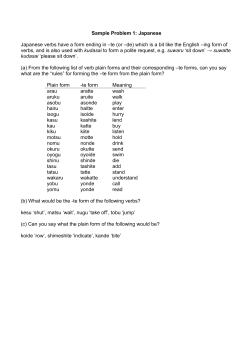

Sample Issue

Samp le Issue Cover Story Cover Story SADACHIKA WATANABE Staff writer JAKARTA – In populous Southeast Asian countries such as Indonesia and the Philippines, local conglomerates led by ethnic Chinese are going on the offensive in their investing activity. In Indonesia, Salim Group has re-entered the automobile market to tap robust domestic demand, while Lippo Group is stepping up the construction of shopping malls. In these attempts to expand business, they often team up with Japanese and other foreign companies boasting technology and service, playing a role in ushering in foreign investments. Salim has agreed with parties concerned to reacquire up to about 70% of shares in Indomobil Sukses International for $809.3 million. The group once sold a controlling stake in the major car company of Indonesia at the time of the Asian currency crisis in the 1990s. Brisk auto sales Indomobil makes and sells automobiles in partnerships with Japan's Suzuki Motor Corp. and Nissan Motor Co. In Indonesia, new car sales hit a record high last year for the third consecutive year, With the expanded middle-income class behind the brisk auto sales, Salim apparently judged it was a good time to re-launch the car business. Another Indonesian company, PT Lippo Karawaci Tbk, a real estate arm of the Lippo Group, plans to boost the number of shopping malls it operates to 50 by 2016 from the current 28. For this ($103 million) to build three shopping malls. In the Philippines, SM Group, the country's biggest retailer headed by Chinese Filipino tycoon shopping malls in the country last year. Meanwhile, Charoen Pokphand Group of Thailand plans to enhance its mainstay food processing business by Cambodia, Laos, Myanmar and other neighboring nations. Crowds of shoppers check out goods on sale in a shop in Jakarta. Chinese conglomerates have set their sights on middle-income earners. Next generation Southeast Asian conglomerates are typically owned and run by ethnic Chinese business people or families. In recent years, the leaderships of such conglomerates have been transferred from the countries from China before World War II and started business to the next generation who have Southeast Asian countries' citizenships and often studied management at Western graduate schools. Chinese conglomerates in Southeast Asia have been valued as business leaders by governments in power at the time since 1960s-1970s, with the groups enjoying near monopolies over business areas they are adept at. For foreign companies foraying into the region, the conglomerates are "attractive partners which have ample funds, land assets and extensive logistic networks," said an executive at a Japanese trading company. On the part of Chinese conglomerates, they are willing to introduce trends and new services from overseas. As the conglomerates' interests coincide with those of foreign companies intending to accelerate their penetration of Southeast Asian markets, the two groups are increasingly joining hands. In Indonesia, Temasek Holdings, an investment company owned by the Singaporean government, with Lippo. Aeon Co., Japan's leading retailer, Mas Group, is on track to operate a large-scale shopping center in Indonesia. In the Philippines, Fast Retailing Co. of Japan Cover Story runs Uniqlo casual clothes stores through a joint venture with SM Group. In Thailand, Shanghai Automotive Industry Corp. of China has created a joint venture with CP Group, planning in 2014 to start producing and marketing passenger cars under Shanghai Automotive's MG brand. Salim Group, which decided to re-enter the car businesses on top of automobiles at the time. But has grown into one of the world's biggest makers production capacity reaching 15 billion packages showed that four of the top 10 countries of the world December quarter last year were Southeast Asian nations, with the Philippines coming in second, the highest among the four. This underscores the vigorous consumer spending in the region even by global standards. Financial reserves One reason for the aggressive investments by Chinese conglomerates in Southeast Asia is that expansion of domestic demand after having been forced to scale down operations in the aftermath of the Asian currency crisis in the late 1990s. group has found itself able to move into the auto business again. Another factor behind the Chinese conglomerates' investment spree in Southeast Asia is a growing uncertainty over the outlook of their operations in mainland China, which they have been focusing on since the 2000s. Ciputra Group in Indonesia had unveiled in May last year a plan to invest more than $60 million in a real estate development project, including the construction of houses and commercial facilities, in the Chinese city of Shenyang. Recently, however, the group said it would postpone the sale of lots. In the meantime, Chinese conglomerates are stepping up domestic investments to build shopping malls and hotels in a bid to diversify their investment risks. Their return to investment activity in Southeast Asia, helped by the booming stock markets which have made their fund raising easier, is becoming