Document 412141

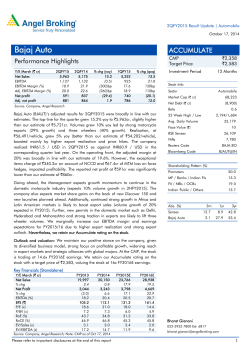

2QFY2015 Result Update | Pharmaceutical November 10, 2014 Cadila Healthcare NEUTRAL Performance Highlights CMP Target Price Y/E March (` cr) 2QFY2015 2QFY2015 % chg (qoq) 2QFY2014 % chg (yoy) Net sales Other income Gross profit Operating profit Adj. Net profit 2,064 59 1242 377 278 2020 40 1206 346 241 2.1 47.1 3.0 8.9 15.2 1698 61 296 212 183 21.5 (2.8) 319.5 77.6 51.6 Source: Company, Angel Research Cadila Healthcare (Cadila) announced a decent set of numbers for 2QFY2015. Its revenue for the quarter grew by an impressive 21.5% yoy to `2,064cr, almost in line with our expectation of `2,020cr. The sales growth during the period was aided by exports, which grew by 33.5% yoy, while domestic sales grew by 10.5% yoy. On the operating front, the gross margin was stagnant at 60.2%. However, owing to a lower rise in employee , R&D and other expenses, which rose by 5.2%, (8.5%) and 12.6% respectively, the operating margin improved by 576bp yoy to 18.2%, above our estimate of 17.6%. The tax expenses during the period rose by 465.1% yoy, which lead the Adj. net profit to come in at `278cr, a yoy growth of 51.6%, and higher than our estimate of `264cr. We remain Neutral on the stock. OPM better than expectation: The revenue for the quarter grew by an impressive 21.5% yoy to `2,064cr, almost in line with our expectation of `2,020cr. The sales growth during the period was aided by exports, which grew by 33.5% yoy, while domestic sales grew by 10.5% yoy. On the operating front, the gross margin was stagnant at 60.2%. However, owing to a lower rise in employee, R&D and other expenses, which rose by 5.2%, (8.5%) and 12.6% respectively, the operating margin improved by 576bp on a yoy basis to 18.2%, above our estimate of 17.6%. The tax expenses during the period rose by 465.1% yoy, which lead the Adj. net profit to come in at `278cr, a yoy growth of 51.6% yoy, and higher than our estimate of `264cr. `1,490 - Investment Period - Stock Info Pharmaceutical Sector Market Cap (` cr) 30,506 Net debt (` cr) 1,716 Beta 0.1 52 Week High / Low 1,508 / 705 Avg. Daily Volume 22,768 Face Value (`) 5 BSE Sensex 27,869 Nifty 8,337 Reuters Code CADI.BO Bloomberg Code CDH@IN Shareholding Pattern (%) Promoters 74.8 MF / Banks / Indian Fls 12.8 FII / NRIs / OCBs 6.6 Indian Public / Others 5.8 Abs.(%) Sensex Cadila 3m 1yr 3yr 8.9 33.8 58.6 35.6 107.2 94.1 Outlook and valuation: We expect Cadila’s net sales to post a 20.1% CAGR to `10,176cr and EPS to report a 24.3% CAGR to `61.9 over FY2014–16E. We maintain our Neutral rating on the stock. Key financials (Consolidated) Y E March (` cr) FY2013 FY2014 FY2015E FY2016E 6,155 7,060 8,505 10,176 % chg 20.9 14.7 20.5 19.7 Net profit 655 819 1,019 1,266 Net sales 0.8 25.0 24.4 24.3 EPS 32.0 40.0 49.8 61.9 EBITDA margin (%) 15.0 14.7 16.7 17.2 % chg P/E (x) 46.6 37.2 29.9 24.1 RoE (%) 23.3 25.3 26.5 26.5 RoCE (%) 13.2 13.8 18.2 19.9 P/BV (x) 10.0 8.9 7.2 5.8 5.2 4.5 3.7 3.0 34.9 30.7 22.2 17.7 EV/Sales (x) EV/EBITDA (x) Source: Company, Angel Research; Note: CMP as of November 7, 2014 Please refer to important disclosures at the end of this report Sarabjit Kour Nangra +91 22 39357600 Ext: 6806 [email protected] 1 Cadila Healthcare | 2QFY2015 Result Update Exhibit 1: 2QFY2015 performance (Consolidated) Y/E March (` cr) 2QFY2015 1QFY2015 2,064 59 Total Income Gross profit Net Sales Other Income Gross margin (%) % chg (qoq) 2QFY2014 % chg (yoy) 1HFY2015 1HF2014 2,020 2.1 40 47.1 2,123 