Sample Report Category Competitive Online Media Spends (

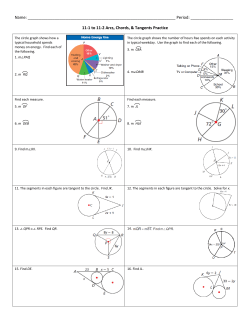

Sample Report Category Competitive Online Media Spends (herein take mobile phone as sample) Agenda 1> VN Market Online Spends 2> Interested Category Online Spends 3> Online Competitive Spends Analysis 4> Takeouts 1. VN Market Online Spends Online Spends by month. In last 3 months, top online media spends peaked on October at US$11.6mil. Source: Vietdev - iTracker Top Categories Online Spends. In 3 months period, telecommunications and Services are top 2 categories spending on Online. Source: Vietdev – iTracker (Sept-Nov, 2012) Top Advertisers, Brands. VMS Mobifone, Sao Thai Duong Co. and Samsung Electronics are top spenders. Regarding brands, VMS-Mobifone, Samsung Mobile are top spending brands. Source: Vietdev – iTracker (Sept-Nov, 2012) 2. Interested Category Online Spends Mobile Phone Category Mobile Phone Spending. In 3 months period, online spending of mobile phone is increasing. Source: Vietdev – iTracker (Sept-Nov, 2012) Top Advertisers, Brands In 3 months period, Samsung & HTC are top spenders. Source: Vietdev – iTracker (Sept-Nov, 2012) Top Mobile Phone Models Galaxy Note II is the most-invested Galaxy model by Samsung in this year end. Samsung has pushed its wide range of product models. HTC followed up with middle-up range of product smartphone models. Source: Vietdev – iTracker (Sept-Nov, 2012) 3. Online Competitive Spends Analysis Samsung Note II Campaigns (Hereafter, we analyze top spender: Samsung Galaxy Note II) In specific requested brand, we analyze much deeper in terms of the brand vs. its competitors. Galaxy Note II Campaigns. The online plans Galaxy Note II had impressive spending in its launch. Galaxy Note II emphasized its premium branding by offering premium gift campaign at the year-end. Samsung used demand-stimulated tactics by offering one-day special-rate buy. Based on planned sites, we guessed that G. Note II target office workers and hi-tech followers. Source: Vietdev – iTracker (Sept-Nov, 2012) “Galaxy Note II Appeared” Campaign. Creative banners This creative banner communicated on the PEN to note. The key emphasis is about “pop-up note; note right in the phone call”. Hidden concept is “smarter, more convenient and available to buy”. Source: Vietdev – iTracker (Sept-Nov, 2012) “Galaxy Note II Appeared” Campaign. Campaign performance re-evaluation This “Galaxy Note II Appeared” campaign received 659mil impression, with 4,337 GRPs. The campaign reached 83.48% online users; whereas 21.43% saw the ads at least 3 times. As shown on the captured media plan, campaign target (office workers and geeks) should be from 25 y.o to 44 y.o. Hence, The campaign got 337mil impression from this target with 4,777 GRPs 83.87% of target 25-44 have ever seen the ads, whereas 21.55% of this target saw it 3 times up. All campaign re-evaluation Reach/Frequency function. figures Source: comScore Campaign Reach/Frequency are based on comScore Campaign 4. Takeouts Deeper takeouts will be considered on specific reportsubscribed brand. It will help the brand for necessary competitive review and would give ideas of media weight and serve for planning purposes. Takeouts High seasonality of spending in October. Telecoms and services are top Category in last 3 months . Mobile Phone Category has been increasing its online spends in the year end. This increase in spends has mainly come from Samsung, for its product models launch HTC competed on the smartphone sub-category against Samsung. That’s why it was quite aggressive in its key-driven product model as OneX (HTC hero product line). Galaxy Note II is the strong emphasis of Samsung after its big investment of Galaxy SIII that we monitored. Via comScore Campaign Reach/Frequency, we could get a point that Galaxy Note II had high reach. Seemingly, its 2nd objective is getting mass. That’s why we realized that GRPs, Reach 1+% and Reach 3+% of total audience and target 25-44 were close to each other, respectively.

© Copyright 2026