April 2015 - Western Union Business Solutions

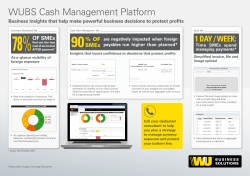

International Trade Monitor April 2015 Views and opinions of over 1,000 UK small and medium enterprises involved in international trade UK SMEs call for simplified tax system to boost exports The latest findings from the International Trade Monitor reveal that 84% small and medium-sized enterprises (SMEs) are confident in the UK’s economic climate. Such confidence may not seem that surprising, especially given the improving macroeconomic conditions over the last 12 – 18 months and the fact that the UK is one of the fastest growing economies in the developed world. It is equally reassuring to see that the vast majority (89%) of the UK SMEs surveyed believe that this improvement is sustainable. 84% 89% Are confident in the UK’s ecconomic climate Believe this improvement is sustainable Investing for growth but costs are on the up Over half of business owners (59%) said they plan to increase investment in their company, an increase of 10% from the same period last year. However, despite deflation being at a record low, nearly half (47%) of SMEs have seen rising costs in their business, which they appear to be combatting by increasing prices. Twenty two per cent said they will increase the prices they charge in the next 6 – 12 months, an increase from 18% nine months ago in Q3 of 2014. A question of tax For the first time the ITM asked SMEs about which government policy they would change in order to make their business more successful. Not surprisingly, the top two relate to taxation and, in the lead up to the General Election, British SMEs will be listening closely to how the major parties are promising to help importers and exporters in the next parliament. The top five policy changes are: 87% A simp li tax sys fied tem 81% r tax Greate r relief foers export 68% Greater access to credit /finance 26% Reformcost to the ess in of bus rates 22% Inve in higstment digit h spee d infra al struc ture Interestingly, only 5% of respondents said legislation on late payments would make a difference to their business, despite previous surveys regularly citing late payments and cash flow regularly being as top concerns for SMEs. Tony Crivelli UK Managing Director of Western Union Business Solutions said: Despite inflation falling to zero, we cannot ignore the fact that Britain’s businesses are still faced with rising costs. Whilst previous surveys showed that SMEs were reluctant to pass on these costs to customers, the mood is beginning to change; one in five plan to increase their prices in an attempt to protect profit margins. SMEs are seeking new customers in the growth markets of China and India. Both of these markets represent two of the largest growing middle classes across the globe who are demanding goods and services. Expanding into these markets is not without risk; SMEs will be wise to implement robust risk management strategies in order to manage exchange rate volatility when sending or receiving international payments, in order to remain competitive in the global market. Top SME Concerns SMEs continued to be worried about economic basics but there is a distinct ‘creep’ in concerns about regulation and political influence in the lead up to the general election and uncertainty and the UK’s position in the EU. Top Challenges for SMEs 53% International regulation and compliance 64% 60% Cash flow Overall health of the economy. Despite topping the list this figure continues to fall, in the same quarter in 2014 the figure stood at 72% 60% Cheaper competitors UK EXPORT MARKETS Q1/2015 WHAT ARE YOUR CURRENT EXPORT MARKETS? 56% Currency 41% Political volatility influence WHICH COUNTRY REPRESENTS THE BIGGEST OPPORTUNITY TO MARKET YOUR BUSINESS? 2% 78% 23% NORTH AMERICA EUROPE 0% RUSSIA 15% 12% 21% 8% 14% AFRICA INDIA 10% OTHER ASIA OTHER SOUTH AMERICA 9% 3% BRAZIL 14% 5% 34% 6% 16% 4% CHINA 4% 7% OTHER 3% AUSTRALASIA 4% Export revenues and SMEs eye up China UK SMEs are more confident about international trade conditions than ever before, with 91% of respondents feeling confident during the first quarter of 2015, compared to 87% the previous quarter. This is reflected in the fact that now over a quarter (26%) of SME business revenue comes from exports, a 10% rise from the previous quarter. Media Enquiries: Sally Walton / Vanessa Chance +44 (0) 20 7382 4740 [email protected] A fifth of UK SMEs (21%) now export to China, an increase from 15% the previous quarter. Exports to Europe remain consistent, with 78% of SMEs exporting to the Continent in the last 12 months. The research shows that sluggish Eurozone growth has led to more UK SMEs turning their gaze towards the Chinese and Indian markets. Over a third (34%) of UK SMEs said China has the greatest export market potential in the future, an increase from 25% six months ago. British SMEs are also increasingly regarding India as a growing export market, possibly in line with the country’s economic advances*; 10% of SMEs believe India is the country with the biggest export opportunity, more than double the proportion from Q3 2014 (4%). 34% 10% of UK SMEs said China has the greatest export market potential of UK SMEs believe India has the biggest export opportunity *http://www.tradingeconomics.com/india/gdp-growth-annual Exports to Europe remain steady with an average of 78% of SMEs in the last 12 months exporting to Europe. A further 44% of SMEs said they believe the proportion of export earnings to overall revenue will increase in the next 12 months. This is a signal that export assistance from the UKTI as well as the Bank of England’s investing in micro-financing initiatives is being realised by SMEs across the UK. © 2015 Western Union Holdings, Inc. All rights reserved. Western Union Business Solutions is a division of The Western Union Company. Services in the UK are provided by Custom House Financial (UK) Limited (which does business under the trade name of Western Union Business Solutions) or Western Union Business Solutions (UK) Limited (collectively referred to as “WUBS” or “Western Union Business Solutions”). Custom House Financial (UK) Limited (Registered in England, Company Number 04380026, Registered Office Address: 2nd Floor, 12 Appold Street, London EC2A 2AW) is authorised by the Financial Conduct Authority under the Payment Services Regulations 2009 (Register Reference: 517165) for the provision of payment services and is registered as an MSB with HM Revenue & Customs (Registered No: 12140130). Western Union Business Solutions (UK) Limited (Registered in England, Company Number 02854737, Registered Office Address: 12 Appold Street, London EC2A 2AW) is authorised by the Financial Conduct Authority under the Payment Services Regulations 2009 (Register Reference: 536611) for the provision of payment services and is registered as an MSB with HM Revenue & Customs (Registered No: 12122416). This brochure has been prepared solely for informational purposes and does not in any way create any binding obligations on either party. Relations between you and WUBS shall be governed by the applicable terms and conditions. No representations, warranties or conditions of any kind, express or implied, are made in this brochure.

© Copyright 2026