Document 378230

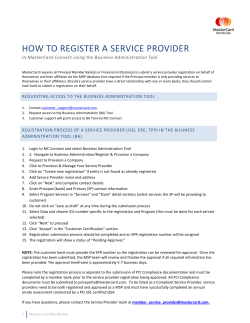

PCImonday_pp01_03_07_10_FINAL.qxp 10/26/2014 8:35 PM Page 1 MONDAY CONFERENCE NEWS | 2014 ANNUAL MEETING Time of disruptive transformation sets stage for 2014 conference IN BRIEF International group unveils capital requirements for insurers The International Association of Insurance Supervisors has developed the first global insurance capital standard, the Basel, Switzerland-based group of international insurance regulators said. Known as the Basic Capital Requirements for Global Systemically Important Insurers, standards initially would apply to Allianz S.E., American International Group Inc., Assicurazioni Generali S.p.A., Aviva P.L.C., Axa S.A., MetLife Inc., Ping An Insurance (Group) Co. of China Ltd., Prudential Financial Inc. and Prudential P.L.C. U.S. property/casualty insurers tap reserves most since 2007 U.S. property/casualty insurers tapped policyholders’ reserves in 2013 to bolster profitability the most since 2007, according to the 2014 “Insurance Risk Benchmarks Research: Annual Statistical Review.” The report was released Sunday by Marsh & McLennan Cos. Inc. subsidiaries Guy Carpenter & Co. L.L.C. and Oliver Wyman. Another key finding is that total P/C industry premiums increased by 4.4% in 2013 over 2012. XL North America names North America P/C COO XL Group P.L.C. has named Donna Nadeau chief operating officer of North America property/casualty. She will manage the operational functions of XL Group’s North America property/casualty business, including property, excess/ surplus, environmental, construction, excess casualty, programs and global risk management. OCTOBER 27, 2014 BY MARK A. HOFMANN T he theme of this year’s Property Casualty Insurers Association of America’s annual conference — “Leading in an Age of Disruptive Transformation” — comes at a time when the insurance industry, the nation and the economy face a period of accelerating change. “Uncertainty has manifested itself full-blown into an era of disruptive transformation,” PCI President David Sampson said. “We don’t develop these conference themes in a vacuum.” “To have a conference that talks about transformation and recognizes that we have to be part of it, or maybe ahead of it, is a useful theme,” incoming PCI Chairman Terry W. Cavanaugh said. “Obviously, we’re (the insurance industry) a big part of the economy,” said Mr. Cavanaugh, who is also president and CEO of See THEME page 7 Outgoing chairman proud of PCI’s thought leadership BY MARK A. HOFMANN T he Property Casualty Insurers Association of America is in great shape as he makes an exit, outgoing Chairman Robert Restrepo said. Mr. Restrepo, who is chairman, CEO and president of State Auto Insurance Cos. of Columbus, Ohio, said that’s because PCI President David Sampson has “recruited and developed a terrific staff,” which has allowed the group to be a thought leader in the industry. That’s been particularly important during the year of Mr. See RESTREPO page 10 Robert Restrepo PCI PRIORITIES OUT & ABOUT ON THE SCENE Focus is on TRIA and emerging risks Scottsdale sights, activities and dining Photos from the area and conference PAGE 3 PAGE 6 PAGE 8 Entire contents copyright by Crain Communications Inc. All rights reserved. Aon Benfield As a trusted adviser, Aon Benfield utilizes unmatched risk data and market insights to reduce clients’ exposures. Visit aonbenfield.com to learn how our award-winning teams provide solutions to overcome even your greatest challenges and steer your business on the best course. Move FORWARD with a TRUSTED PARTNER Risk. Reinsurance. Human Resources. 14bi0313.pdf RunDate: 10/27/14 PCI SD Full Page Color: 4/C PCImonday_pp01_03_07_10_FINAL.qxp 10/26/2014 8:35 PM Page 2 MONDAY OCTOBER 27, 2014 PCI DISPATCHES Terrorism backstop extension, financial regulations top PCI agenda BY MARK A. HOFMANN BY MATTHEW LERNER Welcome to PCI’s 2014 conference E ven though it was chosen months ago, the theme for this year’s annual meeting — “Leading in an Age of Disruptive Transformation” — seems particularly appropriate in light of recent events. Insurance executives find they have no choice but to navigate a sometimes trying new world. Keeping up with ever-changing technology demands constant attention. The emergence of the sharing economy and potentially game-altering technological changes such as