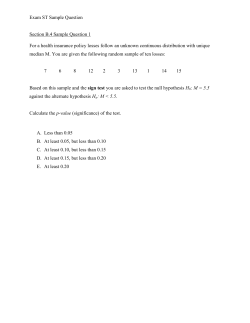

14 27 w o r k i n g p