The Romanian Banking Institute and ACCA

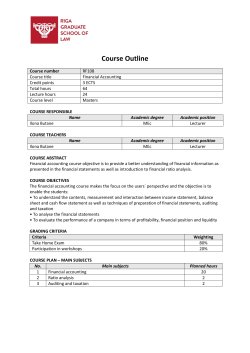

The Romanian Banking Institute and ACCA It is the fundamental mission of the Romanian Banking Institute (RBI) to raise the level of knowledge and experience of all finance professionals in Romania. Supported by all of the banks operating in Romania, RBI offers specific training courses and access to high-quality professional qualifications through a variety of learning methodologies and has established itself as the country’s primary provider of professional finance education. RBI is very pleased to announce the provision of intensive revision courses to support ACCA students preparing to take their ACCA examinations in December 2014. Intensive Revision Courses RBI is offering intensive revision for ACCA papers F6-P3. We will widen our range of papers very quickly, for future sessions, and intend to offer courses for all F and P papers 2015. RBI has a large, modern and fully equipped, built-for-purpose training centre located close to Unirii in central Bucharest. It can easily be reached by car and all forms of public transport. All RBI’s ACCA courses will be delivered at this excellent venue at all times. RBI’s intensive ACCA courses include: An individual study plan, created by each course trainer for each student and given to them with the course study material at the start of each course. Comprehensive study material provided by Kaplan, the international specialists in ACCA training, and approved by ACCA. Four full classroom teaching days per paper – two Friday and Saturday sessions scheduled in October and November (please see the enclosed teaching schedule). One progress test, taken between the two classroom sessions and one mock exam after each course with extensive feedback from the course trainer. All of the above are included in the very competitive course fee. Course Fees RBI’s very competitive, affordable and all-inclusive fees for the December 2014 revision courses are: For each ACCA F paper – 250 Euro (VAT not applicable) For each ACCA P paper – 300 Euro (VAT not applicable) The first 15 students who enrol for RBI’s ACCA courses, for the December 2014 exam session will benefit from an excellent opportuniy: RBI will cover the cost of Kaplan textbooks. Thus, the price for F papers will be 200 euros, and for P papers, 250 euros. ACCA Course Trainers RBI believes absolutely in the excellence of our team of very experienced and knowledgeable ACCA course trainers. These professionals present RBI’s reputation to our students and so we have selected them very carefully. Mirela Paunescu PhD, ACCA, CAFR, CECCAR Papers F6 – Taxation (Ro) and F7 – Financial Reporting Mirela has over 14 years’ experience as a Tax Advisor, Auditor and as a consultant to multi-national companies on the implementation of International Financial Reporting Standards (IFRS). Her main areas of expertise are Financial Accounting and Reporting, Taxation, consolidation and Auditing. She has taught ACCA papers since 2008, including F6 (Ro), F7 (Int), F8 (Int), P1 and P7 with consistently excellent results. Ovidiu Coca FCCA, CECCAR, CAFR Paper F8 – Audit and Assurance Ovidiu is currently Head of Internal Audit in one of Romania’s major banks. He has extensive Audit and Accounting experience within the ‘Big 4’ and he has amassed over 10 years’ experience in the banking industry. Ovidiu is a highly regarded professional with a comprehensive knowledge of IFRS, the banking regulatory environment, the consolidation of groups, planning, budgeting and budget monitoring. He is a Fellow of ACCA and a very talented trainer. Kemal Ozmen ACCA, CFE, CIA, CISA, AF Paper F9 – Financial Management Kemal has risen to the position of Director in one of the ‘Big 4’ during a distinguished career spanning 16 years and is in charge of Dispute Analysis and Investigations. He is certainly on the very front line of Auditing and Financial Management in Romania with considerable expertise in Financial Accounting, Auditing, IT