driverless cars present new challenges. External disruptions such as the Ebola outbreak and the possibility of Islamic Stateinspired terrorism on U.S. soil underscore the evolving landscape of risk — and opportunity. This conference provides numerous opportunities to learn new lessons in leadership in turbulent times. One speaker alone — former Secretary of Defense, CIA Director and Texas A&M University President Robert Gates — has the experience of providing such leadership under more trying circumstances, than virtually any other dozen people put together. There’s no way to avoid the turbulence that confronts the insurance world and beyond. This year’s conference appears guaranteed to provide proven guidance in how to deal with it, and even prosper while doing so. S ecuring an extension of the federal terrorism insurance backstop created by the Terrorism Risk Insurance Act of 2002 tops the agenda for the Property and Casualty Insurers Association of America, but it’s far from the organization’s sole concern. The insurer trade group has considerably more on its plate, including regulatory issues and unforeseen aspects of emerging ride-sharing businesses, PCI President David Sampson said. “The most important priority for the remainder of 2014 is to secure the reauthorization of the Terrorism Risk Insurance Act, which expires Dec. 31,” he said. “That has been our top federal legislative priority for this year.” “I don’t think anyone believes that it is in the best interests of the nation or the economy, at a time of significantly heightened international terrorist threats upon the homeland, that this pro- David Sampson, president of the Property Casualty Insurers Association of America. gram expire,” Mr. Sampson said. He seemed optimistic that a resolution could be reached. “There’s been a lot of progress throughout the course of the year,” he said, noting that the Senate had approved reauthorization by a 94-3 vote and that the House Financial Services Committee passed a version of the bill this summer. “Every indication we have had from our extensive and ongoing visits with key leaders on the Hill is that everyone recognizes this is a ‘must do’ piece of legislation,” Mr. Sampson said. He pointed to the nearly unanimous nature of the Senate vote. “It’s pretty miraculous when you consider the gridlock and hyperpartisanship in Washington that you could have an overwhelmingly bipartisan support for reauthorization of this federal backstop,” he said. The question now is the “end game,” Mr. Sampson said. “That will be our top priority as we look forward to Congress coming back for the lame-duck session after the (November) election.” Also on the PCI agenda of critical priorities is “the continuing global regulatory convergence that would seek to impose onesize-fits-all bank-centric capital See PRIORITIES page 10 Insurance firms cited as best workplaces A record 75 insurance industry companies were recognized in the 2014 Business Insurance Best Places to Work in Insurance program. Best Places to Work is a joint effort of Business Insurance and the Harrisburg, Pennsylvania-based Best Companies Group. The program, which involves months of in-depth evaluation, is open to all public or privately held property/casualty insurers, group life/health insurers, retail agents and brokers, wholesale brokers/ managing general agents, reinsurers, reinsurance brokers, benefits brokers and advisers, and claims managers with at least 25 employees in the United States and serving the commercial insurance market. This is the sixth year for the Best Places to Work in Insurance program. Companies recognized this year range in size from 30 to 8538 employees and create workplaces in which employees can thrive. Best Companies Group, an independent workplace excellence research firm that manages other industry and regional programs in the United States and Canada, managed the registration process, conducted the surveys, evaluated the data and selected the firms chosen as Best Places to Work in Insurance. Each company had to demonstrate a minimum standard of excellence to earn a spot on the list. Participation in the program was free. Participating companies can buy the BCG Employee Feedback Report that summarizes data collected in the employee survey process. BUSINESS INSURANCE PCI SHOW DAILY 2014 3 PCImonday_p04_FINAL.qxp 10/26/2014 8:21 