IN THE COURT OF MEMBER MOTOR ACCIDENT CLAIM TRIBUNAL, NAGAON... M.A.C. Case No.314/08

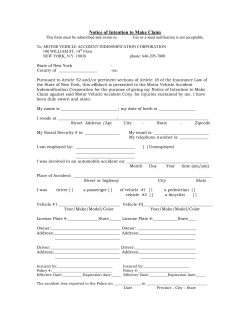

IN THE COURT OF MEMBER MOTOR ACCIDENT CLAIM TRIBUNAL, NAGAON (ASSAM) M.A.C. Case No.314/08 Smti Bharati Devi Hazarika & Ors. : Claimants. -Vs(1) Sri Biju Saikia (2) New India Ass. Co. Ltd., and (3) Sri Utpal Bora. : Opp. Parties. Present: Smti Selina Begum, Member M.A.C.T., Nagaon. Advocate for the claimant Advocate for the Ins. Co. : : Mr. P.K.Nath. Mr.P.K.Bora. Date of evidence Date of argument Date of Judgment : : : 11.12.12, 12.02.13, 04.04.13, 14.06.13. 25.03.14. 11.04.13. JUDGMENT The present claim case has arisen out of a claim petition filed U/S 166 of the M.V.Act claiming compensation, on account of death of Kanak Hazarika in a motor vehicular accident. Smti Bharati Devi Hazarika (wife of the deceased), Bharati Hazarika (mother of the deceased), Smti Priyanka Nath, daughter of the deceased (aged about 10 years), Smti Tonmoyee Nath, daughter of the deceased ( aged about 7 years) and Kaushik Nath, son of the deceased (aged about 4 years) being represented by claimant no.1 Smti Bharati Devi Hazarika (mother) are the claimants. The case of the claimant in a nut shell is that on 24.01.08 at about 5 a.m., while the deceased Kanak Hazarika along with other injured persons was travelling in the vehicle bearing registration no. NL-02/C-2179 (Maruti Zen) from Nagaon to Jorhat through N.H.Way 37 and when the said vehicle reached at Behora Bazar the Maruti Zen hit an electric pole. The accident happened as the driver drove the vehicle in a rash and negligent manner. As a result of the accident Kanak Hazarika and Montu Kachari died on the spot and the driver Utpal Bora sustained serious injuries. The accident took place due to rash and negligent driving by the driver of the offending vehicle bearing registration no.NL-02/C-2179 (Maruti Zen). The claimant in their claim petition has impleaded the owner, driver and insurer of the vehicle involved in the accident. The O.P. No.2, New India Ass. Co. Ltd., the insurer of vehicle no.NL-02/C-2179 (Maruti Zen) in their written statement contended, inter-alia, that there is no cause of action, that the claim petition is bad for non-joiner of necessary parties. It is submitted that the driver of the vehicle had no valid driving licence at the relevant time of accident and hence the company is not liable to indemnify the owner. Rash and negligent driving on the part of the driver of the vehicle is also denied. The insurance company denied the age, income, occupation of the deceased as alleged in the claim petition. None has appeared on behalf of the O.P. No.1 an 3 the owner and driver of the vehicle to contest the case hence, the case proceeded ex-parte against the owner and the driver of the vehicle. The following issues are framed for decision:1. Whether the claim petition is maintainable? 2. Whether the accident occurred due to rash and negligent driving of the driver of vehicle no. NL-02/C-2179 (Maruti Zen)? 3. Whether the claimant is entitled for compensation? If so what relief/reliefs the claimant is entitled to? 4. To what amount the claimant is entitled to and who will be liable to pay the amount? DECISION AND REASONS THEREOF Issue No 1 The claimant has filed this claim petition U/S 166 of the M.V.Act claiming compensation for the death of Kanak Hazarika who is the husband of the claimant No.1. In the claim petition she has impleaded the owner, driver and also the insurer of the vehicles which were involved in the accident. The evidence of the claimant No.1 is that the incident occurred due to rash and negligent driving of the driver of the vehicle no. NL-02/C-2179 (Maruti Zen) and that as a result of the accident her husband died. There is nothing in the record to show why the claim petition is not maintainable. Accordingly this issue is decided in affirmative. Issue No.2 P.W.1 Smti Bharati Devi Hazarika testified that on 24.01.08 at about 5 a.m., while her husband Kanak Hazarika was proceeding from Nagaon to Jorhat on N.H.Way 37 along with two other persons in the vehicle bearing registration no. NL-02/C-2179 (Maruti Zen) and when the said vehicle reached at Behora