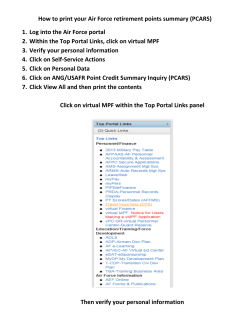

VIGILANCE MANUAL VOLUME III DIGEST OF CASE LAW