Document 372742

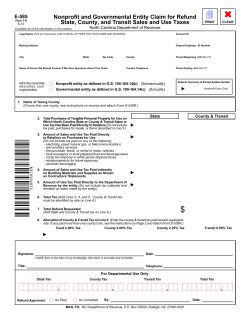

Claim for Refund State, County, and Transit Sales and Use Taxes for Certain Cancelled Service Contracts E-588SC Web-Fill 10-14 4 ✖ PRINT CLEAR North Carolina Department of Revenue SSN Legal Name (First 32 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS) FEIN Street Address City State Zip Code Service Contract Original Date of Sale County Name of Person We Should Contact if We Have Questions About This Claim Date Refund Received Contact Telephone Do not complete and file this form if you received a refund of sales and use tax on a cancelled service contract. 1. Name of Taxing County Where Contract Purchased (If more than one county, see instructions) 2. Taxable Service Contract Amount Refunded (Amount will not include any sales tax previously paid) 3. N.C. State Sales and Use Tax Calculation (Multiply Line 2 by 4.75% State rate) 4. N.C. County Sales and Use Tax Calculation (Multiply Line 2 by County rate from table on Page 2) 5. N.C. Transit Sales and Use Tax Calculation (Multiply Line 2 by Transit rate from table on Page 2, as applicable) $ 6. Total Amount of Refund Requested (Add Lines 3, 4, and 5) 7. Allocation of County and Transit Tax on Lines 4 and 5 (Enter the County Tax at the applicable rate from Line 4 and enter the Transit Tax from Line 5, as applicable. If you paid more than one county’s tax, see the line by line instructions on Page 3 and attach Form E-536R.) Transit 0.50% Tax County 2.00% Tax County 2.25% Tax Durham, Mecklenburg, Orange or Form E-588SC must be filed within 30 days after the date the purchaser receives a refund on any portion of the sales price for a taxable service contract that was sold on or after October 1, 2014. The date the purchaser receives a refund is considered the date of the postmark on the envelope in which the refund is received, the date of an electronic transfer, or the date of the check, whichever is later. Form E-588SC filed by the purchaser for a refund after the due date is barred and can not be processed by the Department. This form must be supported by a copy of the originally taxed service contract invoice or sales documentation, a copy of the refund check received or proof of electronic transfer, a copy of the envelope or other information to support when the refund was received by the purchaser and any other documentation received by the purchaser in conjunction with the refund. Failure to attach documentation will prohibit or delay processing of the claim for refund state, county, and transit sales and use taxes and may result in the denial of the request by the Department. Signature: Date: I certify that, to the best of my knowledge, this claim is accurate and complete. Telephone: Title: For Departmental Use Only Refund Approved: Period Beginning (MM-DD-YY) , By: County 2.00% Tax , . As Filed As Corrected Period Ending (MM-DD-YY) Account ID County 2.25% Tax Transit Tax , , . , , , . Date: MAIL TO: NC Department of Revenue, P.O. Box 25000, Raleigh, NC 27640-0001 , State Tax , Total Tax , . . Page 2 E-588SC Web-Fill 10-14 County County Sales and Use Tax Rates in North Carolina Counties As of October 1, 2014 CountyCounty Transit 2.00%2.25% 0.50% County CountyCounty Transit 2.00%2.25% 0.50% Alamance10-1-14 Alexander10-1-14 10-1-14 Johnston Jones10-1-14 Alleghany10-1-14 Lee10-1-14 Anson10-1-14 Ashe10-1-14 Avery10-1-14 Lincoln10-1-14 Macon10-1-14 Beaufort10-1-14 Madison10-1-14 Bertie10-1-14 Bladen10-1-14 Brunswick10-1-14 Martin10-1-14 McDowell10-1-14 Mecklenburg 10-1-14 Buncombe10-1-14 Burke10-1-14 Mitchell10-1-14 Cabarrus10-1-14 Caldwell10-1-14 Camden10-1-14 Carteret10-1-14 Caswell10-1-14 Catawba10-1-14 Lenoir10-1-14 10-1-14 Montgomery10-1-14 Moore10-1-14 Nash10-1-14 New Hanover 10-1-14 Northampton10-1-14 Chatham10-1-14 Cherokee10-1-14 Onslow10-1-14 10-1-1410-1-14 Orange Pamlico10-1-14 Pasquotank10-1-14 Chowan10-1-14 Clay10-1-14 Pender10-1-14 Perquimans10-1-14 Cleveland10-1-14 Columbus10-1-14 Person10-1-14 Pitt10-1-14 Craven10-1-14 Cumberland10-1-14 Polk10-1-14 Randolph10-1-14 Currituck10-1-14 Dare 10-1-14 Richmond10-1-14 Robeson10-1-14 Davidson10-1-14 Davie10-1-14 Rockingham10-1-14 Duplin10-1-14 10-1-1410-1-14 Durham Edgecombe10-1-14 Rowan10-1-14 Rutherford10-1-14 Sampson10-1-14 Forsyth10-1-14 Scotland10-1-14 Stanly10-1-14 Franklin10-1-14 Gaston10-1-14 Stokes10-1-14 Surry10-1-14 Gates10-1-14 Graham10-1-14 Swain10-1-14 Transylvania10-1-14 Granville10-1-14 Greene10-1-14 Tyrrell10-1-14 Union10-1-14 