To read full results click here

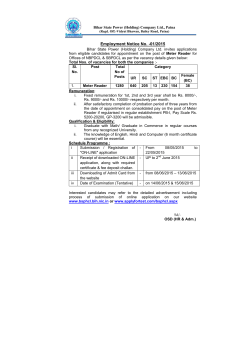

th 25 March 2015 CHIME COMMUNICATIONS PLC ANNOUNCEMENT OF AUDITED PRELIMINARY RESULTS FOR ST THE YEAR ENDED 31 DECEMBER 2014 A year of transformation and growth Strengthened position as an international communications and sports marketing group Chime Communications plc, the international communications and sports marketing group, today announces st its full year results for the year ended 31 December 2014. OPERATIONAL HIGHLIGHTS • • • • • • • • • • Group now structured into four operating divisions: Sport and Entertainment, Advertising and Marketing Services, Healthcare Communications and Insight and Engagement 2 Strong growth in income and profits in all four divisions – like for like growth in operating profits of 10% Net new business of £31 million already won for 2015 compared to £23 million won in the same period in 2014 Two significant contracts delayed from 2014 are in final stages of negotiation Zak Brown, currently Chief Executive of JMI, appointed as Chief Executive of our Sport and Entertainment division, reporting to Lord Coe and restructuring plan now being developed. Roopesh Prashar has also been appointed as Finance Director of this division Major events in 2015 include European Games in Baku and the Rugby World Cup in the UK and we are involved in both Expansion into US continuing following successful acquisitions of JMI and SJX Advertising and Marketing Services had a successful year with double digit income growth and margin improvement Healthcare and Insight and Engagement divisions continue to grow ahead of the marketplace Board further strengthened in 2014 through the appointment of Lord Coe HEADLINE FINANCIAL HIGHLIGHTS 1 2014 £m Operating Income Operating Profit Profit Before Tax Operating Profit Margin Earnings Per Share Total Dividend 198.9 32.2 30.1 16.2% 22.0p 8.40p 2013 £m 168.0 26.0 25.2 15.5% 19.7p 7.34p 2014 % Change +18 +24 +19 +5 +12 +14 2014 Like for Like 2 % Change +6 +10 +6 st • Net bank debt as at 31 December 2014 of £53.1 million compared to a new five year facility of £130 million agreed with RBS and HSBC until September 2019 • Final dividend increased with total dividend for the year increased by 14% to 8.40p (2013: 7.34p) Christopher Satterthwaite, Chief Executive of Chime Communications, said: “2014 was a year of good growth and saw the development of CSM as a global player in the sport and entertainment marketing businesses. Our communications businesses continue to grow and with the proportion of shared clients also increasing, we are sharpening our competitiveness as an international communications and sports marketing group”. 1 STATUTORY FINANCIAL HIGHLIGHTS Operating Income Operating Profit Profit/(Loss) Before Tax Operating Profit Margin Profit/(Loss) Per Share Note: 2014 £m 2013 £m % Change 2014 Like for Like 2 % Change 200.2 18.3 15.8 9.1% 9.6p 170.1 (4.7) (12.6p) +18 +100 - +6 +454 +813 1. All numbers and comments shown in this section are headline unless otherwise stated. The appendix to this announcement shows a reconciliation of these headline numbers to the reported numbers. The headline numbers adjust for the following: • Deemed remuneration charge add back in respect of the change in accounting policy adopted in the st year ended 31 December 2012 for earn-out payments including LLP capital based payments. • Add back of charges to the income statement in respect of amortisation of intangible assets, impairment of goodwill (see note 7) and costs relating to acquisition and restructuring. • Add back of results from businesses classed as discontinued that do not meet the definition of discontinued operations under the accounting standard. 2. Like for Like comparisons are calculated by taking current year actual results (which include acquisitions from the relevant date of completion) compared with prior year actual results, adjusted to include the results of acquisitions for the commensurate period in the prior year. For further information please contact: Christopher Satterthwaite, Chief Executive Chime Communications 020 7096 5888 Mark Smith, Chief Operating Officer and Finance Director Chime Communications 020 7096 5888 James Henderson/Victoria Geoghegan/Elizabeth Snow Bell Pottinger 020 3772 2562 OVERVIEW Performance in 2014 was well ahead of 2013 with growth in operating income and profit across all four divisions. The performance of the Advertising and Marketing Services division was particularly strong. Our Sports and Entertainment division has continued to expand both its international reach and its reputation and we are now being asked to pitch for more international briefs than ever before. We have now restructured the Group from five divisions into four, with the Public Relations division being integrated into two other divisions. The Good Relations branded businesses have become part of the Sport and Entertainment division, with the other businesses joining the Chime Specialist Group, part of the Advertising and Marketing Services division. STRATEGY We continue to develop our strategic capability as an international sports marketing and communications group and we continue to invest in Sport and Entertainment and Advertising and Marketing Services businesses particularly in new geographies and disciplines. 2 KEY PERFORMANCE INDICATORS Average Fee per Client Average fee per client for 2014 was £111,000, compared to £99,000 in 2013. 