Prime Orion Philippines Inc. Unaudited Interim Consolidated Financial Statements 2010

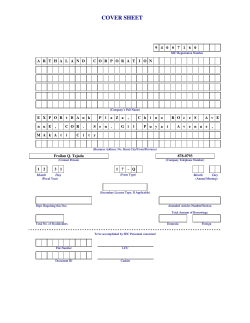

COVER SHEET 1 6 3 6 7 1 SEC Registration Number P R I M E O R I O N P H I L I P P I N E S , I N C . (Company’s Full Name) 2 0 / F L K G M A K A T I T OW E R 6 8 0 1 A Y A L A A V E N U E C I T Y (Business Address: No. Street City/Town/Province) ATTY. DAISY L. PARKER 884-1106 (Contact Person) (Company Telephone Number) 0 6 3 0 SEC Form 1 7 - Q Month Day (Form Type) Month (Fiscal Year) Day (Annual Meeting) (Secondary License Type, If Applicable) Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier STAMPS Remarks: Please use BLACK ink for scanning purposes. PRIME ORION PHILIPPINES, INC. AND SUBSIDIARIES Unaudited Interim Consolidated Financial Statements March 31, 2010 and June 30, 2009 PRIME ORION PHILIPPINES, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (Amounts in Thousands, Except Par Value and Number of Shares) UNAUDITED March 31, 2010 ASSETS Current Assets Cash and cash equivalents (Note 4) Receivables - net (Note 5) Inventories – net (Note 6) Real estate held for sale and development (Note 7) Amounts owed by related parties - net (Note 19) Available-for-sale (AFS) investments (Note 9) Other current assets - net (Note 8) Total Current Assets Noncurrent Assets Investments in associates - net (Note 11) Leasehold rights - net Held-to-maturity (HTM) investments (Note 10) Investment properties - net (Note 13) Property, plant and equipment - net (Note 12) At cost At revalued amounts Deferred income tax assets Other noncurrent assets - net (Note 14) Total Noncurrent Assets TOTAL ASSETS LIABILITIES AND EQUITY (CAPITAL DEFICIENCY) Current Liabilities Accounts payable and accrued expenses (Notes 18) Loans payable (Notes 15) Long-term debt (Note 16) Rental deposits and advances Convertible note (Note 17) Amounts owed to related parties (Note 19) Total Current Liabilities Noncurrent Liabilities Retirement benefit obligation Deferred income tax liabilities Subscriptions payable Total Noncurrent Liabilities Total Liabilities (Forward) AUDITED June 30, 2009 P =155,374 731,402 213,827 352,345 5,122 616,520 179,962 2,254,552 =469,436 P 429,644 250,741 388,031 5,196 449,614 172,366 2,165,028 530,521 33,251 26,000 612,270 530,721 39,946 19,931 739,880 46,822 612,662 84,149 129,238 2,074,913 P =4,329,465 41,041 630,059 83,866 93,387 2,178,831 =4,343,859 P P =1,236,219 – – 198,128 – 2,877 1,437,224 =2,036,349 P 156,441 140,000 197,081 1,251,339 16,647 3,797,857 54,609 194,504 528,470 777,583 2,214,807 51,379 212,438 528,470 792,287 4,590,144 -2- Equity (Capital Deficiency) Attributable to Equity Holders of the Parent Capital stock - = P1 par value Authorized - 2,400,000,000 shares Issued and subscribed – 2,367,149,383 shares (net of subscriptions receivable of P =300,797) Additional paid-in capital Revaluation increment in property, plant and equipment Revaluation reserve on investment properties at deemed cost Unrealized valuation gain (loss) on AFS investments Deficit Minority interest Total Equity (Capital Deficiency) TOTAL LIABILITIES AND EQUITY (CAPITAL DEFICIENCY) UNAUDITED March 31, 2010 AUDITED June 30, 2009 P =2,066,352 829,904 198,428 235,889 163,622 (1,444,483) 2,049,712 64,946 2,114,658 P =4,329,465 =2,066,352 P 829,904 198,428 235,889 (8,709) (3,638,908) (317,044) 70,759 (246,285) =4,343,859 P PRIME ORION PHILIPPINES, INC. AND SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF INCOME (Amounts in Thousands, Except Earnings (Loss) Per Share) QUARTER ENDED MARCH 31 NINE MONTHS ENDED MARCH 31 2010 2009 2010 2009 Merchandise sales - net 171,420 162,323 520,523 526,046 Rental REVENUES 114,583 110,416 377,071 357,044 Insurance premiums and commissions 42,575 27,726 109,455 73,835 Real estate sales 78,045 - 79,423 - 406,623 300,465 1,086,472 956,925 Operating expenses (Note 20) 129,828 117,885 371,243 341,690 Cost of goods sold and services 169,634 166,057 495,541 591,798 Rental and utilities 55,310 59,925 166,563 179,815 Insurance underwriting deductions 27,038 7,460 86,231 41,195 COST AND EXPENSES Cost of real estate sold 50,396 - 51,352 - 432,206 351,327 1,170,930 1,154,498 3,159 (29,685) 12,311 (95,428) - - 1,246,640 - OTHER INCOME (CHARGES) Interest and others – net Gain on extinguishment of debt Gain (Loss) on sale of assets Reversal (provision) for probable losses Foreign exchange gains (losses) - net Reversal of allowance for doubtful accounts Dividend income Others – net INCOME (LOSS) BEFORE INCOME TAX BENEFIT FROM INCOME TAX NET INCOME (LOSS) - 497 419,457 (9,120) (2,498) 4,600 544,962 4,600 172 (70) 261 (167) 8,559 2,368 8,559 6,401 - 188 22,540 15,933 7,168 4,379 21,975 24,030 16,560 (17,723) 2,276,705 (53,750) 415,646 369,050 (1,105,775) 1,208,248 (9,023) (68,585) 2,192,247 (251,323) (778) (2,313) 1,101 (6,129) (8,245) (66,272) 2,191,146 (245,194) (9,336) (72,515) 2,194,425 (247,945) 1,091 6,243 (3,279) 2,751 (8,245) (66,272) 2,191,146 (245,194) (0.004) (0.031) 0.927 (0.105) ATTRIBUTABLE TO: Equity holders of the company Minority interest EARNINGS (LOSS) PER SHARE (Note 21) Basic, for income (loss) for the period attributable to ordinary equity holders of the parent PRIME ORION PHILIPPINES, INC. AND SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Amounts in Thousands, Except Earnings (Loss) Per Share) QUARTER ENDED MARCH 31 2010 2009 NET INCOME (LOSS) FOR THE PERIOD NINE MONTHS PERIOD ENDED MARCH 31 2010 2009 (8,245) (66,272) 2,191,146 (245,194) 38,852 18,469 172,332 (235,655) 30,607 (47,803) 2,363,478 (480,849) 28,897 (57,242) 2,366,776 (483,600) 1,710 9,439 (3,298) 2,751 30,607 (47,803) 2,363,478 (480,849) Other comprehensive income (loss): Changes in fair value of available for sale investments in equity securities TOTAL COMPREHENSIVE INCOME (LOSS) FOR THE PERIOD Total comprehensive income (loss) attributable to: Equity holders of the company Minority interest PRIME ORION PHILIPPINES, INC. AND SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (CAPITAL DEFICIENCY) FOR THE PERIOD ENDED MARCH 31, 2010 AND 2009 (Amounts in Thousands) Balances at June 30, 2008 Capital Stock Additional Paid-in Capital = P2,066,352 P =829,904 Revaluation Reserve on Investment Properties at Deemed cost Unrealized Valuation Gain (Loss) on AFS Investments = P203,372 =281,181 P =144,137 P Revaluation Increment in Property, Plant and Equipment Deficit (P =3,399,279) Minority Interest Total =72,199 P =197,866 P – – – (235,655) (247,945) Balances at March 31, 2009 = P2,066,352 P =829,904 = P203,372 =281,181 P (P =91,518) (P =3,647,224) =68,475 P (P =289,458) Balances at June 30, 2009 = P2,066,352 P =829,904 = P198,428 =235,889 P (P =8,709) (P =3,638,908) =70,759 P (P =246,285) Total comprehensive income (loss) for the period Acquisition of minority interest Total comprehensive income (loss) for the period Balances at March 31, 2010 – – = P2,066,352 P =829,904 (3,724) (487,324) - - - – (2,534) (2,534) – – 172,332 2,194,425 (3,279) 2,363,478 =163,622 P (P =1,444,483) = P198,428 =235,889 P =64,946 P =2,114,658 P PRIME ORION PHILIPPINES, INC. AND SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in Thousands) Nine Months Ended March 31 2009 2010 CASH FLOWS FROM OPERATING ACTIVITIES Income (Loss) before income tax Adjustments for: Interest expense Depreciation and amortization Provisions for (reversal of): Probable losses Doubtful accounts Unrealized foreign exchange losses (gains) Loss (Gain) on sale of assets Gain on extinguishment of debt Interest income