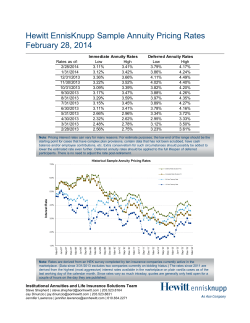

i Global 100% PR 80% PR

Previous Rate Sheet Rate Lock Policies Previous Rate Sheet Field Bulletins Effective November 2014 i Annuity rates for all states EXCEPT: NY Index Annuity Rates effective Wednesday, November 12 Global 100% PR 80% PR 2Yr Pt to Pt Monthly Multiple Annual Pt to Annual Pt to Cap Avg Spread Index Cap Pt Cap Pt Cap Product Monthly Additive Cap Participation Rate Current Product Available Guar. Min Fixed in All States Fixed Rate Interest Rate EXCEPT GMWV Additional Information Power 10 Protector [4% Premium Enhancement 1 (Bonus)] No Guaranteed Living Benefit — 3.50% — — 6.50% 1.25% 100% 1.50% Check State Availability Map 1.00% — 2.75% — — 6.00% 0.75% 100% 1.00% Check State Availability Map 1.00% 87.5% Premiums under $100,000 — 4.10% — — 4.00% 1.65% 100% 1.80% Check State Availability Map 1.00% 2 87.5% @ 1.00% available Premiums of $100,000 or more — 4.60% — — 3.50% 2.00% 100% 1.80% Check State Availability Map 1.00% 2 87.5% @ 1.00% available Premiums under $100,000 — 4.50% — — 4.00% 1.50% 100% 2.00% Check State Availability Map 1.00% 2 87.5% @ 1.00% Guaranteed Living Benefit Premiums of $100,000 or more — Check State Availability Map 1.00% VT 1.00% 2 87.5% @ 1.00% available Contract #AG-801 Power 10 Protector Plus Income [4% Premium Enhancement (Bonus)] ® 1 2 Lifetime Income Plus @ 1.00% Guaranteed Living Benefit Rider automatically included SINGLE PREMIUM ISSUE DAILY Contract #AG-801 Power 7 Protector Contract #AG-800 FLEXIBLE PREMIUM INDEX ANNUITY OPTIONAL LIVING BENEFIT RIDERS each month ISSUE DATES: 6TH, 12TH, 20TH, and 28TH of Power 7 Protector Plus Income Contract #AG-800 AG Global 8 Index Contract #07371 (Subsequent Premiums Only) 5.00% 2.00% — Annual Cost Roll Up Rate — — — — 3.50% — 1.75% 1.10% 100% 30% 2.00% 1.80% No Guaranteed Living Benefit No Guaranteed Living Benefit Lifetime Income Plus® Rider automatically included Lifetime Income Plus® 2 87.5% @ 1.00% Guaranteed Living Benefit Rider automatically included Available for subsequent 87.5% @ 1.00% premiums only Bold blue text indicates the change from the previous rate. RATES ARE SUBJECT TO CHANGE AT ANY TIME. Applicable rate is determined by the date the contract is issued. A contract will be issued on the issue date following receipt of the completed paperwork in good order (including premium and appropriate licensing and contracting information) at the Home Office. For more information: (888) 438-6933 1 Premium Enhancement (Bonus): For all premiums paid in the contract’s first 30 days; subject to vesting and recapture schedule. Not available in all states. Bonus is 3% for Option 2 AK, CT, MN, MO, OH, and PA or email 2 Guaranteed Minimum Withdrawal Values (GMWV) may change each quarter. The rate in effect on contract issue date is the GMWV. GMWV is 90% @ 1.00% for New Jersey [email protected] Annuities are designed for long-term retirement investing and typically include limitations, exclusions and expense charges. Income taxes are payable upon withdrawal. Withdrawals made prior to age 59 ½ may be subject to a 10% federal tax penalty. Lifetime Income Plus 0.95% 7.00% This information is general in nature and may be subject to change. American General Life Insurance Company, its agents and representatives are not authorized to give legal, tax or accounting advice. Applicable laws and regulations are complex and subject to change. Any tax statements in this material are not intended to suggest the avoidance of U.S. federal, state, or local tax penalties. For advice concerning your situation, consult your professional attorney, tax advisor or accountant. Annuities issued by American General Life Insurance Company (AGL) except in New York, where issued by The United States Life Insurance Company in the City of New York (US Life). Issuing insurance company is responsible for the financial obligations of insurance products it issues and is a member of American International Group, Inc. (AIG). Guarantees are backed by the claims