Bazar due to rash and negligent driving of the said vehicle by the driver it hit an electric pole on the roadside. He disclosed that as a result of the accident her husband Kanak Hazarika and another person Mantu Kachari died on the spot and the driver Utpal Bora was also seriously injured. She disclosed that her brother in law Sri Debajit Hazarika lodged an FIR at Bokakhat police station on the same day and the Bokakhat P.S., registered a case vide P.S. Case NO.12/08 U/S 279/304(A)/338/427 of IPC. She testified that post mortem examination of her deceased husband was done at K.K.Civil Hospital, Golaghat. She has submitted Ext.1 accident information report, Ext.2 post morten report, Ext.3 salary certificate of her deceased husband. However, during cross-examination P.W.1 admitted that she did not witness the occurrence but she arrived at the place of occurrence after the occurrence. P.W.3 Sri Jiten Bora, who claimed himself to be an eye witness disclosed during his evidence that on 23.01.08 he came to Behara for attending a marriage ceremony of Smti Swapnali Dutta, the sister of his friend Sri Dilip Dutta. On the next morning i.e., on 24.01.08 at about 5 a.m., while he came out towards N.H.Way 37 he noticed that a vehicle bearing registration no. NL-02/C-2179 (Maruti Zen) which was coming from Nagaon towards Jorhat side in a rash and negligent manner dashed against an electric light post on the left side of the N.H.Way 37. He disclosed that as a result of the accident two occupants of the vehicle died on the spot and the driver was injured. Front and left side of the vehicle was completely damaged in the accident. He further disclosed that after the accident he along with other persons shifted all the three injured persons to the Golaghat Civil Hospital for treatment but two of them were declared dead by the doctor. Defence though cross-examined this witness thoroughly yet could not assail his evidence regarding rash and negligent driving of the driver of the offending vehicle for whose fault the accident happened. On careful appraisal of the testimony of the eye witness P.W.3 Sri Jiten Bora who claimed himself as an eye witness to the occurrence it appears that he clearly revealed that the accident happened due to the rash and negligent driving by the driver of vehicle bearing registration No. NL-02/C-2179 (Maruti Zen). He is a charge sheeted witness of the police case and vividly described the accident. His appearance at the place of occurrence is found to be quite natural as he came to Behora for attending a marriage ceremony. The O.P., could not dislodge the testimony of P.W.2 regarding the above fact. He reiterated that the maruti zen hit an electric post due to rash and negligent driving by the driver of truck bearing registration No. NL-02/C-2179 (Maruti Zen).The insurance also did not adduce any evidence in rebuttal of the testimony of the eye witness. Ext.1 accident information report show that a case being Bokakhat P.S. Case No.12/08 U/S 279/304(A)/338/427 of IPC was registered by Bokakhat P.S., regarding the accident caused by the driver of vehicle bearing registration No. NL-02/C-2179 (Maruti Zen) and Kanak Ch. Hazarika was shown as the ill fated person who succumbed to his injuries due to the accident. Ext.2 the post mortem report of Kanak Ch. Hazarika established the death of Kanak Ch. Hazarika. On the basis of above discussion, I have come to conclusion that claimant has proved the fact that the accident was caused due to rash and negligent driving by the driver of the vehicle bearing registration No. NL-02/C-2179 (Maruti Zen) and that the claimant’s husband died in the accident. Accordingly, this issue is decided in favour of the claimant. Issue No.3 & 4 It is already proved that the husband of claimant No.1 died due to the motor vehicle accident caused due to rash and negligent driving of the driver of the vehicle bearing registration no.NL-02/C-2179 (Maruti Zen). The claimants are the wife, mother and children of the deceased Kanak Ch. Hazarika who died in the accident. He was the sole earning member of the family and due to his pre-matured death in the accident the claimant have found it difficult to maintain themselves. The