Finance Systems and Internal Audit, Fraud and Enterprise Risk Management. He is the founding President of the Romanian Chapter of the Association of Certified Fraud Examiners (ACFE). Kemal is delighted to be sharing his vast experience with RBI’s ACCA students. Florentiu Petra ACCA Paper P1 - Governance, Risk and Ethics Florentiu is a Senior Director responsible for Small and Medium Enterprise credit Risk in one of Europe’s major banks. He specialises in credit monitoring, bank risk strategies and procedures and risk analysis. He is also responsible for the internal training of bank staff working in the vital business of lending. Florentiu regularly delivers specialist training courses and seminars at RBI. Mihai Stan FCCA, CAFR, CECCAR ACCA Paper P2 – Corporate Reporting Mihai is currently Head of Methodology, Reporting and Shareholdings at one of Europe’s major banks. He is responsible for the bank’s IFRS and RAS financial reporting. He has over 10 years’ experience within the banking industry and 4 years’ experience working in large multi-nationals in addition to his work in the ‘Big4’. Mihai is an excellent and experienced trainer and has been teaching ACCA courses in papers F7, P2 and P5 since 2008. Luminta Doniga ACCA ACCA Paper P3 – Business Analysis Luminita is a widely experienced finance professional with over 20 years in the industry. She is currently a Senior Consultant in an international consulting services firm. Luminita has spent 7 years as an auditor within a Big4 company and then held positions such as finance controller, business controller and finance director for various international companies, mainly start-ups. This offered her the opportunity to work on many projects, gaining both financial management and project management extensive experience. Program Coordination The ACCA courses will be coordinated by Dr. Gabriela Hârţescu, General Director of RBI, who has extensive prior experience in managing the ACCA program within a European regional training company; Gabriela’s management has lead the company to obtain the Gold and Platinum statuses, as approved ACCA learning provider, in the shortest possible time. Gabriela’s experience includes the coordination of several international qualification programs and cooperations with multinational and Big4 companies. Gabriela is one of the top experts in the field of developing, implementing and successfully running training programs for the financial services industry since 1996. Should someone be interested in receiving the highest quality assurance standards in training, they find the right person in Gabriela, as she tests everything through her own professional experience as a lecturer and consultant in the field of International Trade Finance. ACCA Intensive Revision Course Schedule – December 2014 Session OCTOBER MONTH MON TUE NOVEMBER THU FRI SAT SUN 29-Sept 30-Sept 1-Oct 2-Oct 3-Oct 4-Oct 5-Oct 6-Oct 7-Oct 8-Oct 9-Oct 10-Oct 11-Oct 12-Oct 13-Oct 14-Oct 15-Oct 16-Oct 17-Oct 18-Oct 19-Oct P2 P2 F9 (TBC) F9 (TBC) 24-Oct 25-Oct F6 F6 P1 P1 P3 P3 31-Oct 1-Nov F7 F7 F8 F8 20-Oct 27-Oct 21-Oct 28-Oct 22-Oct 29-Oct 23-Oct 30-Oct 26-Oct 2-Nov 3-Nov 4-Nov 5-Nov 6-Nov 7-Nov 8-Nov 9-Nov 10-Nov 11-Nov 12-Nov 13-Nov 14-Nov 15-Nov 16-Nov P1 P1 P3 P3 F9 (TBC) F9 (TBC) 21-Nov 22-Nov F6 F6 F8 F8 28-Nov 29-Nov 30-Nov St.Andrew 17-Nov 24-Nov 1-Dec DECEMBER WED 18-Nov 25-Nov 19-Nov 26-Nov 20-Nov 27-Nov 23-Nov F7 F7 P2 P2 6-Dec 7-Dec 13-Dec 14-Dec 2-Dec 3-Dec 4-Dec 5-Dec Exam F6, P4 Exam F7 Exam F8, P5 Exam P6, F9 11-Dec 12-Dec National Day Exam F5, P7 8-Dec 9-Dec 10-Dec Exam F4, P3 Exam P2 Exam P1 Course Booking Please book your RBI ACCA intensive revision course as early as possible to ensure your place on the course. To book, please contact Emilia Frunza, Training Manager: e-mail: [email protected]; phone: 0748 886 834 or 0372 394 409. Romanian Banking Institute, 3 Negru-Voda Street, sector 3, Bucharest, www.ibr-rbi.ro RBI - your very own, dedicated, ACCA learning provider!

© Copyright 2026