paying ability of AGL and US Life. Product may not be available in all states and product features may vary by state. Please refer to your contract. If you are an agent prior to soliciting business be certain that you are appropriately licensed and appointed with the insurer and that the product has been approved for sale by the insurer in that state. If uncertain contact your American General Life Insurance Company representative for assistance. © 2014 AIG. All rights reserved. Page 1 of 5 FOR PRODUCER USE ONLY NOT FOR DISTRIBUTION TO THE PUBLIC Effective October 2014 Rate Lock Policies Previous Rate Sheet Field Bulletins i Annuity rates for all states EXCEPT: NY Fixed Annuity Rates effective Monday, October 13 Year One Base Rate for remaining years 1st Year Interest Bonus Product Available in all states EXCEPT Guar Min Fixed Rate GMWV* American PathwaySM Select MVA 10 Annuity (5 year rate guarantee) Contract #05377 1.55% 1.55% — AK, MN, MO, NJ, NY, OH, OR, PA, UT, WA 1.00% 87.5% @ 1.00% MVA; 30 day window after year 5 American PathwaySM Select MVA 10 Annuity (7 year rate guarantee) Contract #05377 1.75% 1.75% — AK, MN, MO, NJ, NY, OH, OR, PA, UT, WA 1.00% 87.5% @ 1.00% MVA; 30 day window after year 7 1.00% 87.5% @ 1.00% MVA; 30 day window after year 10 SINGLE PREMIUM American PathwaySM Select MVA 10 Annuity (10 year rate guarantee) Contract #05377 2.15% 2.15% — American PathwaySM Achiever MVA 10 Annuity (6 year rate guarantee) Contract #05377 1.55% 1.55% — American PathwaySM Secure 10 Annuity (5 year rate guarantee) Contract #05376 1.40% 1.40% — American PathwaySM Secure 10 Annuity (7 year rate guarantee) Contract #05376 FLEXIBLE PREMIUM TRADITIONAL FIXED DEFERRED ANNUITIES Product 1.75% 1.75% AK, DE, MN, MO, NJ, NY, NV, OH, OR, PA, SC, TX, UT, WA AK, MN, MO, NJ, NY, OH, OR, PA, UT, WA 1.00% AK, CA, NY, UT 1.00% AK, NY, UT 1.00% — AK, NJ, NY, UT 1.00% 87.5% @ 1.00% MVA; 30 day window after year 6 87.5% @ 1.00% No MVA; 30 day window after year 5 87.5% @ 1.00% No MVA; 30 day window after year 7 87.5% @ 1.00% MVA American PathwaySM Fixed MYG 10 Annuity (6 year rate guarantee) Contract #04370 5.00% 2.00% 3.00% American PathwaySM Fixed MVA 9 Plus Annuity (6 year rate guarantee) Contract #04362 6.00% 2.00% 4.00% AK, MN, MO, NJ, NY, OH, OR, PA, UT, WA 1.00% 87.5% @ 1.00% American PathwaySM Flex Fixed 8 Annuity (1 year rate guarantee) Contract #04371 4.05% 2.05% 2.00% AK, UT 1.00% N/A For more information: 888.438.6933 OPTION 2 or email [email protected] Additional Information MVA No MVA Bold blue text indicates the change from the previous rate. RATES ARE SUBJECT TO CHANGE AT ANY TIME. Applicable rate is determined by the date the contract is issued. A contract will be issued on the issue date following receipt of the completed paperwork in good order (including premium and appropriate licensing and contracting information) at the Home Office. *Guaranteed Minimum Withdrawal Values (GMWV) may change each quarter; rate in effect on contract issue date is the GMWV. Annuities are designed for long-term retirement investing and typically include limitations, exclusions and expense charges. Income taxes are payable upon withdrawal. Withdrawals made prior to age 59 ½ may be subject to a 10% federal tax penalty. This information is general in nature and may be subject to change. American General Life Insurance Company, its agents and representatives are not authorized to give legal, tax or accounting advice. Applicable laws and regulations are complex and subject to change. Any tax statements in this material are not intended to suggest the avoidance of U.S. federal, state, or local tax penalties. For advice concerning your situation, consult your professional attorney, tax advisor or accountant. Annuities issued by American General Life Insurance Company (AGL) except in New York, where issued by The United States Life Insurance Company in the City of New York (US Life). Issuing insurance company is responsible for the financial obligations of insurance products