claimant has preferred this claim U/S 166 of the M.V.Act and as legal heirs of the deceased and being dependent on the income of the deceased they are entitled to receive compensation. Now, the question is what should be the quantum of compensation and who is liable to pay the compensation. The claimant testified that her husband was a Sub-Inspector of Police and earned monthly Rs.10,006/-. It is disclosed that the age of her husband was 32 years at the time of occurrence and that the whole family was dependant upon the income of the deceased. Claimant exhibited Ext.3 as the certificate issued by Superintendent of Police, Jorhat relating to salary of the deceased. P.W.2 Dharmeswar Kalita who is the Junior Asstt., of Jorhat S.P., Office, Jorhat disclosed that deceased Kanak Hazarika who died in a motor vehicle accident was a Sub-Inspector of Police. He disclosed that the S.P.Office, JOrhat issued a certificate regarding the salary of the deceased and he exhibited the salary certificate of the deceased as Ext.3. The learned advocate for the claimant relying upon the decision of Shyamwati Sharma & Ors. -Vs- Karam Singh and Ors reported in 2010(4) TAC 29 (SC) submitted that deduction towards GPF, life insurance premium, repayment of loans etc. should not be excluded from income. In the instant case the claimant exhibited Ext.3 as the salary certificate of the deceased at the time of his death. Ext.3 the salary certificate of the deceased shows that Baisc pay of the deceased was Rs.4210/-, DA-Rs.2589/-, other DA -Rs.2,105, medical allowance Rs.-350/- others Rs.752/-. In total gross salary is shown as Rs.10,006. After deduction for GPF Rs.500/-, GIS-Rs.30 and P.Tax Rs.208/- the net salary of the deceased is shown to be Rs.9,268/-. Hon'ble Suprem Court in Shyamwati Sharma & Ors. -Vs- Karam Singh and Ors reported in 2010(4) TAC 29 (SC) held that while ascertaining income of the deceased any deduction towards GPF, life insurance premium, repayment of loans etc. should not be excluded from income. So amount deducted for GPF, GIS is not deducted from the gross salary and only P.Tax is deducted. After deduction of P.Tax of Rs.208/- the net salary of the deceased would be Rs.9,798/-. Applying view taken in Sarla Verma -Vs- Delhi Transport Corporation & another reported in (2009) 6 SCC 121 as dependents are 4 to 6 so a sum of 1/4th will have to be deducted which the victim would have incurred had he been alive. In Sarla Verma -Vs- Delhi Transport Corporation & another reported in (2009) 6 SCC 121 the Hon'ble Supreme Court laid down the principles relating to addition to income towards future prospects. The Hon'ble Supreme Court held that wherever the deceased was below 40 years of age and had a permanent job, the actual salary (less tax) should be increased by 50% towards future prospects, to arrive at the monthly income. In Shyamwati Sharma & Ors. -Vs- Karam Singh and Ors reported in 2010(4) TAC 29 (SC) applying Sarla Verma case added 50% towards future prospect in awarding compensation where the deceased was a Sub-Inspector of Police. In the case in our had also the deceased was a Sub-Inspector of police (Govt. employee). As per claim petition and post mortem report his age was 32 years. So he had left a long period of service at the time of his death. P.W.3 Jiten Borah who proved the salary certificate disclosed that the income of the deceased would have Rs.26,020/as per revised pay scale if he would have alive. But he could not show any documents regarding probable enhancement of income. However, deceased was only 32 years of age and a long period of service was left at the time of his death. Definitely there is scope of enhancement of the income due to revised pay and further increment. Relying upon Hon'ble Supreme Court decision there must be addition of 50% to the actual income of the deceased while computing future prospect. In Rajesh & Ors. -Versus- Rajbir Singh & Ors. reported in 2013 AIAR (Civil) 662 (SC), Hon'ble S.C., in para 17 of the judgment observed as follows:Hon'ble Supreme Court in the above referred case also observed that having regard to inflation factor, the compensation under conventional heads:- Loss of consortium to