evident. Cover Story High-rise hospitals like this one operated by Lippo are appearing in Jakarta. Lippo, other Indonesian firms stepping up hospital business SADACHIKA WATANABE Staff writer JAKARTA – Chinese-run Indonesian conglomerates are accelerating their hospital operations. The Lippo Group will double the number of facilities it has to 27 by 2015. The Ciputra Group aims to have 15 facilities in operation by the same year. Both companies are adding commercial facilities thanks to strong consumer spending and corporate investment, but they are also focusing on the growing long-term demand for hospitals that serve the middle and upper classes with their eyes set on cultivating new revenue streams. PT Lippo Karawaci Tbk, Lippo Group's giant real estate unit, currently operates 13 hospitals, including locations in Jakarta, the capital ciy, and Surabaya. "This year, they will generate 40% of the entire company's pretax profit," according to one company executive. trillion rupiah ($164.8 million) to break ground on seven new facilities. It will also expand hospitals in core regional cities such as Medan on the island of Sumatra and Semarang in Central Java, with the aim of operating 27 hospitals by 2015. Lippo's hospitals are quite large with 100-300 beds. Staffed with medical specialists and equipped with cutting-edge diagnostic imaging equipment and medical devices, they provide medical services PT Ciputra Development Tbk has also announced plans to build 15 new hospitals by around 2015. Each is expected to cost more than 200 billion rupiah. The company first entered the hospital business in 2011 and currently operates one location. Both companies' main business is urban development and office building management. Lippo plans to increase the number of shopping malls it operates from 28 at present to 50 by 2016. Ciputra will expand Ciputra World, a large complex Cover Story in Jakarta, and will also develop residential districts in various areas. In the future, the two companies are eyeing the in tandem with their existing urban development and real estate operations. Besides the middle class, which is gaining the economic power to afford medical treatment at hospitals, the number of affluent people in the country is growing, so demand for hospitals, the upgrading of which has lagged, is almost certain to increase. As of the end of September 2012, there were a total of around 2,000 hospitals in Indonesia of which 1,500 were government-operated and 500 privately-owned. However, few hospitals have advanced medical facilities. When suffering from serious conditions, many of the wealthy choose to receive treatments or be hospitalized at facilities in neighboring Singapore or Malaysia. of patients to foreign countries by upgrading hospitals at home, and in the long term aim to lure "medical tourists" from abroad to Indonesia. Companies in Indonesia are becoming increasingly interested in medical services, as evidenced by the expansion of clinics operated by major pharmaceutical concerns such as PT Kalbe Farma Tbk and PT Kimia Farma Tbk. To manufacturers in Japan and other industrialized nations, progress in building large hospitals in developing countries such as Indonesia signals the expansion of the export market for medical equipment in those countries. Among cancer diagnostic and treatment equipment, PET (positron emission tomography) scanners that detect tumors using radioactive drugs can cost hundreds of millions of yen for the imaging device alone. It is also necessary to have drug manufacturing equipment and facilities installed with special walls to block the radiation, so such equipment presents an enormous investment for a hospital. Expertise in running the equipment must also be transferred. With the expansion of the middle class, such demand is growing rapidly. European and American medical-equipment manufacturers comprise a large share of the market in industrialized countries, but Japanese manufacturers are going on the offensive in developing countries. Japan's Ministry of Economy, Trade and Industry held a medical seminar in Jakarta on Feb. 23 and Japanese manufacturers such as Hitachi Ltd. promoted their goods and services there. Ship Healthcare Holdings Co., a hospital construction to do public relations work on operating-room construction and is putting effort into promotion in the country. Cover Story Kerry Group Chairman Robert Kuok appears at a groundbreaking ceremony for Shangri-La Asia Ltd.'s new hotel in Guangzhou, China, Malaysian billionaire Kuok lays out succession plan CK TAN Staff writer KUALA LUMPUR – Last month, Singapore-listed Wilmar International Ltd. announced that it was expanding its palm plantation business by taking a majority stake in plantation company Noble Resources Pte, which owns 230 sq. km of land in West Papua, Indonesia. Although, it is already one of the biggest palm plantation companies in the world with a total planted area of 2,556 sq. km, Wilmar is still expanding its land bank. Wilmar is one of the companies controlled by 89-year-old Robert Kuok, a Malaysian of Chinese ethnicity. Forbes Asia magazine ranked him the richest Malaysian in 2013 with a fortune of $12.5 billion. The publicity-shy Kuok still pulls the strings behind the scenes, overseeing his family-run business in plantations, commodities trading, hotels, real estate, logistics and publishing. After more than 63 years helming the business, people are wondering how he wants to pass the baton to the next generation. In a rare press interview with Bloomberg early this year, he said, "Everything on Earth is dynamic. I can only give my children a message, not money. If they follow it, we can go another three or four generations." In reality, his children and relatives are already occupying key positions in his stable of companies. His eldest son, Kuok Khoon Chen, is chairman of Kerry Properties Ltd., a Hong Kong listed real estate company. Another son, Kuok Khoon Ean, is the CEO of Shangri-la Asia Ltd., also a Hong Konglisted company managing the Shangri-la brand of luxury hotels. Kuok Hui Kwong, the tycoon's daughter, is the Executive Director of SCMP Group Ltd., the publisher of South China Morning Post, Hong Kong's leading English daily. Kuok Khoon Hong, who runs Wilmar, is his nephew. Kuok was born in 1923 in Johor Baru, a town in southern Malaysia bordering Singapore, to Chinese immigrant parents who ran a small grocery store. Although he spoke his parents' Fuzhou dialect and Mandarin, he was sent to a local English primary school, a natural choice for parents who wanted the best education for their children during the British colonial era. He later attended the prestigious interrupted by the outbreak of World War II. An 18-year-old school dropout by then, Kuok found work at Mitsubishi Corp.'s Johor branch where he was exposed to commodities trading. When his father passed away, Kuok and his brothers inherited the business and took it to new heights by registering it under Kuok Brothers Ltd. to trade commodities. The turning point came when the company obtained a trading license for sugar, a price-controlled item in Malaysia, building up a near-monopoly. The company produced more than 10% of the world's sugar at one time, earning Kuok the nickname "Sugar King." Cover Story The Shangri-la Hotel in Kuala Lumpur is one of 108 hotels worldwide owned by Robert Kuok. Overseas Chinese, especially those from his generation are very family-oriented, frugal, downto-earth and they still feel attached to China. They are successful through sheer hard work in their adopted country. Kuok is no different but he is perhaps one of the few outsiders who took a bold move to invest in the early days of China's market economy in the 1980s. Much of his success is also due to his instinct to venture into untapped area and connection to decision makers of the countries that he has business interest. In an interview with China’s CCTV two years ago, he said he foresaw the potential of the Chinese tourism industry when he although tourist facilities, especially public toilets, were still in poor condition. "I had a feeling that China would have the most prosperous travel industry, as it has historical relics and sites," Kuok reasoned. When China faced sugar shortages in 1973 at the height of the Cultural Revolution, he readily agreed to the request of Mao Zedong's government to fill the gap. And when he heard that Japanese and Western investors were about to acquire prime land in Beijing's business district in the early 1980s, he again stepped in to partner with the Chinese government to build what is now the capital's China World Trade Center. In Malaysia, Kuok enjoyed good relations with the first Prime Minister Abdul Rahman, whose administration gave his company licenses to trade action policy, introduced in 1971 to help ethnic Malays land business and government jobs, is seen as hampering Chinese businesses like Kuok's ability to grow in a big way. Today, Kuok Brothers and Kerry Holdings Ltd., Hong Kong, are the privately held holding arms of his business empire. Kuok has made Hong Kong his headquarters since 1974 and from there he built up his presence in China at a time when foreign investors were still scarce. Currently, Wilmar has 50% market share of edible oils and a substantial share of the rice and flour market in China. There are now 108 hotels under the Shangri-la group worldwide and half of them are in various locations in China. Last year, Kerry Properties made a turnover of $4.38 billion, 76% of it from China and Hong Kong. Last December, Kuok received the CCTV Economic Person of the Year's lifetime achievement in China's economic development. walked in small steps onto the stage to receive the award and modestly told the audience, "Be focused on what you do, and when you succeed don't be complacent, because success can also be the cause of failure." Cover Story Pan Qinglin speaks at the Chinese People's Political Consultative Conference on March 7 in Beijing. Overseas Chinese deplore impact of territorial dispute GAKU SHIMADA Staff writer BEIJING – A Chinese businessman based in Beijing caught other members of the Chinese People's Political Consultative Conference off guard during internal deliberations when he said that the group of uninhabited islands in the East China Sea at the center of an increasingly bitter territorial