Document 398588

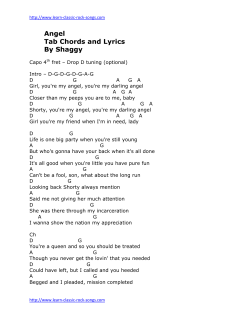

2QFY2015 Result Update | IT October 31, 2014 Tech Mahindra BUY Performance Highlights CMP Target Price (` cr) 2QFY15 1QFY15 % chg (qoq) 2QFY14 Net revenue 5,488 EBITDA 1,097 EBITDA margin (%) Adj. PAT % chg (yoy) 5,122 7.2 4,772 15.0 928 18.2 1,111 (1.2) 20.0 18.1 187bp 23.3 (329)bp 720 631 14.1 718 0.2 Source: Company, Angel Research; For 2QFY2015, Tech Mahindra posted marginally better-than-expected numbers on the top-line front, while the net profit came in below expectations. The company posted a revenue of US$900mn (V/s an expected US$890mn), a qoq growth of 5.2%. Revenue in Constant Currency (CC) terms rose 6.2% qoq. On the operating front, the EBIT margin came in at 17.4% (V/s an expected 17.2%), an expansion of ~220bp qoq, on lower employee costs during the period. Thus, the net profit came in at `720cr (V/s an expected `748cr) a 14.1% qoq growth. The net profit was impacted by a forex loss of `45.8cr, incurred during the quarter. We maintain our Buy recommendation on the stock with a price target of `2,887. Result highlights: For the quarter, the company posted marginally better-thanexpected numbers on the top-line front, while the net profit came in below expectations. The company posted a revenue of US$900mn (V/s an expected US$890mn), a qoq growth of 5.2%. Revenue in Constant Currency (CC) terms rose 6.2% qoq. On the operating front, the EBIT margin came in at 17.4% (V/s an expected 17.2%), an expansion of ~220bp qoq, on lower employee costs during the period. Thus, the net profit came in at `720cr (V/s an expected `748cr) a 14.1% qoq growth. The net profit was impacted by a forex loss of `45.8cr, incurred during the quarter.. Outlook and valuation: The Management remains confident of growth from the non-British Telecom (BT) business with the company continuing to see a robust deal pipeline across geographies. We expect a CAGR of 15.7% and 15.0% in USD and INR revenue respectively over FY2014-16E. The PAT is expected to grow at a CAGR of 21.8% over FY2014-16. We maintain our Buy rating on the stock with a target price of `2,887. `2,480 `2,887 Investment Period 12 months Stock Info IT Sector Market Cap (` cr) 58,413 Net debt (` cr) (4,393) Beta 0.3 52 Week High / Low 2,542/1,516 Avg. Daily Volume 74,226 Face Value (`) 10 BSE Sensex 27,346 Nifty 8,169 Reuters Code TEML.BO TECHM@IN Bloomberg Code Shareholding Pattern (%) Promoters 36.0 MF / Banks / Indian Fls 12.7 FII / NRIs / OCBs 40.6 Indian Public / Others 10.7 Abs. (%) Sensex Tech Mahindra 3m 1yr 3yr 4.8 30.0 53.6 15.0 59.5 322.5 Key financials (Consolidated, Indian GAAP) Y/E March (` cr) FY2012 FY2013 FY2014 FY2015E FY2016E Net sales 11,702 14,332 18,831 21,636 24,211 % chg 127.7 22.5 31.4 14.9 11.9 Net profit 1,806 2,115 2,671 3,187 3,900 % chg 129.8 17.1 26.3 19.3 22.4 EBITDA margin (%) 16.7 21.4 22.2 22.3 22.3 EPS (`) 78.2 91.3 114.4 136.5 167.0 P/E (x) 31.7 27.2 21.7 18.2 14.8 P/BV (x) 6.8 8.6 6.4 4.8 3.7 RoE (%) 37.5 30.9 29.1 26.3 24.4 RoCE (%) 20.1 27.6 31.3 28.8 25.8 4.8 3.9 2.9 2.4 2.0 28.8 18.2 12.9 10.6 8.9 EV/Sales (x) EV/EBITDA (x) Source: Company, Angel Research; Note: CMP as on October 30, 2014 Please refer to important disclosures at the end of this report Sarabjit kour Nangra +91 22 3935 7800 Ext: 6806 [email protected] 1 Tech Mahindra | 2QFY2015 Result Update Exhibit 1: 2QFY2015 performance (Consolidated, Indian GAAP) (` cr) 2QFY15 1QFY15 % chg (qoq) 2QFY14 % chg (yoy) 1HFY15 1HFY14 % chg (yoy) Net revenue 5,488 5,122 7.2 4,772 15.0 10,609 8,875 19.5 Cost of revenue 3,616 3,439 5.1 2,883 25.4 7,055 5,452 29.4 Gross