the spouse, loss of love and care and guidance to children and funeral expenses needs to be increased. It is further observed that the loss of companionship, love, care and protection etc., the spouse is entitled to get, has to be compensated appropriately. Hon'ble Supreme Court also observed that by loss of consortium, the courts have made an attempt to compensate the loss of spouse's affection, comfort, solace, companionship, society, assistance, protection, care and sexual relationship during the future years. The Hon'ble Supreme Court in the above referred case granted Rs.1,00,000/- as loss of consortium and Rs.25,000/- as funeral expenses and Rs.1,00,000/- to the minor children for loss of care and guidance. In the present case the age of the wife is shown to be 29 years at the time of swearing the affidavit evidence so she was quite young at the time of death of her husband. So applying the principle laid down by the Hon'ble Supreme court in the above referred case and considering the age of the wife of the deceased an amount of Rs.50,000/- is added towards loss of consortium. Rs.25,000/- is added as funeral expenses. In the case cited above there were three minor child and Hon'ble Supreme Court granted Rs.1,00,000/- in total for loss of care and guidance for minor children. In the case in our hand the deceased left 3 minor children. So for loss of care and guidance for the minor children an amount of Rs.60,000/- is added for loss of care and guidance. The compensation which the claimant,s are entitled is assessed as follows:- Sl. No. HEADS CALCULATION (i) Income (ii) 50% of (i) above to be added as future Rs.9,798/- + Rs.4,899/- =Rs.14,697/- per prospects month. (iii) 1/4th of (ii) deducted as personal Rs. 14,697/- – Rs.3,674.25/expenses of the deceased Rs.11,022,75/- per month. (iv) Compensation after multiplier of 17 is Rs. 11,022,75 X 12 X 17= 22,48,641/applied (v) Loss of consortium (vi) Loss of care and guidance for minor Rs. 60,000/children (vii) Funeral Expenses TOTAL COMPENSATION AWARDED Rs. 9,798/- per month. = Rs. 50,000/- Rs.25,000/- Rs.23,83,641/- Now the question is who is liable to pay the compensation to the claimant. The learned counsel for the insurance company strenuously argued that the policy had no coverage for occupants of the vehicle. It is argued that as the husband of the claimant is a occupant of the vehicle and not a 3 rd party so insurance company is not liable to indemnify the owner. In this regard the insurance side examined D.W.1 Md. Abdul Kasem, Senior Asstt. New India Ass. Co. Ltd., Nagoan. He testified that policy no.530108/31/06/01/00002686 of the offending vehicle bearing registration no.NL-02/C-2179 (Maruti Zen) has the coverage only relating to the 3rd party. It is disclosed by him that as the owner did not pay any premium for occupants or passengers of the vehicle so company is not liable to pay any compensation in case of death or injury to any passengers or occupants of the vehicle. He exhibited Ext.A as the policy copy. During cross-examination he admitted that the policy is a package policy. The claimant side on the other hand relying upon (1) National Ins. Co. Ltd.,-VsBalakrishna and another reported in (2013)1 SCC 731 (2) Oriental Ins. Co. Ltd., -VsSurendra Nath Loomba & Ors reported in 2013 (1) TAC 15 (SC) submitted that insurer is liable to pay compensation to an occupant of a private vehicle in case of comprehensive/package policy. The case in our hand is not in connection with an act policy but the policy is a package policy. From perusal of the policy Ext.A it is clear that the policy of the offending vehicle is a package policy and is not a statutory policy only. Hon'ble S.C., in National Ins. Co. Ltd., -Vs- Balakrishna and another reported in (2013)1 SCC 731 held that:“An Act policy stands on a different footing from a comprehensive/package policy. As the insurance Regulatory and Development Authority (IRDA), which is presently the statutory regulatory authority, has commanded the insurance companies that a comprehensive/package policy covers the liability of the insurer for payment of compensation to the occupant in a motor vehicle, there cannot be any dispute in that regard. The