Understanding Your 1098-T

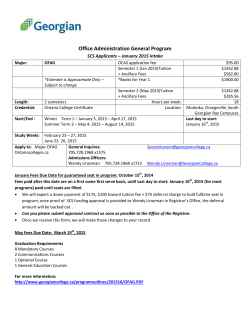

Understanding Your 1098-T (1) New York University New York University Office of the Bursar Office of the Bursar (A) 105 E. 17th Street, 1053rd E. 17th Floor Street, 3rd Floor New York, NY 10003 New York, NY 10003 (212) 998-2806(212) 998-2806 (B) (2) (3) (C) (D) (8) (4) (5) (6) (7) (9) (10) Legend: See the box descriptions below for a breakdown of the information furnished on the 1098-T. (A) Filer’s Information: New York University’s name, address, and telephone number. (B) Filer’s Federal Identification Number: New York University’s Taxpayer Identification Number (TIN). (C) Student’s Social Security Number: This will indicate the student’s Social Security Number on file. Changes or corrections to the student’s Social Security Number must be made with the Office of the Registrar. (D) Student’s name, address, city, ZIP code: This will indicate the student’s address on file. Changes or corrections to addresses must be made by the student in the Albert Student Center. Box (1): The IRS instructs universities to fill out either Box 1 (payments received for qualified tuition and related expenses) or Box 2 (amounts billed for qualified tuition and related expenses). NYU fills out Box 2. Thus, Box 1 will not have amounts populated for NYU 1098Ts. Box (2): This box includes amounts billed for qualified tuition and related expenses from January 1 to December 31. This may include amounts for multiple semesters depending on when the student registers. Forms typically include amounts for January Term 2014, Spring 2014, Summer 2014, Fall 2014, January 2015, and Spring 2015. For example, if the student was billed in 2014 for Spring 2015 registration, those amounts would be included in Box 2 of the 2014 form. The student may be able to use that tuition in calculating this year’s potential tax credit. Box (3): This box will not be checked, because New York University has not changed its reporting method. Box (4): Box 4 includes any adjustments to tuition and fees made during the year that were reported in a prior year. For example, if the student was billed for a Spring 2014 course in 2013, that amount was reported in 2013. If subsequently the student dropped that course between January 1, 2014 and December 31, 2014 the tuition costs for that reduction in course tuition and fees would be reported in Box 4 on the 2014 form. Box (5): Box 5 includes scholarships and grant aid posted to the student account during the year (January 1 to December 31). It also includes amounts for which third parties (such as government, private entities, religious organizations, and non-profit entities) were billed. Box (6): Box 6 includes any reductions or adjustments made to scholarships, grant aid, or third party amounts that had been reported in Box 5 in a prior year. Box (7): This box will be checked if Box 2 includes amounts for an academic period beginning January 2015 to March 2015 (January Term 2015 and Spring 2015). This is because the educational tax credits can be calculated for qualified expenses paid in 2014 for terms starting in the first three months of 2015. Box (8): This box will be checked if the student was enrolled at least half time (minimum 6 credits or having an equivalency) during any academic period during the 2014 year (January Term 2014, Spring 2014, Summer 2014, or Fall 2014). Box (9): This box will be checked if the student was matriculated in a program leading to a graduate degree during any academic period in 2014. Box (10): New York University is not required to provide information in this box. For 1098-T FAQs and more 1098-T information, visit www.nyu.edu/bursar/1098T.

© Copyright 2026