Trust Jurisdictions: Are They All The Same?

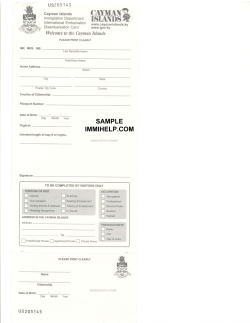

Trust Jurisdictions: Are They All The Same? RBC can offer trust services in multiple jurisdictions but we are sometimes asked why we offer such a large choice. Surely they all allow for the establishment of the same types of structure? Alan Binnington Private Client Director RBC Trust Company (International) Limited La Motte Chambers St Helier Jersey JE1 1PB +44 (0) 1534 602 401 [email protected] www.rbcwealthmanagement.com www.rbcwmfiduciarynews.com Trust and fiduciary services To some degree the answer to this question is yes, but there are in fact many reasons why a client might favour one jurisdiction over another. Sometimes it is simply a matter of personal preference but a jurisdiction may have particular characteristics in respect of its planning environment that make it more attractive. In the case of an individual for whom a robust and mature legal system is important, London might be the obvious choice if one wanted the jurisdiction with the longest established trust law - England being the home of the common law trust. However if one were looking for the jurisdiction that has contributed most to trust case law in recent years then Jersey would be a strong contender. Although Jersey’s trust statute is only 30 years old, the Jersey Courts have gained a reputation for the quality of their decisions and for the number of trust cases that have come before them. Many of these cases concern applications by trustees for directions; for example, where they are proposing to take a momentous decision or where they find themselves in a position of conflict of interest. An important factor when choosing a trust location is whether the courts are able to assist trustees or beneficiaries when the need arises. If one were looking for an innovative jurisdiction then perhaps the Cayman Islands might spring to mind. They introduced their own unique form of non-charitable purpose trust in late 1997 in a statute called the Special Trusts (Alternative Regime) Law, or STAR Law as it is more commonly known. STAR trusts provide a solution for those settlors who are reluctant to allow beneficiaries full information rights by providing a regime whereby the trust is enforceable by a designated enforcer rather than by beneficiaries. Of course innovation isn’t confined to the Cayman Islands, the Bahamas having also created an innovative concept in an Act passed in 2011 which enabled the creation of a Bahamas Executive Entity or “BEE”. This is a legal entity with limited liability and with no share capital or beneficiaries. It is intended to be used to carry out executive functions in private wealth structures, for example by acting as a protector or an enforcer of a trust. Trust Jurisdictions: Are They All The Same? continued If one were looking for a jurisdiction that offers a network of double taxation agreements (“DTAs”) and bilateral investment treaties than one might favour setting up a trust in Barbados. DTAs can provide significant benefits in terms of reduced withholding taxes on dividends and interest payments. In addition investment treaties may prove useful if the family lives in a country where government expropriation of assets is a risk, with treaties often providing recourse to international arbitration to obtain compensation for an investment that has been nationalized or expropriated. For families living in a jurisdiction operating a black-list system for the taxation of foreign private wealth structures, the use of an “onshore” jurisdiction such as Switzerland may prove advantageous. One example of a Swiss-led structure used to mitigate the impact of black-lists is the Anglo-Swiss trust; a fiduciary arrangement consisting of a trust governed by English law with two trustees, one in London and one in Switzerland. This solution has in the past proved to be popular with Latin American clients. Equally, a trust based in Singapore may provide a solution given that Singapore has positioned itself as an “onshore” jurisdiction providing “offshore” services and is therefore less likely to be found on tax black-lists than some of its competitor jurisdictions. On the subject of Asia, which is rapidly blazing a trail in wealth creation, clients from China may favour Hong Kong as a jurisdiction, if having their trust relationship managed by individuals in the same time zone and who possess the relevant language skills and cultural affinity is of most importance to them. Although a settlor who is concerned about beneficiary information rights may choose to create a Cayman STAR trust, a number of jurisdictions are now considering limiting information rights. For example, Guernsey in its 2007 Trust Law introduced the ability of settlors to restrict the rights of beneficiaries to information, subject to the right to apply to the courts, where the onus is on the applicant to show that disclosure is necessary. Guernsey, in common with Jersey and the Bahamas, has also introduced a Foundations Law, which provides an alternative structure for those clients who may be unfamiliar with the trust concept and which may also be used to limit information rights. Many prospective settlors hope that a trust structure set up for the benefit of family members will last long enough to provide for a number of generations and are concerned that some jurisdictions, for example England, Barbados, Singapore and the Cayman Islands, place a limit on the maximum period for which a trust can exist. However a number of jurisdictions now permit trusts for individuals for an unlimited duration, notably the Bahamas, Guernsey and Jersey. It is not unusual for some families to have concerns about potential attacks on their trust, whether in respect of forced heirship rights, creditor claims or claims made by a party during divorce proceedings. Most of the offshore jurisdictions have now incorporated into their laws what are known as “firewall” provisions, which are designed to defeat such claims unless they are in compliance with the domestic law of the trust. Although the precise wording of these provisions may vary from jurisdiction to jurisdiction, they tend to provide that matters such as the validity of the trust, the validity of transfers into it and the administration of the trust are to be determined by the governing law of the trust and that foreign judgements that are inconsistent with