dispute with Japan belonged to both countries. Speaking to the advisory body for the People's Republic of China, Pan Qinglin said, "I always say this in Japan. Both of us (Chinese and Japanese) possess Diaoyu," the Chinese name for the Senkaku Islands. The more than 50 people in the conference room immediately looked at the speaker. Some appeared visibly angry because he did not say unequivocally that the disputed islands belong to China, but others appeared to fear for him, wondering if he could get away with such a remark. This reporter was allowed to sit in on meetings at the ongoing National People's Congress and the Chinese People's Political Consultative Conference, which closed on March 12, at a time when the SinoJapanese relationship remained tense over the disputed islands. Pan, who came to Japan to study in 1985, is married to a Japanese woman. He claims halfjokingly that these islands belong to "us," whether they are owned by China or Japan, because his relationship with his wife is rock solid. But his remarks were also prompted by much more serious considerations. "China and Japan are the only countries in the world where Chinese characters are still used, so broadly speaking, the two countries share the same over the small islands?" he said. He added that both Japan and China must work together now to ease the tensions. Cover Story He also criticized China's Foreign Ministry, saying, "It is not just relations with Japan that have deteriorated, but with neighboring countries such as Mongolia and Vietnam as well. Whose fault is it?" A silence fell over the conference room. These internal deliberations were attended by a group of overseas returnees charged with advising and other issues. Minutes of their discussions are kept, and their recommendations are presented to the Chinese Communist Party's leadership. Many of them are in business, so Chinese foreign policy has an immense impact on their livelihoods. Pan, for example, played a key role in an extensive network of overseas Chinese that encouraged European aircraft maker Airbus SAS to site its first Asian factory in Tianjin, his hometown. "The Chinese Foreign Ministry runs the nation's foreign policy using government and taxpayers' money, but ministry officials do not suffer any direct consequences to their livelihoods even if they make serious mistakes,” Pan went on. “In contrast, overseas Chinese are working hard to raise China's profile abroad, spending our own hard-earned money. This is a huge difference," he said. A significant number of people in the room nodded in agreement with his assertion that from an economic standpoint, China must quickly improve its relationship with Japan. According to 2012 trade data compiled by Beijing, Japan was China's third-largest source of is true that China's dependence on trade with Japan has been decreasing, but Chinese manufacturers still depend heavily on Japanese imports to obtain many key components they need to produce export items. A case in point is the iPhone 5, manufactured in China under contract for Apple Inc. Many of its key parts, including its LCD screen, are Japanesemade, and Chinese contract manufacturers cannot produce the smartphone for export without these parts. The Wall Street Journal reported in 2010 that only 3% of the iPhone’s value stemmed from the assembly work done in China, while Japanese 17% respectively. Economic ties with Japan remain one of the lifelines for the Chinese economy. Many Chinese economists agree that it makes no economic sense to argue that China no longer needs Japan, although this argument that has gained currency among ordinary Chinese since tensions flared up between the two countries over the uninhabited islands in the East China Sea last year. Overseas Chinese have been raising their presence in the Chinese corridors of power since Xi Jinping became the CCP's General Secretary last November. He served for nearly 20 years as to which many overseas Chinese can trace their origins. One reason he has been able to become China's top leader is a power base built with financial resources provided by overseas Chinese networks. It would be wrong to discount the Chinese on China's new leadership, led by Xi, Japanese Prime Minister Shinzo Abe in February sent a New Year's message to Chinese nationals residing in Japan as they celebrated the Lunar New Year. "The Sino-Japanese relationship is one of the most important bilateral ties for Japan. I will do my best not to let specific disagreements disrupt the entire relationship," he said in part. The content of this message was quickly conveyed to Xi and other top Chinese leaders, who interpreted it as a signal from Abe that he wished to mend the strained bilateral ties. Neither Tokyo nor Beijing can afford to be seen compromising politically over the territorial dispute, given inflamed public opinion in both countries. Each understands the political situation faced by the other at home. How will the Japanese and Chinese leaders work together to soften the adverse effects the prolonged confrontation is having on bilateral economic ties, and find a way to repair the strained relationship? Their political skills are being