2,061 1242 1206 60.2 59.7 1,698 21.5 4,084 3,306 23.5 61 (2.8) 99 103 (3.7) 3.0 1,759 20.7 4,183 3,409 22.7 3.0 1022 21.5 2449 2090 17.2 60.0 63.2 60.2 377 346 18.2 17.1 Financial Cost 17 18 (4.5) 19 (10.7) 35 Depreciation 73 68 8.3 52 41.6 141 98 43.9 345 300 15.0 202 71.1 645 426 51.4 Operating profit Operating Margin (%) PBT Tax Adj. PAT before Extra-ordinary item 8.9 212 77.6 12.5 722 468 17.7 14.2 % chg 54.3 47 (24.8) 57 52 8.9 10 465.1 110 30 265.2 288 248 16.3 192 50.3 536 395 35.6 0 1 0 1 0 10 7 45.6 8 17 16 Reported PAT 278 240 15.7 183 51.6 518 378 37.0 Adj. PAT 278 241 15.2 183 51.6 519 378 37.2 EPS (`) 13.6 11.8 25.3 18.5 Exceptional loss/(gain) Minority 8.9 Source: Company, Angel Research Exhibit 2: 2QFY2015 – Actual vs. Angel estimates (` cr) Actual Estimates Variance Net Sales 2,064 2,020 2.2 377 355 6.0 Operating profit Tax Net profit 57 52 9.0 278 264 5.3 Source: Company, Angel Research Revenue up 21.5% yoy; almost in line with our expectation For, the quarter, the company posted sales of `2,064cr (V/s an expected `2,020cr), a yoy growth of 21.5%. The growth was led by exports (52.7% of sales), which grew by 33.5% yoy, mainly driven by USA (`802.0cr) which grew by 67.6% yoy. Emerging markets (`88.5cr) de-grew by 4.3% yoy, while Europe (`77.7cr) de-grew by 17.5% yoy. The growth in the domestic market (41.9% of sales) by 10.5% yoy was mainly led by formulations (`680.8cr) which grew by 8.7% yoy. API (`25.7cr) on the other hand grew by 115.6% yoy, while Wellness (`110.1cr) grew by 5.9% yoy. Animal Health and others (`66.9cr) grew by 16.2% yoy. On the regulatory front, the company filed 1 ANDA during the quarter. There have been 250 ANDAs filed cumulatively till date, of which, 97 are approved and 68 are being marketed actively. November 10, 2014 2 Cadila Healthcare | 2QFY2015 Result Update Exhibit 3: Sales trend in the US and Europe 880 802 800 720 640 (` cr) 560 480 717 678 632 473 400 320 240 160 119 94 101 85 80 78 0 2QFY2014 3QFY2014 4QFY2014 US 1QFY2015 2QFY2015 Europe Source: Company, Angel Research Domestic sales (`883.5cr) grew by 10.5% yoy, with formulations posting a growth of 8.7% yoy during the period. Other segments in the domestic markets i.e API, Wellness and Animal health posted sales growth of 115.6%, 5.9% and 16.2% respectively. Exhibit 4: Sales trend in Domestic Formulation and Wellness Divisions 800 700 626 588 600 681 675 625 (` cr) 500 400 300 200 100 104 107 103 108 110 0 2QFY2014 3QFY2014 4QFY2014 Domestic Formulation 1QFY2015 2QFY2015 Consumer division Source: Company, Angel Research On the CRAMS front, the company generated sales of `113.6cr (vs `106.8cr in 2QFY2014), reporting a growth of 6.4% yoy. OPM expands by 576bps yoy The OPM for the quarter came in at 18.2% (V/s an expected 17.6%), an expansion of 576bp yoy. This came inspite of the flat gross margin (60.2% in 2QFY2015), and was aided by lower rise in employee, R&D and other expenses, which rose by 5.2%, (8.5%) and 12.6% respectively. November 10, 2014 3 Cadila Healthcare | 2QFY2015 Result Update Exhibit 5: OPM trend 18.5 18.2 17.5 16.5 17.1 16.0 (%) 15.5 14.5 14.2 13.5 12.5 11.5 12.5 10.5 2QFY2014 3QFY2014 4QFY2014 1QFY2015 2QFY2015 Source: Company, Angel Research Net profit up 51.6% yoy: The tax expenses during the period rose by 465.1% yoy, which lead the Adj. net profit to come in at `278cr, a yoy growth of 51.6% yoy, higher than our estimate of `264cr. Tax as a % of PBT in 2QFY2015 came in at 16.6% V/s 5.0% during the corresponding period of last