Document 328140

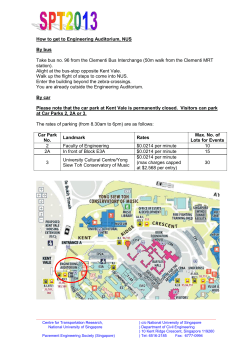

Singapore | Industrials Asia Pacific Equity Research SEMBCORP MARINE | BUY MARKET CAP: USD 5.9B 8 Oct 2014 Company Update AVG DAILY TURNOVER: USD 8M RECENT SELL-DOWN TOO AGGRESSIVE Recent sell-down overdone Drillship has left SG Upgrade to BUY with 20% upside • • • BUY (upgrade) Fair value S$4.18 add: 12m dividend forecast S$0.130 versus: Current price S$3.58 12m total return forecast Aggressive selling in recent days Sembcorp Marine’s (SMM) share price has fallen by about 10% since early Sep, with about half of this drop in the last five trading days. This compares to the STI’s ~3% fall since early Sep. We believe that this is partly due to weaker oil prices of late, as well as company-specific factors such as worries over execution risks for its new drillship. 20% Analysts Low Pei Han, CFA (Lead) ● +65 6531 9813 [email protected] Carey Wong ● +65 6531 9808 [email protected] Key information Market cap. (m) Drillship has left for Brazil; on track for Jun 2015 delivery According to news reports online1, the Dockwise heavy-lift vessel Black Marlin has been seen ballasting down last Friday to load SMM’s first drillship, the Arpoador. A call with SMM also confirmed that the unit has left Singapore for Brazil, and SMM reiterated that the unit is on track for delivery in Jun next year, despite its departure date from Singapore being delayed for more than six months from its original schedule. S$7,480 / USD5,868 Avg daily turnover (m) S$10 / USD8 Avg daily vol. (m) 2.5 52-wk range (S$) 3.54 - 4.6072 Free float (%) 39.1 Shares o/s. (m) 2,089.3 Exchange SGX BBRG ticker Execution risk has been lowered with more construction done here The market has been worried that SMM would fail to deliver its first drillship on time, especially with the yard in Brazil being new and inexperienced. While acknowledging these risks, we point out that execution risk of this unit may actually be lower now with a greater percentage of the construction work being done in Singapore instead of the new Brazil yard – at least 70% of the unit has been completed. We also would not be surprised if SMM has built in a buffer or a grace period, since this is a new product for the group. SMM SP Reuters ticker SCMN.SI ISIN code S51 GICS Sector Industrials GICS Industry Machinery Sembcorp Industries60.8% Top shareholder 1m 3m Company (%) Relative total return -9 -11 12m -17 STI-adjusted (%) -6 -11 -24 Price performance chart Significant upside despite lowering margins We had been forecasting operating margins of 11.7% for FY14 and 12.6% for FY15 (1H14: 11.3%). To be more conservative, we lower our FY15 margin assumption to 11.9%. With this, we see limited downside risks to margins. Though our fair value estimate is correspondingly lowered from S$4.36 to S$4.18, we see a 20.5% upside (this includes a ~4% dividend yield) on the stock, which is attractive. Upgrade to BUY on SMM, as the recent sell-down seems to be overdone. Share Price (S$) Index Level 5.45 3900 4.99 3560 4.54 3220 4.09 2880 ` 3.63 3.18 Oct-13 2540 Jan-14 Apr-14 Fair Value Jul-14 SMM SP 2200 Oct-14 FSSTI Sources: Bloomberg, OIR estimates Key financial highlights Year Ended Dec 31 (S$m) Revenue Industry-relative metrics FY12 FY13 FY14F FY15F 4,430.1 5,525.9 5,850.7 6,233.2 Gross profit 694.5 707.8 819.1 872.6 EBITDA 644.8 741.5 830.7 943.3 Mkt Cap Profit attributable to shareholders 538.4 555.7 568.8 604.0 Beta 25.8 26.6 27.2 28.9 na na 27.8 29.8 Earnings per share (S cents) Cons. EPS (SG cents) Net profit margin (%) 12.8 10.6 10.3 10.3 PER (x) 13.9 13.5 13.1 12.4 ROE (%) 23.3 22.0 20.2 19.3 EV/EBITDA (x) 11.6 10.1 9.0 7.9 1 “Dockwise BLACK MARLIN seen ballasting down last Friday morning at the Singapore to load Arpoador Drillship”. Heavyliftnews.com. 5 Oct 2014. Please refer to important disclosures at the back of this document. Percentile 0th 25th 50th 75th 100th ROE PE PB