Three black crows on Nifty

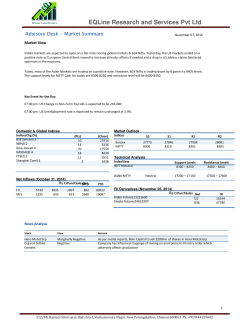

For April 20, 2015 A Sharekhan technical research newsletter Punter’s Call Three black crows on Nifty Market on April 17, 2015: Resistance @ 8760 Nifty daily: 8606 9200 9150 The Nifty fell and closed with losses for the third consecutive day and what’s more, it managed to hit a century on the downside on all three days. So bears have now scored a hat trick. The index has formed a “Three black crows” candlestick pattern on the daily chart and a “bearish engulfing” candlestick pattern on the weekly chart. These are signs of a reversal. Hence, we have kept our short-term as well as medium-term bias down. On the hourly chart, the index has broken the previous five-wave declining pattern. So the minimum equality target comes to 8550, which is also the 50% retracement level of the rise from 8269 to 8850. The Bank Nifty seems to have started its wave Z down and if the falling wedge pattern is drawn on the daily chart, then it will break the previous low of 17719 and find support near 17450. The momentum indicators on the weekly and monthly charts remain in sell mode which is a bearish sign going forward. 9100 9050 9000 8950 8900 8850 8800 8750 8700 8650 8600 8550 8500 8450 8400 8350 8300 8250 8200 8150 8100 8050 8000 7950 7900 KST (0.97089) 5 0 22 29 5 2015 12 19 27 2 9 February 16 23 2 9 March 16 23 30 6 April 13 20 27 4 Ma 60-minute 8900 ii 8850 8800 i iv 8750 Other technical observations iii 8700 8650 v On the daily chart, the index is trading below the 20day moving average (DMA) and the 40-DMA, ie 8612 and 8661 respectively. The momentum indicator is trading in positive mode on the daily chart. 8600 8550 8500 8450 8400 On the hourly chart, the Nifty is trading below the 20hour moving average (HMA) and the 40-HMA, ie 8708 and 8702 respectively, which are crucial intra-day levels. The hourly momentum indicator has turned negative. The market breadth was negative with 509 advances and 989 declines on the National Stock Exchange. KST (-1.05053) 19 20 23 24 25 26 27 30 31 1 April 6 7 8 1.0 0.5 0.0 -0.5 -1.0 -1.5 9 10 13 15 16 17 18 19 Market breadth BSE NSE Advances 1184 509 Decline 1635 989 121 54 3,456 cr 17,747 cr Unchanged Volume (Rs) For Private Circulation only REGISTRATION DETAILS Regd office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos. BSE - INB/INF011073351 ; BSE- CD ; NSE- INB/INF231073330; CD-INE231073330 ; MCX Stock Exchange - INB/INF261073333 ; CD-INE261073330 ; DP - NSDL-IN-DP-NSDL-233-2003 ; CDSL-IN-DP CDSL-271-2004 ; PMS-INP000000662 ; Mutual Fund-ARN 20669 ; Commodity trading through Sharekhan Commodities Pvt. Ltd.: MCX-10080 ; (MCX/TCM/ CORP/0425) ; NCDEX-00132 ; (NCDEX/TCM/CORP/0142) ; NCDEX SPOT-NCDEXSPOT/116/CO/11/20626 ; For any complaints email at [email protected]; Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and Do’s & Don’ts by MCX & NCDEX and the T & C on www.sharekhan.com before investing. Looking Trendy Short Term Trend Index Target Sensex 28150 Trend 8556 u Index Target Trend Sensex 26800 Nifty Reversal u Support / Resistance Up above 29100 28150/29100 Up above 8850 8556/8850 Medium Term Trend Nifty u u 8180 u u Up Reversal Support / Resistance Up above 29430 26800/29430 Up above 8937 8180/8937 Icon guide Down Upswing matures Downswing matures Trendy Levels for Tomorrow Sensex Support Nifty Resistance 28368 28630 18800 19300 28150 28737 18693 19700 27950 28865 18182 20062 20DSMA 40DEMA 