China Africa Development Fund: Beyond a foreign policy instrument

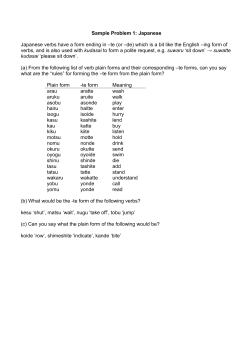

13 January 2015 CCS COMMENTARY: China Africa Development Fund: Beyond a foreign policy instrument The 2007- initiated China Africa Development Fund (CADFund), which facilitates Chinese investments in Africa, has attracted much attention from academics and practitioners. As one of the eight measurements put forward by former Chinese president Hu Jintao at the 2006 Forum on China Africa Cooperation (FOCAC), the fund has not been able to shake its reputation as a vehicle for Chinese political power. Nevertheless, a closer glance reveals that the CADFund is highly diversified, working more along market principles than as an instrument of government policy. What the CADFund is not Existing research on the CADFund focuses on how its role in promoting Sino-Africa relations will likely limit the growth of the fund itself, making it inappropriate as a tool in China’s and Africa’s development. One of the main reasons that CADFund is viewed as a government vehicle is because various scholars and independent agencies treat it as a sovereign wealth fund (SWF). Certain studies view the fund as only investing with Chinese State Owned Enterprises (SOEs), so as to strengthen government Source: www.cottongrower.com behaviour; this has led to accusations that the CADFund does not care about the development of Chinese small and medium-sized enterprises (SMEs) or African enterprises in general. Strictly speaking, the only pure SWF of China is China Investment Corporation (CIC) which is typically funded by the Ministry of Finance (MOF) of PRC. Current studies on CADfund mix up the concepts of SWFs, foreign exchange reserve held by central banks, pension funds, SOEs. CADFund is essentially a private equity (PE) fund with only background government participation, a point stressed many times by Chi Jianxin, the president of CADFund. The CADFund is a market driven PE in which the questions of SOE’s is not the key criteria for partner selection – reflected in its collaboration with many non-SOEs. Additionally, some research mixes trade and aid-related aspects of the CADFund. Unlike economic aid, CADFund is market-orientated and bears risks on its own; in the vein of “win-win” rhetoric, it aims to promote Africa’s development as well as to pursue its own interests. Putting aside political factors, a key question should be how to maximise the positive effects of the CADFund in terms of co-operation between Chinese and African enterprises and its own development from financing, operating and investment perspectives. Teething Problems The CADFund currently sits at US$ 3 billion; investments are at US$ 2 billion and in 2013 there were 70 projects in over 30 African countries. However, returns on investments are not very fluid, with some projects running for several years, with unknown returns. The dividend pay-out of investee companies largely influences the coming (third) round of fundraising, especially with the intention to attract external investors. CADFund originally planned to invite market participants to join its second injection effort, which failed. This was in part due to the fact that Chinese investors are hesitant – still a foreign investment destination with some high-risk environments. More importantly, running projects have often been at early stages where investment returns are still unknown. Thus, it is crucial that current projects bring reasonable profits so as to increase investors’ confidence, which aids in further financing and project operation of the CADFund. Another aspect is the way in which CADFund reaps its investments and disengages from particular projects. There are many exit methods varying from project to project. For instance, the fund can exit by initial public offering (IPO) which relies on the state of stock markets. Because African equity markets, besides South Africa, are under developed, the CADFund may look for IPO opportunities in other equity markets to sell its ownership. Moreover, the fund can ask its portfolio companies to repurchase shares, which was adopted, for instance, in the case of a glass factory in Ethiopia. Another method is to transfer ownership to other investors by agreements. Only by exiting from an investment smoothly can CADFund ensure the possibility of further development. Maximising opportunities China Development Bank (CDB) is experienced in fund management and has gained significant experience in African investing; CADFund is one of its useful attempts at outward direct investment in Africa. Nevertheless, there is still a long way to go in terms of financing, operation and investment. In the meantime, with the gradual deepening of China-Africa relations, more investment opportunities will be created, and more investors like the CADFund will distribute their assets on the African continent. Thus, it is of importance to offer suggestions for further investors by exploring an effective way to boost economic and social development of host countries as well as investors’ own benefits. ZHANG Qiaowen CCS Affiliate Centre for Chinese Studies Stellenbosch University “Commentaries are written by Research Analysts at the Centre and focus on current and topical discussions or media events with regard to China or China/Africa relations. Occasionally, the CCS accepts commentaries from non-CCS affiliated writers with expertise in specific fields. Their views do not necessarily reflect those of the CCS. Commentaries can be used freely by the media or other members of the interested public if duly referenced to the author(s) and the CCS.” For more information, please check the CCS website: www.sun.ac.za/ccs or contact us under [email protected]

© Copyright 2026