sorely tested. Asia Business Map Asia Business Map Markets & Finance Market whispers: Cyprus crisis a warning for Japan One day, the government suddenly announces a tax on bank deposits. Citizens rush to banks in front of ATMs and operations at all branches suspended until the following week. If the banks go bust, depositors could lose 30-40% of their deposits, or they might get their deposits back when banks resume operations but in some new currency rather than euros. Individual depositors in Cyprus are living this nightmarish experience. Japan cannot dismiss the situation as someone else's troubles, however. known as Abenomics, could push down real interest rates and erode the value of bank deposits, which would have the same effect as a deposit tax. Because Cyprus is part of the eurozone, it does currency. But Japan is groping for a way out of a recession made more persistent by the strong yen. The government has public support for its policy to lower the value of the yen – under the banner currency undermines the value of yen deposits against other currencies. Especially now that the yen's purchasing power will strike directly at people’s standard of living. The recent fall in the value of the yen to 95 to the dollar has been welcomed because it helps Japanese products regain competitiveness in international markets. As the yen approaches 100 to the dollar, however, the Japanese will begin to feel the negative effects of the weaker currency. The abrupt imposition of a deposit tax is an discipline is not maintained in a country with outstanding government bonds to the tune of ¥1,000 trillion, the government’s last resort would be the more than ¥1,500 trillion socked away as In its hour of crisis, Cyprus is counting on Russia, a country with whom the Mediterranean island nation has had traditionally strong economic relations. The country with which Japan has had the closest economic ties is the U.S., but its public debt has already swelled to the legal limit. Although the U.S. responded to the 2011 earthquake and tsunami with Operation Tomodachi (friend), it can Protesters march through central Nicosia during a demonstration March 24. (Reuters) Markets & Finance It would be problematic from the perspective of national security to ask China to buy more Japanese government bonds, so the International Monetary Fund is likely to be the only possible rescuer for Japan. The Cyprus crisis reminds us of government – two of the three arrows of Abenomics – in the quest to save Japan’s economy. More than mere economics Banks in Cyprus are hoping that Russia will bail it out, but President Vladimir Putin is upset that the country did not consult his government in advance. The EU is in a delicate position, since its proposed tax on deposits would have hit many Russian individuals and businesses. Geopolitically, the pressure is on Europe: the region relies on Russia for 36% of its natural gas, and it will be a long time before it can diversify energy supplies by importing shale gas from the U.S. Unless the European Union makes concessions to Cyprus, allowing for a more politically palatable bailout deal, Cyprus could move away from the EU Among EU nations, Germany in particular has been critical of Cyprus. The island nation sought to corporate tax to 10%, but Germany called this "tax dumping." France has also expressed concern over the intervention of Russia in the Cyprus bailout. This tug of war reveals the underlying dynamic that has Cyprus stuck in the middle. People in Nicosia queue to withdraw their deposits from a Cypriot bank. The government of Cyprus decided to delay reopening the banks. Cypriot banks have managed to survive so far, thanks to life support in the form of liquidity supplied by the European Central Bank (ECB) to banks within the EU. If the government does not accept the EU deal, however, even ECB President Mario Draghi, who has said that the bank was "ready to do whatever it takes" to preserve the to Cyprus. The country has been told by other European nations that it must make up the shortfall on the same time, Cyprus cannot accept Russia's conditions wholesale and risk falling into bondage to Russia. In the meantime, the people of Cyprus have rejected the EU’s conditions for saving their country, and the Cypriot president is buying time by extending the lockdown on banks. Once the banks resume operations, major Russian depositors are expected to scramble to withdraw their money and transfer it elsewhere. Local citizens are already increasingly distrustful of their government, which they feel has prioritized international clients over domestic depositors. Local newspaper headlines have described this as "Russian roulette." If the president accidentally pulls the trigger, it could ruin the country. As talks came down to the wire, the Orthodox Church in Cyprus, the largest landowner in the country, felt moved to act and offered to mortgage announced that he would remain in Moscow until a preliminary accord is reached with Russia. While IMF statistics show that Cyprus's direct investment in Russia amounted to $128.8 billion in 2011, one private sector estimate puts Russian lending to Cyprus at about $120 