year. Exhibit 6: Adjusted Net profit trend 300 278 251 250 (` cr) 200 183 189 2QFY2014 3QFY2014 241 150 100 50 0 4QFY2014 1QFY2015 2QFY2015 Source: Company, Angel Research Concall takeaways November 10, 2014 Growth excluding the impact of DPCO 2013 and discontinuation of the Boehringer Ingelheim contract was 14.0% in the domestic formulation market. The Management is confident of increasing the current EBITDA margins to 21% in FY2016, aided by growth in US sales. The company launched 16 products during the quarter in India. The tax rate is guided at 17-18% for FY2016. R&D expenses as % of sales are expected to be around 7-8%. Capex is expected to be around `550cr in FY2015 and `600cr in FY2016. 4 Cadila Healthcare | 2QFY2015 Result Update Recommendation rationale Strong domestic portfolio: Cadila is the fifth largest player in the domestic market, with sales of about `2,464cr in FY2014; the domestic market contributes ~44% to its top-line. The company enjoys a leadership position in the CVS, GI, women healthcare and respiratory segments, and has a sales force of 4,500 executives. The company, on an aggressive front, launched more than 75 new products in FY2014. During FY2009-14, the company reported a ~15% CAGR in its top-line in the domestic formulation business. Further, the company has a strong consumer division through its stake in Zydus Wellness, which has premium brands such as Sugarfree, Everyuth and Nutralite, under its umbrella. This segment which contributes ~5.9% of sales, registered a growth of 4.8% yoy during FY2014. Going forward, the company expects the segment to grow at an above-industry rate on the back of new product launches and field force expansion. In FY2014, sales were lower; however, FY2015 should witness strong sales growth. During FY2014-16E, we expect the domestic segment to grow at a CAGR of 15.9%. Exports on a strong footing: Cadila has a two-fold focus on exports, wherein it is targeting developed as well as emerging markets, which contributed around 50% to its FY2014 top-line. The company has established a formidable presence in the developed markets of US, Europe (France and Spain) and Japan. In the US, the company achieved critical scale of `2,170cr on the sales front in FY2014. The growth in exports to the US along with other regions like Europe would be driven by new product launches, going forward. Overall, exports are expected to post a CAGR of 22.1% over FY2014-16E. Outlook and valuation We expect Cadila’s net sales to post a 21.9% CAGR to `10,176cr and EPS to report a 24.3% CAGR to `61.9 over FY2014–16E. We maintain our Neutral rating on the stock. November 10, 2014 5 Cadila Healthcare | 2QFY2015 Result Update Exhibit 7: Key Assumptions Key assumptions FY2015E FY2016E Domestic growth (%) 15.0 17.0 Exports growth (%) 22.0 21.6 Growth in employee expenses (%) 15.1 18.7 Operating margins (excl tech. know-how fees) (%) 16.7 17.2 Capex (` cr) 650 650 Source: Company, Angel Research Exhibit 8: One-year forward PE band 1,600 1,400 1,200 1,000 800 600 400 200 Oct-14 28x Apr-14 Oct-13 Apr-13 Apr-12 21x Oct-12 14x Oct-11 Apr-11 Oct-10 7x Apr-10 Oct-09 Price Apr-09 Oct-08 Apr-08 Oct-07 Apr-07 Oct-06 - Source: Company, Angel Research Company background: Cadila Healthcare‘s operations range across API, formulations, animal health products and cosmeceuticals. The group has global operations spread across USA, Europe, Japan, Brazil, South Africa and 25 other emerging markets. Having already achieved the US$1bn sales mark