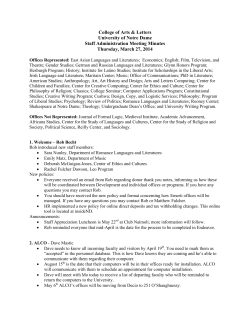

Document 255183