Industry Average Company Note: Industry universe defined as companies under identical GICS classification listed on the same exchange. Sources: Bloomberg, OIR estimates MCI (P) 004/06/2014 OCBC Investment Research Singapore Equities Local content requirements – not really where you build it, but where you source it To satisfy local content requirements of at least 50% for the first unit, a significant amount of equipment and consumables has been procured from Brazil. Work for certain parts of the drillship is also ongoing in Brazil, such that they can be fitted onto the hull upon arrival. As the Brazil yard ramps up subsequently, the plan is to do more physical work in Brazil for the later drillship units. Reasonable assumptions buttressing 3% and 6% PATMI growth for FY14 and FY15 The group has secured about S$2.8b worth of work YTD, accounting for ~70% of our full year forecast. In our model, we have assumed new orders of S$4b for this year vs. S$4.2b that was secured last year, as well as S$4.5b for FY15, which we believe is still reasonable despite a slow down in new order flows and softening in day rates, as the group has a wide product ranging from drilling rigs to offshore production structures and ship repair. Meanwhile, our FY15 operating margin assumption has been lowered from 12.6% to 11.9%, and with this, we see limited downside risks to margins. Though there are operational risks in Brazil, it is imperative that the group establishes a firm presence there where the growth potential is. BUY when the stock is under-appreciated and unloved Once the darling of the market, SMM has turned to be the one of the most shorted stocks of late, with its short sale value accounting for 3-4% of total shorted stocks from 15-26 Sep. This went up to about 8% on 2 Oct. With a confluence of negative news such as 1) lower oil prices which may lead to slow order flow and 2) execution risks for its first drillship, we believe that investors may want to consider whether it is time to pick up a quality stock that still has solid fundamentals over the long term. Exhibit 1: The Black Marlin (heavy-lift vessel) carrying the first drillship, Arpoador, for departure from Singapore Source: Andre Korver- Dockwise Shipping B.V Exhibit 2: Sum-of-parts valuation Profit after tax Stake Valuation type Multiple (x) (S$m) (S$) 100% FY14/15F earnings 14 8,148 3.90 30% FY14/15F earnings 12 158 0.08 4.97% OIR fv: S$0.61 68 0.03 (S$m) SMM ex COSCO $ 582 COSCO Shipyard Group $ 44 COSCO Corp Singapore Net cash $ 355 Value to SMM 355 Valuation/share 0.17 Shares outstanding (m) 2088 SOTP valuation (S$) 4.18 Source: OIR estimates 2 OCBC Investment Research Singapore Equities Company financial highlights Income statement Year Ended Dec 31 (S$m) Revenue Gross profit Operating and admin expenses EBITDA Operating profit Other expenses/income Associates Pre-tax profit Profit for the year Profit attributable to shareholders Balance sheet As at Dec 31 (S$m) Cash and cash equivalents Other current assets Property, plant, and equipment Total assets Debt Current liabilities excluding debt Total liabilities Shareholders equity Total equity Total equity and liabilities Cash flow statement Year Ended Dec 31 (S$m) Op profit before working cap. changes Working cap, taxes and int Net cash from operations Purchase of PP&E Other investing flows Investing cash flow Financing cash flow Net cash flow Cash at beginning of year Cash at end of year Key rates & ratios Earnings per share (S cents) NTA per share (S cents) Gross profit margin (%) Net profit margin (%) PER (x) Price/NTA (x) EV/EBITDA (x) Dividend yield (%) ROE (%) Net gearing (%) FY12 FY13 FY14F FY15F 4,430.1 694.5 -140.3 644.8 554.2 19.2 56.3 629.6 567.4 538.4 5,525.9 707.8 -63.6 741.5 644.3 5.1 15.6 665.0 588.3 555.7 5,850.7 819.1 -133.0 830.7 686.1 -5.4 27.6 708.4 602.1 568.8 6,233.2 872.6 -132.5 943.3 740.1 -15.6 27.6 752.1 639.3 604.0 FY12 FY13 