it issues and is a member of American International Group, Inc. (AIG). Guarantees are backed by the claims paying ability of AGL and US Life. Product may not be available in all states and product features may vary by state. Please refer to your contract. If you are an agent prior to soliciting business be certain that you are appropriately licensed and appointed with the insurer and that the product has been approved for sale by the insurer in that state. If uncertain contact your American General Life Insurance Company representative for assistance. © 2014 AIG. All rights reserved. AGLC103676 Page 2 of 5 FOR PRODUCER USE ONLY. NOT FOR DISTRIBUTION TO THE PUBLIC. Effective November 2014 Previous Rate Sheet Rate Lock Policies Field Bulletins i Annuity rates for New York FLEXIBLE PREMIUM SINGLE PREMIUM TRADITIONAL FIXED DEFERRED ANNUITIES Index Annuity Rates effective Monday, November 10 Product Year One Base Rate 1st Year Interest Bonus Guar. Min. Fixed Rate American PathwaySM Empire 5 Annuity Contract #03049N — — — — American PathwaySM Empire 7 Annuity Contract #03049N 1.80% 1.80% — 1.00% American PathwaySM Flex Fixed 8 Annuity Contract #04371N 4.05% 2.05% 2.00% 1.00% Additional Information Temporarily Unavailable NO MVA 30 day walkaway option after year 7 Index Annuity Rates effective Monday, November 10 SINGLE PREMIUM TRADITIONAL FIXED DEFERRED ANNUITIES Product Guarantee Rate Length of Guarantee Rate 1st Year Interest Bonus Product Available in all states EXCEPT Guar Min Fixed Rate American PathwaySM SolutionsMYG Annuity: 5-year term Contract #A125 Premiums < $100,000 2.25% 5 _ IA, MN, MO, SC 1.00% Premiums ≥ $100,000 2.40% 5 _ IA, MN, MO, SC 1.00% American PathwaySM SolutionsMYG Annuity: 6-year term Contract #A125 Premiums < $100,000 2.35% 6 _ IA, MN, MO, SC 1.00% Premiums ≥ $100,000 2.50% 6 _ IA, MN, MO, SC 1.00% American PathwaySM SolutionsMYG Annuity: 7-year term Contract #A125 Premiums < $100,000 2.65% 7 _ IA, MN, MO, SC 1.00% Premiums ≥ $100,000 2.80% 7 _ IA, MN, MO, SC 1.00% Additional Information Product FLEXIBLE PREMIUM INDEX ANNUITIES Issue Dates: 5TH, 12TH, 20TH, and 28TH of each month Index Annuity rates effective Monday, September 22 AG Global 8 Index Contract #07371N (Subsequent Premiums Only) Global Multiple Index Cap Monthly Additive Cap Participation Rate Current Fixed Interest Rate Guar Min. Fixed Rate 2.00% — 25% 1.75% 1.00% Additional Information Available for subsequent premiums only Bold blue text indicates the change from the previous rate. RATES ARE SUBJECT TO CHANGE AT ANY TIME. Applicable rate is determined by the date the contract is issued. A contract will be issued on the issue date following receipt of the completed paperwork in good order (including premium and appropriate licensing and contracting information) at the For more information: 888.438.6933 Home Office. Annuities are designed for long-term retirement investing and typically include limitations, exclusions and expense charges. Income taxes are payable upon withdrawal. Withdrawals made prior to age 59 ½ may be subject to a 10% federal tax penalty. OPTION 2 or email [email protected] This information is general in nature and may be subject to change. American General Life Insurance Company, its agents and representatives are not authorized to give legal, tax or accounting advice. Applicable laws and regulations are complex and subject to change. Any tax statements in this material are not intended to suggest the avoidance of U.S. federal, state, or local tax penalties. For advice concerning your situation, consult your professional attorney, tax advisor or accountant. Annuities issued by American General Life Insurance Company (AGL) except in New York, where issued by The United States Life Insurance Company in the City of New York (US Life). Issuing insurance company is responsible for the financial obligations of insurance products it issues and is a member of American International Group, Inc. (AIG). Guarantees are backed by the claims paying ability of