PM Page 1 MONDAY OCTOBER 27, 2014 Insurance-linked securities could break record STEVEN CHANG MUNICH REINSURANCE CHINA CO. Steven Chang is CEO of Munich Reinsurance China Co. in Beijing. He joined American Re, part of Munich Reinsurance Co., in 1997. From 2002 until 2008, he was chief representative in Munich Re’s office in Shanghai, before moving back to Beijing to become deputy CEO of Munich Re’s Beijing branch office before becoming CEO a year later. He spoke to Business Insurance Senior Editor Sarah Veysey during the Rendez-vous de Septembre in Monte Carlo, Monaco. Edited excerpts follow. BY MATTHEW LERNER D espite a slow third quarter for insurance-linked securities which only saw one transaction come to market, 2014 will still likely surpass 2007’s record year for these nonlife securities, according to a report by Willis Group Holdings P.L.C.’s Willis Capital Markets & Advisory unit. Third-quarter issuance “was comparatively slow relative to the record-breaking second quarter, with quarterly issuance volume the lowest since 2010,” according to the report “No Surprises.” The only third-quarter transaction was Golden State Re II, which closed Sept. 16 and provides California’s State Compensation Insurance Fund, the state’s largest workers compensation insurance provider, with $250 million of fully collateralized workers comp coverage against California earthquake risks for a period of just over four years. The latest quarter also pales compared with the record-breaking third quarter of 2013, when $1.4 billion of nonlife catastrophe bond capacity was issued, Willis said in a statement. Senior Willis executives, however, remain confident that 2014’s total will still surpass the just over $7 billion issued in 2007. The third quarter “followed a robust issuance season with new capital having already been deployed. It will only take about $1.2 billion more in 2014 to break 2007’s nonlife ILS issuance record, so we believe this is incredibly likely,” said Willis Capital Markets & Advisory CEO Tony Ursano in a statement. “We maintain our prediction of a final tally between $8 and $9 billion of non-life ILS issuance,” said Bill Dubinsky, head of ILS at WCMA, in the statement. 4 PCI SHOW DAILY 2014 Munich Re China has specialty focus Q A What is the reinsurance market like in China? In China, there are three segments to the reinsurance market: China Re, the governmentowned reinsurer that plays a dominant role in both life and property and casualty; seven reinsurers, including Munich Re and Hannover Re Group, that have opened up in China; and companies writing China business from outside. From a Munich Re perspective, we always position ourselves as a premium provider. In my portfolio, about 80% of the business is specialty based on bilateral agreement with buyers. risk-based. For example, for natural catastrophe risk, the capital requirements for reinsurers will increase. We really welcome this change because it is an alignment with how we operate in the home office. Currently, for reinsurance branch offices, no capital must be held locally. But under the CROSS draft, we would be required to establish local capital. That is quite a change for us, but it will be an even larger change for those overseas companies writing China reinsurance business because there will be a credit risk capital charge for those reinsurers that run on an overseas basis. Q A What effects are regulatory changes having on the market? Q A There are several regulatory changes taking place. The China Insurance Regulatory Commission (with its China Risk Oriented Solvency System slated for finalization by the end of this year, a transitional period in 2015 and full implementation in 2016) decided to largely follow the theme of Solvency II but made it very clear that it had to reflect the specifics of China. At the moment, C-ROSS is very BUSINESS INSURANCE Are there any areas of business that are ripe for development? The government earlier this year published a document on how it thinks the insurance market can support the development of the economy. For natural catastrophe, we see three layers of development. First, the development of a national natural catastrophe pool — we will try to support the regulator and our clients to do groundwork on that. Secondly, the development of regional natural catastrophe pools — we’ll try to develop