I.T. A. Nos. 448 to 450 /AHD/2011 (Assessment Years: 2003

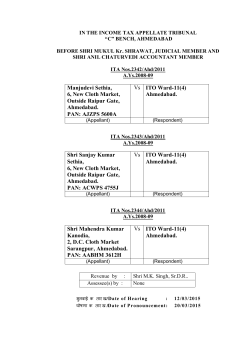

IN THE INCOME TAX APPELLATE TRIBUNAL “ D ” BENCH, AHMEDABAD (BEFORE SHRI MUKUL Kr. SHRAWAT, J.M. & SHRI ANIL CHATURVEDI, A.M.) I.T. A. Nos. 448 to 450 /AHD/2011 (Assessment Years: 2003-04 to 2005-06) Income Tax Officer Ward6(1), Ahmedabad (Appellant) V/S Shri Pravin B. Kachadia HUF 9, Abhishek Bunglow Zadeshwar Chokadi B/h Sarveshwar Nagar Zadeshwar Road Bharuch (Respondent) C.O. Nos. 75 to 77/AHD/2011 (Assessment Years: 2003-04 to 2005-06) Shri Pravin B. Kachadia HUF 9, Abhishek Bunglow Zadeshwar Chokadi B/h Sarveshwar Nagar Zadeshwar Road Bharuch (Appellant) V/S Income Tax Officer Ward6(1), Ahmedabad (Respondent) PAN: AAHHP9428E Appellant by Respondent by : Smt. Sonia Kumar, Sr. D.R. : Shri S.N. Divetia, A.R. (आदेश )/ORDER Date of hearing Date of Pronouncement : 28-01-2015 : 30 -01-2015 2 . ITA Nos. 448 to 450/A/11 & C.O Nos. 75 to 77/A/11 A.Ys. 2003-04 to 2005-06 PER SHRI ANIL CHATURVEDI,A.M. 1. These 3 appeals filed by the Revenue and the 3 C.Os. of the Assessee are against the order of CIT(A)-XI, Ahmedabad dated 15.12.2010 for A.Ys. 2003-04, 2004-05 & 2005-06 respectively. 1. Before us, at the outset, both the parties submitted that though the appeals pertains to 3 different years, but most of the grounds are common and therefore they have common submissions to make and therefore all the appeals can be heard together. We therefore proceed to dispose of all the appeals by a consolidated order for the sake of convenience and thus proceed with narrating the facts of A.Y. 2005-06 (ITA No. 450/AHD/2011). 2. Assessee is an HUF stated to be engaged in the business of grains and having agricultural income. In this case a return of income was filed on 31.03.2006 declaring total income of Rs. 47,520/-. The case was selected for scrutiny and thereafter the assessment was framed under section 143(3) vide order dated 15.12.2009 and the total income was determined at Rs. 47,83,540/-. Aggrieved by the order of A.O., Assessee carried the matter before CIT(A) who vide order dated 30.03.2010 granted substantial relief to the Assessee. Aggrieved by the aforesaid order of CIT(A) Revenue is now in appeal before us and the Assessee has also filed C.O. The grounds raised by the Revenue reads as under:1. 2. 3. The Ld. Commissioner of Income tax (A) has erred in law and on facts in treating the return of income as non-est and the assessment framed on its basis u/s. 144 as ab-initio void. The Ld. Commissioner of Income tax (A) has erred in law and on facts in annulling the assessment order. On the facts and circumstances of the case, the Ld. Commissioner of Income tax (A) ought to have upheld the order of the Assessing Officer. 3 ITA Nos. 448 to 450/A/11 & C.O Nos. 75 to 77/A/11 A.Ys. 2003-04 to 2005-06 . 4. It is, therefore , prayed that the order of the Ld. Commissioner of Income tax (A) may be set-aside and that of the Assessing Officer be restored . 3. On the other hand the grounds raised by the Assessee in the C.O reads as under:1. In the alternative and without prejudice to invalidity of return of income being non-est the Income Tax Officer has erred on facts as well as in law in making the following additions: Capital Balance u/s. 68 of the Act Rs. 2,77,035 Unsecured Loans u/s. 68 of the Act Rs. 10,11,237 Agricultural Income u/s. 68 of the Act Rs. 95248 Since the grounds raised by Revenue and Assessee are interconnected both are considered together. 4. During the course of assessment proceedings and on perusing the return of income, A.O noticed that Assessee is stated to have received unsecured loan from 4 persons aggregating to Rs. 11,35,485/- (list of depositors stated at page 3 of the order). He also noticed that Assessee had also shown balance in the capital account of Rs. 6,53,975/-. A.O noted that various notices were issued by him to Assessee to explain the source of capital and genuineness of loans but none attended nor any clarification called for by him were furnished. A. O therefore considered the cash credit on account of capital balance of Rs. 6,53,975/- and unsecured loan of Rs. 11,35,485/- as unexplained cash credit u/s. 68 and added to the income of the Assessee. Similarly, the gross agricultural income of Rs. 2,12,218/- that was shown by the Assessee in the Return of Income, and in the absence of any justification or proof about the same, the agricultural expenses of Rs. 56,113/- were disallowed and the gross agricultural income of Rs. 2,12,218/- was considered to be from unexplained sources and it was treated as cash credit 