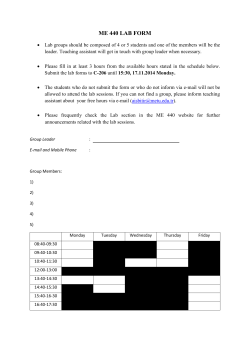

Due Date Calendar 2014-2015

THIRTY-THIRD DISTRICT PTA 2014-2015 Calendar for Council Financial Officers Paperwork and/or money must be received by the appropriate Thirty-Third District PTA financial officer* on or before the due dates listed below. Be sure to read page two for important tax information. *Money is sent to the financial secretary, budgets are sent to the budget & finance chairman, council audits are sent to the auditor, and required financial forms are sent to the treasurer. All items are to be sent to the Thirty-Third District PTA office at PO Box 1235, Lakewood, California 90714 or turned in at a Presidents/Executive Board Meeting. August, 2014 15th - Friday District Executive Board Orientation reservations due in the district office September, 2014 10th - Wednesday (Council Presidents Meeting) 2013 Council & Unit Tax Returns and RRF-1 forms due to the district treasurer (unless extension filed) 22nd - Monday (Executive Board Meeting) Council Financial Workshop reservations due in the district office Fall Officers Training reservations due in the district office District Legislation Conference reservations due in the district office 27th - Saturday Council Financial Workshop at the district office, 9:30 a.m. October, 2014 15th – Wednesday (Council Presidents Meeting) Council 2014 - 2015 Budgets due to the district budget & finance director Council & Unit Year End Audits due to the district auditor Council & Unit Tax Returns and RRF-1 forms due to the district treasurer (if filed extension) 21st – Thursday Membership Dues ($4.00 per capita) due in the district office in order to qualify for the State “Ready, Set… Remit” award (minimum 30 members) 27th - Monday (Executive Board Meeting) Presidents & Administrators Conference reservations due in the district office November, 2014 15th - Friday Membership Dues - ($4.00 per capita) minimum 15 memberships must be turned in to the district office to remain in good standing Council & Unit Form 8868, Application for 2nd Extension to File Tax Return due in the district office 25th - Monday (Executive Board Meeting) Youth Camp Donations due to the district financial secretary December 2014 10th – Wednesday (Council Presidents Meeting) Insurance Premiums due in the district office. The premium cost will be announced to council presidents and treasurers in advance. If premiums are not paid on time a $25.00 late fee will be assessed by the State PTA. January, 2015 14th - Wednesday (Council Presidents Meeting) Membership Dues ($4.00 per capita) must be turned in to the district office to qualify for the “Teachers Matter, Members Matter” award. Units must mail the applications directly to the State PTA office to arrive by 1-31-15. Mid-Winter Conference reservations due in the district office Sacramento Safari registration forms and money due in the district office Workers Compensation Forms due - One copy for the council and one copy for each unit are due to the district treasurer. Units/councils paying more than $1,000 to employees must also pay insurance surcharge at same time. 26th – Monday (Executive Board Meeting) “Teen Scene” Middle & High School Conference reservations due in the district office February, 2015 11th - Wednesday (Council Presidents Meeting) Diversity & Inclusion Conference reservations due in the district office 23rd - Monday (Executive Board Meeting) Founders Day Donations received are due to the district financial secretary Council & Unit Mid-Year Audits due to the district auditor March, 2015 1st – Sunday Membership Dues ($4.00 per capita) must be turned in to the district office to qualify for any recognition at convention 24th - Monday (Executive Board Meeting) April, 2015 8th - Monday (Executive Board Meeting) Annual Meeting reservations due in the district office 20th - Monday (Executive Board Meeting) Council & Unit End of Fiscal Year Audits due to the district auditor Treasurer’s Annual Reports due in the district treasurer (1 copy of council and 1 copy of each unit’s reports) May, 2015 13th – Wednesday (Council Presidents Meeting) Spring Officers Training reservations due in the district office 18th - Monday (Executive Board Meeting) Founders Day Donations are due to the financial secretary. This is the final deadline for the 2014/2015 contribution. One-fourth of the total amount is returned to district by the California State PTA for leadership training. Money received after this date will be credited towards 2015/2016. June, 2015 10th – Wednesday (Council Presidents Meeting) Membership Dues ($4.00 per capita) must be turned in to the district office for State PTA year-end awards IMPORTANT INFORMATION If any unit or council submits two non-sufficient fund checks in a fiscal year, the district will require future payments to be by money order or cashier’s check. ALL CHECKS RETURNED UNPAID BY THE BANK WILL REQUIRE REPAYMENT PLUS A $15.00 FEE PAID TO THIRTY-THIRD DISTRICT PTA. 2014 Federal Tax Return - Internal Revenue Service form 990-N (e-Postcard) must be filed electronically by all units and councils with gross receipts normally less than or equal to $50,000; IRS form 990EZ must be filed by units and councils with gross receipts more than $50,000 and less than $200,000; IRS form 990 must be filed by units and councils with gross receipts of $200,000 or th more. These forms may be filed any time after the close of the fiscal year (February 28 ), but must be received by the IRS no th th later than July 15 . Apply for a 3-month extension, Form 8868, if you will not be able to make the July 15 deadline. If you th received a 3-month extension and will not be able to make the October 15 deadline, apply for an additional 3-month extension. 2014 State Tax Return - California State Franchise Tax Board form 199N must be filed electronically by all units and councils with gross receipts equal to or less than $50,000 or form 199 with gross receipts greater than $50,000. These forms may be filed any th time after the close of the fiscal year (February 28 ), but must be received by the California State Franchise Tax Board no th later than July 15 or by the extension date. RRF-1 Forms – All councils and units must have a valid charitable trust (CT) number must file an annual registration renewal form with the California Attorney General/Registry of Charitable Trusts. These forms may be filed any time after the close of the th fiscal year (February 28 ), but must be received by the California Attorney General/Registry of Charitable Trusts no later th than July 15 or by the extension date. California Secretary of State SI-100 (Statement of Information) Forms – All incorporated councils and units must file a SI-100 form and the $20 filing fee with the California Secretary of State every other year, during the applicable filing period, which is in the calendar month during which the initial Articles of Incorporation were filed and the immediately preceding five calendar months. Councils and units incorporated in odd-numbered years must file the SI-100 in odd-numbered years. Councils and units incorporated in even-numbered years must file the SI-100 in even-numbered years. NOTE: This form MUST be filed biennially (every other year) even if a notice to file is not received. The Secretary of State may not send a reminder of the filing due date. REMIND YOUR UNITS NOT TO IGNORE ANY TAX FORMS OR NOTICES. PLEASE DO NOT CALL CALIFORNIA STATE PTA DIRECTLY. Refer your questions to the district treasurer. REMEMBER - Non-profit organizations may not have to pay taxes, but they DO HAVE TO PAY FINES for not following the rules and regulations. Send a copy of all completed tax returns, RRF-1 forms, and SI-100 forms to Thirty-Third District PTA and to the council treasurer. Mail all tax returns and government agency required forms via “Certified Mail - Return Receipt Requested.” This is the only proof you have that filing requirements have been met by specified due dates.

© Copyright 2026