Dividend income Operating income before working capital changes Decrease (increase) in: Receivables Inventories Real estate held for sale and development Other current assets Increase (decrease) in: Accounts payable and accrued expenses Rental deposits and advances Net cash flows from (used in) operations Interest received Interest paid Net cash flows from (used in) operating activities CASH FLOWS FROM INVESTING ACTIVITIES Decrease (increase) in: Investment property Investment in shares of stocks Other noncurrent assets AFS investments - net HTM investments Dividends received from associates Proceeds from sale of investment property Proceeds from sale of AFS investments Acquisition of minority interest Increase in amounts owed by related parties Acquisitions of property, plant and equipment Net cash flows from investing activities (Forward) P =2,192,247 (P =251,323) 139,726 115,342 149,613 (544,962) 7,430 (261) (419,457) (1,246,640) (12,496) (22,540) 93,047 (4,600) (15,210) 84 9,120 (19,914) (15,933) (32,821) (285,247) 31,132 35,686 (7,596) 52,833 79,474 (2,455) (16,766) 76,831 1,047 (55,100) 12,496 – (42,604) (121,355) 9,165 (31,925) 19,914 (12,011) 200 (35,051) 4,868 (6,069) 22,540 24,179 2,564 (2,534) (1,566) (17,324) (8,193) (116) (7,526) 48,813 7 15,933 (11,506) 45,605 -2- Nine Months Ended March 31 2009 2010 CASH FLOWS FROM FINANCING ACTIVITIES Decrease in amounts owed to related parties Payments of: Convertible note Loans Long-term debt Net cash used in financing activities (P =13,769) (P =3,545) (183,453) (34,853) (31,190) (263,265) – – – (3,545) NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS (314,062) 30,050 CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR 469,436 330,972 CASH AND CASH EQUIVALENTS AT END OF PERIOD (Note 4) P =155,374 =361,022 P PRIME ORION PHILIPPINES, INC. AND SUBSIDIARIES NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS 1. Corporate Information Prime Orion Philippines, Inc. (the Parent Company) was incorporated and registered with the Philippine Securities and Exchange Commission on May 19, 1989. The Company’s registered office address is 20th Floor, LKG Tower, 6801 Ayala Avenue, Makati City. The Parent Company’s primary purpose is to acquire by purchase, exchange, assign, donate or otherwise, and to hold, own and use, for investment or otherwise and to sell, assign, transfer, exchange, lease, let, develop, mortgage, pledge, traffic, deal in and with, and otherwise operate, enjoy and dispose of any and all properties of every kind and description and wherever situated, as and to the extent permitted by law, including but not limited to, buildings, tenements, warehouses, factories, edifices and structures and other improvements, and bonds, debentures, promissory notes, shares of capital stock, or other securities and obligations, created, negotiated or issued by any corporation, association, or other entity, domestic or foreign. Prime Orion Philippines, Inc. and Subsidiaries, collectively referred to as “the Group”, have principal business interests in real estate, financial services and manufacturing. The unaudited condensed consolidated financial statements of the Group as of March 31, 2010 and June 30, 2009 and for the nine months ended March 31, 2010 and 2009 were approved and authorized for issue by the Audit Committee and the Board of Directors on May 19, 2010. 2. Summary of Significant Accounting Policies Basis of Preparation The unaudited condensed consolidated financial statements have been prepared on a historical cost basis, except for certain property, plant and equipment that are carried at revalued amounts and AFS investments that are carried at fair values. The unaudited condensed financial statements do not include all of the information and disclosures required in the June 30, 2009 annual audited consolidated financial statements, and should be read in conjunction with the Group’s annual consolidated financial statements as of end of the year ended June 30, 2009. The unaudited consolidated financial statements are presented in Philippine peso, which is the Group’s functional and presentation currency. Statement of Compliance The financial statements of the Group have been prepared in compliance with Philippine Financial Reporting Standards (PFRS). -2- Basis of Consolidation The unaudited condensed consolidated financial statements include the accounts of the Parent Company and its subsidiaries as of March 31, 2010 and June 30, 2009: Effective Percentage of Ownership March 31,2010 June 30, 2009 Orion Land Inc. (OLI) and Subsidiaries: OLI Tutuban Properties, Inc. (TPI) and Subsidiaries: 22BAN Marketing, Inc. TPI Holdings Corporation (TPIHC) Orion Property Development, Inc. (OPDI) and Subsidiary: Orion Beverage, Inc. Luck Hock Venture Holdings, Inc. Orion I Holdings Philippines, Inc. (OIHPI) and Subsidiaries: OIHPI Lepanto Ceramics, Inc. (LCI) Orion Brands International, Inc. (OBII) OYL Holdings, Inc. ZHI Holdings, Inc. (ZHI) DHG Capital Holdings, Inc. (DCHI) and Subsidiaries: DCHI HLG Philippines, Inc. (HPI) Orion Solutions, Inc. (OSI) OE Holdings, Inc. (OEHI) and Subsidiaries: OEHI OE Enterprises Holdings, Inc. (OEEHI) Orion Maxis Inc. FLT Prime Insurance Corporation (FPIC) 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 60.00 100.00 100.00 60.00 100.00 100.00 100.00 60.00 100.00 100.00 100.00 100.00 60.00 100.00 100.00 100.00 100.00 100.00 96.00 100.00 100.00 100.00 70.00 100.00 100.00 100.00 70.00 All of the above companies are based in the Philippines. Subsidiaries are consolidated from the date on which control is transferred to the Group and cease to be consolidated from the date on which control is transferred out of the Group. Consolidated financial statements are prepared using uniform accounting policies for like transactions and other events in similar circumstances. All significant intercompany transactions and balances between and among the Group, including intercompany profits and unrealized profits, have been eliminated in the consolidation. -3- Minority interests represent interests in certain subsidiaries not held by the Group. The equity and net income attributable to minority interests are shown separately in the consolidated balance sheet and consolidated statement of income, respectively. Changes in Accounting Policies The accounting policies adopted in the preparation of unaudited condensed consolidated financial statements are consistent with those of the previous financial year, except for the new Standards effective January 1, 2009. PFRS 1, First-time Adoption of PFRS - Cost of an Investment in a Subsidiary, Jointly Controlled Entity or Associate The amended PFRS 1 allows an entity, in its separate financial statements, to determine the cost of investments in subsidiaries, jointly controlled entities or associates (in its opening PFRS financial statements) as one of the following amounts: (a) cost determined in accordance with PAS 27, Consolidated and Separate Financial Statements; (b) at the fair value of the investment at the date of transition to PFRS, determined in accordance with PAS 39; or (c) previous carrying amount (as determined under generally accepted accounting principles) of the investment at the date of transition to PFRS. PFRS 2, Share-based Payment - Vesting Condition and Cancellations The standard has been revised to clarify the definition of a vesting condition and prescribes the treatment for an award that is effectively cancelled. It defines a vesting condition as a condition