billion. Furthermore, some 7% of Russia's private sector loans are made via Cyprus. There is little doubt that Cyprus serves as an offshore banking center for Russia. In New York, many analysts are sounding the alarm over this Russian connection – although the size of the Cypriot economy is small, the fallout from this crisis could be much more extensive. Squeezed between the EU and Russia, and buffeted by their brinkmanship, the Cyprus problem is deeper than Markets & Finance Itsuo Toshima is the representative of his own Japan representative of the World Gold Council until September 2011. Born in Tokyo in 1948, Toshima received a degree in international economics from Hitotsubashi University. After joining Mitsubishi Bank, one of the predecessors of Bank of Tokyo-Mitsubishi UFJ, he was assigned to the becoming a foreign exchange and precious metals dealer. A gold expert with extensive market experience in Zurich and New York, Toshima writes about and macroeconomics for lay people from an independent stance. He is the author of several books published by Nikkei Publishing Inc. and Nikkei Business Publications Inc. Science & Technology Innovate Suzaka developed the Graper specifically to make grape-picking easier. Cyberdyne has teamed up with Daiwa House Industry to produce a robotic suit for nursing care, called HAL. Bionic helpers suiting up to lend a hand A number of Japanese companies are developing wearable robots and other gear designed to assist people's movements. Such devices may come to play an increasingly important role in a rapidly graying Japan, especially in such physically demanding In January, farming equipment maker Kubota Corp. showcased its new "assist-robot ARM-1" at a product fair for dealers in Kyoto. The wearable equipment, which the Osaka-based company plans to launch in October, provides support to the arms to make it easier for farmers to perform such actions as picking fruit. The backpacklike robot is equipped with sensors that detect which way the user wants to move his or her arms and adjust the robot's position accordingly. Activelink Co., a subsidiary of Panasonic Corp. that specializes in robots, worked with Kubota in developing the ARM-1. The company says the device is designed to reduce the physical burden on farmers who have to hold their arms up for long periods. Kubota will sell the robot for ¥126,000 ($1,326) announced on March 4 that it has formed a capital tie-up with trading giant Mitsui & Co. in the bionicsuit business. Kubota's assist-robot ARM-1, which will go on sale in October, is designed to support the arms during activities that require reaching up. Science & Technology Easier pickings Innovate Suzaka, a consortium of small and midsize businesses based in Suzaka, Nagano Prefecture, has developed a power-assist suit called the Graper. The device, which is size-adjustable and worn on the upper body, is designed to help alleviate neck pain, a common ailment among grape pickers. The device is manufactured by Misuya Industry Co., which is based in Suzaka, a city known for grape production. "Local farmers told us they often have stiff necks, so we developed the device last year by working with the community as a whole," said a Misuya with another Graper product released in 2009 that is designed to support the arms. The annual sales target for the Graper is about 100 units. The neck version is priced at ¥15,000, and a set that includes both types is about ¥40,000. Back helper manufacturer, last October began selling a back supporter called the Rakunie. The product is designed to help nursing care staff lift bedridden people, and the company says it reduces the load on the back muscles by 14%. Morita has long developed technology to ease carry water hoses and other heavy equipment. The with Keio University Prof. Nobutoshi Yamazaki and medical equipment maker Daiya Industry Co. The Rakunie extends from the shoulders to the knees and wraps around the waist. Because it is made of an elastic material, it allows the wearer to move freely and is easy to put on and take off. It is also designed not to put too much pressure on blood vessels and nerves. The device is priced at ¥24,150, and the company have received inquiries from overseas," a Morita Teaming up Universities are also getting in on the robotic-suit action. A research team led by Shigeki Toyama, a professor at the Tokyo University of Agriculture and Technology, has developed a motor-embedded assist suit designed to ease the physical demands of farmwork. Cyberdyne Inc., a venture set up by the University of Tsukuba, has teamed up with Daiwa House Industry Co. to produce a robotic suit for nursing care. A number of care facilities already use the wearable device, called HAL (Hybrid Assistive Limb). Asia in Pictures Asia in Pictures The Nikkei Asian Review on your iPad™ provides a comprehensive weekly update of current affairs. “This is the best Asian business magazine” “All the issues I read are interesting” “Good app with proffessional contents and insights” (Reader’s voice) Download the free app now and keep in touch with Asia! iPad is a trademark of Apple Inc. App Store is a service mark of Apple Inc.

© Copyright 2026