Document 257520

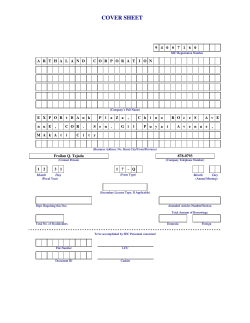

COVER SHEET

9 4 0 0 7 1 6 0

SEC Registration Number

A R T H A L A N D

E I B

R e a

l

t

C O R P O R A T I O N

y

D e v e

l

o p e r

s

(

,

f

o r m e r

I n c

.

l

y

)

(Company’s Full Name)

P I C A D I L L Y

4 T H

A V E N U E

B O N I F A C I O

T A G U I G

S T A R

B U I L D I

C O R N E R

G L O B A L

C I T Y ,

N G ,

2 7 T H

S T R E E T

C I T Y ,

M E T R O

M A N I L A

(Business Address: No. Street City/Town/Province)

Atty. Riva Khristine V. Maala

(+632) 878-0390

(Contact Person)

(Company Telephone Number)

DEFINITIVE

1 2

3 1

Month

Day

2 0

-

I S

(Form Type)

(Fiscal Year)

0 6

2 5

Month

Day

(Annual Meeting)

(Secondary License Type, If Applicable)

Dept. Requiring this Doc.

Amended Articles Number/Section

Total Amount of Borrowings

2,181

Total No. of Stockholders

Domestic

Foreign

To be accomplished by SEC Personnel concerned

File Number

LCU

Document ID

Cashier

STAMPS

Remarks: Please use BLACK ink for scanning purposes.

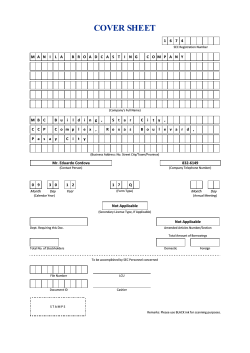

ALCO DEFINITIVE Information Statement 1

SECURITIES AND EXCHANGE COMMISSION

SEC FORM 20-IS

INFORMATION STATEMENT PURSUANT TO SECTION 20

OF THE SECURITIES REGULATION CODE

1. DEFINITIVE Information Statement

2. Name of Registrant as specified in its charter:

ArthaLand Corporation (ALCO)

3. Metro Manila, Philippines

Province, country or other jurisdiction of incorporation or organization

4.

SEC Identification Number: ASO-94-007160

5.

BIR Tax Identification Number: 116-004-450-721

6. 8/F Picadilly Star Building, 4th Avenue corner 27th Street, Bonifacio Global City, Taguig City

Address of Principal Office

1634

Postal Code

7. (+632) 403-6910/403-6915

Registrant's telephone number, including area code

8. EIB REALTY DEVELOPERS, INC., Exportbank Plaza, Chino Roces corner Gil Puyat Avenues,

Makati City

Former name, former address and former fiscal year, if changed since last report

9.

25 June 2010, 8:30 A.M., ArthaLand Sales Pavillon, McKinley Parkway corner 7th Avenue,

Bonifacio Global City, Taguig City

Date, time and place of the meeting of security holders

10. 03 June 2010

Approximate date on which the Information Statement is first to be sent or given to security holders

11. Securities registered pursuant to Sections 8 and 12 of the SRC, or Sec. 4 and 8 of the RSA:

Title of Each

Class

Common Shares

Number of Shares of Common Stock

Outstanding

Amount of Debt Outstanding

5,118,095,199 (P0.18 par value)

None

12. Are any or all of these securities listed on a Stock Exchange?

Yes [x]

No [ ]

If yes, disclose the name of such stock exchange and the class of securities listed therein:

Philippine Stock Exchange

Common Shares (2,096,865,199 ONLY)

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

ALCO DEFINITIVE Information Statement 2

A. GENERAL INFORMATION

ITEM 1. Date, Time and Place of ANNUAL STOCKHOLDERS’ MEETING of Security Holders

a.

Date: 25 June 2010 (Friday)

Time: 8:30 A.M.

Place: ArthaLand Sales Pavillon

McKinley Parkway corner 7th Avenue

Bonifacio Global City, Taguig City

b.

Principal Address of Issuer:

c.

The approximate date on which the Information Statement is first sent or given to security

holders is 03 June 2010.

8/F Picadilly Star Building

4th Avenue corner 27th Street

Bonifacio Global City, Taguig City

ITEM 2. Dissenters’ Right of Appraisal

The stockholders’ right of appraisal is given under the instances provided by Section Title X,

Appraisal Right, Corporation Code of the Philippines.

In the forthcoming Annual Stockholders’ Meeting, approval of the stockholders will be sought for the

amendment of the latest By-laws of ArthaLand Corporation (ALCO) for purposes of incorporating

therein the procedures for the nomination and election of independent directors and revising such

other provisions thereof which are inconsistent with the Securities Regulation Code. Under the

Corporation Code, this would entitle dissenting stockholders to exercise their appraisal right.

For the valid exercise of the appraisal right, ALCO adopts the procedure laid down in the Corporation

Code, as follows:

1.

The dissenting stockholder must have voted against the proposed corporate action. In

this case, the proposed amendment to ALCO’s By-Laws shall involve incorporating

therein the procedures for the nomination and election of independent directors and

revising such other provisions thereof which are inconsistent with the Securities

Regulation Code.

2.

The dissenting stockholder must make a written demand within thirty (30) days from

the date the vote was taken. Failure to make the demand within the prescribed period

shall be deemed a waiver of the appraisal right.

From the time of demand, all rights accruing to the shares, including voting and

dividend rights shall be suspended in accordance with the provisions of the

Corporation Code, except the right of the stockholder to receive payment of the fair

value of the shares. The dividend, voting and rights of the dissenting stockholder

shall be restored if ALCO fails to pay the fair value within thirty (30) days after the

award.

3.

The price of the shares will be determined based on the fair value of the shares as of

the day prior to the date on which the vote was taken, excluding any appreciation or

depreciation in anticipation of such corporate action.

ALCO DEFINITIVE Information Statement 3

4.

The withdrawing stockholder must submit (through the Office of the Corporate

Secretary1) the stock certificate/s representing his ALCO shares for notation of being

a dissenting stockholder, within ten (10) days from written demand. Failure to do so

shall, at ALCO’s option, terminate the stockholder’s appraisal right.

5.

ALCO shall pay the withdrawing stockholder for his shares, provided that, ALCO has

unrestricted retained earnings in its books to cover such payment.

The right of payment shall cease under the following instances:

a. If the dissenting stockholder withdraws his demand for payment, subject to

ALCO’s consent;

b. If ALCO abandons the proposed action;

c. If the Securities and Exchange Commission (SEC) disapproves the proposed

action; and,

d. Where the SEC determines that such stockholder is not entitled to the appraisal

right.

Upon payment by ALCO, the stockholder’s shares must then be transferred to ALCO.

ITEM 3. Interest of Certain Persons in or Opposition to Matters to be acted upon

While certain persons may have interest in the matters to be acted upon in the meeting, as of the date

of this Information Statement, ALCO has not received any written information from any director,

nominee or stockholder on any intention to oppose any action to be taken up at the meeting.

B. CONTROL AND COMPENSATION INFORMATION

ITEM 4. Voting Securities and Principal Holders Thereof

a.

Class entitled to vote

Class of Shares

No. of Shares

(As of 30 April 2010)

Voting Rights

5,118,095,199

With voting rights

Common

b.

Record Date: 03 June 2010 (Thursday)

c.

Cumulative Voting Rights

Section 4, Article II of ALCO’s By-laws provides that at “all stockholders’ meetings, every

stockholder shall be entitled to one (1) vote for each share of voting stock standing in his

name on the proper books of the Corporation at the time of closing thereof for the purpose of

the meeting.”

For the election of directors, ALCO adopts the manner and method of election provided under

Section 24 of the Corporation Code which entitles the stockholders to cumulative voting.

1

8/F Picadilly Star Building, 4th Avenue corner 27th Street, Bonifacio Global City, Taguig City 1634.