that includes an explicit or implicit requirement to provide services. It further requires non-vesting conditions to be treated in a similar fashion to market conditions. Failure to satisfy a non-vesting condition that is within the control of either the entity or the counterparty is accounted for as cancellation. However, failure to satisfy a non-vesting condition that is beyond the control of either party does not give rise to a cancellation. PFRS 8, Operating Segments PFRS 8 will replace PAS 14, Segment Reporting, and adopts a full management approach to identifying, measuring and disclosing the results of an entity’s operating segments. The information reported would be that which management uses internally for evaluating the performance of operating segments and allocating resources to those segments. Such information may be different from that reported in the balance sheet and statement of income and the Company will provide explanations and reconciliations of the differences. This standard is only applicable to an entity that has debt or equity instruments that are traded in a public market or that files (or is in the process of filing) its financial statements with a securities commission or similar party. Amendments to PAS 1, Presentation of Financial Statements These amendments introduce a new statement of comprehensive income that combines all items of income and expenses recognized in the profit or loss together with ‘other comprehensive income’. Entities may choose to present all items in one statement, or to present two linked statements, a separate statement of income and a statement of comprehensive income. These amendments also prescribe additional requirements in the presentation of the balance sheet and owner’s equity as well as additional disclosures to be included in the financial statements. Adoption of this Amendment will not have significant impact on the Group except for the presentation of a -4- statement of comprehensive income. PAS 23, Borrowing Costs The standard has been revised to require capitalization of borrowing costs when such costs relate to a qualifying asset. A qualifying asset is an asset that necessarily takes a substantial period of time to get ready for its intended use or sale. In accordance with the transitional requirements in the standard, the Group will adopt this as a prospective change. Accordingly, borrowing costs will be capitalized on qualifying assets with a commencement date after January 1, 2009. No changes will be made for borrowing costs incurred to this date that have been expensed. Amendments to PAS 27, Consolidated and Separate Financial Statements - Cost of an Investment in a Subsidiary, Jointly Controlled Entity or Associate These amendments prescribe changes in respect of the holding companies’ separate financial statements including (a) the deletion of ‘cost method’, making the distinction between pre- and post-acquisition profits no longer required; and (b) in cases of reorganizations where a new parent is inserted above an existing parent of the group (subject to meeting specific requirements), the cost of the subsidiary is the previous carrying amount of its share of equity items in the subsidiary rather than its fair value. All dividends will be recognized in the statement of income. However, the payment of such dividends requires the entity to consider whether there is an indicator of impairment. Amendments to PAS 32, Financial Instruments: Presentation and PAS 1, Presentation of Financial Statements - Puttable Financial Instruments and Obligations Arising on Liquidation These amendments specify, among others, that puttable financial instruments will be classified as equity if they have all of the following specified features: (a) the instrument entitles the holder to require the entity to repurchase or redeem the instrument (either on an ongoing basis or on liquidation) for a pro rata share of the entity’s net assets; (b) the instrument is in the most subordinate class of instruments, with no priority over other claims to the assets of the entity on liquidation; (c) all instruments in the subordinate class have identical features; (d) the instrument does not include any contractual obligation to pay cash or financial assets other than the holder’s right to a pro rata share of the entity’s net assets; and (e) the total expected cash flows attributable to the instrument over its life are based substantially on the profit or loss, a change in recognized net assets, or a change in the fair value of the recognized and unrecognized net assets of the entity over the life of the instrument. Philippine Interpretation IFRIC 16, Hedges of a Net Investment in a Foreign Operation This interpretation provides guidance on identifying foreign currency risks that qualify for hedge accounting in the hedge of net investment; where within the group the hedging instrument can be held in the hedge of a net investment; and how an entity should determine the amount of foreign currency gains or losses, relating to both the net investment and the hedging instrument, to be recycled on disposal of the net investment. Improvements to PFRS In May 2008, the International Accounting Standards Board issued its first omnibus of amendments to certain standards, primarily with a view to removing inconsistencies and clarifying wording. There are separate transitional provisions for each standard. -5• PFRS 5, Noncurrent Assets Held for Sale and Discontinued Operations When a subsidiary is held for sale, all of its assets and liabilities will be classified as held for sale under PFRS 5, even when the entity retains a non-controlling interest in the subsidiary after the sale. • PFRS 7, Financial Instruments: Disclosures Removal of the reference to ‘total interest income’ as a component of finance costs. • PAS 1, Presentation of Financial Statements Assets and liabilities classified as held for trading are not automatically classified as current in the balance sheet. • PAS 8, Accounting Policies, Changes in Accounting Estimates and Errors Clarification that only implementation guidance that is an integral part of a PFRS is mandatory when selecting accounting policies. • PAS 10, Events After the Balance Sheet Date Clarification that dividends declared after the end of the reporting period are not obligations. • PAS 16, Property, Plant and Equipment The amendment replaces the term ‘net selling price’ with ‘fair value less costs to sell’, to be consistent with PFRS 5 and PAS 36, Impairment of Assets. Items of property, plant and equipment held for rental that are routinely sold in the ordinary course of business after rental, are transferred to inventory when rental ceases and they are held for sale. Proceeds of such sales are subsequently shown as revenue. Cash payments on initial recognition of such items, the cash receipts from rents and subsequent sales are all shown as cash flows from operating activities. • PAS 18, Revenue Replacement of the term ‘direct cost’ with ‘transaction costs’ as defined in PAS 39. • PAS 19, Employee Benefits Revises the definition of ‘past service costs’ to include reductions in benefits related to past services (‘negative past service costs’) and to exclude reductions in benefits related to future services that arise from plan amendments. Amendments to plans that result in a reduction in benefits related to future services are accounted for as a curtailment. Revises the definition of ‘return on plan assets’ to exclude