AGL and US Life. Product may not be available in all states and product features may vary by state. Please refer to your contract. If you are an agent prior to soliciting business be certain that you are appropriately licensed and appointed with the insurer and that the product has been approved for sale by the insurer in that state. If uncertain contact your American General Life Insurance Company representative for assistance. © 2014 AIG. All rights reserved. AGLC103676-NY Page 3 of 5 FOR PRODUCER USE ONLY NOT FOR DISTRIBUTION TO THE PUBLIC. Effective November 2014 Rate Lock Policies Previous Rate Sheet Field Bulletins i Annuity rates for all states Index Annuity Rates effective Monday, November 10 Guarantee Rate Length of Guarantee Rate 1st Year Interest Bonus Product Available in all states EXCEPT Guar Min Fixed Rate Premiums under $100,000 2.25% 5 _ IA, MN, MO, SC 1.00% Premiums of $100,000 or more 2.40% 5 _ IA, MN, MO, SC 1.00% Premiums under $100,000 2.35% 6 _ IA, MN, MO, SC 1.00% Premiums of $100,000 or more 2.50% 6 _ IA, MN, MO, SC 1.00% Premiums under $100,000 2.65% 7 _ IA, MN, MO, SC 1.00% Premiums of $100,000 or more 2.80% 7 _ IA, MN, MO, SC 1.00% Premiums under $100,000 2.55% 8 _ IA, MN, MO, NY, SC 1.00% Premiums of $100,000 or more 2.70% 8 _ IA, MN, MO, NY, SC 1.00% Premiums under $100,000 2.60% 9 _ IA, MN, MO, NY, SC 1.00% Premiums of $100,000 or more 2.75% 9 _ IA, MN, MO, NY, SC 1.00% Premiums under $100,000 2.60% 10 _ IA, MN, MO, NY, SC 1.00% Premiums of $100,000 or more 2.75% 10 _ IA, MN, MO, NY, SC 1.00% SINGLE PREMIUM TRADITIONAL FIXED DEFERRED ANNUITIES Product American Pathway 5-year term Contract #A125 SM American Pathway 6-year term Contract #A125 SM American Pathway 7-year term Contract #A125 SM American Pathway 8-year term Contract #A125 SM American Pathway 9-year term Contract #A125 SM SolutionsMYG Annuity: SolutionsMYG Annuity: SolutionsMYG Annuity: SolutionsMYG Annuity: SolutionsMYG Annuity: Additional Information The 8, 9 and 10-year terms are not available in NY American PathwaySM SolutionsMYG Annuity: 10-year term Contract #A125 For more information: 888.438.6933 OPTION 2 Bold blue text indicates the change from the previous rate. RATES ARE SUBJECT TO CHANGE AT ANY TIME. Applicable rate is determined by the date the contract is issued. A contract will be issued on the issue date following receipt of the completed paperwork in good order (including premium and appropriate licensing and contracting information) at the Home Office. Annuities are designed for long-term retirement investing and typically include limitations, exclusions and expense charges. Income taxes are payable upon withdrawal. Withdrawals made prior to age 59 ½ may be subject to a 10% federal tax penalty. or email [email protected] This information is general in nature and may be subject to change. American General Life Insurance Company, its agents and representatives are not authorized to give legal, tax or accounting advice. Applicable laws and regulations are complex and subject to change. Any tax statements in this material are not intended to suggest the avoidance of U.S. federal, state, or local tax penalties. For advice concerning your situation, consult your professional attorney, tax advisor or accountant. Page 4 of 5 Annuities issued by American General Life Insurance Company (AGL) except in New York, where issued by The United States Life Insurance Company in the City of New York (US Life). Issuing insurance company is responsible for the financial obligations of insurance products it issues and is a member of American International Group, Inc. (AIG). Guarantees are backed by the claims paying ability of AGL and US Life. Product may not be available in all states and product features may vary by state. Please refer to your contract. If you are an agent prior to soliciting business be certain that you are appropriately licensed and appointed with the insurer and that the product has been approved for sale by the insurer in that state. If