ALCO DEFINITIVE Information Statement 4

In cumulating votes, a stockholder may either (1) cumulate his shares and give one candidate

as many votes as the number of directors to be elected multiplied by the number of his shares

shall equal, or (2) cumulate his shares by multiplying the number of his shares by the number

of directors to be elected and distribute the same among as many candidates as he shall see fit.

The total number of votes to be cast by the stockholder must not exceed the number of shares

owned by him as shown in the books of ALCO multiplied by the whole number of directors

to be elected.

d.

Security Ownership of Certain Record and Beneficial Owners and Management2

(1)

Security Ownership of Certain Record and Beneficial Owners of more than 5%

of the Voting Shares (as of 30 April 2010)

Title

of Class

------------Common

Name and Address of Record

Owners, Nature of Ownership

& Name of Beneficial Owner

---------------------------------

Citizenship

--------------

No. of Shares

------------------

Percentage

Held

---------------

Filipino

2,983,730,000*

58.30%

Filipino

981,699,817**

19.18%

AO Capital Holdings I, Inc.

Record and Direct Beneficial Owner

25/F Philamlife Tower

8767 Paseo de Roxas, Makati

City

Common

Export and Industry Bank, Inc.

Record and Direct Beneficial Owner

Exportbank Plaza, Exportbank

Drive corner Chino Roces

Avenue, Makati City

* The shares will be voted by Mr. Jaime C. Gonzalez, Chairman of AO Capital Holdings 1,

Inc., with business address at the 25/F Philamlife Tower, 8767 Paseo de Roxas, Makati City.

** The shares will be voted by Mr. Juan Victor S. Tanjuatco, President of Export and Industry

Bank, Inc., with business address at the 37/F Exportbank Plaza, Exportbank Drive corner

Chino Roces Avenue, Makati City.

There are no other participants who own more than 5% of ALCO’s voting securities.

(2)

Security Ownership of Management (as of 30 April 2010)

There are no shares held or acquired beneficially by any one of the directors and executive

officers of ALCO, other than the nominal shares held by said directors and executive officers.

(This portion was intentionally left blank.)

2

Figures are based on the total common voting shares of ALCO as of 30 April 2010.

ALCO DEFINITIVE Information Statement 5

Title

of Class

-------------

Name, Address and Position of

Record Owners

---------------------------------

Common

Dionisio E. Carpio, Jr.

Director/Compliance Officer

40 Columbia Street, Loyola Grand

Villas, Quezon City

Common

Common

Common

Common

Common

Common

None

None

Jaime C. Gonzalez

Director/Chairman

50 McKinley Road, Forbes Park,

Makati City

Angela de Villa-Lacson

Director/President

Unit 3503 The Regency at Salcedo

Tordesillas corner Sanchez Streets

Salcedo Village, Makati City

Omar T. Salvo

Director

15 Peace Street, Multinational

Village, Paranaque City

Pauline C. Tan

Director/Treasurer

42 Russel Street, Pasay City

Ernest K. Cuyegkeng

Independent Director

1839 Santan Street, Dasmarinas

Village, Makati City

Rene R. Fuentes

Independent Director

11 Yuchengco Drive, Pacific

Malayan Village Cupang,

Muntinlupa City

Daisy P. Arce

Corporate Secretary

200 Recoletos Street, Urdaneta

Village, Makati City

Riva Khristine V. Maala

Assistant Corporate

Secretary/Corporate Information

Officer

21 J. Paredes St., BF Homes,

Diliman Quezon City

Citizenship

--------------

Amount &

Nature of

Ownership

-----------------

% of Class

---------------

1

Filipino

Record and Direct

Beneficial Owner

Filipino

Record and Direct

Beneficial Owner

Filipino

Record and Direct

Beneficial Owner

Filipino

Record and Direct

Beneficial Owner

Filipino

Record and Direct

Beneficial Owner

Filipino

Record and Direct

Beneficial Owner

Filipino

Record and Direct

Beneficial Owner

0.00 %

Filipino

0

N.A.

Filipino

0

N.A.

TOTAL

----------------7 shares

0.00 %

1

0.00 %

1

0.00 %

1

0.00 %

1

0.00 %

1

0.00 %

1

ALCO DEFINITIVE Information Statement 6

(3)

Voting Trust Holders of 5% or More

There are no voting trust holders registered in the books of ALCO.

(4)

Changes in Control

During ALCO’s Annual Stockholders’ Meeting held on 16 October 2009, the stockholders

unanimously elected the following as the members of its Board of Directors for the year

2009-2010, to hold office as such and until their respective successors are duly nominated,

elected and qualified:

Regular Directors

1.

2.

3.

4.

5.

Mr. Dionisio E. Carpio, Jr.

Mr. Jaime C. Gonzalez

Ms. Angela de Villa-Lacson

Ms. Pauline C. Tan

Mr. Omar T. Salvo

Independent Directors

6.

7.

Mr. Ernest K. Cuyegkeng, and

Mr. Rene R. Fuentes

ITEM 5. Directors, including Independent Directors, and Executive Officers

a.

Incumbent Directors and Positions Held/Business Experience for the Past Five (5) Years

The following are ALCO’s incumbent Directors who were elected in accordance with the Bylaws of ALCO.

Name

Position

Age

Jaime C. Gonzalez

Angela de Villa Lacson

Pauline C. Tan

Dionisio E. Carpio, Jr.

Omar T. Salvo

Ernest K. Cuyegkeng

Rene R. Fuentes

Chairman

President

Director/Treasurer

Director/Compliance Officer

Director

Director (Independent)

Director (Independent)

64

64

40

64

48

64

63

Jaime C. Gonzalez, Filipino, is the Chairman of AO Capital Holdings 1, Inc. and Elite

Holdings, Inc. concurrently. He also holds the chairmanship of Export and Industry Bank,

Inc. (“Exportbank”) and its group of companies. He is the co-founder and presently

Chairman and CEO of AO Capital Partners, a boutique investment bank with operations in

the Asian region. He serves on the boards of a number of other publicly listed companies

including IPVG Corp. (which is involved in information technology and communications in

the Philippines and selected countries in Asia) and Euromoney Institutional Investor plc

(which is a UK company involved in publishing, conferences and data services). He is a

graduate of the Harvard Business School.

Angela de Villa-Lacson, Filipino, comes from a successful stint with Ayala Land, Inc. (ALI)

where she was involved in growing the Residential Business of the company from a very

ALCO DEFINITIVE Information Statement 7

small share in 1999 during the depressed real estate market, to its current position of

accounting for more than half of the revenues of the company. While in ALI, she led various

high-end residential developments, notably One Roxas Triangle, Serendra, The Residences at

Greenbelt and One Legazpi Park, and some low-rise developments, Montgomery Place and

Ferndale. She was also involved in the development of the new communities in the South:

Ayala Greenfields and Ayala Westgrove. Concurrent to her position in ALI as head of Ayala

Land Premier, she started and grew its subsidiary, Community Innovations, Inc. (CII), the

company that addressed the needs of the middle market. Some of CII's projects that she led

were The Columns in Ayala Avenue and Legazpi, and Verdana. She also headed the

Innovation and Design Group of ALI. This group leads the design, masterplanning and

development of various communities of ALI in residential high-rise, gated villages,

commercial buildings, BPO campuses and retail. She headed the Ayala Museum too, leading

the design development and installation of its newest primary exhibition, 'Crossroads of

Civilization'. Prior to joining ALI, she was marketing director of San Miguel Corporation

(Beer and Foods) and headed various marketing groups of Unilever, both here and in Europe.

Pauline C. Tan, Filipino, is the President and General Manager of EIB Securities, Inc., a

wholly owned subsidiary of Exportbank, of which she was a director until 25 May 2006. She

is also presently a Vice President/Director and Compliance Officer of Medco Holdings, Inc.

She was connected with the Hong Kong Chinese Bank in 1994. From 1995 to 1999, she was

a director of Lippo Securities, Inc.; from 1995 to 1998, of Medco Asia Investment Corp.,

formerly Lippo Asia Investment Corporation; and, from 1995 to 2000, of Manila Exposition

Complex, Inc. She was also the Managing Director of Sung Hung Kai Securities Philippines,

Inc. from 1999 to June 2000.