4 . ITA Nos. 448 to 450/A/11 & C.O Nos. 75 to 77/A/11 A.Ys. 2003-04 to 2005-06 u/s. 68. Aggrieved by the order of A.O., Assessee carried the matter before CIT(A) who after considering the submissions of the Assessee deleted the addition made by A.O by holding as under:2. The facts of the case, quite peculiar in nature, are as follow. Return of income came to be filed on 3103-2006 admitting income of Rs. 47,520/- and agricultural income of Rs. 1,56,105/-. The Balance sheet annexed to the ROI is reproduced below :………………………………………………….. As detailed in the assessment order, the opportunities given to the appellant were not availed of in the first five instances. Shri Pravinbhai Becharbhai Kachadiya (the alleged Kartha of the appellant HUF) appeared before A.O. on 06-12-2007 and furnished documents mentioned at para 4.1 of the assessment order. He appeared before A.O. once again on 19-12-2007 and furnished the documents mentioned at para 4.3 of the assessment order. Statements u/s. 131 were recorded from him and family members. Shri Vinod J. Modi, ITP was summoned and statement u/s. 131 was recorded by the A. O. on 20-12-2007, the contents of which find place at para 4.7 of the assessment order. As seen from page-7 of the assessment order, the balance in the capital account of Rs. 6,53,975/- and unsecured loans of Rs. 11,35,485/- were added to income retuned and agricultural income returned of Rs. 2,12,218/- was treated as income from other sources. Hence the appeal. 2.1. As stated in the preceding para, the instant case is a strange one and the facts of the case are very rare in occurrence. Having considered the A.O's observations, the contentions of the learned A.R. and the facts of the case, it appears to me that the basic issue to be decided at first is whether the return of income was filed by the appellant at all or the ROI is simply a scrap of paper, filed by an anonymous person (for reasons best known to it) containing fictitious particulars. ……………………………………… CIT(A) after reproducing the submissions of Assessee from para 2.1.2 to to para 3.1 at page 4 to 14 of the order, observed as under:3.1.2. Coming to the additions made, it is seen from para-3 and 4.7 of the assessment order that immovable property -'Bharuch Shala' costing Rs. 17 lakhs was shown but no documentary evidence was enclosed. As seen from paras 4.6 and 4.7 of the assessment order, appellant is stated to be a teacher with "Atmiya Higher Secondary School" and the same school is supposed to be owned by appellant. As against this asset, unsecured loans of Rs. 11.35 lakhs from family members (father who passed away in 2002; mother aged 65 years; wife; and son studying in 7th Std.) and capital of Rs. 6,53,975/- were shown. A.O. never made any attempt to counter the appellant's explanation that he does not have any such asset nor the said liabilities and capital balance. Once the asset is not existing, there is no way to conclude that the non-existent liabilities are income of the appellant. 3.1.3. Further, it is seen from the return of income that name and father's name is kept blank in the 'verification'. The signature is totally different from the signature of the appellant as appearing in the 'driving licence' and the signature as attested by the banker. (The signatures on the return of income for A.Ys. 03-04, 04-05 and 05-06 differ year to year). Bank account No (mentioned in ROI) is .15873 with BOI, Naroda. 3.1.4, Inspite of the glaring discrepancies and the explanation (with supporting evidence) of the appellant, A.O. did not accept the appellant's contention that the appellant HUF never existed and that the ROI was never filed by it. The basis for rejection of appellant's claim, as appearing at para 4.8 of the assessment order, is vague and unconvincing. 3.1.5. Keeping in view the gamut of facts narrated above and the written submissions filed, I am of considered opinion that the appellant's contention that it never applied for PAN and that the Return of Income was not verified or filed by it stands established. In the light of the decisions relied on by the learned A.R., the R.O.I has to be treated as a scrap of paper filed by anonymous person reflecting fictitious income, assets and liabilities. A.O. has not conducted any inquiry to prove that the appellant owned the 5 . ITA Nos. 448 to 450/A/11 & C.O Nos. 75 to 77/A/11 A.Ys. 2003-04 to 2005-06 immovable property valued at over Rs.l 7 lakhs.A.O. did not establish that the bank account mentioned in the ROI ever existed or that it was in appellant's name. The overwhelming evidence filed by the appellant (supported by documentary evidence and affidavit) is uncontroverted. There is nothing on record to show that copy of the statement recorded from Shri Vinod J. Modi, ITP on 20-12-2007 (relied on by the A. O. in the assessment order) was furnished to the appellant or to show that appellant was afforded opportunity to cross-examine Shri Vinod J. Modi. 4. Therefore, I hold that the ROI is non-est and the assessment framed on its basis u/s. 144 is ab-initio void and nullity. The assessment order is annulled. 