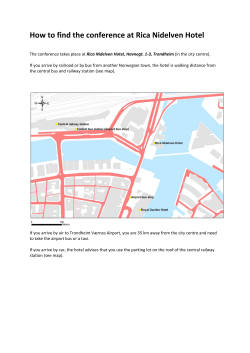

Kvartalsrapport per 30