Dionisio E. Carpio, Jr., Filipino, is presently a Director of Exportbank and its group of

companies which include EIB Savings Bank, Inc. and EIB Securities, Inc. He is also a

Director and executive officer of both Medco Asia Investment Corp. and Medco Holdings,

Inc. He has over twenty-five (25) years experience in investment advisory and trust fund

management services as well as in investment banking and securities brokerage. Mr. Carpio

holds a Masters degree in Business Management from the Asian Institute of Management.

Omar T. Salvo, Filipino, is Managing Director of American Orient Capital Partners, Inc. and

concurrently President of Beacon Hill Resources Management, Inc. He was previously

connected with the Land Bank of the Philippines, where he held senior management positions

in various units covering corporate banking, investment banking and asset recovery. He holds

an AB Economics degree from the Ateneo de Manila University and a Master in Business

Management degree from the Asian Institute of Management.

Ernest K. Cuyegkeng, Filipino, is presently the Executive Vice President/Chief Financial

Officer of A. Soriano Corporation. His other concurrent positions include being the President

of Phelps Dodge Philippines, Inc. and Anscor Land, Inc., and a Director of Seven Seas

Resorts & Leisure, Inc., A. Soriano Air Corporation, and AB Capital & Investment

Corporation. He holds a Bachelor of Arts degree in Economics and a Bachelor of Science

degree in Business Administration, both from the De La Salle University. He also obtained a

Masters degree in Business Administration from the Columbia Graduate School of Business

in New York.

Rene R. Fuentes, Filipino, is presently the Director/Advisor of the Liberal Arts Program of

Sycip Gorres Velayo & Co. (SGV), the President of the De La Salle University Science

Foundation, Inc. and the General Manager of 1911 Insurance Agency Corporation. He has

been affiliated with SGV since 1973. He holds a Bachelor of Arts degree, Major in History

and Political Science, and a Bachelor of Science degree in Business Administration, both

from the De La Salle University. He also obtained a Masters degree in Business

ALCO DEFINITIVE Information Statement 8

Administration from the University of Sta. Clara, U.S.A., and finished the Management

Development Program of the Asian Institute of Management.

Term of Office:

The Board of Directors is composed of seven (7) members who are generally elected at an

annual stockholders’ meeting and their term of office shall be one (1) year and until their

successors shall have been elected at the next annual stockholders’ meeting and have

qualified in accordance with the By-laws of ALCO.

b.

Procedure for the Nomination & Election of Independent Directors

For the nomination and election of Independent Directors, ALCO adopts the rules prescribed

by SRC Rule 38 of the Implementing Rules and Regulations of the Securities and Regulation

Code, as amended, pending amendment of its By-Laws to incorporate therein the said

provision, among others.

Nomination of Independent Director/s

1. Nomination of independent director/s shall be conducted by the Nomination Committee3

(the ‘Committee’) prior to a stockholders’ meeting. All recommendations shall be signed

by the nominating stockholders together with the acceptance and conformity by the

would-be nominees.

2

The Committee shall pre-screen the qualifications and prepare a final list of all candidates

and put in place screening policies and parameters to enable it to effectively review the

qualifications of the nominees for independent director/s.

3. After the nomination, the Committee shall prepare a Final List of Candidates which shall

contain all the information about all the nominees for independent directors, as required

under Part IV (A) and (C) of Annex ‘C’ of SRC Rule 12, which list, shall be made

available to the Commission and to all stockholders through the filing and distribution of

the Information Statement, in accordance with SRC Rule 20, or in such other reports the

company is required to submit to the Commission. The name of the person or group of

persons recommending the nomination of the independent director shall be identified in

such report including any relationship with the nominee.

4. Only nominees whose names appear on the Final List of Candidates shall be eligible for

election as Independent Director/s. No other nominations shall be entertained after the

Final List of Candidates shall have been prepared. No further nominations shall be

entertained or allowed on the floor during the actual annual stockholders’/memberships’

meeting.

Election of Independent Director/s

1. Except as those required under the SRC and subject to pertinent existing laws, rules and

regulations of the Commission, the conduct of the election of independent director/s shall

be made in accordance with the standard election procedures under ALCO’s By-laws.

2. The Chairman of the Meeting shall be responsible for informing all stockholders in

attendance of the mandatory requirement of electing independent director/s. He shall

ensure that an independent director/s is elected during the stockholders’ meeting.

3

Composed of Messrs. Jaime C. Gonzalez (Chairman), Dionisio E. Carpio, Jr. and Rene R. Fuentes.

ALCO DEFINITIVE Information Statement 9

3. Specific slot/s for independent directors shall not be filled up by unqualified nominees.

4. In case of failure of election for independent director/s, the Chairman of the Meeting shall

call a separate election during the same meeting to fill up the vacancy.

For the Annual Stockholders’ Meeting on 25 June 2010, the following were nominated as

directors and independent directors of ALCO for the ensuing year, namely:

A.

Nominees for Regular Directors

1.

2.

3.

4.

5.

B.

Mr. Dionisio E. Carpio, Jr.

Mr. Jaime C. Gonzalez

Ms. Angela de Villa-Lacson

Mr. Omar T. Salvo

Ms. Pauline C. Tan

Nominees for Independent Directors

6.

7.

Mr. Ernest K. Cuyegkeng

Mr. Rene R. Fuentes

Messrs. Cuyegkeng and Fuentes were nominated by Mr. Gonzalez. They are not in anyway

related to Mr. Gonzalez or to any one of ALCO’s shareholders owning more than 5% of its

voting shares. Both of them possess all the qualifications and none of the disqualifications of

an independent director. Further, they are not officers or employees of ALCO or any of its

subsidiaries and are free from any business or other relationships with ALCO or any of its

subsidiaries which could, or could reasonably be perceived to, materially interfere with the

exercise of their independent judgment in carrying out their responsibilities as independent

directors.

c.

Corporate and Executive Officers and Positions Held/Business Experience for the Past

Five (5) Years

The following are ALCO’s principal corporate officers:

Chairman of the Board

President

Treasurer

Corporate Secretary

Assistant Corporate Secretary/

Corporate Information Officer

Compliance Officer

Jaime C. Gonzalez

Angela de Villa Lacson

Pauline C. Tan

Atty. Daisy P. Arce

Atty. Riva Khristine V. Maala

Dionisio E. Carpio, Jr.

Daisy P. Arce – Atty Arce, Filipino, is the Corporate Secretary of Exportbank and its group

of companies. She was also recently elected a Director of EIB Securities, Inc. She holds a

Bachelor of Laws degree from the Ateneo de Manila University. She was a partner at Quasha

Ancheta Peña & Nolasco Law Offices and now has her own practice.

Riva Khristine V. Maala – Atty. Maala, Filipino, is the Assistant Corporate Secretary of

Exportbank and its group of companies. She holds a Bachelor of Arts degree in Philosophy

(cum laude) and a Bachelor of Laws degree, both from the University of the Philippines.

Prior to joining Exportbank in October 2001, she was an Associate Attorney of Fortun

Narvasa and Salazar Law Offices.

ALCO DEFINITIVE Information Statement 10

Term of Office:

The corporate officers of ALCO are appointed/elected by the Board of Directors at the

organizational meeting following the stockholders’ meeting for a term of one (1) year and

until their successors are appointed/elected and have qualified in accordance with the By-laws

of ALCO.

d.

Significant Employees

Other than the above-named directors and corporate officers, the following are significant or

key personnel of ALCO who are expected to make a significant contribution to the business

of ALCO:

Catherine A. Ilagan, Filipino, is the Head of Project Business Development. She comes

with an extensive fifteen (15) years experience in Real Estate in Ayala Land, Inc. (ALI). She

spent seven (7) years in Corporate Planning, where she played a key role in the determination

of the growth projects of the company. This was followed by about six and a half (6½) years

of Vertical Residential Project Developments. Her last one and half (1½) years there saw her

do Estate Management where she played a key role of maximizing the value of the ALI land

developed by the various business units of ALI. She was part of the team that conceptualized

and successfully launched Nuvali, the 1,600 hectare landholdings of ALI in Canlubang. She

was also responsible for the management of ALI’s landholdings in Makati.