plan administration costs if they have already been included in the actuarial assumptions used to measure the defined benefit obligation. Revises the definition of ‘short-term’ and ‘other long-term’ employee benefits to focus on the point in time at which the liability is due to be settled. -6 Deletes the reference to the recognition of contingent liabilities to ensure consistency with PAS 37, Provisions, Contingent Liabilities and Contingent Assets. • PAS 20, Accounting for Government Grants and Disclosure of Government Assistance Loans granted with no or low interest rates will not be exempt from the requirement to impute interest. The difference between the amount received and the discounted amount is accounted for as a government grant. • PAS 23, Borrowing Costs Revises the definition of borrowing costs to consolidate the types of items that are considered components of ‘borrowing costs’, i.e., components of the interest expense calculated using the effective interest rate method. • PAS 27, Consolidated and Separate Financial Statements When a parent entity accounts for a subsidiary at fair value in accordance with PAS 39 in its separate financial statements, this treatment continues when the subsidiary is subsequently classified as held for sale. • PAS 28, Investments in Associates If an associate is accounted for at fair value, in accordance with PAS 39, only the requirement of PAS 28 to disclose the nature and extent of any significant restrictions on the ability of the associate to transfer funds to the entity in the form of cash or repayment of loans will apply. An investment in an associate is a single asset for the purpose of conducting the impairment test. Therefore, any impairment test is not separately allocated to the goodwill included in the investment balance. • PAS 29, Financial Reporting in Hyperinflationary Economies Revises the reference to the exception that assets and liabilities should be measured at historical cost, such that it notes property, plant and equipment as being an example, rather than implying that it is a definitive list. • PAS 31, Interests in Joint Ventures If a joint venture is accounted for at fair value, in accordance with PAS 39, only the requirements of PAS 31 to disclose the commitments of the venturer and the joint venture, as well as summary financial information about the assets, liabilities, income and expense will apply. • PAS 34, Interim Financial Reporting Earnings per share is disclosed in interim financial reports if an entity is within the scope of PAS 33, Earnings per Share. • PAS 36, Impairment of Assets When discounted cash flows are used to estimate ‘fair value less cost to sell’, additional disclosure is required about the discount rate, consistent with -7- disclosures required when the discounted cash flows are used to estimate ‘value in use’. • PAS 38, Intangible Assets Expenditure on advertising and promotional activities is recognized as an expense when the Company either has the right to access the goods or has received the services. Advertising and promotional activities now specifically include mail order catalogues. Deletes references to there being rarely, if ever, persuasive evidence to support an amortization method for finite life intangible assets that results in a lower amount of accumulated amortization than under the straight-line method, thereby effectively allowing the use of the unit of production method. • PAS 39, Financial Instruments: Recognition and Measurement Changes in circumstances relating to derivatives - specifically derivatives designated or de-designated as hedging instruments after initial recognition - are not reclassifications. When financial assets are reclassified as a result of an insurance company changing its accounting policy in accordance with paragraph 45 of PFRS 4, Insurance Contracts, this is a change in circumstance, not a reclassification. Removes the reference to a ‘segment’ when determining whether an instrument qualifies as a hedge. Requires use of the revised effective interest rate (rather than the original effective interest rate) when re-measuring a debt instrument on the cessation of fair value hedge accounting. • PAS 40, Investment Property Revises the scope (and the scope of PAS 16) to include property that is being constructed or developed for future use as an investment property. Where an entity is unable to determine the fair value of an investment property under construction, but expects to be able to determine its fair value on completion, the investment under construction will be measured at cost until such time as fair value can be determined or construction is complete. • PAS 41, Agriculture Removes the reference to the use of a pre-tax discount rate to determine fair value, thereby allowing use of either a pre-tax or post-tax discount rate depending on the valuation methodology used. Removes the prohibition to take into account cash flows resulting from any additional transformations when estimating fair value. Instead, cash flows that are expected to be generated in the ‘most relevant market’ are taken into account. -8- 3. Significant Accounting Judgments and Estimates The preparation of the accompanying unaudited condensed consolidated financial statements in conformity with PFRS requires management to make judgments, estimates and assumptions that affect the amounts reported in the unaudited condensed consolidated financial statements and accompanying notes. The estimates and assumptions used in the accompanying unaudited condensed consolidated financial statements are based upon management’s evaluation of relevant facts and circumstances as of the date of the unaudited condensed consolidated financial statements. Actual results could differ from such estimates. Estimates and judgments are continually evaluated and are based on historical experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. Judgments In the process of applying the Company’s accounting policies, management has made the following judgments, apart from those involving estimations, which have the most significant effect on the amounts recognized in the financial statements: Determining functional currency Based on the economic substance of underlying circumstances relevant to the Company, the functional currency of the Company has been determined to be the Philippine peso. The Philippine peso is the currency of the primary economic environment in which the Company operates and it is the currency that mainly influences the underlying transactions, events and conditions relevant to the Company. Operating lease commitments - Group as lessor The Group has entered into commercial property leases on its investment property portfolio. The Group has determined that it retains all the significant risks and rewards of ownership of these properties which are leased out under operating lease arrangements. Operating lease commitments - Group as lessee The Group has entered into a lease agreement for the corporate office space and a subsidiary’s mall operations. The Group has determined that it does not obtain all the significant risks and rewards of ownership of the assets under operating lease arrangements. Impairment of AFS investments The Group follows the guidance of PAS 39 in determining when an investment is other-thantemporarily impaired. This determination requires significant judgment. In making this judgment, the Group evaluates, among other factors, the duration and extent to which the fair