Guilford10-1-14 Vance10-1-14 Halifax10-1-14 Harnett10-1-14 Haywood10-1-14 Henderson10-1-14 Wake10-1-14 Warren10-1-14 Washington10-1-14 Hertford10-1-14 Hoke10-1-14 Hyde10-1-14 Wayne10-1-14 Wilkes10-1-14 Wilson10-1-14 Iredell10-1-14 Jackson10-1-14 Yadkin10-1-14 Yancey10-1-14 Watauga10-1-14 Page 3 E-588SC Web-Fill 10-14 General Instructions - Complete this Web-Fill form in its entirely on your computer, print the completed form, and mail form and supporting documentation to the Department. - This form is for use only by a purchaser who receives a refund on any portion of the sales price of a taxable service contract from a person other than the retailer required to remit the sales and use tax on the retail sale of the service contract provided sales and use tax was originally charged on the sales price of the service contract and the service contract was sold on or after October 1, 2014. If the amount refunded to the purchaser by the person does not include the sales and use tax originally paid on the taxable pro rata share of the sales price of the service contract that was sold on or after October 1, 2014, then the purchaser may apply to the Department for a refund of the pro rata amount of the sales and use tax originally paid based on the taxable amount of the service contract refunded to the purchaser. - Sales and use taxes for which a refund is allowed directly to the purchaser for sales and use tax paid on a taxable service contract that was sold on or after October 1, 2014 are not an overpayment of tax and do not accrue interest as provided in N.C. Gen. Stat. § 105-241.21. - The Department will take one of the following actions within six months after the date the claim is filed: (1) Send the requested refund to you; (2) Adjust the amount of the refund; (3) Deny the refund; or (4) Request additional information. If the Department does not take one of the actions within six months, the inaction is considered a proposed denial of the requested refund. If you object to a proposed denial of a refund, you may request a Departmental review of the action provided the request is made in writing and filed within 45 days of the date the notice of proposed denial was mailed to you. If the Department has not taken action within six months after the date the claim was filed, a request for review can be filed at any time between the end of the six-month period and when the Department takes a prescribed action. If a timely request for a Departmental review is not filed, the proposed action is final and is not subject to further administrative or judicial review. -If you have questions about how to complete this form, you may call the Taxpayer Assistance and Collection Center tollfree at 1-877-252-3052. Line by Line Instructions Line 1 - If county and transit taxes included on this form were paid in only one county, enter the name of that county. If county and transit taxes were paid for more than one county, do not enter a county name on Line 1. Line 2 - Enter the service contract amount refunded (Amount will not include any sales and use tax previously paid) that was received from a person other than the retailer required to remit the sales and use tax on the retail sale of the service contract that was sold on or after October 1, 2014. Line 3 - Compute the general State tax amount by multiplying the amount on Line 2 by 0.0475 (4.75%). Line 4 - Compute the county tax amount by multiplying the amount on Line 2 by the corresponding rate for the correct county from the table on page 2 based on the original purchase date of the sales contract invoice or sales documentation. Line 5 - Compute the transit tax amount by multiplying the amount on Line 2 by 0.005 (0.50%) for the eligible counties from the table on page 2. Line 6 - Enter the total amount of State, county, and transit tax refund requested by adding Lines 3, 4, and 5. Line 7 - Allocate the amount of county tax included on Line 4 to the applicable rate and enter on Line 7 under County 2.00% Tax or County 2.25% Tax. Enter the transit tax amount included on Line 5 under Transit 0.50% Tax if applicable. If county tax or transit tax was paid in more than one county, complete Form E-536R, Schedule of County Sales and Use Taxes for Claims for Refund, to identify the applicable rates and individual counties to which sales and use tax was paid for the period. The total of all entries on Form E-536R should equal the total of the county and transit tax shown on Line 7.

© Copyright 2026