Jose V. Asuncion, Jr., Filipino, is the Vice President for Technical Services. He replaced

Nestor Omar T. Arce-Ignacio in December 2009. Mr. Asuncion has over 30 years of

experience as an architect in various property development firms, playing an integral part

during its success years. While he is a licensed architect, his previous posts have allowed him

to be involved in construction management as well. His recent projects prior to joining ALCO

include the Fairways Tower in Bonifacio Global City and St. Francis Towers in

Mandaluyong. He was also involved in Makati CBD high-rise developments like BSA

Mansion, BSA Plaza, Prince Plaza and the Asian Mansion Condos. Previous to this, he

headed the Architectural Group of the HLURB from 1982-1991.

Froilan Q Tejada, Filipino, is the Chief Finance Officer. He joined ALCO with fourteen

(14) years of Finance experience and was involved with the acquisition, turn-around and

expansion of groups such as KFC, Philippines (7 years) and Bitexco, a real estate property

development company in Vietnam (3 years). He was involved for four (4) years in the Fort

Bonifacio Development Corporation, heading the treasury and planning functions. For

Bitexco, he was involved in raising funds of about US$200.0MM for their various property

projects. He set up and implemented the SAP Enterprise Resource Planning system in

Bitexco and mapped out its corporate restructuring and medium term financial plan. He had

also negotiated and closed a management agreement with Marriott in Vietnam.

e.

Family Relationship

The above-mentioned incumbent directors and executive officers of ALCO are not related to

each other, either by consanguinity or affinity.

f.

Involvement in Certain Legal Proceedings

The above-named directors and corporate/executive officers of ALCO have not been involved

during the past five (5) years up to the date of this Information Statement in any bankruptcy

proceeding or any proceeding involving a violation of securities or commodities laws or

regulations, nor have they been convicted by final judgment in a criminal proceeding. Neither

ALCO DEFINITIVE Information Statement 11

has there been any order or judgment enjoining, barring, suspending or limiting their

involvement in any type of business, securities, commodities or banking activities.

As of the date of this Information Statement, there is no official notice filed with ALCO

involving any of its directors and executive officers in their personal capacities in any legal

proceeding.

g.

Certain Relationships and Related Transactions

In the ordinary course of business, ALCO has normal banking transactions with one of its

shareholders, Exportbank.

Except for the above, there are no other transactions (or series of similar transactions) with or

involving Exportbank or any of its subsidiaries in which a director or an executive officer or a

stockholder who owns ten percent (10%) or more of ALCO’s total outstanding shares or

member/s of their immediate family, had or is to have a direct or indirect material interest.

ITEM 6. Compensation of Directors and Executive Officers

a.

Compensation of Directors and Executive Officers

Section 10, Article III of ALCO’s By-laws provides that the “Board of Directors is

empowered and authorized to fix and determine the compensation of its members, including

profit sharing and other incentives, subject to the limitations imposed by law.” Pursuant to

this provision, to compensate the members of the Board, a per diem of P7,500.00 is given to

each director for each board of director’s meeting (special or regular) attended. Each director

is also paid a per diem of P2,500.00 for each committee meeting he has attended, of which he

is a member. These committees are the Audit Committee, the Stock Option and

Compensation Committee and the Nomination Committee.

Section 7, Article IV in turn provides that the “Chairman, or such other officer(s) as the Board

of Directors may authorize, shall determine the compensation of all the officers and

employees of the Corporation.”

Compensation for 2009

Name and Principal Position

-----------------------------------

Year

-----------

Directors and Executives

1. President/CEO

2. Compliance Officer

3. Chief Financial Officer

4. VP, Business Development

5. VP, Technical Services

2007

2008

2009

Salary

Bonus

--------------- ---------------P516.0K

P17.513M

P29.097M

P61.0K

None

None

Other

-----------------P255.0K

None

None

Mr. Jaime C. Gonzalez – Chairman of the Board

Ms. Angela de Villa Lacson – President

Ms. Catherine A, Ilagan – Vice President (Head of Project Business Development)

Mr. Jose V. Asuncion – Vice President (Technical Services)

Mr. Froilan Q. Tejada – Chief Finance Officer

ALCO DEFINITIVE Information Statement 12

Name and Principal Position

-----------------------------------Other Officers (as a group)

Year

-----------

Salary

Bonus

--------------- ----------------

Other

-----------------

2007

2008

2009

None

P2.412M

P2.412M

None

None

None

None

None

None

Year

----------2010

Salary

-------------P29.097M

Bonus

--------------None

Other

-----------------None

2010

P2.412M

None

None

Estimated Compensation for 2010

Name and Principal Position

----------------------------------Directors and Executives

1. President/CEO

2. Compliance Officer

3. Chief Financial Officer

4. VP, Business Development

5. VP, Technical Services

Officers (as a group)

b.

Standard Arrangement/Material Terms of Any Other Arrangement/Terms and

Conditions of Employment Contract with Above Named Corporate/Executive Officers

In ALCO’s annual meeting held on 16 October 2009, the stockholders representing more than

sixty-seven percent (67%) of all its issued and outstanding common shares which are entitled

and qualified to vote approved the 2009 ALCO Stock Option Plan for its qualified employees.

The total amount of shares which are available and may be issued for this purpose will

amount to 10% of ALCO’s total outstanding capital stock at any given time. At present, this

is equivalent to 511,809,520 shares. The Stock Option and Compensation Committee

consisting of at least three (3) directors, one (1) of whom is an independent director, will

administer the implementation of this plan.

Under the 2009 ALCO Stock Option Plan, the qualified employees eligible to participate are

(i) members of the Board; (ii) President and CEO and other corporate officers, which include

the Corporate Secretary and the Assistant Corporate Secretary; (iii) Employees and

Consultants who are exercising managerial level functions or are members of the

Management Committee; and, (iv) Executive officers assigned to ALCO’s subsidiaries or

affiliates4.

The Stock Option and Compensation Committee is empowered to determine to whom the

Options are to be granted, determine the price the Option is to be exercised (which in no case

shall be below the par value of ALCO’s common stock), decide when such Option shall be

granted and its effectivity dates, and determine the number and class of shares to be allocated

to each qualified employee. The Committee will also consider at all times the performance

evaluation of the qualified employee and/or the result of the achievement of the objectives of

ALCO each year.

The Option Period during which the qualified employee may exercise the option to purchase

such number of shares granted will be three (3) years starting with the full year vesting.

On the Exercise Date, the qualified employee should pay the full Purchase Price or in such

terms as may be decided upon by the Committee.

4

ALCO must have at least 50% equity holdings therein.

ALCO DEFINITIVE Information Statement 13

ITEM 7. Independent Public Accountant

Article V of ALCO’s By-laws provides, among others, that the External Auditor shall be appointed by

its Board of Directors and shall receive such compensation or fee as may be determined by the

Chairman or such other officer(s) as the Board of Directors may authorize.

ALCO is in compliance with SRC Rule 68 of the Implementing Rules and Regulations of the

Securities and Regulation Code, as amended, requiring the rotation of external auditors or engagement

partners after their engagement for a consecutive period of five (5) years.

Punongbayan and Araullo (P&A) was appointed as ALCO’s external auditor for 2007, 2008 and 2009

and there had been no disagreement with P&A during this time.

P&A shall send its representatives to the annual stockholders’ meeting on 25 June 2010 for purposes

of addressing accounting concerns and related questions which may be raised by the stockholders in

the said meeting.

Information on Independent Accountant

Accountant

Mailing Address

:

:

Certifying Partner

C.P.A. Reg. No.

TIN No.

PTR No.

SEC Accreditation No.

BIR Account No.

:

:

:

:

:

:

Punongbayan & Araullo

20/F Tower 1, The Enterprise Center

6766 Ayala Avenue, Makati City

Mr. Francis B. Albalate

0088499

120-319-015

208.7609, 04 January 2010, Makati City

0104-AR-1

08-002511-5-2008 (25 November 2008 to 2011)

Fees and Other Arrangements

The external auditor’s fees are based on the estimated time that would be spent on an engagement and

ALCO is charged at hourly rates vis-à-vis the experience level of the professional staff members who

will be assigned to work on the engagement. Fees are also generally based on the complexity of the

issues involved and the work to be performed, as well as the special skills required to complete the

work.