value of an investment is less than its cost; and the financial health of and near-term business outlook for the investee, including factors such as industry and sector performance, changes in technology and operational and financing cash flows. Estimates and assumptions The key assumptions concerning the future and other key sources of estimation uncertainty at the balance sheet date that have a significant risk of causing a material adjustment to the carrying -9- amounts of assets and liabilities within the next financial year are discussed below. Estimated allowance for impairment losses The Group reviews its receivables and amounts owed by related parties at each reporting date to assess whether an allowance for impairment should be recorded in the unaudited statement of income. In particular, judgment by management is required in the estimation of the amount and timing of future cash flows when determining the level of allowance required. Such estimates are based on assumption about a number of factors and actual results may differ, resulting in future changes to the allowance. For the amounts owed by related parties, the Group uses judgment, based on the best available facts and circumstances, including but not limited to, assessment of the related parties’ operating activities (active or dormant), business viability and overall capacity to pay, in providing allowance against the recorded receivable amounts. For the receivables, the Group evaluates specific accounts where the Group has information that certain customers or third parties are unable to meet their financial obligations. Facts, such as the Group’s length of relationship with the customers or other parties and the customers’ or other parties’ current credit status, are considered to ascertain the amount of allowance that will be provided. The allowances are evaluated and adjusted as additional information is received. Estimated useful lives of property, plant and equipment and investment properties The estimated useful lives used as bases for depreciating the Group’s property, plant and equipment and investment properties were determined on the basis of management’s assessment of the period within which the benefits of these asset items are expected to be realized taking into account actual historical information on the use of such assets as well as industry standards and averages applicable to the Group’s assets. The Group estimated the useful lives of its property, plant and equipment and investment properties based on the period over which the assets are expected to be available for use. The estimated useful lives of property, plant and equipment and investment properties are reviewed, at least, annually and are updated if expectations differ from previous estimates due to physical wear and tear and technical or commercial obsolescence on the use of these assets. It is possible that future results of operations could be materially affected by changes in these estimates brought about by changes in the factors mentioned above. A reduction in the estimated useful lives of property, plant and equipment and investment properties would increase depreciation expense and decrease property, plant and equipment and investment properties. Determining fair values of financial instruments Where the fair value of financial assets and financial liabilities recorded in the balance sheet cannot be derived from active markets, they are determined using valuation techniques including the discounted cash flows model. The inputs to these models are taken from observable markets where possible, but where this is not feasible, a degree of judgment is required in establishing fair values. The judgments include considerations of inputs such as liquidity risk, credit risk and volatility. Changes in assumptions about these factors could affect the reported fair value of financial instruments. Estimating Realizability of deferred income tax assets The Group reviews the carrying amounts of deferred income tax assets at each balance sheet date - 10 - and reduces deferred income tax assets to the extent that it is no longer probable that sufficient taxable income will be available to allow all or part of the deferred income tax assets to be utilized. However, there is no assurance that the Group will generate sufficient taxable income to allow all or part of its deferred income tax assets to be utilized. Asset impairment Internal and external sources of information are reviewed at each balance sheet date to identify indications that the assets may be impaired or an impairment loss previously recognized no longer exists or may be decreased. If any such indication exists, the recoverable amount of the asset is estimated. An impairment loss is recognized whenever the carrying amount of an asset exceeds its estimated recoverable amount. The Group assesses the impairment of assets whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The factors that the Group considers important which could trigger an impairment review include the following: • • • significant underperformance relative to expected historical or projected future operating results; significant negative industry or economic trends; and deterioration in the financial health of the investee for investments in stocks, industry and sector performance, changes in technology, and operational and financing cash flows. Pension and other retirement benefits The determination of the Company’s obligation and retirement expense is dependent on the selection of certain assumptions used by actuaries in calculating such amounts. Those assumptions include, among others, discount rates, expected returns on plan assets and salary increase rates. In accordance with PFRS, actual results that differ from the Company’s assumptions, subject to the 10% corridor tests, are accumulated and amortized over future periods and therefore, generally affect the recognized expense and recorded obligation in such future periods. While the Company believes that the assumptions are reasonable and appropriate, significant differences between actual experiences and assumptions may materially affect the Company’s accrued retirement obligation and annual retirement expense. Contingencies The Parent Company and certain subsidiaries are currently involved in various legal proceedings. The estimate of the probable costs for the resolution of these claims has been developed in consultation with outside legal counsel handling the defense in these matters and is based upon an analysis of potential results. It is possible, however, that future results of operations could be materially affected by changes in estimates or in the effectiveness of the strategies relating to these proceedings. - 11 - 4. Cash and Cash Equivalents Cash on hand and in banks Short-term investments Surety bond deposit June 30, 2009 March 31, 2010 (In Thousands) =145,266 P P =64,442 261,670 90,932 62,500 – =469,436 P P =155,374 Cash in banks earn interest at the respective bank deposit rates. Short-term investments are made for varying periods of up to three months depending on the immediate cash requirements of the Group and earn interest at the respective short-term investment rates. 