in 2011, the company is estimated to achieve a sales mark of over US$3bn by 2015 and be a research-driven pharmaceutical company by 2020. November 10, 2014 6 Cadila Healthcare | 2QFY2015 Result Update Exhibit 9: Recommendation Summary Company Reco CMP Tgt. price Alembic Pharma Neutral Aurobindo Pharma Neutral Cadila Healthcare Cipla Dr Reddy's Accumulate Dishman Pharma Buy GSK Pharma* Upside FY2016E (`) (`) EV/Sales (x) EV/EBITDA (x) CAGR in EPS (%) RoCE (%) RoE (%) 405 - - 22.0 3.0 15.6 21.2 31.7 32.6 1,031 - - 19.3 2.6 13.1 8.1 18.2 27.0 Neutral 1,490 - - 24.1 3.1 18.0 24.3 19.9 26.5 Neutral 651 - - 25.8 3.8 19.2 20.6 15.8 16.3 3,397 3,723 9.6 18.3 3.1 12.7 21.2 21.8 25.0 161 221 37.4 7.3 1.0 4.2 27.7 12.9 12.7 Neutral 2,793 - - 47.0 7.6 37.3 0.4 25.9 25.7 Indoco Remedies Neutral 311 - - 21.9 2.7 14.7 50.0 19.8 21.8 Ipca labs Buy 661 843 27.5 13.3 2.1 9.2 12.4 22.1 23.2 Lupin Neutral 1,420 - - 23.4 4.0 14.7 19.3 33.0 25.4 Ranbaxy Neutral 668 - - 50.2 2.8 31.7 (5.9) 5.3 10.8 Sanofi India* Neutral 3,470 - - 28.4 3.3 18.0 6.6 19.0 20.6 Sun Pharma Neutral 892 - - 27.8 4.6 15.6 5.3 25.5 26.1 % PE (x) FY14-16E FY2016E Source: Company, Angel Research; Note: *December year ending November 10, 2014 7 Cadila Healthcare | 2QFY2015 Result Update Profit & Loss statement (Consolidated) Y/E March (` cr) Gross sales FY2012 FY2013 4,521 5,181 6,285 FY2014 FY2015E FY2016E 7,208 8,591 10,279 56 91 129 148 86 103 4,465 5,090 6,155 7,060 8,505 10,176 166 173 203 164 164 164 4,630 5,263 6,358 7,224 8,669 10,340 25.6 13.7 20.8 13.6 20.0 19.3 Total expenditure 3,604 4,179 5,232 6,024 7,085 8,427 Net raw materials 1,475 1,679 2,320 2,714 3,104 3,663 162 320 387 443 534 639 Less: Excise duty Net sales Other operating income Total operating income % chg Other mfg costs 549 751 903 1,071 1,248 1,493 1,417 1,429 1,622 1,796 2,199 2,631 EBITDA 861 911 923 1,036 1,420 1,749 % chg 24.1 5.8 1.4 12.3 37.0 23.2 (% of Net Sales) 19.3 17.9 15.0 14.7 16.7 17.2 Personnel Other Depreciation& amortisation 127 158 183 201 245 284 EBIT 734 753 740 835 1,175 1,465 % chg 31.1 2.6 (1.7) 12.8 40.7 24.8 (% of Net Sales) 16.4 14.8 12.0 11.8 13.8 14.4 Interest & other charges 70 185 169 90 152 152 Other income 13 53 37 51 51 51 2 7 5 5 4 3 (% of PBT) Recurring PBT 842 794 811 959 1,238 1,528 % chg 39.0 (5.7) 2.1 18.3 29.0 23.5 - 3 - 17 - - Extraordinary expense/(Inc.) 842 794 811 942 1,238 1,528 106.4 113.0 119.5 106.0 185.6 229.3 (% of PBT) 12.6 14.2 14.7 11.3 15.0 15.0 PAT (reported) 736 681 692 836 1,052 1,299 25.1 28.6 36.4 32.6 32.6 32.6 PAT after MI (reported) 711 653 655 804 1,019 1,266 ADJ. PAT 711 650 655 819 1,019 1,266 % chg 39.6 (8.6) 0.8 25.0 24.4 24.3 (% of Net Sales) 15.9 12.8 10.6 11.4 12.0 12.4 Adj.Basic EPS (`) 34.7 31.7 32.0 40.0 49.8 61.9 Adj. Fully Diluted EPS (`) 34.7 31.7 32.0 40.0 49.8 61.9 % chg 39.6 (8.6) 0.8 25.0 24.4 24.3 PBT (reported) Tax Less: Minority interest (MI) November 10, 2014 FY2011 8 Cadila Healthcare | 2QFY2015 Result Update Balance Sheet (Consolidated) Y/E March (` cr) FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E SOURCES OF FUNDS Equity share capital 102 102 102 102 102 102 Reserves & Surplus 2,069 2,471 2,938 3,337 4,140 5,191 Shareholders funds 2,171 2,574 3,041 3,441 4,245 5,297 Minority interest 67 90 119 144 177 210 1,092 2,289 2,681 2,265 2,265 2,265 Other Long Term Liabilities 19 43 47 55 43 44 Long Term Provisions 62 79 64 76 76 77 Deferred tax liability 113 119 100 96 119 120 3,523 5,193 6,054 6,077 6,805 7,891 2,317 3,008 4,105 