profit 1,872 1,682 11.3 1,889 (0.9) 3,554 3,423 3.8 775 754 2.7 778 (0.4) 1,529 1,447 5.6 SG&A expense EBITDA 1,097 928 18.2 1,111 (1.2) 2,026 1,976 2.5 Dep. and amortization 143 149 (4.5) 122 16.6 292 240 21.5 EBIT 955 779 22.5 989 (3.4) 1,734 1,736 (0.1) 4 4 24 8 46 58 89 38 147 245 Interest Other income PBT 1,008 864 16.6 1,003 0.5 1,873 1,935 (3.2) Income taxes 281 231 21.6 284 (1.2) 512 517 (1.1) PAT 728 634 14.8 719 1.2 1,361 1,418 (4.0) 8 3 11 13 720 631 1,350 1,405 Profit from associates - - - - - Exceptional item - - - - - Reported PAT 720 631 14.1 718 0.2 1,350 1,405 (3.9) Adj. PAT 720 631 14.1 718 0.2 1,350 1,405 (3.9) Diluted EPS 29.8 26.2 14.0 30.3 (1.6) 126.8 59.3 113.8 Gross margin (%) 34.1 32.8 126bp 39.6 (548)bp 33.5 38.6 (507)bp EBITDA margin (%) 20.0 18.1 187bp 23.3 (329)bp 19.1 22.3 (317)bp EBIT margin (%) 17.4 15.2 218bp 20.7 (332)bp 16.3 19.6 (322)bp PAT margin (%) 13.1 12.3 80bp 15.1 (194)bp 12.7 15.8 (310)bp Minority interest PAT after minority interest 0 14.1 718 0.2 (3.9) Source: Company, Angel Research Exhibit 2: 2QFY2015 – Actual vs Angel estimates (` cr) Actual Estimate Var. (%) Net revenue 5,488 5,409 1.5 EBIT margin (%) 17.4 17.2 20bp PAT 720 748 (3.8) Source: Company, Angel Research Strong revenue growth The company posted a revenue of US$900mn (V/s an expected US$890mn), posting a qoq growth of 5.2%. In INR terms, the company posted net sales of `5,488cr (V/s an expected `5,409cr), a qoq growth of 7.2%. Revenue in Constant Currency (CC) terms grew 6.2% qoq, during the period. In terms of geography, the growth was mainly driven by USA, which posted a qoq growth of 9.7%, mostly driven by top clients. The company also added new clients with the repeat business dipping to 97% from 99% in 1QFY2015. In terms of verticals, the Telecom sector grew by 7.3% qoq, Manufacturing 5.2% qoq and BFSI grew by 5.2% qoq, while Technology, Media & Entertainment declined by 6.5% qoq. October 31, 2014 2 Tech Mahindra | 2QFY2015 Result Update Exhibit 3: Trend in revenue growth (qoq) 950.0 7.0% 5.2% 900.0 3.7% 800.0 5.0% 4.3% 850.0 6.0% 4.0% 4.4% 4.7% 3.0% 750.0 2.0% 700.0 1.0% 0.0% 650.0 2QFY14 3QFY14 4QFY14 Sales ( in US $mn) 1QFY15 2QFY15 qoq (%) Source: Company, Angel Research Exhibit 4: Growth in industry segments Particulars % to revenue % growth (qoq) % growth (yoy) Telecom 52% 7.3 28.6 Manufacturing 18% 5.2 12.5 TME 8% (6.5) (13.7) BFSI 10% 5.2 31.9 RTL 6% 5.2 18.7 Others 6% 5.2 18.7 Source: Company, Angel Research Geography wise, revenue from RoW declined by 4.3% qoq due to completion of a few system integration projects in the region. The US exhibited solid growth of 9.7% qoq, making it the second quarter of strong growth. Europe also bounced back to end the period with a qoq growth of 5.2%. Exhibit 5: Growth trend in geographies Particulars % to revenue % growth (qoq) % growth (yoy) Americas 47% 9.7 32.2 Europe 31% 5.2 11.5 RoW 22% (4.3) 3.2 Source: Company, Angel Research Hiring and client metrics During the quarter, the company reported a net addition of 2,580 employees, taking its overall headcount to 95,309. The BPO headcount has continuously been on a declining trajectory since the last few quarters and currently stands at 22,433. The company witnessed an addition of 2,080 software professionals during the quarter. The overall headcount increased by 2,580 to 95,309. Attrition (on LTM basis) was at 18%. October 31, 2014 3 Tech Mahindra | 2QFY2015 Result Update Exhibit 6: Employee metrics Particulars 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 Software professionals 55,432 57,601 60,997 64,095 66,175 BPO professionals 