5. Receivables Trade debtors Insurance receivables Current portion of Manila Electric Company (Meralco) refund - net Others Less allowance for impairment losses June 30, 2009 March 31, 2010 (In Thousands) =237,790 P P =258,423 201,635 407,942 1,119 340,344 1,007,828 276,426 P =731,402 5,674 269,519 714,618 284,974 =429,644 P 6. Inventories June 30, 2009 March 31, 2010 (In Thousands) At NRV: Finished goods Work-in-process Raw materials Factory supplies and spare parts Materials in-transit P =134,306 13,068 33,516 31,527 1,410 P =213,827 =186,034 P 10,448 17,552 26,439 10,268 =250,741 P 7. Real Estate Held for Sale and Development This account represents real estate held for sale and development located in Calamba, Laguna and Sto. Tomas, Batangas, with a total carrying value of about = P119.1 million and = P233.2 million, respectively. - 12 - 8. Other Current Assets June 30, 2009 March 31, 2010 (In Thousands) Creditable withholding taxes - net of allowance for probable losses amounting to = P16,381 and P =16,415 in March 31, 2010 and June 30, 2009, Respectively Input value - added tax (VAT) – net of allowance for probable losses amounting to P =2,156 and = P2,161 in March 31, 2010 and June 30, 2009, respectively Prepayments P =140,309 =140,224 P 36,773 2,880 P =179,962 31,901 241 =172,366 P 9. Available-for-Sale (AFS) Investments Listed equity securities - at market Nonlisted securities – at cost June 30, 2009 March 31, 2010 (In Thousands) =293,333 P P =489,079 156,281 127,441 =449,614 P P =616,520 10. Held-to-Maturity (HTM) Investments This account pertains to investments in government debt securities with interest rates ranging from 6.875% to 11.50%. These investments have maturity dates starting from July 2010 to July 2013. 11. Investments June 30, 2009 March 31, 2010 (In Thousands) Investments in associates at equity: Acquisition costs: Balance at beginning of year Balance at end of the period Accumulated equity in net income (losses) of associates: Balance at beginning of year Equity in net income of associates Dividends received Balance at end of the period Allowance for probable losses on investments P =1,416,101 1,416,101 (160,357) – (200) (160,557) 1,255,544 (725,023) P =530,521 =1,416,101 P 1,416,101 (160,609) 252 – (160,357) 1,255,744 (725,023) =530,721 P - 13 - 12. Property, Plant and Equipment As of March 31, 2010 Furniture, Fixtures and Equipment Leasehold Improvements Machinery and Equipment (In Thousands) Transportation Equipment = P26,846 22 – 26,868 = P2,054,988 2,216 – 2,057,204 = P36,509 9,896 – 46,405 = P104,371 5,190 (842) 108,719 = P2,222,714 17,324 (842) 2,239,196 Accumulated depreciation and amortization and allowance for impairment: At beginning of year Depreciation and amortization Disposals At end of the period 20,842 610 – 21,452 2,044,527 2,169 – 2,046,696 30,948 1,874 – 32,822 85,356 6,090 (42) 91,404 2,181,673 10,743 (42) 2,192,374 Net book value, 3/31/2010 = P5,416 = P10,508 = P13,583 At cost: At beginning of year Additions Reclassification/Disposals At end of the period At revalued amounts: At beginning and end of year Accumulated depreciation and amortization: At beginning of year Depreciation and amortization At end of the period Net book value, 3/31/2010 = P17,315 Total = P46,822 Land and Improvements Buildings and Improvements (In Thousands) Total = P307,580 =536,560 P =844,140 P 13,228 960 14,188 = P293,392 200,853 16,437 217,290 = P319,270 214,081 17,397 231,478 = P612,662 As of June 30, 2009 At cost: At beginning of year Additions Disposals At end of the period Accumulated depreciation and amortization and allowance for impairment: At beginning of year Depreciation and amortization Disposals At end of the period Net book value Transportation Equipment Furniture, Fixtures and Equipment Leasehold Improvements Machinery and Equipment (In Thousands) = P21,710 5,136 – 26,846 = P2,051,235 3,753 – 2,054,988 = P37,388 1,017 (1,896) 36,509 = P98,943 6,137 (709) 104,371 = P2,209,276 16,043 (2,605) 2,222,714 19,992 850 – 20,842 2,030,859 13,668 – 2,044,527 30,477 1,983 (1,512) 30,948 78,307 7,758 (709) 85,356 2,159,635 24,259 (2,221) 2,181,673 =6,004 P = P10,461 = P5,561 = P19,015 Total = P41,041 - 14 - At revalued amounts: At beginning and end of year Accumulated depreciation and amortization: At beginning of year Depreciation and amortization At end of the period Net book value Land and Improvements Buildings and Improvements (In Thousands) Total = P307,580 = P536,560 = P844,140 11,948 1,280 13,228 = P294,352 178,935 21,918 200,853 = P335,707 190,883 23,198 214,081 = P630,059 Land and Land Improvements Machinery and Equipment 13. Investment Properties As of March 31, 2010 Building Total (In Thousands) Cost: Beginning balance Reclassification Disposals Ending balance 2,120,552 – – 2,120,552 36,387 – (22,720) 13,667 17,378 – – 17,378 2,174,317 – (22,720) 2,151,597 Accumulated depreciation: Beginning balance Depreciation Ending balance Net book value 1,421,228 104,890 1,526,118 =594,434 P – – – = P13,667 13,209 – 13,209 P =4,169 1,434,437 104,890 1,539,327 = P612,270 Building Land and Land Improvements Machinery and Equipment Total As of June 30, 2009 (In Thousands) At cost: At beginning of year Additions At end of the period Accumulated depreciation: At beginning of year Depreciation At end of the period Net book value =2,116,692 P 3,860 2,120,552 = P36,387 – 36,387 P =17,378 – 17,378 P =2,170,457 3,860 2,174,317 1,282,125 139,103 1,421,228 =699,324 P – – – = P36,387 13,209 – 13,209 P =4,169 1,295,334 139,103 1,434,437 = P739,880 - 15 - 14. Other Noncurrent Assets Deferred reinsurance premiums Meralco refund - net of current portion Others June 30, 2009 March 31, 2010 (In Thousands) =28,708 P P =52,119 1,987 62,692 77,119 =93,387 P P =129,238 . 15. Loans Payable This account consists of short-term loans from various local banks and financial institutions which bear interest at prevailing market rates ranging from 9% to 18%. The LCI loans are secured by the receivables and inventory of LCI under the CTI. 16. Long-term Debt This account consists of term loans and syndicated loans from local banks for certain projects of the Group: June 30, 2009 March 31, 2010 (In Thousands) Granito and Ceramic Tile Expansion Projects of LCI P =P =- P140,000 = =140,000 P 17. Convertible Note On June 9, 2000, the Parent Company, together with OLI, Orion Property Development, Inc. (OPDI) and LCI entered into a Memorandum of Agreement (MOA) with United Coconut Planters Bank (UCPB) for the settlement of the Parent Company and LCI’s obligations to UCPB. On December 11, 2000, the Parent Company entered into a Loan Agreement with UCPB to refinance the Group’s remaining short-term obligations after the implementation of the MOA. On May 4, 2002, the Parent Company executed an Investment Agreement with UCPB to reform/supersede the Loan Agreement. The terms of the Investment Agreement include, among others, the following: • Prior to Maturity Date (December 11, 2005), UCPB has the option to require the Parent Company to redeem the Convertible Note (the “Note”) through the issuance of the Parent Company’s common shares; - 16 • • • • At any time on or before Maturity Date, the Parent Company has the option to redeem the Note in cash and at 5% premium; The Note is subject to an annual simple interest rate of ten percent (10%) which interest the Parent Company shall have the option to pay on any interest payment date, either in cash or through the issuance of the Parent Company’s common shares; UCPB shall be entitled to one seat in the Parent Company’s BOD and shall designate its nominee within 10 days from the execution of the Investment Agreement; and The Note is to be secured by a first lien over a subsidiary’s investment in shares of stock of Tutuban