this will not be enforced by the courts of the trust’s home jurisdiction. Although these provisions are principally directed at forced heirship and matrimonial claims, they may also affect claims brought by a settlor’s creditors. In relation to claims by creditors many jurisdictions recognize the ability of a creditor to have a transfer of property set aside where the debtor intended thereby to defraud his creditors. The Cayman Islands, for example, recognize the remedy in their Fraudulent Dispositions Law 1989 but provide a limit of six years from the transfer in which to make a claim. The corresponding period in Barbados is three years and in the Bahamas it is two. In Jersey the matter is not provided for by statute but a similar remedy is available in the form of a Pauline action for which the time limit is ten years. Although there have been no decided Guernsey cases on the point it is likely that the Guernsey courts would have regard to Jersey case law on the subject, albeit with variations based on Guernsey’s own customary law. Although Jersey may have a more generous period within which claims can be brought, it is one of the few jurisdictions in which the matter has been fully argued before the courts (in the Esteem case). Accordingly there is now a significant degree of certainty as to the limits of the remedy in that jurisdiction. RBC has a trust capability in each of the jurisdictions referred to in this article. As can be seen there are differences in the types of structure that can be offered and while there may be legal factors that will influence the choice of jurisdiction, the choice often comes down to matters of personal preference such as convenience of time zones, language capabilities, cultural affinity and established professional relationships. Trust Jurisdictions: Are They All The Same? continued This publication has been issued by Royal Bank of Canada on behalf of certain RBC® companies that form part of the international network of RBC Wealth Management. RBC Wealth Management offers trust and fiduciary services via the principal operating companies detailed below. Services outlined may be provided by a variety of Royal Bank of Canada subsidiaries and offices, either independently or acting together, operating in a number of different jurisdictions. You should note that the applicable regulatory regime, including any investor protection or depositor compensation arrangements, may well be different from that of your home jurisdiction. Some of the services detailed in this document are not offered in all jurisdictions and may not be available to you. You should carefully read any risk warnings or regulatory disclosures in this document or any other literature enclosed with this document or forwarded to you by Royal Bank of Canada’s subsidiaries or affiliates. This document is intended as general information only and is not intended as tax, legal, investment or other professional advice. You should always obtain independent professional advice particular to your individual circumstances. The information in this document is based on sources considered reliable at the time, but no representation is made regarding its completeness or accuracy and no obligation is undertaken whatever to update it for any changes of law or interpretation. Royal Bank of Canada, its affiliates and subsidiaries and their officers, directors, employees and agents are not responsible for and will not be liable to you or anyone else for any damages whatsoever (including direct, indirect, incidental, special, consequential, exemplary or punitive damages) arising out of or in connection with your reliance on the document, even if the Royal Bank of Canada, its affiliates or subsidiaries or their officers, directors, employees or agents have been advised of the possibility of these damages. IRS Circular 230 Notice: To ensure compliance with requirements imposed by the Internal Revenue Service (IRS), we inform you that in compliance with the U.S. Federal Tax Regulations, unless expressly stated in writing otherwise, any discussion of tax matters contained in this communication (or any attachment hereto) is not intended or written to be used as and cannot be used as or considered to be a “covered opinion” or other written tax advice; and should not be relied upon by any person for the purpose of (i) avoiding any Internal Revenue Code (IRC)-related penalties that may be imposed on a taxpayer or (ii) promoting, marketing or recommending to another party any transaction or tax-related matter(s) addressed herein (or attachments hereto) for IRS audit, tax dispute or any other purpose. The addresses and main regulators of the principal RBC Wealth Management companies providing trust and fiduciary services: Royal Bank of Canada Trust Company (Bahamas) Limited: Lyford Cay House, Western Road, P.O. Box N-3024 Nassau, NP Bahamas: Regulated by the Central Bank of the Bahamas. Royal Bank of Canada (Caribbean) Corporation and Royal Bank of Canada Financial Corporation: Chelston Park, Second Floor, Building 2 Collymore Rock, St Michael, Barbados: Regulated by the Central Bank of Barbados. Royal Bank of Canada Trust Company (Cayman) Limited: 24 Shedden Road, Royal Bank House - 4th Floor, PO Box 1586, George Town, Grand Cayman KY1-1110 Cayman Islands: Regulated by the Cayman Islands Monetary Authority. Roycan Trust Company S.A.: Rue du Stand 56, 1204 Geneva, Switzerland. RBC Trustees (Guernsey) Limited: PO Box 48, Canada Court, Upland Road, St Peter Port, Guernsey GY1 3BQ, Channel Islands: Registered company number 37379: Regulated by the Jersey and Guernsey Financial Services Commissions. Royal Bank of Canada Trust Company (Asia) Limited: 17th Floor, Cheung Kong Center, 2 Queen’s Road Central Hong Kong: Regulated by the Mandatory Provident Fund Schemes Authority. RBC Trust Company (International) Limited: La Motte Chambers, St Helier, Jersey JE1 1PB, Channel Islands: Registered company number 57903: Regulated by the Jersey Financial Services Commission. Royal Bank of Canada Trust Corporation Limited: Riverbank House, 2 Swan Lane, London, EC4R 3BF. RBC Trust Company (Singapore) Pte. Ltd: 20 Cecil Street, #28-01 Equity Plaza, Singapore, 049705: Registered company number 198702460K: Regulated by the Monetary Authority of Singapore (licence number TC000053-1). ®/™ Trademark(s) of Royal Bank of Canada. Used under licence. C/A2142 15/620 112019 (10/14)

© Copyright 2026