289 clients paid us over £100,000 in 2014 compared to 247 in 2013. Our largest client represented 8.6% of total operating income (2013: 12.6%). The breadth and quality of our client list continues to improve and our top 30 clients now represent 41% of total income compared to 44% in 2013. Income from Shared Clients The Group acted for 1,786 clients in 2014 compared to 1,689 in 2013. 306 of these clients used more than one of our businesses (2013: 284) which represented 70% of total operating income (2013: 68%). Operating Profit Margin Operating profit margin for 2014 was 16.2% compared to 15.5% in 2013 reflecting our focus in 2014 on margin, particularly in our Advertising and Marketing Services division. Income from Overseas Offices Income from overseas offices increased by 53% in 2014 and as a percentage of total income increased from 18% in 2013 to 24% in 2014. International expansion continues to be a major part of our growth strategy. Earnings per Share 1 Earnings per share in 2014 increased 12% to 22.0p (2013: 19.7p). HEADLINE DIVISIONAL PERFORMANCE Sport and Entertainment Operating Income Operating Profit Operating Profit Margin 2014 £m 2013 £m 81.2 13.5 63.2 10.8 16.6% 17.1% % Change +28 +25 2014 Like for Like % Change +1 Our Sport and Entertainment division continued to grow its income, profits and international reach in 2014. Overall the three major events in 2014, the World Cup in Brazil, the Winter Olympics in Sochi and the Commonwealth Games in Glasgow were successful for us, providing a strong base from which we can build for the Olympics in Brazil in 2016 and the World Cup in Russia in 2018 and for providing invaluable learning for those future events. We are investing in global management capability in this division under the chairmanship of Lord Coe with Jim Glover taking on a new role as Deputy Chairman leading the increasing number of global accounts and new business opportunities. Zak Brown, currently CEO of JMI, has now been appointed CEO of this division. We have appointed Roopesh Prashar as Finance Director of this division. This management team has commenced an investment and restructuring programme to ensure we are well placed to achieve our future growth targets and properly control and forecast the major contracts we are winning. We continue to operate strongly in seven of the top ten sports by value in the world and as the global sports market continues to grow, we are exploring many new opportunities, particularly in North America where Zak Brown’s experience will be invaluable. In the 2015 Rugby World Cup in the UK we are handling Land Rover’s sponsorships and managing 82 players who are expected to play from the eight top world ranked countries. 3 Our major acquisition in November 2013, JMI (motorsport business based in the UK and US) has integrated well into the Group, continued its expansion and had double digit growth in both income and profits. Good Relations, our brand and corporate public relations business, grew profits by over 10% and is expected to show continuing strong growth as it increases its international expansion using the CSM international network. Global new business pitches using this model are already underway. New business wins include: International Paralympic Committee, Unilever, Ford, VW, Epson, Bose, Haas F1, Verizon IndyCar Series, Williams Martini Racing, Banco do Brasil, Fédération Equestre Internationale, FIA Formula E Competition, PruHealth/Vitality, Waitrose, Hardys, Clifford Chance, Remy, Volvo Ocean Race, Rio 2016, Bradesco, Saudi Olympic Committee, Coca-Cola, MetLife, Infiniti, Samsung and Southeastern. Advertising and Marketing Services Operating Income Operating Profit Operating Profit Margin 2014 £m 2013 £m 86.8 12.4 14.2% 77.2 9.5 12.3% % Change 2014 Like for Like % Change +12 +30 +11 +23 In 2014 this division focused on developing the new clients it won in 2013 as well as margin improvement. VCCP was also the advertising agency with the most new client opportunities and the agency with the most wins in the UK (Source: AAR). This division now includes Corporate Citizenship (corporate and social responsibility), Harvard (technology based communications) and inEvidence (customer reference) which have come together with Teamspirit and Pure Media to form the Chime Specialist Group of businesses under the leadership of Joanne Parker. New business wins include: BMW Motorad, Kia, World First, Royal London, ING (Australia), Qatari Diar, BILD and CBRE. Healthcare Communications 2014 £m Operating Income Operating Profit Operating Profit Margin 21.8 4.3 20.1% 2013 £m % Change 18.5 3.9 21.0% +18 +13 2014 Like for Like % Change +18 +13 A year of successful consolidation of previous acquisitions with the strong focus on market access and patient data delivering both double digit income and profit growth. All Open Health communications agencies showed strong growth and we continue to invest in digital communications. New business wins include: Astra Zeneca, Eisai, Celgene, Novartis and Janssen. Insight and Engagement 2014 £m Operating Income Operating Profit Operating Profit Margin 9.1 3.1 34.1% 2013 £m % Change 9.1 2.8 31.2% +10 2014 Like for Like % Change +10 This division has grown its operating profit mainly due to the continued growth of its high margin digital research business and the development of a ‘full service’ offering to the research and insight marketplace. New business wins include: Paypoint, Brakes, npower, Allianz, Ulster Bank and Anglian Water. 