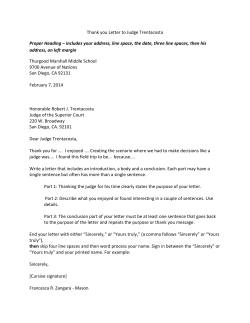

Document 53008