For 2007 and 2008, P&A’s fees for the services rendered to ALCO are P110,000.00 and P220,000.00,

respectively. For 2009, P&A’s fees are P 270,000.00. These fees are exclusive of VAT and out of

pocket expenses.

ITEM 8. Compensation Plans

As reflected in Item 6b above, ALCO made available to its qualified employees in 2009 a stock

option plan wherein they can enjoy the benefits of ownership of ALCO and thereby increase their

concern for its long-term progress and well-being, induce their continued service and stimulate their

efforts towards the continued success thereof.

C. ISSUANCE AND EXCHANGE OF SECURITIES

No action will be taken during the Annual Stockholders’ Meeting on 25 June 2010 with respect to the

Authorization or Issuance of Securities Other than for Exchange (Item 9); Modification or Exchange

ALCO DEFINITIVE Information Statement 14

of Securities (Item 10); Financial and Other Information (Item 11); Mergers, Consolidations,

Acquisitions and Similar Matters (Item 12); Acquisition or Disposition of Property (Item 13); or,

Restatement of Accounts (Item 14).

D. OTHER MATTERS

ITEM 15. Action With Respect to Reports

Management will present at the Annual Stockholders’ Meeting ALCO’s financial reports as of 31

December 2009.

The Minutes of the Stockholders’ Meeting held on 16 October 2009 will be submitted for approval of

the stockholders.

Ratification by the stockholders of all actions of ALCO’s Board of Directors and Management from

the last stockholders’ meeting of 16 October 2009 until the date of the forthcoming Annual

Stockholders’ Meeting will also be sought. These refer to all actions undertaken in the development

of ALCO’s pilot project, Arya Residences.

Copies of the Minutes together with a summary of all resolutions of the Board and Management will

be distributed during the annual meeting itself.

Other than the foregoing, there is no other matter with respect to Reports to be presented for which the

stockholders’ approval is sought.

ITEM 16. Matters Not Required To Be Submitted

There is no matter not required to be submitted to a vote of the stockholders present at the Annual

Stockholders’ Meeting.

ITEM 17. Amendment of Charter, By-Laws or Other Documents

The stockholders will be asked during the Annual Stockholders’ Meeting to approve the proposed

amendment of ALCO’s By-laws for purposes of incorporating therein the procedures for the

nomination and election of independent directors and revising such other provisions thereof which are

inconsistent with the Securities Regulation Code.

ITEM 18. Other Proposed Action

The election of ALCO’s External Auditor for the ensuing year will be taken up at the Annual

Stockholders’ Meeting, pursuant to ALCO’s By-Laws. Management will nominate P&A as ALCO’s

External Auditor for 2010.

ITEM 19. Voting Procedures – Voting for Corporate Actions

a.

Voting for Corporate Actions

Voting on matters submitted for stockholders’ approval during the Annual Stockholders’ Meeting

shall be done by viva voce and shall be supervised by the designated staff of P&A, ALCO’s External

Auditor, and by Professional Stock Transfer, Inc., ALCO’s Stock and Transfer Agent.

ALCO DEFINITIVE Information Statement 15

b.

Nominations and Voting for the Uection of Dircctors

O)

'all stockholdcrs' meetings.

Section,1,Article II of AI-CO'S By-laws providesthat at

eyery stocklolder shall be entitl€d to one (1) vote for each share of ]loing stock

standing ir his name on the p.oper book of dre Corpotation ar Ihe time of clostlrg

thereoffor the purposeoflhc meeting."

(2)

No nominalions ftom the floor during dre stockholders' meeting sball be allowed or

recognizcd.

(3)

For the purpose of electing dlrecto$, the system ol cumulative voting shall be

followed. Each stocklolder has a number of voies equal to the number of shareshe

owns, times the number ofdfectors to be elected. Thc stockholderunder this votmg

s,vstemhas the option to (i) castall his votesm favor of onenomineo; or (ii) distsibutc

those votes in the samcpnnciple among as mary nomineesas hc shall se€trt. Oily

caldidates drily nomiiated shall be voted by the slockholde$ entitled to vote or by

their respecti\.eProxies.

The top seven(7) nomineesreceiling the highest numberof votes sball bc considered

elccleil as dirccton ol ALCO for tle te.m 2010-2011 and until tleir successorsshaii

ba1€ been elected at the next annual stock}olden meetilg and until they have

qualified in accordancewitl the ByJaws of ALCO.

(4)

Voling for the electror of Dhectors shalI be by ballot and ihe tabulation of th€ votes

shall be supervisedby the desi$ated staff of ALCO'S Er.lemal Auditor and Stoch

and Tmnsfer Agent; prolrded. that voting may bc by vrva voce upon approval by the

majority of the stockholdeNprEsenth ihe meetitrg.

F

slclurunn plcr

Aftcr reasonableinquiry and to the b€st of my trJrowledgeand betie{ I certi4' tlar the information set

lod ir this bformation Statementis true, completeand correc! This is siercd in Tnguig ('itr or

June 2010.

ISAI-AND

CORPORATION

DAISY PIIARCE

SUBSCRIBEDAND SWORNto betdreme this A( da\ of June 20111atTuguig Ci6, Philippincs

: -a.lfi.1nt*":l!ib.ituS to ]ne fier Passforl No EB0Ij-1668rssuedon -21Ap/rl 2lll0 ai the Crfi ofMftirl8.

Pldlippines.- -^

d\A,1

i\-tradirEi'rittj Manag€mentReport

J0HllPAull/f,.lCABILAO

ofTaguig

CitY

NoitryPuqlc'

20l1

Decomber

Ap;c:nlmEnt

107.

i.lo. Unti,31

,12bFlocr,

26hst,cor.3'iAvenue

N€loneCenler,

193.i

Global

CiV,

Taguig

ii,:scenl

Boniiaclo

Pail(

\?le$!,

NO,

54363

IiCLL

O:ATTORNEYS

lr4.lvl.

Taguig

Cily,

FTRtlo.0!i,ill:3'0;0i10812010;

1/21lo8/Ceb!

City

Li;:!Tlij:i;: ilor07ti5;

ALCO DEFINI llvl

IDformation Strtenenl 16

MANAGEMENT REPORT

BUSINESS AND GENERAL INFORMATION

a.

Business Development

ARTHALAND CORPORATION (“ALCO”), formerly EIB Realty Developers, Inc., was

incorporated on 10 August 1994 for the purpose of engaging in property development of

residential, commercial, leisure and industrial projects. ALCO’s principal office has been

moved to the 8th floor Picadilly Star Building, 4th Avenue corner 27th Street, Bonifacio Global

City, Taguig City.

In its earlier years, ALCO (then known as EIB Realty) undertook the development and

completion of Exportbank Plaza and the One McKinley Place Condominium, which was a

joint venture undertaking of ALCO and the Philippine Townships, Inc. (formerly RFM

Properties and Holdings, Inc.) through One McKinley Place, Inc. as the corporate vehicle.

ALCO’s property investments include three (3) parcels of land at the Bonifacio Global City

(BGC) with a combined land area of close to one (1) hectare, a 33-hectare property in

Tagaytay City and a 500-square meter property in Davao.

In 2007, ALCO instituted several corporate actions to prepare for its medium and long term

business goals. It underwent a quasi-reorganization consisting of the following:

1.

Decrease in the par value of ALCO’s common shares from P1.00 to P0.18 per share,

with the corresponding decrease in the authorized capital stock from P2.0 Billion to

the paid-in capital stock of P246,257,136.00 only1;

2.

Increase in the authorized capital stock from P246,257,136.00 to P2,946,257,135.82,

divided into 16,368,095,199 common shares at a par value of P0.18 per share2; and

3.

Issuance of warrants to the holders of the 1,368,095,199 issued and outstanding

common shares as of 04 December 20073.

Following the reduction in the par value of its shares and decrease in authorized capital stock,

ALCO undertook a recapitalization program which led to the entry of new investors, namely

AO Capital Holdings 1, Inc., Vista Holdings Corporation, The First Resources Management

and Securities Corporation and Elite Holdings, Inc. The Board approved the P750.0 million

subscription in ALCO equivalent to 3.750 billion common shares of the new investors on 12

August 2008.