23,225 23,213 21,830 21,936 22,433 Sales & support 6,577 6,585 6,614 6,698 6,701 Total employees 85,234 87,399 89,441 92,729 95,309 14 15 15 16 18 Attritions (%) Source: Company, Angel Research Exhibit 7: Trend in utilization rate 76 75 (%) 74 75 75 74 73 73 72 72 71 70 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 Utilization (%) Source: Company, Angel Research In terms of client additions, the company added a net 17 clients during the period, taking the active client lists to 649 V/s 632 in 1QFY2015. A majority of the client wins have been in the US$1-5mn order size and one client was added in the >US $20mn and >US$ 50mn category respectively. Exhibit 8: Client metrics Particulars Total active clients US$1mn–5mn US$5mn–10mn US$10mn–20mn US$20mn–50mn US$50mn+ 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 576 146 29 22 16 10 605 164 28 22 14 11 629 164 23 25 16 11 632 162 29 22 18 11 649 159 36 20 18 12 Source: Company, Angel Research Operating margin dips For 2QFY2015, the company’s EBITDA margin moved up by 187bp qoq to 20.0%. Gross margin for the quarter expanded by 126bp qoq to 34.1%. The EBIT margin moved up by 218bp qoq to 17.4%, on back of absence of visa cost, leverage at SG&A from strong revenue growth, Rupee depreciation (50bp) and increased utilization. October 31, 2014 4 Tech Mahindra | 2QFY2015 Result Update Exhibit 9: Margin trend (%) 45 40 35 39.6 38.7 30 25 20 23.3 20.7 15 32.8 32.8 18.1 18.1 34.1 23.2 20.3 18.4 15.2 20.0 17.4 10 2QFY14 3QFY14 Gross margin 4QFY14 1QFY15 2QFY15 EBITDA margin EBIT margin Source: Company, Angel Research Investment arguments Growth prospects robust: The Management indicated that the company remains confident of growth from the non-BT business with it continuing to see a robust deal pipeline across geographies. Tech Mahindra has been able to scale up well across verticals through its focused approach on large deals. We expect a CAGR of 15.7% and 15.0% in USD and INR revenue respectively over FY2014-16E. Deal pipeline healthy: Tech Mahindra remains confident of improving revenue growth citing healthy deal pipeline along with pick up in discretionary spending primarily in the US. The Management sounded confident of demand from BFSI, healthcare (healthy demand across players and providers), manufacturing and retail. Tech Mahindra is following a two-pronged strategy to expand its enterprise business end-to-end offerings in leadership areas like manufacturing and niche offering-led entry strategy in areas like BFSI where it is a challenger. Better crosssell of services can help grow marquee accounts post-merger. We expect the enterprise segment growth to be led by broader revival in the markets and deepening of existing relationships. Outlook and valuation The Management expects to use the cash balance of ~US$610mn for inorganic growth initiatives. The company expects to maintain margins in the medium term through a) greater scale and hence SG&A leverage, b) improving utilization (room to improve utilization by ~200bp) and c) broadening the employee pyramid (~33% of employees in 0-3 years experience range). However, in spite of conservative estimates, wherein we have assumed EBITDA margins at 22.4% and 23.0% in FY2015 and FY2016 (almost same as 22.2% in FY2014), the stock trades at 14.6x FY2016E. We recommend a Buy on the stock with a target price of `2,887. October 31, 2014 5 Tech Mahindra | 2QFY2015 Result Update Exhibit 10: Key assumptions FY2015E FY2016E Revenue growth (US$) 16.5 15.0 USD-INR rate (realized) 60.0 60.0 Revenue growth (`) 15.0 15.0 EBITDA margin (%) 22.4 23.0 Tax rate (%) 26.3 26.4 