FY14F FY15F 1,408.9 2,232.0 1,476.2 5,786.5 378.7 2,685.2 3,239.4 2,438.5 2,547.0 5,786.5 1,694.9 2,526.2 2,394.2 7,250.1 846.1 3,364.3 4,440.6 2,677.0 2,809.5 7,250.1 1,385.3 2,609.4 3,035.5 7,759.5 1,030.0 3,359.1 4,619.3 2,974.4 3,140.2 7,759.5 1,363.2 2,569.4 3,364.3 8,105.5 1,030.0 3,337.2 4,597.4 3,307.0 3,508.1 8,105.5 FY12 FY13 FY14F FY15F 670.7 -463.1 207.5 -516.8 -9.9 -526.7 -231.9 -551.1 1,989.6 1,408.9 748.6 188.6 937.2 -814.9 17.2 -797.7 135.3 274.8 1,408.9 1,694.9 487.3 12.9 500.2 -800.0 88.9 -711.1 -87.6 -298.4 1,694.9 1,385.3 1,012.7 -72.1 940.6 -500.0 -191.2 -691.2 -271.4 -22.1 1,385.3 1,363.2 FY12 FY13 FY14F FY15F 25.8 115.2 15.7 12.8 13.9 3.1 11.6 3.6 23.3 Net cash 26.6 126.8 12.8 10.6 13.5 2.8 10.1 3.6 22.0 Net cash 27.2 141.2 14.0 10.3 13.1 2.5 9.0 3.6 20.2 Net cash 28.9 157.1 14.0 10.3 12.4 2.3 7.9 3.6 19.3 Net cash Sources: Company, OIR forecasts Company financial highlights OCBC Investment Research Singapore Equities SHAREHOLDING DECLARATION: The analyst/analysts who wrote this report holds/hold NIL shares in the above security. DISCLAIMER FOR RESEARCH REPORT This report is solely for information and general circulation only and may not be published, circulated, reproduced or distributed in whole or in part to any other person without our written consent. This report should not be construed as an offer or solicitation for the subscription, purchase or sale of the securities mentioned herein. Whilst we have taken all reasonable care to ensure that the information contained in this publication is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness, and you should not act on it without first independently verifying its contents. Any opinion or estimate contained in this report is subject to change without notice. We have not given any consideration to and we have not made any investigation of the investment objectives, financial situation or particular needs of the recipient or any class of persons, and accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient or any class of persons acting on such information or opinion or estimate. You may wish to seek advice from a financial adviser regarding the suitability of the securities mentioned herein, taking into consideration your investment objectives, financial situation or particular needs, before making a commitment to invest in the securities. OCBC Investment Research Pte Ltd, OCBC Securities Pte Ltd and their respective connected and associated corporations together with their respective directors and officers may have or take positions in the securities mentioned in this report and may also perform or seek to perform broking and other investment or securities related services for the corporations whose securities are mentioned in this report as well as other parties generally. Privileged / confidential information may be contained in this document. If you are not the addressee indicated in this document (or responsible for delivery of this message to such person), you may not copy or deliver this message to anyone. Opinions, conclusions and other information in this document that do not relate to the official business of OCBC Investment Research Pte Ltd, OCBC Securities Pte Ltd and their respective connected and associated corporations shall not be understood as neither given nor endorsed. RATINGS AND RECOMMENDATIONS: - OCBC Investment Research’s (OIR) technical comments and recommendations are short-term and trading oriented. - OIR’s fundamental views and ratings (Buy, Hold, Sell) are medium-term calls within a 12-month investment horizon. - As a guide, OIR’s BUY rating indicates a total return in excess of 10% based on the current price; a HOLD rating indicates total returns within +10% and -5%; a SELL rating indicates total returns less than -5%. Co.Reg.no.: 198301152E Carmen Lee Head of Research For OCBC Investment Research Pte Ltd Important disclosures

© Copyright 2026