Properties, Inc. (TPI) and shares of stocks of and/or subscription rights to Cyber Bay and real properties of the Parent Company and a subsidiary, with a total carrying value of = P170.0 million as of June 30, 2009 and 2008. On August 10, 2009, the Group entered into a Compromise Agreement with Asset Pool A (SPVAMC), Inc. for the settlement of the Group’s remaining loans for a total consideration of = P680 million (see Notes 15 and 16). Under the compromise settlement, POPI and a subsidiary shall settle the Compromise Amount within a period of 18 months. On March 15, 2010, the Group paid the remaining balance of = P49.5 million to APA after deducting the down payments and the semi-annual installments covered by Standby Letter of Credit (SBLC) issued by Banco de Oro Unibank, Inc. (BDO). As of March 31, 2010, the Group was able to settle = P249.5 million of the Compromise Amount through cash settlement and assignment of receivable arising from the sale of a property in located in Mandaue, Cebu City amounted to = P430.5 million. Accordingly, the loan settlement reduced the outstanding loan obligations from = P1.5 billion to = P nil. 18. Accounts Payable and Accrued Expenses Trade payables Accrued interest and penalties (see Notes 15 and 16) Accrued provision for probable losses Claims payable Nontrade payables Reserve for unearned premiums Due to reinsurers and ceding companies Others June 30, 2009 March 31, 2010 (In Thousands) P =348,128 =326,339 P 681,853 250,268 312,817 130,884 95,072 134,257 118,851 78,620 65,755 57,772 295,596 376,356 P =1,236,219 =2,036,349 P - 17 - 19. Related Party Transactions Parties are considered to be related if one party has the ability to control, directly or indirectly, the other party or exercise significant influence over the other party in making financial and operating decisions. Parties are also considered to be related if they are subject to common control or common significant influence. Related parties may be individuals or corporate entities. The Parent Company and its subsidiaries in their normal course of business have entered into transactions with related parties principally consisting of noninterest-bearing advances with no fixed repayment terms and are due and demandable. Account balances with related parties, other than intra-group balances which are eliminated in consolidation, are as follows: June 30, 2009 March 31, 2010 (In Thousands) Amounts owed by related parties: Cyber Bay and Subsidiary Hong Way Holdings, Inc. Guoman Philippines, Inc. Zeus Holdings, Inc. Others Less allowance for impairment losses P =85,939 1,841 1,627 1,191 1,009 91,607 86,485 P =5,122 =84,298 P 1,840 1,575 1,184 1,145 90,042 84,846 =5,196 P (In Thousands) Amounts owed to related parties: OYL Overseas, Ltd. Others P =2,673 204 P =2,877 P2,673 = 13,974 =16,647 P - 18 - 20. Operating Expenses Depreciation and amortization Personnel expenses Supplies and repairs Taxes and licenses Marketing expenses Professional and legal fees Provision for (reversal of) doubtful accounts Communication and transportation Insurance Representation Others Nine months ended March 31 2009 2010 (In Thousands) =126,442 P P =125,320 132,675 139,369 9,495 7,500 31,186 23,500 19,543 17,613 10,152 23,670 (15,210) 7,935 2,827 1,629 15,016 =341,690 P 7,430 7,158 2,562 1,662 15,459 P =371,243 21. Earnings (Loss) Per Share The following table presents information necessary to calculate basic and diluted earnings (loss) per share: Nine months ended March 31 2010 Net income (loss) attributable to equity holders of the Parent (in thousands) b. Weighted average number of shares Basic and diluted earnings (loss) per share (a/b) 2009 a. P =2,194,425 2,367,149 P =0.927 (P =247,945) 2,367,149 (P =0.105) 22. Segment Information Business Segments The Group’s operating businesses are organized and managed separately according to the nature of services provided and the different markets served, with each segment representing a strategic business unit. The industry segments where the Company and its subsidiaries and associates operate are as follows: • Financial services - insurance and related brokerage • Real estate - property development - 19 • Manufacturing and distribution - manufacture and distribution of beverage and ceramic tiles Financial information about the operations of these business segments is summarized as follows: Real Estate Manufacturing Holding and Property Financial and Company Development Services Distribution Total = P109,455 Quarter ended March 31, 2010 Revenue = P– = P456,494 = P520,523 P =1,086,472 1,448,372 57,534 (16,661) 701,901 2,191,146 922 114,253 3,295 21,256 139,726 – – – – – 612,646 1,846,546 637,615 1,232,658 4,329,465 891 8,870 4,381 3,182 17,324 Investment in associates 528,470 – 2,051 – 530,521 Total liabilities 545,896 602,599 574,300 492,012 2,214,807 Holding and Property Financial and Company Development Services Distribution Total Net income (loss) Depreciation and amortization Equity in net income of associates As of March 31, 2010 Total assets Capital expenditures Real Estate Manufacturing (In Thousands) Quarter ended March 31, 2009 Revenue = P526,046 = P956,925 (14,817) 4,340 (170,194) (245,194) 484 113,679 3,174 32,276 149,613 – – - – – As of June 30, 2009 Total assets 727,182 1,858,190 388,423 1,370,064 Capital expenditures 1,371 1,534 2,096 11,042 16,043 528,470 – 2,251 – 530,721 2,136,295 612,955 544,301 1,296,593 4,590,144 Net income (loss) = P– (64,523) = P357,044 = P73,835 Depreciation and amortization Equity in net income of associates Investment in associates Total liabilities Geographical Segments The Group does not have geographical segments. 4,343,859 - 20 - 23. Financial Risk Management Objectives and Policies The Group’s principal financial instruments comprise of amounts owed to related parties and loans from various banks. The main purpose of these financial instruments is to finance the Group’s operations. The Group has various other financial instruments such as cash and cash equivalents, receivables, accounts payable and accrued expenses, amounts owed by related parties, AFS and HTM investments and rental deposits and advances which arise directly from operations. The main risks from the use of financial instruments are liquidity risk, interest rate risk, foreign currency risk and credit risk. Liquidity risk In the management of liquidity, the Group monitors and maintains a level of cash deemed adequate by the management to finance the Group’s operations and mitigate the effects of fluctuations in cash flows. The tables below summarize the maturity profile of the Group’s financial liabilities as of March 31, 2010 based on contractual undiscounted payments. Accounts payable and accrued expenses Amounts owed to related parties Rental deposits and advances On demand Less than 3 months 3 to 12 months (In Thousands) 1 to 5 years Total = P605,339 2,877 198,128 =806,344 P =239,073 P – – = P239,073 =312,461 P – – = P312,461 =54,624 P – – = P54,624 P =1,211,497 2,877 198,128 P =1,412,502 Interest rate risk The Group obtains additional financing through bank and related party borrowings. The Group’s policy is to obtain the most favorable interest rates available without increasing its foreign currency exposure. The following table sets out the carrying amount, by maturity, of the Group’s financial instruments that are exposed to interest rate risk for the period ended March 31, 2010: March 31, 2010 Floating rate Within 1 year Cash and cash equivalents = P155,374 