solutions at the provisional level. And third, commercial natural cat business — we actively support our clients there. In the coming three to five years, natural catastrophe will become one of the most important areas for the reinsurance industry in China. And various liability classes — for example, food security is a very important topic, as is environmental liability. Also, because of the development of the middle class in China, there is great potential for personal lines business. The challenge we have is the need to develop the primary market knowledge. We think we have the know-how to do it, and we bring mature products from our home office. Q How can companies increase their penetration in the Chinese reinsurance market? A A presence in the market is very important, obviously. But when you have a presence, you have to understand the market and judge how the market will develop. We think that a local team is important because you can link culturally and be close to the client. Your in-depth knowledge Our unique perspective A clearer view of what’s ahead What will future economic and societal trends bring? What legal reforms may lie ahead? What will their impact be? The past is not always helpful in forecasting the future. Our forward-looking modelling is a radical new approach to assessing liability risks. It provides a unique perspective – one that’s particularly useful in markets where past data is unavailable or unsuitable. It brings our vision of what lies ahead into sharper focus. And it enables us to identify future casualty trends together, anticipate the impact of developments, and manage future exposure. Looking for a partner who’ll keep you ahead of the game? We’re smarter together. www.swissre.com/pci2 Size 8.125X 10-7/8 - .125” bleed set up as 4 color - file: ARM-14-05220-P1-BUSINEES_INSURANCE_PCI-Dailie-10-6 PCImonday_p06_FINAL.qxp 10/26/2014 8:27 PM Page 1 MONDAY SCOTTSDALE CONVENTION & VISITORS BUREAU OCTOBER 27, 2014 LOCAL FLAVOR BOOTLEGGERS MODERN AMERICAN SMOKEHOUSE 7217 E. First St. Scottsdale 480-404-9984 For your inner meat lover, try the signature Bacon Board or the 14hour hickory-smoked brisket, amid the barn-wood walls and high, wood-beam ceilings. With Chef James Fox at the helm and Matt Carter overseeing culinary development, Bootleggers is the place for the meat enthusiast. THE SIGHTS I BROWN’S CLASSIC AUTOS f you’re looking for natural beauty and a connection to the land, The McDowell Sonoran Preserve gives visitors the chance to hike, climb and even explore on horseback. The preserve, protected by the McDowell Sonoran Conservancy, offers more than 100 miles of trails for running, biking and riding. The Bajada Nature Trail offers an interactive experience on a halfmile barrier-free interpretive trail. The conservancy encompasses more than 30,000 acres with almost 130 miles of trails. Trailhead gates are open from sunrise to sunset, and there is no charge for parking or access. One of the most popular public BROWN’S CLASSIC AUTOS 16066 N. 77th St. Scottsdale 480-998-4300 For a more industrial, manmade experience, auto fans can visit Brown’s Classic Autos to see a vast selection of automotive history. The dealership can provide everything from retail sales and consignments to classic rebuilds and restorations. 6 PCI SHOW DAILY 2014 BUSINESS INSURANCE McDowell Sonoran Preserve 18333 N. Thompson Peak Parkway Scottsdale 480-312-7013 educational features is the conservancy’s hike program, which provides guided experiences with an interactive opportunity for volunteers to share their expertise about what lives along preserve trails, including Sonoran Desert plants, wildflowers, wildlife and the geology of the McDowell Mountains. Visitors also can take advantage of rock climbing at the conservancy. Climbers follow a rock-climbing plan that includes designated trails to historic climbing crags, associated parking lots, and clear and accurate signage. Most trails in the preserve are available for horseback riding, which is a great way to visit some of the remote areas. In 2013, the preserve opened Brown’s Ranch Trailhead in North Scottsdale. The hike is a three-mile round trip that provides great views of Brown’s Mountain. RUSTY SPUR SALOON 7245 E. Main St. Scottsdale 480-425-7787 Ensconced in a registered historic landmark — Farmers Bank of Scottsdale, which operated from 1921 