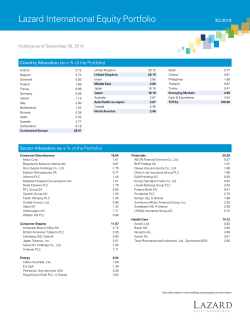

Quarterly Holdings - Lazard Asset Management

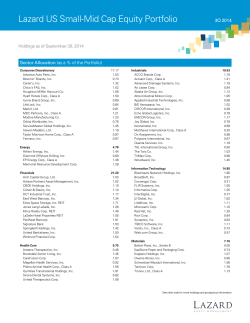

Lazard International Equity Portfolio 4Q 2014 Holdings as of December 31, 2014 Country Allocation (as a % of the Portfolio) Austria 0.69 Belgium 2.80 Denmark 0.74 Finland 1.85 France 7.11 Germany 4.42 Ireland 1.21 Italy 2.25 Netherlands 3.72 Spain Sweden Switzerland Continental Europe 2.16 3.87 7.72 38.53 United Kingdom United Kingdom Israel Middle East Japan Japan Australia Asia-Pacific ex-Japan Canada North America 26.68 26.68 3.04 3.04 17.66 17.66 2.72 2.72 2.85 2.85 Brazil Greece Philippines Taiwan Thailand Turkey Emerging Markets Cash & Equivalents TOTAL 0.66 0.81 1.14 1.66 0.84 0.98 6.09 2.42 100.00 Sector Allocation (as a % of the Portfolio) Consumer Discretionary Asics Corp. Bayerische Motoren Werke AG Don Quijote Holdings Co., Ltd. Estacio Participacoes SA Informa PLC Mediaset Espana Comunicacion SA Reed Elsevier PLC RTL Group SA Swatch Group AG Taylor Wimpey PLC United Arrows, Ltd. Valeo SA William Hill PLC Wolters Kluwer NV 16.63 0.55 0.89 2.18 0.66 1.59 1.11 1.94 0.62 0.98 1.45 0.74 1.50 0.94 1.48 Consumer Staples Anheuser-Busch InBev NV British American Tobacco PLC Carlsberg A/S, Class B Japan Tobacco, Inc. Seven & I Holdings Co., Ltd. Unilever PLC 9.46 2.80 2.21 0.74 1.06 1.46 1.18 Energy Caltex Australia, Ltd. Royal Dutch Shell PLC, A Shares 4.11 1.00 3.10 Financials AEON Financial Service Co., Ltd. Azimut Holding SpA BNP Paribas SA Daiwa House Industry Co., Ltd. Direct Line Insurance Group PLC GAM Holding AG Krung Thai Bank Public Co. Ltd. Lloyds Banking Group PLC Piraeus Bank SA Provident Financial PLC Prudential PLC Sampo Oyj, A Shares Sumitomo Mitsui Financial Group, Inc. Swedbank AB, A Shares UNIQA Insurance Group AG 21.64 0.53 0.81 1.88 2.13 1.13 0.74 0.84 2.46 0.54 1.03 2.84 1.85 2.07 2.11 0.69 Health Care Ansell, Ltd. Bayer AG Novartis AG Shire PLC Teva Pharmaceutical Industries, Ltd. Sponsored ADR 12.97 0.89 2.91 4.52 1.61 3.04 See other side for more holdings and prospectus information Lazard International Equity Portfolio 4Q 2014 Holdings as of December 31, 2014 Sector Allocation (as a % of the Portfolio) – Continued Industrials Airbus Group NV Alliance Global Group, Inc. Assa Abloy AB, Class B Atlantia SpA Daikin Industries, Ltd. International Consolidated Airlines Group SA MacDonald Dettwiler & Associates, Ltd. Makita Corp. Rolls-Royce Holdings PLC Ryanair Holdings PLC Sponsored ADR Information Technology Cap Gemini SA NXP Semiconductor NV Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR 14.05 1.16 1.14 1.76 1.44 1.91 1.57 1.40 0.71 0.75 1.21 4.53 1.57 1.30 1.66 Materials Anglo American PLC Glencore PLC James Hardie Industries PLC Rexam PLC KDDI Corp. Rogers Communications, Inc., Class B 5.18 0.98 1.49 0.82 1.89 2.41 1.38 Telecom Services Hellenic Telecommunications Organization SA KDDI Corp. Koninklijke KPN NV Rogers Communications, Inc., Class B SoftBank Corp. Turkcell Iletisim Hizmetleri AS 7.97 0.27 2.66 0.94 1.45 1.67 0.98 Utilities Red Electrica Corporacion SA 1.04 1.04 Cash & Equivalents 2.42 TOTAL 100.00 Published on January 21, 2015. Equity securities will fluctuate in price; the value of your investment will thus fluctuate, and this may result in a loss. Securities in certain non-domestic countries may be less liquid, more volatile, and less subject to governmental supervision than in one’s home market. The values of these securities may be affected by changes in currency rates, application of a country’s specific tax laws, changes in government administration, and economic and monetary policy. Small- and mid-capitalization stocks may be subject to higher degrees of risk, their earnings may be less predictable, their prices more volatile, and their liquidity less than that of large-capitalization or more established companies’ securities. Emerging market securities carry special risks, such as less developed or less efficient trading markets, a lack of company information, and differing auditing and legal standards. The securities markets of emerging market countries can be extremely volatile; performance can also be influenced by political, social, and economic factors affecting companies in emerging market countries. The portfolio invests in stocks believed by Lazard to be undervalued, but that may not realize their perceived value for extended periods of time or may never realize their perceived value. The stocks in which the portfolio invests may respond differently to market and other developments than other types of stocks. The securities mentioned are not necessarily held by Lazard for all client portfolios, and their mention should not be considered a recommendation or solicitation to purchase or sell these securities. It should not be assumed that any investment in these securities was, or will prove to be, profitable, or that the investment decisions we make in the future will be profitable or equal to the investment performance of securities referenced herein. There is no assurance that any securities referenced herein are currently held in the portfolio or that securities sold have not been repurchased. The securities mentioned may not represent the entire portfolio. Not a deposit. May lose value. Not guaranteed by any bank. Not FDIC insured. Not insured by any government agency. Please consider a fund’s investment objectives, risks, charges, and expenses carefully before investing. For more complete information about The Lazard Funds, Inc. and current performance, you may obtain a prospectus or summary prospectus by calling 800-823-6300 or going to www.LazardNet.com. Read the prospectus or summary prospectus carefully before you invest. The prospectus and summary prospectus contain investment objectives, risks, charges, expenses, and other information about the Portfolio and The Lazard Funds that may not be detailed in this document. The Lazard Funds are distributed by Lazard Asset Management Securities LLC. Lazard Asset Management LLC • 30 Rockefeller Plaza • New York, NY 10112 • www.lazardnet.com MF12384

© Copyright 2026