20DSMA 40DEMA 28368 28562 20390 19941 BSE Sensex: 28,442 BSE Sensex: 19013 For Private Circulation only Eagle Eye 2 Support Resistance 8556 5700 8500 5616 8454 5514 20DSMA 20DSMA 8612 6096 8656 5847 8708 5993 8760 6078 40DEMA 40DEMA 8661 5958 April 20, 2015 Nifty: 8,606 Nifty: 5705 Home Smart Charts Date Recommendation Action 17-Apr-15 17-Apr-15 16-Apr-15 9-Apr-15 8-Apr-15 Axis Bank Apr Fut ACC Apr Fut Kotak Bank Apr Fut Jsw steel Apr Fut RCOM Apr Fut Sell Sell Sell Buy Buy Stop Loss/ Reversal (Intra-day) Stop Loss/ Reversal DCL 559.00 1,593.00 1,469.00 940.00 62.80 Buy/Sell Price 542.50 1,534.00 1,416.30 958.30 61.90 Closing Potential % Price P/L at CMP (CMP) 537.00 1,521.20 1,375.00 961.00 70.25 Target1 Target 2 1.01% 500.00 0.83% 1,446.00 2.92% 1,310.00 0.28% 977.00 13.49% 68.00 476.00 1,376.00 1,270.00 1,017.00 77.00 NOTE: Kindly note that all stop losses in Smart Charts Calls are on closing basis unless specified. TPB: Trailing profit booked Momentum Swing For the short term—1 to 5 days Action Date Stock Action Stop loss Price Closing price P/L at CMP Potential % Target1 Target2 17-Apr-15 RCOM Apr Fut Buy 69.60 72.30 70.25 -2.84% 77.00 79.00 17-Apr-15 Tata Steel Apr Fut Buy Book Profit 346.50 353.15 1.92% 356.00 362.00 16-Apr-15 Apollo Hospital Apr Fut Sell Book Profit 1,369.00 1,342.00 1.97% 1,333.00 1,299.00 NOTE: Kindly note that all stop losses in Momentum Calls are on an intra-day basis. TPB: Trailing profit booked NOTE: Action taken after market hours will be highlited in blue colour. Rules for momentum calls: 1) The stop loss should be placed after 9.17am in order to avoid freak trade 2) The same will be revised in the TradeTiger terminal every day for the pop-ups For Private Circulation only Eagle Eye 3 April 20, 2015 Home Short specific Term Trend Stock ideas - CNX BANK INDEX - 1 MONTH (18,650.00, 18,650.00, 18,377.00, 18,418.00, -254.900) 21200 21100 21000 20900 20800 20700 20600 20500 20400 20300 20200 20100 20000 19900 19800 19700 19600 19500 19400 19300 19200 19100 19000 18900 18800 18700 18600 18500 18400 18300 18200 18100 18000 17900 17800 17700 17600 17500 100.0% 61.8% C 50.0% A 38.2% 23.6% B 0.0% Bank Nifty Support: 18252/18149 Resistance: 18519/18718 KST (0.11310) 5 0 -5 12 19 27 2 9 February 16 23 2 March 9 16 23 30 6 April 13 20 27 4 Ma Premium Technical Synopsis Action date Calls Action Segments Reversal^ Stop loss/ (Rs) Stop loss* price Reco price (Rs) Closing P/L (%) (Rs) Potential # (Rs) Tgt.1 (Rs) Tgt.2 Rwd. Risk/ ratio (%) 15.04.2015 Tata Power Buy Cash 77.00 81.50 80.45 -1.29% 95.00 110.00 1/6 09.04.2015 GVKPIL Buy Cash 9.00 9.65 9.20 -4.66% 11.00 13.00 1/5 *DCL # CMP ^Intra-day For Private Circulation only Tgt. = Target Rwd. = Reward Eagle Eye 4 April 20, 2015 Home Day Trader’s Hit List For April 20, 2015 Scrip Name NIFTY Futures Support Levels S2 S1 Close (Rs) Resistance Levels R1 R2 Action 8500.0 8627.0 8636.7 8688.0 8706.0 Go Short Below s1 Bank Nifty Futures 18200.0 18377.0 18415.0 18579.0 18690.0 Go Short Below s1 531.8 533.7 537.0 541.0 Go Short Below s1 Axis Bank 526.0 BHEL 229.5 233.0 234.9 237.0 247.0 Go Long AboveR1 / Go Short Below s1 DLF 139.0 146.5 147.2 149.0 152.0 Go Short Below s1 Hindalco 134.5 137.6 139.8 141.7 144.0 Go Long AboveR1 / Go Short Below s1 ICICI Bank 302.6 308.3 310.1 315.0 317.6 Go Short Below s1 23.4 24.5 24.6 25.1 25.6 Go Short Below s1 1711.0 1730.0 1739.8 1747.0 1765.0 910.0 922.8 926.9 937.0 975.0 Jai Prakash LNT Reliance