to 1931 and closed during the Great Depression — the saloon bills itself as the city’s “Last Real Cowboy Saloon” and boasts a celebrity clientele including John Wayne and Clint Eastwood. PCImonday_pp01_03_07_10_FINAL.qxp 10/26/2014 8:36 PM Page 3 MONDAY OCTOBER 27, 2014 THEME Continued from page 1 Erie, Pennsylvania-based Erie Insurance Group. “Clearly we have to respond to the consumer behavior we see, the technology and innovation that’s going on and we’ve got to be part of that,” Mr. Cavanaugh said. Mr. Sampson said that each year’s conference theme is chosen by a group of executives of PCI’s member insurance companies. “The disruptive transformation we’re seeing is occurring on many fronts,” Mr. Sampson said. These include regulation, technology and demographics. Demographics must be confronted in two ways, he said. “There is a changing demographic of consumers as well as a changing demographic of the workforce,” Mr. Sampson said. opportunities, Mr. Sampson said. Companies need to know how to For insurance executives, the key questions are “How do they need adapt to both of those, he said. In addition, “our member execu- to think in this age?” and “What tives are going to have to navigate kind of questions do they need to a state, federal and international ask?” Organizations need to be preregulatory environment that is rapidly changing,” Mr. Sampson pared to recognize the economic opportunities that exist said. in a period of disruptive At the same time, they transformation, the PCI are also trying to anticipresident said. pate and innovate busi“What are the implicaness models. tions for new business For example, technolmodels” of such develogy is disrupting busiopments as the sharing ness models a lot of the time, he said, adding Terry Cavanaugh economy, driverless cars and greater use of that technology is telematics? “How will they affect “evolving at a lightning pace.” The emergence of the sharing underwriting practices and priceconomy, with ride-sharing com- ing practices going forward?” he panies such as Uber and Lyft asked. Mr. Sampson said the conferbeing used by consumers via mobile phone applications, is one ence’s featured speakers will example of how technology is dis- address the issue from different vantage points. rupting business models. Former Secretary of Defense, This presents both threats and CIA Director and Texas A&M University President Robert Gates today will address the disruptive transformation going on internationally and how it is fundamentally unsettling the global economy. In his presentation, Mr. Gates will examine the threats this transformation presents to U.S. national security. He’ll also speak about his leadership approach in helping large organizations adapt during a period of disruptive transformation. Other conference speakers include Luke Williams, professor of innovation and executive director of the Berkley Entrepreneurship Center at New York University’s Stern School of Business; Larry Sabato, election analyst and founder of the University of Virginia Center for Politics; and demographer Neil Howe. A lineup of timely panel discussions is also scheduled. BUSINESS INSURANCE PCI SHOW DAILY 2014 7 PCImonday_p08_FINAL.qxp 10/26/2014 8:31 PM Page 1 MONDAY OCTOBER 27, 2014 PCI SCENE SCOTTSDALE ■ 2 0 1 4 ■ 8 PCI SHOW DAILY 2014 BUSINESS INSURANCE EVENTS KEYNOTE SPEAKER Brian Duperreault CEO of Hamilton Insurance Group Leadership Workshop & Awards Ceremony December 9, 2014 - New York Marriott Marquis JOIN US IN CELEBRATING THE 9TH ANNUAL WOMEN TO WATCH • Jennifer Barton, Willis North America Inc. • Leah Binder, The Leapfrog Group KEYNOTE SPEAKER Sally Hogshead World-class branding expert and best-selling author • Beth Bombara, Hartford Financial Services Group Inc. • Jacqueline Day, Control Risks Group Holdings Ltd. • Marialuisa Gallozzi, Covington & Burling L.L.P. • Dorothy Gjerdrum, Arthur J. Gallagher & Co. • Cary Grace, Aon Hewitt • Tracie Grella, American International Group Inc. SPONSORS P L AT I N U M • Donna B. Hodges, Alliant Insurance Services Inc. • Anita Ingram, University of Cincinnati • Amy Kessler, Prudential Financial Inc. • Joann M. Lytle, McCarter & English L.L.P. • Carmen Ortiz-McGhee, Aon Risk Solutions • Nicola Parton, Swiss Re Ltd. • Kathleen Reardon, Hamilton Insurance Group Ltd. • Lindsay Rios, Matrix Healthcare Services Inc., dba myMatrixx • Tracy Ryan, Liberty Mutual Insurance Co. GOLD • Deborah Stalker, Ace Ltd. • Kathryn Tazic, Sedgwick Claims Management Services Inc. • Iris Teo, Marsh L.L.C. • Sherry L. Thomas, Guy Carpenter & Co. L.L.C. • Karen Vines, IMA Financial Group Inc. • Donna J. Vobornik, Dentons US L.L.P. • Kim Wilkerson, XL Group P.L.C. • Tracy D. Williams, Sidley Austin L.L.P. H OW YO U C A N PA R T I C I PAT E : MARY PEMBERTON [email protected] - 303.898.4043 S I LV E R REGISTER NOW: WWW.BUSINESSINSURANCE.COM/WOMENTOWATCH Business Insurance started the Women to Watch awards program in 2006 to recognize women leaders doing outstanding work in the insurance sector and risk and benefits management. We invited Business Insurance readers to nominate candidates for Women to Watch, and a panel of BI editors selected the honorees based on those nominations. Profiles of the 2014 honorees will be published in the Dec. 8 edition of Business Insurance, and the honorees will be recognized at an awards event in New York on Dec. 9. 14bi0321.pdf RunDate: 10/27/14 PCI SD Full Page Color: 4/C PCImonday_pp01_03_07_10_FINAL.qxp 10/26/2014 8:37 PM Page 4 MONDAY OCTOBER 27, 2014 RESTREPO Continued from page 1 Restrepo’s chairmanship. Working toward PCI’s top priority — reauthorization of the federal terrorism insurance program created by the Terrorism Risk Insurance Act of 2002 — has not been easy. Congress has yet to renew the program, which is slated to expire on Dec. 31, but appears likely to vote on the issue during next month’s lame-duck session. “We would have preferred to have the bill passed and signed earlier,” Mr. Restrepo said. There is a “great need for the type of security TRIA will provide,” he said, adding that he’s reasonably confident it will be renewed before the end of the year. He said PCI has been able to provide information to senators and congressmen regarding what PRIORITIES Continued from page 3 and regulatory standards on the insurance industry,” he said. “This is an issue that has continued to grow over the past year,” Mr. Sampson said, as international regulatory bodies “are becoming more and more opaque and less open in terms of the process by which they make these decisions.” Along the same lines, the organization will continue trying to pare would happen if TRIA were not passed by Congress. “I’m very proud of the association being a thought leader in providing information,” he said. Another issue that has continued to evolve this year is global regulatory convergence. “As an industry, we used to be concerned about Washington” becoming more involved in insurance regulation, he said. Now the issue is international regulation, he said. PCI has been trying to educate regulators about why the statebased regulatory system is best. “Why would we want to adopt what we think is a bank-centric regulatory system when the current system is working fine?” Mr. Restrepo said. PCI also has had to respond to economic developments such as the emergence of commercial ridesharing ventures, he said. The result has been the creation of what he calls “real gaps in insur- ance coverage for both the folks who are driving as part of this transportation network, as well as people riding,” he said. PCI has been “very aggressive” in working with regulators and legislators about confronting the risks involved, Mr. Restrepo said. “To a large degree PCI’s challenges reflect the challenges of its members,” he said. “The rate of change has accelerated on all fronts.” In addition to regulatory trends, insurers must deal with a changing workforce. The property/casualty insurance industry is “going to lose hundreds of thousands of people over the next five to 10 years,” he said. Recruiting is a challenge for all of PCI’s members, Mr. Restrepo said, and he sees the industry group continuing to provide role models and information to a new generation of professionals entering the industry. similar efforts made by the Collins Amendment to the Dodd-Frank Wall Street Reform and Consumer Protection Act. “There’s been a lot of progress this year on a fix to the Collins Amendment, which imposed bankcentric-type capital standards on insurers as part of the Dodd-Frank Act,” Mr. Sampson said. The emergence of insurance issues related to the evolving U.S. economy, including services such as ride-share startup Uber, also have landed on PCI’s plate. These issues “kind