5. Aggrieved by the order of CIT(A), Revenue is now in appeal before us. 6. Before us, ld. D.R. supported the order of A.O. On the other hand ld. A.R. reiterated the submission made before A.O and CIT(A) and further submitted that Assessee has no income of the HUF and the income shown in the name of HUF is baseless as the father of Pravinbhai Kachadia the karta of HUF, (Shri Becharbhai Kachadia) expired in June 2002 and therefore the father of karta could not have gifted any money in 2005 to the Assessee which was shown in the declaration. The ld. A.R. also pointed to the letter written by the Assessee to the A.O wherein it was stated that the immovable property owned by the father of the Karta was a kachha house in a small village containing 2 rooms only without any bathroom or kitchen and had no piece of land or agriculture land, the mother Ms. Divaliben Kachadia has no bank account no income and no land his son, Atmiya is minor and has no bank account and even the wife of the Karta is a house wife and no income from land. It was further submitted that the return was not filed by the Karta and even the signatures on the return of income are not of Karta He further pointed to the fact that in the return of income it was stated that the marriage of the Karta had taken place in 1982 but in fact he got married in 1989. He further submitted that A.O had relied on the statements made by Mr. Vinod Modi ITP, but Assessee was never given an opportunity to cross examine him. It was therefore submitted that the Assessee did not have the income 6 . ITA Nos. 448 to 450/A/11 & C.O Nos. 75 to 77/A/11 A.Ys. 2003-04 to 2005-06 which is stated in the return of income and the return of income has not been filed by Assessee. He thus supported the order of CIT(A). 7. We have heard the rival submissions and perused the material on record. We find that CIT(A) after considering the submissions made by the Assessee has noted and given a finding that Assessee had never applied for PAN, the return of income was not verified and the return being not filed by the Assessee stand established and the return of income filed has to be treated as a scrap of paper filed by anonymous person reflecting fictitious income, assets and liabilities. He has further noted that the copy of statement of Shri Vinod Modi, ITP which was relied by the A.O for making the additions was never furnished to the Assessee nor the Assessee was afforded opportunity to cross-examine Shri Vinod Modi. Before us, Revenue has not brought any material on record to controvert the findings of ld. CIT(A). We therefore find no reason to interfere with the order of ld. CIT(A). In the result, the appeal of Revenue is dismissed. ITA Nos. 448 & 449/AHD/2011 for A.Ys. 2003-04 & 2004-05. 8. Before us, since both the parties have submitted that the facts and circumstances of the present cases are identical to that of A.Y. 2005-06 and we while deciding the appeal of Revenue in ITA No. 450/AHD/2011 for A.Y. 05-06 hereinabove and for the reasons stated therein have dismissed the appeal of Revenue. Since the facts and circumstances of the case for A.Y. 03-04 & 04-05 and similar to that of A.Y. 05-06, we for the similar reasons stated hereinabove while deciding the appeal for A.Y. 2005-06 (supra) dismiss the grounds of Revenue in the present appeals. 7 . ITA Nos. 448 to 450/A/11 & C.O Nos. 75 to 77/A/11 A.Ys. 2003-04 to 2005-06 9. In the result both the appeals of Revenue are dismissed. C.O. No.75 to 77/AHD/2011for A.Y. 2003-04 to 2005-06 10. Before us, ld. A.R. did not press the captioned C.Os. and therefore all the C.Os. are dismissed as not pressed. 11. In the result all the appeals of the Revenue and C.Os. of the Assessee are dismissed. Order pronounced in Open Court on 30 - 01 - 2015. Sd/(MUKUL Kr. SHRAWAT) JUDICIAL MEMBER Ahmedabad. TRUE COPY Sd/(ANIL CHATURVEDI) ACCOUNTANT MEMBER Rajesh Copy of the Order forwarded to:1. The Appellant. 2. The Respondent. 3. The CIT (Appeals) – 4. The CIT concerned. 5. The DR., ITAT, Ahmedabad. 6. Guard File. By ORDER Deputy/Asstt.Registrar ITAT,Ahmedabad

© Copyright 2026