1 www.accaapc.com ACCA P5 Advanced Performance Management

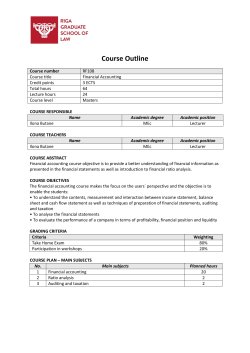

ACCA P5 Advanced Performance Management Sample Study Note For exams in June2014 1 www.accaapc.com © Lesco Group Limited, April 2015 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of Lesco Group Limited. 2 www.accaapc.com Sample Note Content: Product Summary .......................................................................................... 4 Live online course timetable: ........................................................................... 5 Sample note: Corporate failure prediction ......................................................... 8 Please note: This is just the sample study note extracted from the main study note in your tuition study [This tuition study note is consistent in basic/super/gold package]. There would be more chapters in the main study note covering the whole ACCA syllabus. You can also take a look at the content within the main study note below: 3 www.accaapc.com Product Summary content ACCA HD quality super tuition videos ACCA HD quality super revision videos Last minute revision ACCA Live online tuition(4sessions) ACCA Live online revision(14hours) ACCA Mock exams(with tutor mark) ACCA Tutor support ACCA Electronic study note ACCA Student online forum Pass Guarantee ACCA Final revision mock exam paper ACCA Super Live online session (2030hours) ACCA Super Live online revision (Super 3 days) ACCA 1V1 Career Advice ACCA Extra exam techniques demonstration Live online mentoring 4 www.accaapc.com Basic Super Gold package package Package Oxford Brookes BSc in Applied Accounting Live online course timetable: Live session/revision for F4-P7 5 www.accaapc.com 6 www.accaapc.com *Please Note: This Timetable may be subjected to future changes. Kindly check regularly for any possible updates. 7 www.accaapc.com Sample note: Corporate failure prediction Quantitative measure: Altman Z score Z = 1·2X1 + 1·4X2 + 3·3X3 + 0·6X4 + X5 Where: X1 is working capital/total assets (WC/TA); X2 is retained earnings reserve/total assets (RE/TA); X3 is Profit before interest and tax/total assets (PBIT/TA); X4 is market value of equity/total long-term debt (Mve/total long-term debt); X5 is Revenue/total assets (Revenue/TA). Key to remember: If the score is 3 or above they are financially sound Between 1.81 and 2.99 they need further investigation [grey area] Below 1.81 they are in danger of bankruptcy What to do to prevent failure? See the signs and take action. Seek external advice. Management accept there is a problem. Make strategic changes as necessary. Put in more controls and management systems. 8 www.accaapc.com Qualitative measure: Argenti’s A score Qualitative models such as Argenti use a variety of qualitative and some nonaccounting factors such as management experience, dependence on one or a few customers or suppliers, a history of qualified audit opinions and the business environment including the industry and economic situation. Argenti developed a model, which is intended to predict the likelihood of company failure based on three connecting areas that indicate likely failure: defects, mistakes symptoms of failure Which are all awarded a specific score. 9 www.accaapc.com Sources of problems A Variable Score Management defects Chief Executive is an autocrat 8 Chief Executive also holds position of Chairman 4 Passive Board of Directors 2 Unbalanced Board of Directors, not representing all business functions or overweight in one discipline 2 Weak Finance Director Poor management in team 2 1 Accounting defects No budgets or budgetary controls 3 No cash flow forecasts, or not up to date 3 3 No costing system: costs and contribution of each product or service are not known Poor response to change: old-fashioned product or service, obsolete production facilities, out-of-date marketing methods; old directors 15 43 B Management mistakes(as a result from the above defects) High gearing 15 Overtrading 15 Failure of a big project 15 45 C Symptoms of trouble(as a result from the above defects and mistakes) Financial indicators forecasting poor results[poor Z-score] 4 Creative Accounting 4 Non-financial signs (eg high staff turnover). 4 12 10 www.accaapc.com Score Maximum permitted A 10 B 15 C 0 25 If any score which are more than 25 then it will need immediate action to avoid company insolvency. 11 www.accaapc.com Strengths and weaknesses of quantitative and qualitative models for predicting corporate failure Quantitative models: Advantages: Quantitative models such as the Altman Z-score use publicly available financial information about a firm in order to predict whether it is likely to fail within the two-year period. The advantages of such methods are that they are simple to calculate and provide an objective measure of failure. Disadvantages: However, they only give guidance below the danger level of 1·8 and there is potential for a large grey area[1.81-2.99] in which no clear prediction can be made. Additionally, the prediction of failure of those companies below 1·8 is only a probabilistic one, not a guarantee. This means not every company with Z score under 1.8 will go bankruptcy. These models are open to manipulation through creative accounting which can be a feature of companies in trouble. Qualitative models: Advantages: The advantage of the method is the ability to use non-financial as well as financial measures and the judgment of the investigator Disadvantages: But this is subjective and will vary from different investigators. 12 www.accaapc.com

© Copyright 2026