3,756 4,406 5,056 969 1,175 1,358 1,540 1,785 2,069 1,348 1,833 2,747 2,216 2,621 2,987 Total loans Total liabilities APPLICATION OF FUNDS Gross block Less: Acc. depreciation Net block Capital Work-in-Progress 431 484 248 892 892 892 Goodwill 484 1,015 862 908 908 908 21 24 21 87 87 87 Investments Long Term Loans and Adv. 201 263 411 495 494 595 2,125 2,760 3,191 3,391 4,106 5,177 Cash 295 467 582 549 759 1,237 Loans & advances 411 275 279 341 334 335 Other 1,420 2,019 2,330 2,501 3,013 3,605 Current liabilities 1,087 1,186 1,426 1,912 2,303 2,755 Net Current assets 1,038 1,574 1,765 1,480 1,804 2,422 - - - - - - 3,523 5,193 6,054 6,077 6,805 7,891 Current assets Mis. Exp. not written off Total assets November 10, 2014 9 Cadila Healthcare | 2QFY2015 Result Update Cash Flow Statement (Consolidated) Y/E March (` cr) Profit before tax Depreciation 842 794 811 942 1,238 1,528 127 158 183 201 245 284 (286) (427) (223) 168 (113) (242) 13 53 37 51 51 51 Direct taxes paid 106 113 119 106 186 229 Cash Flow from Operations 564 359 614 1,154 1,133 1,291 (Inc.)/Dec.in Fixed Assets (291) (743) (861) (295) (650) (650) (Inc.)/Dec. in Investments (0) (4) 3 (65) - - Other income 13 53 37 51 51 51 (278) (694) (821) (309) (599) (599) - - - - - - (Inc)/Dec in Working Capital Less: Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans 7 1,238 382 (397) (13) 2 (176) (175) (175) (216) (216) (216) (72) (557) 115 (74) (96) (0) (242) 506 322 (686) (324) (214) 45 171 115 158 210 477 Opening Cash balances 251 295 467 582 549 759 Closing Cash balances 295 467 582 549 759 1,237 Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash November 10, 2014 FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E 10 Cadila Healthcare | 2QFY2015 Result Update Key Ratios Y/E March FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E Valuation Ratio (x) P/E (on FDEPS) 42.9 46.9 46.6 37.2 29.9 24.1 P/CEPS 36.3 37.7 36.3 29.8 24.1 19.6 P/BV 14.0 11.9 10.0 8.9 7.2 5.8 Dividend yield (%) 0.4 0.5 0.5 0.5 0.5 0.5 EV/Sales 7.0 6.3 5.2 4.5 3.7 3.0 36.2 35.3 34.9 30.7 22.2 17.7 8.8 6.2 5.3 5.2 4.6 3.9 EPS (Basic) 34.7 31.7 32.0 40.0 49.1 60.4 EPS (fully diluted) 34.7 31.7 32.0 40.0 49.1 60.4 Cash EPS 41.0 39.5 41.0 49.9 61.2 74.5 6.3 7.5 7.5 7.5 7.5 7.5 106.1 125.7 148.5 168.1 206.6 256.6 EBIT margin 16.4 14.8 12.0 11.8 13.8 14.3 Tax retention ratio 87.4 85.8 85.3 88.7 85.0 85.0 Asset turnover (x) 1.6 1.3 1.2 1.3 1.5 1.6 22.7 16.8 12.8 13.8 17.4 19.5 Cost of Debt (Post Tax) 5.6 9.4 5.8 3.2 5.7 5.7 Leverage (x) 0.4 0.5 0.7 0.6 0.4 0.3 30.3 20.8 17.7 20.1 22.3 23.4 ROCE (Pre-tax) 22.9 17.3 13.2 13.8 18.0 19.6 Angel ROIC (Pre-tax) 34.9 27.2 19.5 20.6 29.1 31.6 ROE 37.4 27.4 23.3 25.3 26.2 26.1 Asset Turnover (Gross Block) 2.1 2.0 1.8 1.8 2.1 2.1 Inventory / Sales (days) 62 66 66 69 62 66 Receivables (days) 49 57 54 57 50 53 Payables (days) 80 49 42 55 50 50 WC (ex-cash) (days) 55 64 66 53 42 40 0.4 0.7 0.7 0.5 0.4 0.2 0.9 2.0 2.3 1.7 1.1 0.6 10.5 4.1 4.4 9.3 7.6 9.4 EV/EBITDA EV / Total Assets Per Share Data (`) DPS Book Value Dupont Analysis ROIC (Post-tax) Operating ROE Returns (%) Turnover ratios (x) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Int.) November 10, 2014 11 Cadila Healthcare | 2QFY2015 Result Update Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered Cadila No No No No Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors Ratings (Returns): November 10, 2014 Buy (> 15%) Reduce (-5% to 15%) Accumulate (5% to 15%) Sell (< -15%) Neutral (-5 to 5%) 12

© Copyright 2026