1 www.accaapc.com ACCA F4 Corporate and Business Law(UK)

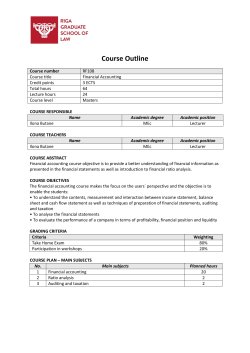

ACCA F4 Corporate and Business Law(UK) Sample Study Note For exams in June2014 1 www.accaapc.com © Lesco Group Limited, April 2015 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of Lesco Group Limited. 2 www.accaapc.com Sample Note Content: Main study note content [Total Pages: 131] ...................................................... 4 Product Summary .......................................................................................... 5 Live online note sample plan ........................................................................... 6 Live online course timetable: ........................................................................... 7 Money laundering......................................................................................... 10 Please note: This is just the sample study note extracted from the main study note in your tuition study [This tuition study note is consistent in basic/super/gold package]. There would be more chapters in the main study note covering the whole ACCA syllabus. You can also take a look at the content within the main study note below: 3 www.accaapc.com Main study note content [Total Pages: 131] 4 www.accaapc.com Product Summary content ACCA HD quality super tuition videos ACCA HD quality super revision videos Last minute revision ACCA Live online tuition(4sessions) ACCA Live online revision(14hours) ACCA Mock exams(with tutor mark) ACCA Tutor support ACCA Electronic study note ACCA Student online forum Pass Guarantee ACCA Final revision mock exam paper ACCA Super Live online session (2030hours) ACCA Super Live online revision (Super 3 days) ACCA 1V1 Career Advice ACCA Extra exam techniques demonstration Live online mentoring 5 www.accaapc.com Basic Super Gold package package Package Oxford Brookes BSc in Applied Accounting Live online note sample plan Live online tuition note plan for June2014 F4 Exam [Only for super / gold package (there would be a unique plan for gold package)] Live sessions: [2 hours/session---live online + recorded after class]: Live session1: English legal system+contract law+law of toirt Live session2: Partnership law+law of agent Live session3: Key areas within company law Live session4: remaining areas within company law+insolvency+fraudulent behavior Live revision note for June2014 F4 exam: [will be available since mid April 2014]: Live revision1+2: [There would be a separate live revision note detailing all past exam questions with answers to go through] 6 www.accaapc.com Live online course timetable: Live session/revision for F4-P7 7 www.accaapc.com 8 www.accaapc.com *Please Note: This Timetable may be subjected to future changes. Kindly check regularly for any possible updates. 9 www.accaapc.com Money laundering Legislation: Proceeds of Crime Act 2002 (as amended). Definition: This means to convert crime money into legal money. Stages: 1. Placement This is the initial disposal of the proceeds of criminal activity, for example by buying a business. 2. Layering This is the process to transfer the money from, for example, place to place or business to business with the aim of concealing its initial source. 3. Integration This is the end result of the previous stages– in that the money now has an appearance of coming from a legitimate source. 10 www.accaapc.com Offences: 1. Laundering This category includes acquiring, possessing, or using the proceeds of criminal Activity; it also includes assisting another to retain the proceeds of criminal activity; It also includes concealing the proceeds of criminal activity. The penalty is a maximum of 14 years‟ imprisonment and/or an unlimited fine. 2. Failing to report This applies to professionals in the regulated sector, such as accountants in professional practice. Such a person has a duty to report to the Serious and Organised Crime Agency (SOCA) if he knows or suspects, or has reasonable grounds to know or suspect, that another is engaged in money laundering. The penalty is a maximum of 5 years‟ imprisonment and/or an unlimited fine. 3. Tipping off Professionals must not make any disclosure which is likely to prejudice any investigation under the legislation. The penalty is a maximum of 5 years‟ imprisonment and/or an unlimited fine. 11 www.accaapc.com

© Copyright 2026