On 27 November 2008, during ALCO’s annual stockholders’ meeting, a resolution was made

to change its name to ArthaLand Corporation which was subsequently approved by the

Securities and Exchange Commission on 26 January 2009. This change in name was made to

reflect the renewed thrust of ALCO’s new Board and Management.

Ms. Angela De Villa-Lacson was elected to the Board of Directors of ALCO on 14 March

2008. The Board also appointed Ms. Lacson as ALCO’s President effective on 01 April

2008. Upon her assumption of office, Mr. Jaime Gonzalez, who was then Chairman and

1

As approved by the SEC on 04 December 2007.

As approved by the SEC on 24 December 2008.

3

These are the shareholders of record at the time when the reduction in the par value of the said shares to P0.18

per share was approved by the SEC.

2

ALCO Management Report

1

President concurrently, continued to be ALCO’s Chairman of the Board.

By end-2008, ALCO has completed its line-up of the key management team. ALCO set up

its sales team in 2009.

b.

Business/Projects

ALCO’s main business activity is property development of residential, commercial and

leisure projects. It is geared to pursuing niched and boutique developments beginning with its

land investments in the BGC as well as opportunistic joint venture developments.

ALCO is a registered member of the US Green Building Council’s Leadership in Energy and

Environmental Design (LEED) for its endeavors in sustainable developments. LEED is a US

organization which sets the world standards for green buildings and sustainable

developments.

ALCO’s various properties consist of the following:

1. ALCo’s flagship project located on Lot 4-1 in BGC: Arya Residences is a 2-tower highend residential development on a 6,357-square meter property along McKinley Parkway.

ALCO commenced planning for Arya Residences at the start of 2009, and completed the

Sales Pavilion which houses the model units in the third quarter of the same year. The

first of the two (2) towers of Arya Residences was officially launched in February 2010.

Tower 1 will have 301 units consisting of 1’s, 2’s and 3 bedrooms. Arya Residences will

offer unique retail and dining areas at the elevated ground floor and an amenity podium.

Arya Residences is a registered project with LEED with a certification goal of gold. The

groundbreaking ceremonies were held last April 2010.

2. Lot 7-1 in BGC: A 1,585-square meter property within the E-Square which is the

Philippine Economic Zone Authority (PEZA) area of the BGC. It is across the new St.

Luke’s Medical Center. The property is intended for a residential development.

3. Lot 5-5 in BGC: A 2,233-square meter property which is likewise within the E-Square.

The property is across the street from the proposed Shangri La Hotel and the Philippine

Stock Exchange. The development plan for this property may be mixed-use.

In 2007, ALCO offered to acquire from Export and Industry Bank, Inc. (EIB) its rights, title

and interests in Exportbank Plaza subject to EIB securing the appropriate regulatory approvals

for the transaction. Due to the protracted delay in obtaining the said regulatory approvals,

ALCO is no longer pushing through with the said acquisition and advised EIB accordingly in

a letter dated 17 May 2010.

While ALCO currently intends to develop its BGC properties as described above, these plans

may change subject to market conditions.

Even when these projects are completed, ALCO commits to provide property management

services to the condominium corporation of the developments. Post-completion involvement

allows ALCO to maintain a high standard of maintenance quality in its developments.

c.

Subsidiary

Urban Property Holdings, Inc. (UPHI) is a subsidiary of ALCO originally established as a 5545 joint venture company with PR Builders Developers and Managers, Inc. (PR Builders) for

the development of a housing project on a 331,760 m2 property in Calamba, Laguna, i.e. the

Tagaytay Project. In 2009, PR Builders assigned all of its rights, title and interests in UPHI.

UPHI remains non-operational to date. There is no major imminent risk involved in the

business of UPHI except for any market price volatility on the Tagaytay property.

ALCO Management Report

2

ALCO wholly owns three (3) other subsidiaries namely, Cazneau Inc., Irmo Inc. and

Technopod, Inc., which are real estate companies. These companies are non-operational to

date.

d.

Competition

ALCO faces competition from other domestic property developers. The level of competition

depends on product types, target market segments, location of developments and pricing,

among others.

ALCO views the major property players which are into the middle and high market categories

for high-rise residential in the vicinity of its investment properties as direct competition.

There are significant barriers to entry into the market such as the considerable capital needed

for the acquisition and development of land, the development expertise and reputation

required from an experienced management team, technological know-how from a technical

team, to name a few.

Competition can also be present in the procurement of raw materials particularly in a tight

supply market. ALCO will also have to contend with competition with other property

developers for high-caliber sales/leasing agents and brokers.

Since ALCO has just launched its first project Arya Residences, it has yet to test its

competitive advantages in the market. ALCO, however, believes that given the desirability of

the project locations, its strict adherence to quality, innovation and sustainability, its

competitive pricing schemes and commitment to its projects even after sales, it will be able to

compete effectively.

e.

Industry Risk

1. High-rise Residential Market

The property development sector is cyclical and is subjected to the Philippine economic,

political and business performance. The industry is dependent primarily on consumer

spending for housing. In the past years, a significant portion of housing demand, particularly

on the low-end, was being driven by purchases from the overseas workers’ market. This

exposes the industry to the economic performance of foreign countries of the overseas

workers such as the United States, Saudi Arabia and countries in Europe.

The industry, and to some extent ALCO, has to contend with risks relating to volatility in

overseas remittances, interest rates, credit availability, foreign exchange, political

developments, costs and supply of construction materials, wages, changes in national and

local laws, and regulations governing Philippine real estate and investments.

2.

Commercial Office Market

The office market has been largely driven by the Business Process Outsourcing (BPO) sector

which caters largely to US and European customers. The BPO industry, organized under the

Business Process Association of the Philippines (BPAP), comprises primarily of contact

centers, back office operations, medical transcription, among others.

The BPO industry has been experiencing phenomenal growth since the mid-2000. However,

with the onset of the global economic slowdown in the middle of 2008, BPO companies took

a wait-and-see position and re-assessed their expansion plans. This led to a glut in office

ALCO Management Report

3

space with supply at 614,000 square meter outpacing demand of 451,000 square meters. The

increased office space vacancies resulted in a downward adjustment in rental rates. Due to

these circumstances, some developers have postponed construction of new office buildings.

The BPAP continues to foresee a steady albeit at a more tempered growth in demand at a rate

of 23% yearly. Total demand is estimated to reach 3.8 million square meters by 2011 or a

total increment of 2.29 million square meters from 2008-2011. With the slow down of

construction activities in this sector, the forecasted supply of 1.75 million square meters for

the period 2008-2011 will result in a shortage in office space. Developers who will be

completing their projects by 2011 will be well-positioned for the recovery.

f.

Sources and availability of raw materials

Construction of the projects are awarded to qualified reputable construction firms subject to a

bidding process and management’s evaluation of contractors’ qualifications and satisfactory

working relationships. The construction materials, primarily cement and rebars, are normally

provided for by the contractors as part of the contract. However, ALCO may opt to procure

owner-supplied construction materials should it be more cost-effective for the projects.

g.

Advances to Related Parties

In the normal conduct of its business, ALCO and its subsidiaries enter into inter-company

transactions with each other, principally consisting of advances and reimbursements for

expenses. These transactions are made substantially on the same terms as with other

individuals and businesses of comparable risks.

h.

Patents and Trademarks

ALCO’s operations are not dependent on patents, trademarks, copyrights and the like.

i.

Government approval for principal products or services

ALCO secures various government approvals such as Environmental Compliance Certificates

(ECCs), development permits and licenses to sell as part of its normal course of business.

1.

High-rise residential projects

Real estate development and sale of residential condominiums or subdivisions are governed

by Presidential Decree No. 957. The administrative function is vested on the Housing and

Land Use Regulatory Board (HLURB). The HLURB with local government units administer

Presidential Decree No. 957 and regulate real estate business in the country.

2.

Philippine Economic Zone Authority

ALCO has properties (lots 7-1 and 5-5) at the PEZA area of the BGC, otherwise called the ESquare. PEZA is a government unit that oversees economic zones which are created by

presidential proclamations and which consist of industrial estates, export processing zones,

free trade zones, tourist areas and information technology enterprises. PEZA-registered

enterprises enjoy income tax holidays and duty-free importation of equipment, machinery and

raw materials.

j.