earlier pronouncements were rendered in respect of an Act policy which admittedly cannot cover a third party risk of an occupant in a car. But if the policy is a comprehensive/package policy, the liability would be covered. IRDA has clarified the position by issuing Circulars dated 16.11.2009 and 03.12.2009. Therefore, a comprehensive/package policy would cover the liability of the insurer for payment of compensation for the occupant in a car.” In Oriental Ins. Co. Ltd., -Vs- Surendra Nath Loomba & Ors reported in 2013 (1) TAC 15 (SC) it is also held that:“ In view of the aforesaid factual position there is no scintilla of doubt that a “comprehensive/package policy” would cover the liability of the insurer for payment of compensation for the occupant in a car. There is no cavil that an “Act policy” stands on a different footing than a “comprehensive/package policy”. As the circulars have made the position very clear and the IRDA, which is presently the statutory authority, has commanded the insurance companies stating that a “comprehensive/package policy” covers the liability, there cannot be any dispute in that regard. We may hasten to clarify that the earlier pronouncements were rendered in respect of the “Act policy” which admittedly cannot cover a third party risk of an occupant in a car. But, if the policy is a “comprehensive/package policy”, the liability would be covered.” As the policy in the case at our hand is a package policy and not an Act only policy so relying upon the decision of Hon'ble S.C., in the case reported in (2013)1 SCC 731 I have no hesitation to hold that the insurer is liable to pay compensation. It is already discussed that the accident occurred due to rash and negligent act on the part of the driver of the vehicle bearing no. NL-02/C-2179 (Maruti Zen). Though the insurance side took the plea that the driver of the vehicle had no valid licence yet the insurance side could not prove the said fact. The accident information report on the other hand shows the fact that driver had the licence bearing no. 31,015/S/Pvt valid upto 20.11.21 which was issued by D.T.O. Sonitpur. Above facts shows that the offending vehicle was driven by a driver having valid licence and owner as such has not violated the condition of the insurance policy. As per the claim petition and accident information report the vehicle bearing no. NL-02/C-2179 (Maruti Zen) is insured with New India Ass. Co. Ltd., vide policy no.530108/31/06/01/00002686. Hence, the New India Ass. Co. Ltd., is liable to pay compensation to the claimant. AWARD AND ORDER Therefore, it is ordered that the New India Ass. Co. Ltd., be directed to make payment of Rs. 23,83,641/- only within a period of 3 months from today and in the event of failure to make the payment within the stipulated period the compensation amount shall bear interest @ 9% per annum from the date of filing the claim petition. The claimant shall also be entitled to Rs.1,000/- as cost of this proceeding. Out of the said amount a sum of Rs.3,00,000/- each in the name of minor son and daughters namely Smti Priyanka Nath, Smti Tonmoyee Nath, and Kaushik Nath shall be kept in fixed deposit account, in any Nationalised bank till they attain majority. So, far as the claimant is concerned, the fixed deposit shall be made by the claimant as the mother and guardian. To meet any urgent need for money claimant or the guardian of the minor, as the case may be, shall make application to the Tribunal for permitting withdrawal. The Tribunal shall consider the application and pass appropriate order. An amount of Rs.4,00,000/- be paid to claimant No.2 Bharati Hazarika (mother of the deceased). The remaining amount of compensation shall be paid to the claimant Bharati Devi Hazarika (wife of the deceased) towards maintaining herself and the family including the welfare of the minor daughters till he attain majority. Copy of judgment and order be communicated to the O.P. The judgment is pronounced and delivered in the open court under my hand and seal of this court on this the 11th day of April/2014. Dictated & corrected by me:Member, Motor Accident Claim Tribunal, Nagaon(Assam). Member, M.A.C.T., Nagaon.

© Copyright 2026