EPS growth (%) 20.0 23.7 Source: Company, Angel Research Exhibit 11: One-year forward PE (x) 3,100 2,800 2,500 2,200 (`) 1,900 1,600 1,300 1,000 700 400 100 Oct-08 Jul-09 Apr-10 Price Jan-11 16 Oct-11 13 Jul-12 10 Apr-13 Jan-14 7 Oct-14 4 Source: Company, Angel Research. Note: P/E includes profits of Mahindra Satyam from FY2012 Exhibit 12: Recommendation summary Company Reco CMP Tgt Price Upside FY2016E FY2016E FY2014-16E FY2016E FY2016E (`) (`) (%) EBITDA (%) P/E (x) EPS CAGR (%) EV/Sales (x) RoE (%) HCL Tech Buy 1,577 1,968 24.8 24.0 14.4 11.6 2.1 23.9 Infosys Buy 3,946 4,700 19.1 27.8 16.7 11.3 2.8 20.8 TCS Accumulate 2,558 2,833 10.8 29.3 19.9 14.9 4.1 37.0 Tech Mahindra Buy 2,480 2,887 16.4 22.8 15.1 21.8 1.8 24.9 Wipro Buy 560 697 24.6 23.7 13.6 14.0 1.8 20.3 Source: Company, Angel Research. October 31, 2014 6 Tech Mahindra | 2QFY2015 Result Update Company Background Tech Mahindra was founded in 1986 as a joint venture between Mahindra Group and British Telecom (BT). Later on, it started servicing other external clients as well (solely in the telecom industry), though it still derives ~13% of its revenue from BT. In June 2009, Tech Mahindra acquired a 42.7% stake in erstwhile Satyam Computers (now Mahindra Satyam) and now the latter is entirely merged with the company. Profit and loss statement (Consolidated, Indian GAAP) Y/E March (` cr) FY2012 FY2013 FY2014 FY2015E FY2016E Net sales 11,702 14,332 18,831 21,656 24,904 Cost of revenues 7,541 9,001 11,700 13,377 15,266 Gross profit 4,162 5,331 7,131 8,279 9,638 35.6 37.2 37.9 38.2 38.7 2,210 2,268 2,948 3,438 3,910 18.9 15.8 15.7 15.9 15.7 % of net sales SG&A expenses % of net sales EBITDA 1,952 3,063 4,184 4,841 5,728 % of net sales 16.7 21.4 22.2 22.4 23.0 Dep. and amortization 319 390 522 602 626 % of net sales 2.7 2.7 2.8 2.8 2.5 1,633 2,674 3,662 4,240 5,102 % of net sales 14.0 18.7 19.4 19.6 20.5 Interest expense 107 92 67 67 67 Other income, net of forex 501 212 113 223 398 Profit before tax 2,027 2,793 3,707 4,396 5,433 Provision for tax 229 648 979 1,156 1,434 EBIT % of PBT 11.3 23.2 26.4 26.3 26.4 1,798 2,146 2,728 3,240 3,999 - - - - - Exceptional item 37 160 (217) - - Minority interest (8) 30 34 34 34 Reported PAT 1,843 1,955 2,917 3,206 3,965 Adjusted PAT 1,806 2,115 2,671 3,206 3,965 78.2 91.3 114.4 137.3 169.8 Recurring PAT Share from associates Fully diluted EPS (`) October 31, 2014 7 Tech Mahindra | 2QFY2015 Result Update Balance sheet (Consolidated, Indian GAAP) Y/E March (` cr) FY2012 FY2013 FY2014 FY2015E FY2016E 231 232 234 234 234 Preference capital - - - - - Share premium - - - - - 4,585 6,621 8,947 11,922 15,660 Equity capital Profit and loss Other reserves - 1 2 2 2 4,816 6,854 9,182 12,157 15,895 Secured loans 623 322 309 309 309 Unsecured loans 527 531 54 54 54 1,150 853 363 363 363 Other long term liability 432 224 376 376 376 Long-term provisions 482 393 414 414 414 Net worth Total debt Minority interest 15 134 144 144 144 Amount pending investigation 1,230 1,230 1,230 1,230 1,230 Total capital employed 8,124 9,689 11,709 14,684 18,422 Gross block 2,478 3,611 5,460 6,460 7,460 (989) (1,379) (2,866) (3,467) (4,093) 1,488 2,232 2,594 2,993 3,367 Accumulated dep. Net block Capital WIP Total fixed assets Investments 260 266 266 266 2,491 2,861 2,469 2,143 35 36 36 36 36 515 743 914 1,051 1,208 1,207 1,207 - - 1 Deferred tax asset, net 268 348 383 490 490 Other non-current assets (94) 120 16 16 17 Long term loans and adv. Interest in TML benefit trust Inventories 15 11 10 11 11 Sundry debtors 2,722 3,369 4,349 5,001 5,751 Cash and cash equv. 3,096 3,463 4,756 7,479 11,363 