of exploded onto the scene this year” after a tragic fatal accident involving an Uber driver and a young girl in San Francisco on New Year’s Eve 2013, he said. “We have expended very serious effort on that set of issues this year with some very significant developments,” Mr. Sampson said, referring to the passage of a California law that seeks to establish insurance requirements for such ride-share companies. “We hope the California law will become a model law for other states,” he said. PCI DAILY COVERAGE AVAILABLE IN ONLINE EDITION Business Insurance is offering PDF versions of its daily news from the Property Casualty Insurers Association of America’s annual meeting in Scottsdale. To share meeting news with colleagues or to revisit information after the event, go to www.businessinsurance.com. 10 PCI SHOW DAILY 2014 BUSINESS INSURANCE Publisher: Frank Quigley (Chicago) Associate Publisher/ Online General Manager: Paul D. Winston (Chicago) Editor: Gavin Souter (Chicago) Editor-at-Large: Jerry Geisel (Washington) Managing Editor: Paul Bomberger (Chicago) Assistant Managing Editors: Charmain Benton (Chicago); Aranya Tomseth (Chicago) Art Editor: William Murphy (Chicago) Senior Editors: Judy Greenwald (San Jose); Mark A. Hofmann (Washington); Sarah Veysey (London); Joanne Wojcik (Denver); Associate Editors: Matt Dunning (New York); Stephanie Goldberg (Chicago); Sheena Harrison (Chicago); Bill Kenealy (Chicago) Matthew Lerner (New York) Copy Desk Chief: Katherine Downing (Chicago) Copy Editor: Dave Roknic (Chicago) Copy Editor/Video Producer: Jewell C. Washington (Chicago) Director of Research: Angelina Villarreal (Chicago) Editorial Cartoonist: Roger Schillerstrom (Chicago) Advertising Sales Director: Peter Oxner (Chicago) Northeast Regional Sales Manager: Ron Kolgraf (Boston) Mid-Atlantic Advertising Manager: Mark Krawiec (New York) Midwest/West Advertising Manager: Spencer Moysey (Chicago) Director of Conference Sales: Mary Pemberton (Denver) Custom Media Business Development Director: Kimberly Jackson (Boston) Account Executive: Pegeen Prichard (Chicago) Director of Demand Generation Services: Par Gandhi (New York) Sales & Marketing Assistant: Emily Stein (Chicago) Production Manager: J. Thomas Janka (Chicago) Associate Group PublisherConferences & Marketing Services: Nikki Pirrello (New York) Director of Audience Development: Sherry Skalko (Chicago) Digital Product Manager: Christina Kneitz (Chicago) Reprint Sales Manager: Lauren Melesio (New York) EDITORIAL: Chicago: 312-649-5200; Denver: 303-278-7444; London: 44-207-457-1400; New York: 212-210-0100; San Jose: 408-774-1500; Washington: 202-662-7200 ADVERTISING: Boston: 617-292-4856; Chicago: 312-649-5224; Denver 303-898-4043; New York: 212-210-0136 SUBSCRIPTIONS & SINGLE COPY SALES: 1-877-812-1587 (U.S. & Canada) 1-313-446-0450 (All other locations) Business Insurance is published by Crain Communications Inc. Crain Communications Inc. Board of Directors Chairman: Keith E. Crain President: Rance Crain Treasurer: Mary Kay Crain Cindi Crain Executive Vice President/Operations: William A. Morrow Executive Vice President/ Director of Strategic Operations: Christopher Crain Senior Vice President/Group Publisher: David Klein Chief Financial Officer: Thomas Stevens Group Publisher: Chris Battaglia Vice President/Production & Manufacturing: Dave Kamis Chief Information Officer: Anthony DiPonio G.D. Crain Jr.: Founder (1885-1973) Mrs. G.D. Crain Jr.: Chairman (1911-1996) Merrilee P. Crain: Secretary (1942-2012) S.R. Bernstein: Chairman-executive committee (1907-1993) PHOTOS BY MICHAEL MARCOTTE Help your industry attract top talent. Introducing An industry-wide collaborative initiative to inform and excite the next generation about the limitless career paths in insurance. Become a partner today. Learn how at www.InsureMyPath.org/GetInvolved 14bi0316.pdf RunDate: 10/27/14 PCI SD Powered by Full Page Color: 4/C A CONTRACT IS A LEGAL DOCUMENT. A TRUE PARTNERSHIP IS SO MUCH MORE. Our experience, expertise and track record are only meaningful if we are able to help our clients. We will listen carefully to your goals and challenges and we will leverage our deep and varied resources to deliver a solution that meets your needs. Find out what you can expect from a true partner at partnerre.com 14bi0317.pdf RunDate: 10/27/14 PCI SD Full Page Color: 4/C

© Copyright 2026