take note that some states call the security document a “trust deed” or “deed of trust.” Whether your state calls it a mortgage or a trust deed, both documents serve to provide security in the event of a default. Recordation Recordation ("recording") is essential because it puts the rest of the world on notice of your claims against the property. Recording also grants you leverage and certain other rights over others who may have or gain a claim to the property that is securing your private loan. When the documents are completed, you will be provided with a certified copy of the them as proof that were recorded and stamped with the seal of the county recorder’s office. If the investor refuses to record any of the documents publically, this IS a deal breaker and you should seek out a different real estate investor. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 14 - The Story of Bob and Betty Now that you understand 'how' banks make their profits and 'what' you need to do and have in place to mimic their business model, we want to share a story with you. This is a story that is true and really happened. For privacy's sake, we have changed the people's names, but everything else is derived from actual events. We're confident you will be able to relate to Bob and Betty's story in at least a few different ways. Knowing you will be able to relate, our goal with this story is to offer you important bits of knowledge and tips that you will need to consider and apply as you go through your own personal journey. The Background Bob and Betty are just your average middle-aged couple. They have been working for years and setting money aside to invest for retirement. Thanks to Bob and Betty's hard work and financial discipline, they had begun to build up a nice little retirement nestegg. That nest-egg was looking particularly "pretty" during the mid 2000's when the stock market was roaring to high after high after high. Things seemed to be on cruise control and that "it is safe to retire" milestone was getting closer and closer by the month. They were happy, their neighbors were happy, their financial advisor was really happy... everyone was happy! All good things must come to an end, however, and what followed is forever indented in their minds. Bob and Betty were not receiving any sort of fixed rates of return with their investments based on the stock market. This is a great thing when the stock market is Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 15 - rising, but, as Bob and Betty (and many others) quickly learned, when the stock market gets ugly, those fixed rate of return investments are very desirable. To no surprise, Bob and Betty's nest-egg was severely damaged during the latter part of the 2000's. This got them thinking, "Is there no better way? Are my only options really stocks, bonds, mutual funds, or becoming a landlord?" In the spirit of being fair and objective, the stock market can give greater returns than private mortgage lending; however, as the chart shows below (15 year historic Dow Jones Industrial Average), it can also take from you. So the key question for Bob and Betty became: can we afford to get "caught" in a downward trend, that according to history, WILL happen again? 54.4% LOSS OF VALUE 38.7% LOSS OF VALUE After considering the stock market does not provide fixed rates of return like private money loans do, should Bob and Betty now have the opinion that investing in stocks and mutual funds is unwise and should be completely avoided? Absolutely not! Instead, due to the inherent risk and unknown future direction of the stock market, it is wise to plan adding in a new strategy for financial diversification. The "Traditional" Choices Bob and Betty now realized they needed more diversification than what the stock market and mutual funds offered, so they decided do some research. Their financial advisor certainly wasn't going to recommend strategies that didn't put cash into his/her pocket; therefore, this was a journey they needed to take on their own. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 16 - Bob and Betty came across a real estate investment company, Huber Property Group, LLC (HPG) who told them about a private mortgage lending strategy. It sounded interesting to them, but given the hard work and discipline they had used to build the nest-egg they now had, they wanted to do some comparisons to other strategies available and weigh out their choices. Bob and Betty's things to consider... Private Mortgage Lending vs. Stock Market Stocks are a pure equity investment. This means that Bob and Betty are part owners in the company. There is always the possibility that a company can go bankrupt or go out of business. Equity holders are the last to get paid, so if there are any issues with liquidity of a company, equity investors get nothing. Bob and Betty certainly remembered when the Enron scandal and the Lehman Brothers bankruptcy was all over the news. Private Mortgage Lending with HPG is a pure debt loan. Bob and Betty liked the aspect of debt compared to equity because there is collateral. If HPG goes bankrupt debt holders are paid back before any equity holders are paid anything. Stocks provide no fixed yield and generally low, if any, dividends. There are some attractive looking dividend stocks out there; however, Bob and Betty learned the general rule of thumb, "the higher the dividend percent, the riskier the company". Add to this the fact that the company can choose to STOP paying a dividend at any point, that isn't very comforting. Private Mortgage Lending provides Bob and Betty with a fixed rate of return each month (or whenever they choose to be paid: monthly, quarterly, yearly, etc.). The terms of the fixed rate are discussed with HPG before any money changes hands. Stocks move up and down with the changing of their value. Being that it is later in life now for Bob and Betty, the scary thing they now needed to remember is that stock values can go down, depending on whether or not there is demand for the stock. This of course is something they have no control over. The other scary part is that everything in the stock market is 100% LTV. Whenever a stock is purchased, it is at "market value" and therefore 100% LTV. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 17 - Private Mortgage Lending is a secure fixed income loan. With HPG, Bob and Betty will be able to make a loan secured by collateral that is at a LTV of no more than 70%. If the value declines, they have a comfortable 30% "equity cushion". Again, Bob and Betty were not looking to abandon the stock market in its entirety, but just look for alternate ways to diversify. When comparing stocks to private lending with HPG, there was a strong case that it was a viable strategy. The table below summarizes the various aspects Bob and Betty needed to contemplate. STOCKS PRIVATE MORTGAGE LENDING Not Secured Physical asset (house) secured by 1st lien mortgage Not Insured Collateral (house) is fully insured Invest at market price (LTV = 100% when you buy) Collateralized below market value Returns are Not known Returns are fixed & agreed upon before transaction Asset = stock certificate Asset = tangible Value of stock drops = you lose money, get nothing Investor stops paying = you assume control of asset Company goes bankrupt (Lehman Brothers/Enron) = risk of total loss Investor goes bankrupt = you assume control of asset Private Mortgage Lending vs. Bonds & Bank CD's Bob and Betty knew that traditional wisdom stated that in your "later years", you should switch to bonds because they are more conservative. While this is true, Bob and Betty still wanted a return that was greater than the rate of inflation (in other words, they didn't want the value of their money to decrease). Their research showed... Bonds are debt investments, so this is a plus for the reasons stated in the previous section. However, many times the debt has no collateral, so although you are better protected than a stock owner, you are less protected than a secure debtor. Private Mortgage Lending loans are debt with collateral. Bonds offer little if any insurance. These could be backed by the government; however, when this is the case, it decreases the interest rates to at or below the inflation rate. Private Mortgage Lending collateral (the house) is fully insured. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 18 - Bob and Betty already liked the fact that with private mortgage lending they would 'have collateral'; however, while that is certainly important, they also wanted to compare what kind of interest rates both options offered. Bonds rates can also have market fluctuation; however, compared to the stock market, it is generally less volatile. The 'grade' of bond will determine the interest and risk you receive. If you enter into the arena of "junk bonds", you can achieve large returns, but at the same time you are putting yourself at a much larger risk. Bob and Betty wanted to keep their strategy on the conservative end of the spectrum, so their main concern was comparing these types of bonds (government backed and high grade corporate) against private mortgage lending. HPG was offering them a private mortgage loan opportunity that achieved an 8% per year fixed rate of return for five years. They used this as their baseline for comparisons sake. Source: Bloomberg.com Bob and Betty loved the fact that these were backed by the United States government; however, the private mortgage loans were also backed by a physical piece of collateral. But, 1% vs. 8%? The choice seemed rather obvious. Whether you are looking for bond rates or CD rates, a quick and easy way to find out this information is to simply type 'government bond rates', 'corporate bond rates' or whichever type you are seeking into Google or whichever search engine you use. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 19 - Bob and Betty knew that United States government bonds paid pretty low interest, but what about higher grade corporate bonds? How did these compare to the 8% per year they were being offered via private mortgage lending? 2.58% Source: Finance.Yahoo.com Whether it was a government bond or a corporate bond, neither came close to the private mortgage lending fixed return of 8%. How about bank certificates of deposit (CD)? Every time Bob and Betty would walk into their local bank they were always seeing advertisements for the CD's being offered. The one component that caught Bob and Betty's eye was the fact that the CD's are insured (up to $250,000) by the FDIC. They then did a Google search online to find what the best rates available are for CD's. Here is what they found... Source: BankRate.com Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 20 - At this point, Bob and Betty loved the opportunity of not only getting an 8% per year fixed return, but that it was also secured by a physical asset, and on top of that, the physical asset was fully insured. This convinced them that diversifying into real estate could indeed provide an opportunity to build additional wealth. You may think this is the end of the story for Bob and Betty, and while the story is getting closer to completion, there is still one extremely important dynamic that Bob and Betty (and you!) needed to consider: time/hassle factor. "Real estate investing" is an extremely broad term. While most classify this with rentals and being a landlord, there are numerous strategies available. Along with rentals, there is 'flipping' houses, wholesaling houses, private lending, and a host of others. The determining factor for you will be "time" and how much "hassle" you want to put up with. Time/Hassle Management: Active vs. Passive Bob and Betty both had full time jobs, so 'flipping' houses or many of the other real estate strategies wouldn't fit into their normal schedules. Because the opportunity from HPG had convinced them that real estate was a viable strategy, what about just buying real estate themselves and becoming landlords? As had been the case through their entire journey, Bob and Betty put on their research caps and began to talk with people and search the internet. They quickly found out that 'just buying real estate themselves' was much easier to say than do... Active Real Estate investing requires... Spending time researching who is a good real estate agent to work with? Does the real estate agent understand the needs of an 'investor'? Is the deal "actually" as good as the real estate agent is presenting, or are they just wanting the commission? Spending time researching which markets make the most sense for investing. Spending even MORE time locating a property that can be turned into a rental property with positive cash flow. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 21 - After finding and purchasing the property... Spending time researching and locating who the reputable contractors are (or spending countless hours trying to fix up the place yourself) Spending time and going through the hassle of getting the renovation bids. Spending time visiting the property on a consistent basis in order to ensure the proper work is being completed. Spending time dealing with all the landlord building codes and city inspectors. After renovating and passing all inspections... Spending time and money creating and distributing marketing materials. Spending time meeting with prospective tenants at the property. Spending time running background and credit checks on possible tenants. After marketing, screening, and putting a tenant into the property... Spending time managing the property (including possible phone calls at 4 am) Spending time chasing down monthly payments Spending time heading to the courthouse for possible evictions Passive Real Estate investing via Private Mortgage Lending saves the time and hassle by avoiding all of the above, and allows for the professional real estate investor to deal with it. Bob and Betty had neither the time nor desire to take all those tasks upon themselves, so they decided the passive form of real estate investing was the more appropriate wealth building strategy for them. Finding Comfort Level This pointed them to one final area that needed to be addressed before they could begin seeking out real estate investors: their comfort level. Everyone has different levels of comfort, so for Bob and Betty this was just a matter of personal preference. After talking with others, they discovered that within the world of private lending, the money can be Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 22 - loaned at different times during the process. Depending on 'when' the money is loaned within the real estate investor's process establishes the type of risk being taken on. The "When" Question To reiterate, the key factor in this scenario is the answer to the question: "when" is the money being loaned to the investor within the overall process? The timing of "when" the money is loaned is going to dictate the type of potential phone calls you get from that investor. For instance let's say Bob and Betty loan money to Investor Headache before the property has been bought, fixed and sold, compared to Huber Property Group, LLC (HPG) who they have loaned money to after the property has been bought, fixed, and sold. Bob and Betty had to now ask themselves what set of phone calls they would rather potentially receive: Phone Calls... Investor Headache - I underestimated the renovation budget, I need more money. HPG - no phone call. Renovations already completed. Investor Headache - I ran into an unknown surprise after tearing open a wall, I need more money. HPG - no phone call. All surprises already dealt with and paid for. Investor Headache - I overestimated the value of the finished home. (translation: I paid too much for the home. I need to raise the price and "HOPE" I can get it sold/rented.) HPG - no phone call. We already know the value since it has already been sold*/rented. Investor Headache - I can't get the home sold/rented. Because I overvalued the house, the time it has taken to try and sell/rent has been much longer than I thought, so now my "cushion funds" to pay you are all spent. You can have the home back since you have 1st lien on it. (translation: thanks for putting up with all the stress I've caused and taking all the risk with your money. You can have back the house that is not worth all the money I put into it.) HPG - to what address would you like your monthly check sent? Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 23 - The investor's business model will determine 'when' your loan will be needed, and as Bob and Betty learned, figuring this out upfront is a crucial step in order to assess your personal comfort level with the potential risks involved. For Bob and Betty, they wanted the maximum amount of comfort, even if that meant slightly lesser interest on their loan. With this being the case, they determined they wanted to go with Huber Property Group's business model which was to make the loan "after" all the risky process steps (fixing and selling/renting) were taken care of. Screening the Investor While Bob and Betty liked the business model of Huber Property Group (HPG) and the comfort it provided, this was only the first half of the process. They now needed to screen HPG and ensure they were a company they could trust making a loan to. Bob and Betty's primary concern was did HPG have any real estate investing experience? This lead to the most important question in the screening process... Have you done this before? It undoubtedly is a very basic and simple question, but as Bob and Betty knew (and so should you!), it leads to the remainder of their screening. HPG claimed to have done multiple projects before, so that lead further to the next round of questions. It is certainly respectable for an investor to be upfront and honest and tell you if it is their first project; however, the risk level on your end dramatically increases. While we won't say you should say 'no' to the investor, we do want you to understand you are unnecessarily increasing risk levels. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 24 - Because Bob and Betty were told by HPG they had done previous projects, their next question in the screening process... Do you have examples of previous projects? As any investor should be, HPG was happy they asked this question. This allowed HPG to show and demonstrate to Bob and Betty that they were not "rookies" in the business. HPG presented Bob and Betty with a packet that explained their program, how it works, and previous projects completed. Inside the packet in HPG's Case Study section, they found details about previous projects that included photos of work HPG has done... 1020 Kusterer Ave Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 25 - 2739 Brooklyn Ave Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 26 - Any real estate investor who has actually done projects before will have some sort of marketing geared around it. Remember, a reputable investor wants you to trust them with your money - what better way to earn this trust than to show you their previous work? Bob and Betty were impressed by HPG's previous projects and now felt reassured that they actually knew what they were doing. Despite this, there were still a couple more questions that needed to be asked. Next up in their screening process... Can you provide us with some referral contact information? Not only did Bob and Betty want to know that they would be putting their money with an experienced investor, they also wanted to be sure they would be 'treated right' after the money had exchanged hands. In order to do this, Bob and Betty requested referral information for the previous/current people who had loaned HPG money. They then got in contact with these people and asked the following questions: 1) Has HPG been professional in their handling of the loan process and addressing all of your questions and concerns? 2) Are they prompt? When an email or phone call is made, how long do you normally have to wait to get a response back? 3) Do payments show up on time? Have you ever had any issues with payments? If so, how were they resolved? Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 27 - The referral contacts answered the questions and highly recommended HPG, so Bob and Betty once again felt more at ease. Receiving 3rd party perspective from previous and/or current people who have loaned money is simple. How simple? A phone number. An email address. After you have this information, you can now go straight to the source. It's also a great way to see if there are any warning signs. If the investor proclaims to have done multiple projects and has many people in their loan program, yet refuses to give you any sort of contact information, that should spark some uncertainty on your part. The MUST-ASK Question This question gets its own section due to its importance. At the end of the day, this question is the one that is the "make-or-break" for the deal. We've mentioned it once already in a previous section; however, it is a point that we want to reiterate. What is this question? Let's jump back into the story of Bob and Betty... Because Bob and Betty had done their research prior to even screening HPG, they knew this next question was of ultimate importance... Are all appropriate documents recorded publically? HPG assured them that all their documents were indeed notarized and recorded with the local county. Bob and Betty knew that without this crucial step, their loan would have all of a sudden been on very thin ice. With this final question out of the way, they were now ready to move onto their final analysis. Having documents recorded is crucial in both directions. Meaning, if an investor impresses you in every way possible, but won't be recording documents, then we would advise against working with them. On the other hand, if the investor doesn't have as much experience and past projects in their portfolio, but will be publically recording all documents, then go for it. Remember, the recording allows you to get the physical asset into your possession should a worst case scenario happen. This then allows you to liquidate the property and get your cash back. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 28 - Final Comfort Analysis After going through the screening process, it all boiled down to a simple question that Bob and Betty had to ask themselves... How comfortable do we feel with this investor/company? Bob and Betty considered... 