Cost and Effects of Compliance with Environmental Laws

ALCO has complied with all environmental regulatory requirements for both the preconstruction and operational phases of completed projects. ALCO will be obtaining

ALCO Management Report

4

government approvals for its new projects based on the projects’ timetable for development

and pre-selling.

k.

Employees

As of the date of this Report, ALCO has a total of thirty (30) employees.

are not covered by a collective bargaining agreement.

l.

These employees

Working Capital

In general, ALCO finances its projects through pre-selling activities, loans and support from

its strategic partnerships with other corporations, considering the long construction time and

the magnitude of investments necessary to complete its projects.

MANAGEMENT DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

ALCO began its first full year of operations in 2009 following the entry of new investors, the

formation of new management and the building-up of the organization in 2008. In 2009, ALCO

focused on the planning of its flagship project, Arya Residences. Investments were made for the

planning of the said project and the construction of the Sales Pavilion which houses the model units of

Arya Residences. The sales team was also organized and trained. Significant groundwork to

introduce ALCO was laid-out in 2009 which led to the launch of Arya Residences in February 2010.

As a start-up company, revenue recognition will take place after pre-selling activities beginning with

Arya Residences, which will be followed by a mid-range residential development on ALCO’s second

property in the BGC. The financial results of ALCO are reflective of the start-up nature of its

operations.

The following are the financial highlights of ALCO and its subsidiaries, UPHI, Cazneau Inc., Irmo,

Inc. and Technopod, Inc. (hereinafter, collectively referred to as the “Group”) for 2009 vis-à-vis 2008

and 2007:

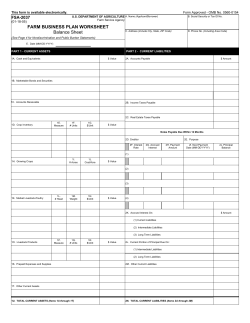

COMPARABLE DISCUSSION FOR FISCAL YEAR 2009

Key Performance Indicators

Earnings Per Share

Net Earnings(loss) attributable to

equity holdings of the Parent to

Weighted Average Number of

Outstanding Common Shares

Capital Adequacy Ratio

Total Equity to Total Assets

Ratio

Liquidity

Liquid To Total Assets Ratio

Profitability

Return on Average Equity

December 2009

December 2008

P -0.0837

P -0.0011

46.71%

59.36%

1.08%

0.69%

-26.44%

-0.43%

Earnings (loss) per share is computed as follows:

Group

2008

2009

Net earnings (loss)

Divided by weighted average

number of outstanding

common shares

(P

Earnings (loss) per share

(P

140,749,470 )

(P

1,682,480,199

0.0837 )

1.537.202 )

(P

Earnings (loss) per share

(P

P

1,368,095,199

(P

0.0011 )

160,522,570

1,368,095,199

P

0.1173

Parent

2008

2009

Net earnings (loss)

Divided by weighted average

number of outstanding

common shares

2007

138,365,410 )

(P

1,682,480,199

0.0822 )

572,372 )

2007

P

1,368,095,199

(P

0.0004 )

159,307,488

1,368,095,199

P

0.1164

There are no dilutive potential common shares at the end of each of the three years.

In 2009, the Group’s Capital Adequacy Ratio (CAR) stood at 46.71% or 12.65% lower compared to

previous year’s ratio of 59.36%. CAR was computed by dividing the Total Average Stockholder’s

Equity over the Total Assets:

Total Average Stockholder’s Equity (P)

Total Assets

Ratio

2009

532.395M

1,139.851M

46.71%

2008

539.645M

909.117M

59.36%

Liquidity ratio indicates the proportion of total assets which can be readily converted into cash. It

also measures the extent to which the assets can be converted into cash to meet its liquidity

requirements. Liquid assets include cash and other cash items. Below is the computation for

Liquidity Ratio:

Total Liquid Assets (P)

Total Assets

Ratio

2009

2008

12.322M

1,139.851M

1.08%

6.268M

909.117M

0.69%

Return on average equity (ROE) ratio decreased from -0.43% in 2008 to -26.44% in 2009. Return on

Average Equity Ratio was calculated as follows:

Total Income (Loss) (P)

Total Average Stockholders’ Equity

Ratio

2009

-140.749M

532.395M

-26.44%

2008

-2.319M

539.645M

-0.43%

Discussion and Analysis of Materials Events

(1)

There are no other known trends, commitments, events or uncertainties that will have a

material impact on ALCO’s liquidity within the next twelve (12) months except for those

mentioned above.

(2)

i.

The present capital expenditure commitments are the planning and development

works on Arya Residences.

ii.

There are no events that will trigger any direct or contingent financial obligation that

is material to the Group or any default or acceleration of an obligation for the period.

(3)

There is nothing to disclose regarding any material off-balance sheet transactions,

arrangements, obligations (including contingent obligations) and other relationships of ALCO

with unconsolidated entities or other persons created during the reporting period.

(4)

There are no other significant elements of income or loss that did not arise from ALCO’s

operations or borrowings for its projects.

(5)

The causes of the material changes of 5% or more from period to period of the following

accounts are as follows:

Balance Sheet Accounts

(i)

Cash and Cash Equivalent – The increase of 97% to P12.322M from

P6.268M was due to increased minimum cash balance employed by the

company to ensure funding for the requirements of the residential project.

(ii)

Receivables – The decrease in receivables related to the nullification of the

Sale and Purchase Agreement dated 28 December 2007 between ALCO and

EIB on the former’s acquisition of the latter’s rights, title and interests in

Exportbank Plaza have been effected in the Parent’s books.

(iii)

Other Current Assets – Increase is mainly due to creditable withholding tax.

(iv)

Property and Equipment – This is due to the construction and completion of

ALCO’s Sales Pavilion.

(v)

Loans Payable -- This was primarily due to new and increased credit facilities

from banks (AUB and Malayan Bank) and private lenders to fund the

requirements of Arya Residences.

(vi)

Accounts Payable and Accrued Expenses – The increase in Accounts Payable

and Accrued Expenses is primarily due to rental costs built by EIB to ALCO

and other obligations arising from the nullification of the Sale and Purchase

Agreement dated 28 December 2007 between ALCO and EIB on the

former’s acquisition of the latter’s rights, title and interests in Exportbank

Plaza.

Income statement

(i)

The decrease in Gross income in 2009 is primarily due to one-time reversals

made in 2008 regarding property impairment losses as well as payables.

(ii)

The higher operating expenses in 2009 is due to reflecting full year corporate

overhead whereas for 2008, the corporate overhead was effectively for only

half a year since the personnel recruitment commenced primarily starting the

second quarter of 2008. From twenty (20) employees in end 2008, ALCO

had thirty (30) employees in 2009.

(iii)

Finance charges increased by P26.408M due to the interest on increased

borrowings.

Summary of Significant Accounting Policies

Basis of Preparation of Financial Statements

The consolidated financial statements of ALCO and its subsidiaries, UPHI, Cazneau Inc.,

Irmo Inc. and Technopod, Inc. have been prepared in accordance with PFRS. PFRS are

adopted by the Financial Reporting Standards Council (FRSC) from the pronouncements

issued by the International Accounting Standards Board.

The consolidated financial statements have been prepared using the measurement bases

specified by PFRS for each type of asset, liability, income and expense. These consolidated

financial statements have been prepared on the historical cost basis.

2009 – As of 31 December 2009, the Group’s total assets stood at P1,139.851M, while its total

liabilities and equity amounted to P670.937M and P468.915M, respectively. Total resources went up

by P230.734M compared to 31 December 2008 level of P909.118M. The increase was brought about

by ALCO’s increased interest in Bonifacio lot identified as Lot 7-1 and expenditures for the planning

and design of its first residential project Arya Residences, including the construction and completion

of ALCO’s Sales Pavilion. Total liabilities increased by P357.695M. This was primarily due to new

and increased credit facilities from banks and private lenders to fund the requirements of Arya

Residences. Total stockholders’ equity amounted to P468.915M in 2009 vis-à-vis P595.876M in 31

December 2008. The decrease is due to necessary operating expenses for the launch of the residential

project.