Industries Go Short Below s1 Go Long AboveR1 / Go Short Below s1 SBI 285.0 289.0 291.8 295.0 305.0 Go Long AboveR1 / Go Short Below s1 Tata Motors 525.0 534.0 535.4 545.0 549.0 Go Short Below s1 Tata Power TISCO TCS 78.3 79.3 80.5 81.5 84.0 Go Long AboveR1 / Go Short Below s1 330.0 341.0 346.0 353.0 364.0 Go Long AboveR1 / Go Short Below s1 2434.0 2470.0 2474.9 2504.0 2550.0 Go Long AboveR1 / Go Short Below s1 *Note: Closing price of Nifty futures is last traded price of Nifty futures on NSE SL=Stoploss For Private Circulation only Eagle Eye 5 April 20, 2015 Home Trading Rationale Smart Charts KST (-1.93604) 10 Axis Bank: Sell 5 0 -5 AXIS BANK (550.000, 550.350, 540.400, 542.000, -8.79999) CMP: Rs542.50 670 660 650 640 630 620 610 600 590 580 570 560 550 540 530 Sell Axis Bank at the current market price of Rs542.50, with the stoploss of Rs559 for the targets of Rs500 and Rs476. The stock has broken out on the downside from an inside bar & has started next leg down. Daily momentum indicator has given a sell signal. 520 510 500 490 480 470 460 450 15000 10000 5000 x1000 15 22 29 5 2015 12 19 27 2 9 February 16 23 2 9 March 16 23 30 6 April 13 20 27 4 Ma Home To know more about our products and services click here. For Private Circulation only Disclaimer This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity to which it is addressed to. This document may contain confidential and/or privileged material and is not for any type of circulation and any review, retransmission, or any other use is strictly prohibited. This document is subject to changes without prior notice. Kindly note that this document is based on technical analysis by studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals. This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report. The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While we would endeavour to update the information herein on a reasonable basis, SHAREKHAN, its subsidiaries and associated companies, their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should make such investigations as he deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult his own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to advise you as to any change of our views. Affiliates of SHAREKHAN may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject SHAREKHAN and affiliates to any registration or licencing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. Either SHAREKHAN or its affiliates or its directors or employees/representatives/clients or their relatives may have position(s), make market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested in any of the securities or related securities referred to in this report and they may have used the information set forth herein before publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved in, or related to, computing or compiling the information have any liability for any damages of any kind. The analyst certifies that all of the views expressed in this document accurately reflect his or her personal views about the subject company or companies and its or their securities and do not necessarily reflect those of SHAREKHAN. Further, no part of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this document.” For Private Circulation only 6 [email protected] April 20, 2015 • Contact: [email protected] Eagle Eye e-mail: Compliance Officer: Ms. Namita Amod Godbole; Tel: 022-6115000; Home

© Copyright 2026