1) HPG was not a rookie. They have done multiple projects and have a system that fits their comfort level (only needing the loan "after" the house has been bought and fixed up). 2) HPG could provide pictures and information about their past projects. They knew and understood that it was one thing for someone to 'say' they've done projects before, but a whole different thing to 'show' past projects. 3) They spoke with the referrals from HPG and they all had good things to say. HPG was professional, prompt and payments showed up on time. 4) Most importantly, HPG ensured all appropriate documentation was recorded publically. Factoring in all the variables along with their screening process, Bob and Betty decided they wanted to become a part of HPG's private lending opportunity program. Everyone's comfort level is different, so there is no "golden goose" solution in terms of the questions you should ask and screening you should do. If you are dealing with a family member, then it would be easier to feel comfortable compared with a stranger. At the end of the day, the best way to look at it is: the more screening you do, the higher the comfort level. Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 29 - Bob and Betty's Results Bob and Betty decided they wanted to diversify $75,000 of their funds into real estate with HPG. In order to ensure the best possible loan-to-value ratios, HPG divided the amount into two separate loans. Loan #1 Details Loan Amount: $35,000 Loan-to-Value (LTV): 61% Interest Rate: 8% simple (interest only payment) Collateral*: Mortgage Deed (lien) Lien Position: 1st Loan Length: 60 months (5 years) *Collateral Details: 3 beds, 1 bathroom, 1,040 square feet, quiet street Property sold for $57,500 on land contract. Purchaser put down $5,000 upfront. LTV calculation: $35,000 / $57,500 = 61% Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 30 - Loan #2 Details Loan Amount: $40,000 Loan-to-Value (LTV): 55.6% Interest Rate: 8% simple (interest only payment) Collateral*: Mortgage Deed (lien) Lien Position: 1st Loan Length: 60 months (5 years) *Collateral Details: 3 beds, 1.5 bathrooms, 1,400 square feet, 1 car garage, finished basment Property sold for $72,000 on land contract. Purchaser put down $5,000 upfront. LTV calculation: $40,000 / $72,000 = 55.6% Overall Loan Results Bob and Betty signed up for direct deposit with HPG, so it truly became a hassle-free way to deal with their money. They didn't even need to walk to their mailbox to pick up a check, it was electronically deposited for them! Bob and Betty's numbers... $75,000 at 8% interest gave them $6,000 per year in fixed income. $6,000 per year provided them with $500 positive cash flow each month. o No headaches. No "being-a-landlord". No chasing payments. Because the loan and interest is fixed, Bob and Betty had no worries of... o Sudden ups and downs of the stock market. o Knowing they were losing money due to inflation. o Ending up with nothing. Remember, in a worst case scenario, Bob and Betty would take control over the physical assets (the properties shown above). Bob and Betty found great uses for that predictable $500 per month that arrived, and are now able to brag to their friends and family that they are "real estate investors", even though they never lift a hammer or talk to a tenant! Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 31 - Conclusion We've gone over some of the greatest secrets, strategies, tools and techniques for making substantially higher returns than what you can usually earn in traditional bank certificates of deposit, money market or related investments. Believe it or not, you now belong to a very small group of the population who is aware of and understands this strategy to diversify your money. While private mortgage investing should not be the "only" strategy you use, it is an excellent way to diversify some of your hard earned funds away from the unpredictability of the stock market and pitiful rates of returns from bonds. We've shown you things to consider, things to look out for, things to be sure that you include and more. Please use the tools, strategies and techniques that have been shared with you in these pages to change your life for the better, and to break free of the confines of traditional bank investing. Remember, when you are keeping your money in the bank, you are simply loaning money to the bank. All your bank then does is turn around and loan it out at much higher rates to other people. You know 'how' they do it, and 'why' they do it, so cut out the middleman and become your own bank! You are now equipped with everything you need to take action and start investing as if YOU were the bank. Private mortgage lending is liberating and is one of the best ways available to really beat the market in a safe, secured and insured way. We wish you the best of luck in your new private lending journey, and we hope that you will feel free to contact us and ask any questions that you have along the way. We are here to answer your questions, to guide you and to lend a helping hand to set you on your path to wealth through private lending in any way that we can. We as a company always have available lending opportunities, so if you don't have any questions about lending in general, but would like to work with us, then by all means, contact us! We'd love to get you involved in our private lending opportunity program. Huber Property Group, LLC Office: 616.730.3355 eMail: [email protected] Website: HuberPropertyGroup.com/contact-us Huber Property Group, LLC • 616.730.3355 • www.HuberPropertyGroup.com Page - 32 -

© Copyright 2026