1-2 years (In Thousands) = P– Total =155,374 P - 21 - June 30, 2009 Fixed rate Within 1 year Convertible notes Long-term debt = P1,251,339 140,000 1-2 years (In Thousands) = P– – Total P =1,251,339 140,000 Floating rate Within 1 year Cash and cash equivalents Loans payable = P469,436 156,441 1-2 years (In Thousands) = P– – Total =469,436 P 156,441 Interest on financial instruments classified as fixed rate is fixed until the maturity of the instrument. Interest on financial instruments classified as floating rate is repriced at intervals of less than one year. Foreign currency risk The Group’s foreign currency risk results primarily from movements of the Philippine Peso against the US Dollar. The Group’s foreign currency risk arises primarily from its trade payables. The Group monitors and assesses cash flows from anticipated transactions and financing agreements denominated in US Dollar. The table below summarizes the Group’s exposure to foreign currency risk as of March 31, 2010 and June 30, 2009. Included in the table are the Group’s assets and liabilities at carrying amounts: June 30, 2009 March 31, 2010 Peso Peso US$ Equivalent US$ Equivalent (In Thousands) Financial Asset: Cash Financial Liability: Accounts payable Net financial asset (liability) 93 1,034 (941) 4,212 76 3,648 46,748 (42,536) 870 (795) 41,887 (38,239) - 22 - The following table presents the impact on the Group’s income before income tax due to changes in the fair value of its monetary assets and liabilities, brought about by a reasonably possible change in the US$/P = exchange rate (holding all other variables constant) as of March 31, 2010. US dollar Change in Effect on Currency Income Rate Before tax (In Thousands) +6.15% (P =2,615) -6.15% 2,615 There is no other impact on the Group’s equity other than those already affecting the profit and loss account. Credit risk The Group establishes credit limits at the level of the individual borrower, corporate relationship and industry sector. It also provides for credit terms with the consideration for possible application of intercompany accounts between affiliated companies. Also, the Group transacts only with affiliated companies and recognized third parties, hence, there is no requirement for collateral. In addition, receivable balances are monitored on an ongoing basis with the result that the Group’s exposure to bad debts is not significant. With respect to credit risk from other financial assets of the Group, which mainly comprise of cash, amounts owed by related parties, AFS investments and HTM investments, the exposure of the Group to credit risk arises from default of the counterparty, with a maximum exposure equal to the carrying amount of these instruments. There are no significant concentrations of credit risk in the Group. Credit quality per class of financial asset The credit quality of financial assets is being managed by the Group by grouping its financial assets into two: (a) High grade financial assets are those that are current and collectible; (b) Standard grade financial assets need to be consistently followed up but are still collectible. The table below shows the credit quality by class of financial asset based on the Group’s credit rating system: Cash and cash equivalents Receivables Amounts owed by related parties HTM investments Past due or Neither past due nor impaired individually High grade Standard grade impaired (In Thousands) =155,374 P = P– = P– 478,172 125,886 403,770 – 5,122 86,485 26,000 – – P =659,546 = P131,008 = P490,255 Total = P155,374 1,007,828 91,607 26,000 = P1,280,809 - 23 - The table below shows the aging analysis of past due but not impaired receivables per class that the Group held as of March 31, 2010. A financial asset is past due when a counterparty has failed to make payment when contractually due. Past due but not impaired Neither past due nor impaired Cash and cash equivalents = P155,374 Receivables 604,057 Amounts owed by related parties 5,122 HTM investments 26,000 =790,553 P Less than 30 31 to 60 days = P– = P– 44,338 7,740 – – – – = P44,338 = P7,740 61 to 90 days = P– 12,168 – – = P12,168 More than 91 days = P– 63,099 – – = P63,099 Total = P155,374 731,402 5,122 26,000 = P917,898 Capital Management The primary objective of the Group’s capital management is to ensure the Group’s ability to continue as a going concern and pay the Group’s currently maturing loans and obligations. The Group manages its capital structure and makes adjustments to it, in light of changes in economic conditions. To maintain or adjust the capital structure, the Group may adjust the dividend payment to shareholders return capital to shareholders or issue new shares. No changes were made in the objectives, policies or processes as of March 31, 2010 and June 30, 2009. 24. Fair Values and Categories of Financial Instruments Fair Values of Financial Instruments The following methods and assumptions were used to estimate the fair value of each class of financial instrument for which it is practicable to estimate such value: March 31, 2010 June 30, 2009 Carrying Carrying Amounts Amounts Fair Values Fair Values (In Thousands) Financial assets: Cash and cash equivalents Receivables Amounts owed by related parties AFS investments HTM investments Financial liabilities: Accounts payable and accrued expenses Loans payable Convertible note Long-term debt Amounts owed to related parties Rental deposits and advances = P155,374 731,402 5,122 616,520 26,000 = P155,374 731,402 5,122 616,520 28,723 = P468,808 429,644 5,196 449,614 19,931 = P468,808 429,644 5,196 449,614 20,735 = P1,211,497 2,877 198,128 = P1,211,497 2,877 198,128 = P1,860,450 156,441 1,251,339 140,000 16,647 197,081 = P1,860,450 156,441 1,251,339 140,000 16,647 197,081 The carrying amounts of cash and cash equivalents, receivables, accounts payable and accrued expenses, amounts owed to and by related parties, convertible notes and loans payable approximate their fair value due to the short-term maturity of these financial instruments. - 24 - AFS equity investments that are listed are based on quoted prices. Nonlisted AFS equity investments are based on cost less impairment, if any. HTM investments are based on quoted prices. The carrying values of long-term debt approximate their fair values due to the quarterly repricing of floating interest rates. Categories of Financial Instruments The carrying values of the Group’s financial asset and liabilities per category are as follows: June 30, 2009 March 31, 2010 (In Thousands) Loans and receivables: Cash and cash equivalents Receivables - net Amounts owed by related parties - net AFS investments HTM investments Other financial liabilities: Accounts payable and accrued expenses Loans payable Convertible note Long-term debt Amounts owed to related parties Rental deposits and advances P =155,374 731,402 5,122 891,898 616,520 26,000 P =1,534,418 P =1,211,497 2,877 198,128 P =1,412,502 =468,808 P 429,644 5,196 903,648 449,614 19,931 =1,373,193 P =1,860,450 P 156,441 1,251,339 140,000 16,647 197,081 =3,621,958 P - 25 - PRIME ORION PHILIPPINES, INC. AND SUBSIDIARIES AGING OF ACCOUNTS RECEIVABLE AS OF MARCH 31, 2010 Current 1 to 30 days 31 to 60 days 61 to 90 days Over 90 days = P175,542 2,411 681 409 79,380 Total receivable-trade 258,423 Advances to officer and employees Insurance receivable Others Total non-trade receivable 47,232 407,942 294,231 749,405 Total receivable 1,007,828 Allowance for impairment losses (276,426) P =731,402

© Copyright 2026