In terms of profitability, the Group performed lower in 2009 compared to 2008 because of higher

operating expenses and higher interest expenses. The higher operating expenses is attributable to

expenses in connection with Arya Residences as well as the full year’s corporate overhead in 2009

vis-à-vis half year’s level in 2008 since the personnel recruitment commenced primarily starting in the

second quarter of 2008. Finance charges increased by P26.408M due to the interest on increased

borrowings.

Impact of New Amendments and Interpretations to Existing Standards

(a)

Effective in 2009 that are Relevant to the Group

In 2009, the Group adopted the following new revisions and amendments to PFRS that are

relevant to the Group and effective for financial statements for the annual period beginning on

or after 01 January 2009:

PAS 1 (Revised 2007)

PAS 23 (Revised 2007)

Various Standards

:

:

:

Presentation of Financial Statements

Borrowing Costs

2008 Annual Improvements to PFRS

Discussed below are the effects on the financial statements of the new and amended

standards.

(i) PAS 1 (Revised 2007), Presentation of Financial Statements, requires an entity to

present all items of income and expense recognized in the period in a single

statement of comprehensive income or in two statements: a separate statement of

income and a statement of comprehensive income. Income and expense recognized

in profit or loss is presented in the statement of income in the same way as the

previous version of PAS 1. The statement of comprehensive income includes the

profit or loss for the period and each component of income and expense recognized

outside of profit or loss or the “non-owner changes in equity,” which are no longer

allowed to be presented in the statements of changes in equity, classified by nature

(e.g., gains or losses on available-for-sale assets or translation differences related to

foreign operations). A statement showing an entity’s financial position at the

beginning of the previous period is also required when the entity retrospectively

applies an accounting policy or makes a retrospective restatement, or when it

reclassifies items in its financial statements.

The Group’s adoption of PAS 1 (Revised 2007) did not result in any material

adjustments in its financial statements as the change in accounting policy only

affects presentation aspects. The Group has elected to present a single statement of

comprehensive income. Moreover, as a result of retrospective restatement (see

Note 22), the Group presented two comparative periods for the statement of

financial position (see Note 2.1).

(ii) PAS 23 (Revised 2007), Borrowing Costs. Under the revised PAS 23, all

borrowing costs that are directly attributable to the acquisition, construction or

production of a qualifying asset shall be capitalized as part of the cost of that asset.

The option of immediately expensing borrowing costs that qualify for asset

recognition has been removed.

The adoption of this new standard has a significant effect on the 2009 financial

statements, as well as for prior periods, as the Group’s existing accounting policy is

to capitalize all interest directly related to qualifying assets.

(iii) 2008 Annual Improvements to PFRS. The FRSC has adopted the Improvements to

Philippine Financial Reporting Standards 2008 which became effective for the

annual periods beginning on or after 01 January 2009.

Among those

improvements, the following are the amendments relevant to the Group:

• PAS 23 (Amendment), Borrowing Costs. The amendment clarifies the

definition of borrowing costs to include interest expense determined using the

effective interest method under PAS 39. This amendment had no significant

effect on the 2009 financial statements.

• PAS 38 (Amendment), Intangible Assets. The amendment clarifies when to

recognize a prepayment asset, including advertising or promotional

expenditures. In the case of supply of goods, the entity recognizes such

expenditure as an expense when it has a right to access the goods. Also,

prepayment may only be recognized in the event that payment has been made in

advance of obtaining right access to goods or receipt of services. The Group

determined that adoption of this amendment had no material effect on its 2009

financial statements.

• PAS 39 (Amendment), Financial Instruments: Recognition and Measurement.

The definition of financial asset or financial liability at fair value through profit

or loss as it related to items that are held for trading was changed. A financial

asset or liability that is part of a portfolio of financial instruments managed

together with evidence of an actual recent pattern of short-term profit taking is

included in such a portfolio on initial recognition. The Group determined that

adoption of this amendment had no material effect on its 2009 financial

statements.

(b)

Effective in 2009 but not Relevant to the Group

The following amendments, interpretations and improvements to published standards are

mandatory for accounting periods beginning on or after January 1, 2009 but are not relevant

to the Group’s financial statements:

PFRS 1 and PAS 27 (Amendments):

PFRS 2 (Amendment)

PFRS 7 (Amendment)

PFRS 8

Philippine Interpretations

International Financial

Reporting Interpretations

Committee (IFRIC) 13

IFRIC 16

(c)

:

:

:

:

:

PFRS 1 – First Time Adoption of PFRS

and PAS 27 – Consolidated and Separate

Financial Statements

Share-based Payment

Financial Instruments: Disclosures

Operating Segments

Customer Loyalty Programmes

Hedges of a Net Investment in a Foreign

Operation

Effective Subsequent to 2009

There are new PFRS, revisions, amendments, annual improvements and interpretations to

existing standards that are effective for periods subsequent to 2009. Among those,

management has initially determined the following, which the Group will apply in accordance

with their transitional provisions, to be relevant to its financial statements:

(i) Philippine Interpretation IFRIC 14, Prepayments of a Minimum Funding

Requirement – Amendment to IFRIC 14 (effective on or before 01 January 2011).

This interpretation addresses unintended consequences that can arise from the

previous requirements when an entity prepays future contributions into a defined

benefit pension plan. It sets out guidance on when an entity recognizes an asset in

relation to a PAS 19 surplus for defined benefit plans that are subject to a minimum

funding requirement. Management does not expect that its future adoption of the

amendment will have a material effect on its financial statements because it does

not usually make substantial advance contribution to its retirement fund.

(ii) Philippine Interpretation IFRIC 18, Transfers of Assets from Customers (effective

from 01 July 2009). This interpretation provides guidance on how to account for

items of property, plant and equipment received from customers; or cash that is

received and used to acquire or construct specific assets. It is only applicable to

agreements in which an entity receives from a customer such assets that the entity

must either use to connect the customer to a network or to provide ongoing access

to a supply of goods or services or both. Management does not anticipate the

adoption of the interpretation to have material impact on its financial statements.

(iii) Philippine Interpretation IFRIC 19, Extinguishing Financial Liabilities with Equity

Instruments (effective on or after 01 July 2010). It addresses accounting by an

entity when the terms of a financial liability are renegotiated and result in the entity

issuing equity instruments to a creditor to extinguish all or part of the financial

liability. These transactions are sometimes referred to as “debt for equity”

exchanges or swaps, and have happened with increased regularity during the

financial crisis. The interpretation requires the debtor to account for a financial

liability which is extinguished by equity instruments as follows:

•

the issue of equity instruments to a creditor to extinguish all (or part of a

financial liability) is consideration paid in accordance with PAS 39;

•

the entity measures the equity instruments issued at fair value, unless this

cannot be reliably measured;

•

if the fair value of the equity instruments cannot be reliably measured, then the

fair value of the financial liability extinguished is used; and,

•

the difference between the carrying amount of the financial liability

extinguished and the consideration paid is recognized in profit or loss.

Management has determined that the adoption of the interpretation will not have a

material effect on it financial statements as it does not normally extinguish financial

liabilities through equity swap.

(iv) 2009 Annual Improvements to PFRS. The FRSC has adopted the Improvements to

Philippine Financial Reporting Standards 2009. Most of these amendments

became effective for annual periods beginning on or after 01 July 2009 or 01

January 2010. Among those improvements, only the following amendments were

identified to be relevant to the Group’s financial statements:

•

PAS 1 (Amendment), Presentation of Financial Statements (effective from

01 January 2010). The amendment clarifies the current and non-current

classification of a liability that can, at the option of the counterparty, be settled

by the issue of the entity’s equity instruments. The Group will apply the

amendment in its 2010 financial statements but expects there to be no material

impact in the Group’s financial statements.

•

PAS 7 (Amendment), Statement of Cash Flows (effective from 01 January

2010). The amendment clarifies that only an expenditure that results in a

recognized asset can be classified as a cash flow from investing activities. The

amendment will not have a material impact on the financial statements since

only recognized assets are classified by the Group as cash flow from investing

activities.

•

PAS 17 (Amendment), Leases (effective from 01 January 2010). The