Loans and advances 1,058 1,293 2,616 2,998 2,998 223 175 - - - Current investments October 31, 2014 368 1,856 Unbilled revenue 654 556 - - - Sundry creditors (691) (858) (1,549) (1,782) (2,049) Other liabilities (1,573) (2,037) (1,415) (1,627) (1,871) Provision (1,164) (1,227) (1,267) (1,457) (1,675) Working capital 4,338 4,744 7,500 10,623 14,528 Total capital deployed 8,124 9,689 11,709 14,684 18,422 8 Tech Mahindra | 2QFY2015 Result Update Cash flow statement (Consolidated, Indian GAAP) Y/E March (` cr) Pre tax profit from operations Depreciation Expenses (deffered)/written off/others Pre tax cash from operations Other income/prior period ad Net cash from operations Tax Cash profits FY2012 FY2013 FY2014E FY2015E FY2016E 1,526 2,581 2,728 3,240 3,999 319 390 522 602 626 - - - - - 1,845 2,971 3,250 3,842 4,625 510 182 113 223 398 2,354 3,153 3,363 4,065 5,023 (229) (648) (979) (1,156) (1,434) 2,125 2,505 2,384 2,909 3,589 (1,685) (647) (980) (652) (750) (14) 4 1 (1) - (332) (235) (1,324) (382) - 443 167 692 232 267 1,141 673 (623) 212 244 (Inc)/dec in Sundry Debtors Inventories Loans and advances Sundry creditors Others Net trade working capital (447) (39) (2,233) (591) (239) 1,678 2,466 151 2,319 3,350 (Inc)/dec in fixed assets (1,497) (1,025) (369) 392 326 (Inc)/dec in investments 2,835 (1) - - - 149 (611) 104 (0) (1) 1,487 (1,636) (265) 391 325 (33) (297) 490 - - Cashflow from operating activities (Inc)/dec in other non current assets Cashflow from investing activities Inc/(dec) in debt Inc/(dec) in deferred revenue 40 (207) - - - Inc/(dec) in equity/premium (155) 1 (1) - - Inc/(dec) in minority interest (1) 119 (9) - - Addition to reserves on amalgamation (60) 70 - - - (127) (149) (231) (231) (228) 1,160 243 437 (336) (463) 1,408 12 209 2,830 367 1,293 2,722 3,884 Cash at start of the year 267 3,096 3,463 4,756 7,479 Cash at end of the year 3,096 3,463 4,756 7,479 11,363 Dividends Others Cashflow from financing activities Cash generated/(utilised) October 31, 2014 9 Tech Mahindra | 2QFY2015 Result Update Key Ratios Y/E March FY2012 FY2013 FY2014 FY2015E FY2016E P/E (on FDEPS) 31.7 27.2 21.7 18.1 14.6 P/CEPS 15.1 25.0 17.1 15.5 12.8 P/BVPS 6.8 8.6 6.4 4.8 3.7 Dividend yield (%) 0.2 0.2 0.2 0.2 0.2 EV/Sales 4.8 3.9 2.9 2.4 1.9 EV/EBITDA 28.8 18.2 12.9 10.6 8.3 EV/Total assets 30.3 22.3 18.9 20.8 22.1 78.2 91.3 114.4 137.3 169.8 164.0 99.1 144.9 160.5 193.5 Valuation ratio (x) Per share data (`) EPS Cash EPS Dividend 4.0 5.0 5.0 5.0 5.0 365.2 289.6 386.9 512.3 669.8 Tax retention ratio (PAT/PBT) 0.9 0.7 0.8 0.7 0.7 Cost of debt (PBT/EBIT) 1.2 1.0 1.0 1.0 1.1 EBIT margin (EBIT/Sales) 0.1 0.2 0.2 0.2 0.2 Asset turnover ratio (Sales/Assets) 6.3 5.8 6.6 8.8 11.6 Leverage ratio (Assets/Equity) 0.4 0.4 0.3 0.2 0.1 38.3 28.5 31.8 26.4 24.9 RoCE (pre-tax) 20.1 27.6 31.3 28.9 27.7 Angel RoIC 36.8 46.2 54.8 61.1 75.1 RoE 37.5 30.9 29.1 26.4 24.9 Asset turnover (fixed assets) 6.3 5.8 6.6 8.8 11.6 Receivables days 59 78 78 78 78 Book value Dupont analysis Operating ROE (%) Return ratios (%) Turnover ratios( x) October 31, 2014 10 Tech Mahindra | 2QFY2015 Result Update Research Team Tel: 022 - 3935 7800 E-mail: [email protected] Website: www.angelbroking.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement Tech Mahindra 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies' Directors ownership of the stock Yes 4. Broking relationship with company covered No Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors Ratings (Returns): October 31, 2014 Buy (> 15%) Reduce (-5% to -15%) Accumulate (5% to 15%) Sell (< -15%) Neutral (-5 to 5%) 11

© Copyright 2026