uncertain contact your American General Life Insurance Company representative for assistance. © 2014 AIG. All rights reserved. AGLC103676 FOR PRODUCER USE ONLY. NOT FOR DISTRIBUTION TO THE PUBLIC. Effective November 5, 2014 ANNUITY RATES Income Annuity Rates effective Wednesday, November 5 Rates For All States Female 65 Non-NY Rates Male 65 Female 70 Male 70 Female 65 SM American PathwaySM Deferred Income Contract #AGLC106378 American Pathway Immediate Contract #01016 Rates effective as of Wednesday, November 5 Monthly Payout for $100,000 premium beginning Monthly Payout for $100,000 premium beginning in 30 days in 30 days (rounded down to the nearest whole dollar) (rounded down to the nearest whole dollar) Life Only $532 $558 $596 $626 Life Only with CPI $387 $413 $462 $492 Life with 10 yr Certain Period $519 $541 $574 $597 Life Only with Installment Refund $492 $508 $535 DELAYED INCOME IMMEDIATE INCOME Rates effective as of Wednesday, November 5 Male 65 Female 70 Male 70 Monthly Payout for $100,000 premium. Payments commence at age 70. PreCommencement Death Benefit is Return of Premium. Monthly Payout for $100,000 premium. Payments commence at age 75. PreCommencement Death Benefit is Return of Premium. (rounded down to the (rounded down to the nearest whole dollar) nearest whole dollar) Life Only $736 $780 $871 $921 Life Only with CPI $566 $609 $717 $768 Life with 10 yr Certain Period $693 $722 $784 $815 $554 Life Only with Installment Refund $676 $705 $772 $809 Life with Cash Refund $483 $497 $523 $541 Life with Cash Refund $669 $696 $762 $797 50% Joint and Contingent $499 $510 $558 $570 50% Joint and Survivor $697 $718 $826 $852 100% Joint and Contingent $465 $465 $515 $515 100% Joint and Survivor $635 $635 $742 $742 Run an Immediate Income Annuity quote: - www.RetirementRaise.com - www.americangeneral.com and log in Call American General for more information 888.438.6933 OPTION 2 Run a Delayed Income Annuity quote: - www.RetirementRaise.com - www.americangeneral.com and log in RATES ARE SUBJECT TO CHANGE AT ANY TIME. Applicable rate is determined by the date the contract is issued. A contract will be issued on the issue date following receipt of the completed paperwork in good order (including premium and appropriate licensing and contracting information) at the Home Office. Annuities are designed for long-term retirement investing and typically include limitations, exclusions and expense charges. Income taxes are payable upon withdrawal. Withdrawals made prior to age 59 ½ may be subject to a 10% federal tax penalty. This information is general in nature and may be subject to change. American General Life Insurance Company, its agents and representatives are not authorized to give legal, tax or accounting advice. Applicable laws and regulations are complex and subject to change. Any tax statements in this material are not intended to suggest the avoidance of U.S. federal, state, or local tax penalties. For advice concerning your situation, consult your professional attorney, tax advisor or accountant. Annuities issued by American General Life Insurance Company (AGL) except in New York, where issued by The United States Life Insurance Company in the City of New York (US Life). Issuing insurance company is responsible for the financial obligations of insurance products it issues and is a member of American International Group, Inc. (AIG). Guarantees are backed by the claims paying ability of AGL and US Life. Product may not be available in all states and product features may vary by state. Please refer to your contract. If you are an agent prior to soliciting business be certain that you are appropriately licensed and appointed with the insurer and that the product has been approved for sale by the insurer in that state. If uncertain contact your American General Life Insurance Company representative for assistance. © 2014 AIG. All rights reserved. AGLC103676 Page 5 of 5 FOR PRODUCER USE ONLY. NOT FOR DISTRIBUTION TO THE PUBLIC.

© Copyright 2026