4 BOARD AND MANAGEMENT CHANGES In May 2014 Lord Coe joined the Board of Chime, further improving our ability to expand in the fast growing sports marketing sector. He also remains as Executive Chairman of our Sport and Entertainment division. th Martin Glenn will resign from the Board on 12 May 2015 following his appointment as Chief Executive Officer of the Football Association. We would like to thank Martin for his valuable contribution since his appointment in August 2013. Zak Brown has been appointed CEO of our Sport and Entertainment division and will join the Executive Management Board. He is an American businessman and former professional racing driver who currently lives in Surrey. He founded JMI in 1995. His accomplishments as a sports marketeer have been reflected through multiple industry recognitions including as a marketeer of the year by Promo magazine, being named four times in the INC 500 Fastest Growing Private Companies of the Year and his inclusion in the Sports Business Journal’s Forty under 40 Hall of Fame, having been presented with the award three times. CORPORATE ACTIVITY 2014 was a year in which we focused mainly on organic growth and consolidating acquisitions made in previous years. We did however, acquire three smaller sports businesses, SJX, Blaze and ABC, which have improved our activities in the US and rugby player management. CASH FLOW AND BANKING ARRANGEMENTS st st Net bank debt at 31 December 2014 was £53.1 million compared to £39.8 million at 31 December 2013. An increased facility has been agreed with RBS and HSBC for £130 million. This runs until September 2019, with an interest rate of between 1.50% and 2.9%, depending on use of the facility compared to EBITDA and the level of borrowing. The estimated earn-outs (which include consideration treated as deemed remuneration) payable in 2015 total £11.4 million of which £3.5 million is payable in shares or loan notes. As expected there was a working capital outflow in 2014 reflecting both the change in working capital profile of the Group and the delay in completion of some major sporting contracts. Whilst we still expect to be cash st generative, the nature of our business now will, from time to time, require working capital investment. At 31 December 2014 the company had a working capital requirement of £10.2 million compared to a negative st requirement of £1.8 million at 31 December 2013. TAXATION The effective tax rate for 2014 was 22.5% compared to 25.8% for 2013. This lower tax rate was due to the use of historical tax losses in the US following the acquisition of JMI. Going forward lower tax rates in the UK will be offset by higher tax rates in some international territories. DIVIDENDS The Board proposes a final dividend of 5.87p per share (2013: 5.14p per share). This will be payable on 12 nd st June 2015 to shareholders on the register at 22 May 2015. The ex-dividend date is 21 May 2015. th Total dividend for the year will be 8.40p compared to 7.34p in 2013. An increase of 14%. This represents a dividend cover of 2.6 times, compared to 2.4 times in 2013 and 3.0 times in 2012. 5 OUTLOOK We continue to grow both our sports marketing and communications businesses with like for like profit growth of 10% in 2014. As sport and entertainment properties provide the opportunity for global brands to reach mass audiences as never before, we are investing in our global management capabilities in the Sport and Entertainment Division in order to compete for major global contracts. The value of sport and entertainment rights therefore continues to grow and we believe the long term prospects for our Sport and Entertainment business are extremely good. However, the nature of large sporting contracts and the cycle of sporting events mean there will be inevitable highs and lows in our sports business. Digital marketing continues to outstrip traditional advertising growth rates which plays to the strengths of our Advertising and Marketing Services division. Our Healthcare Communications and Insight and Engagement divisions are also trading strongly and are well placed for good organic growth ahead of the marketplace. With sports marketing and digital marketing at the heart of the Chime group and the strength of our brands we look forward to long term growth. 6 Appendix - Reconciliation of Income Statement to headline results for the year ended 31 December 2014 The reconciliation below sets out the headline results of the group and the related adjustments to the reported Income Statement that the directors consider necessary in order to provide an indication of the underlying trading performance. Headline 2014 £’000 Continuing Operations Revenue Cost of sales Operating income Operating expenses 2013 £’000 Statutory Income Statement 2014 2013 £’000 £’000 386,171 (187,316) 293,383 (125,405) 4,195 (2,887) 5,803 (3,652) 390,366 (190,203) 299,186 (129,057) 198,855 167,978 1,308 2,151 200,163 170,129 (166,687) (141,953) (15,169) (28,157) (181,856) (170,110) 8,165 7,800 1,281 558 5,093 5,281 Deemed remuneration Loss/(profit) on business being discontinued Amortisation of acquired intangibles and goodwill impairment Acquisitions and transaction related costs/(credit) and restructuring costs (678) Operating profit 32,168 26,025 Other gains and losses Share of results of associates Investment income Finance costs Finance cost of deferred consideration Finance cost of deemed remuneration 1,048 291 (3,148) (287) - 1,053 66 (1,637) (309) - Profit/(loss) before tax 30,072 Tax Profit/(loss) for the period from continuing operations Discontinued operations (Loss)/profit from discontinued operations Adjustments 2014 2013 £’000 £’000 12,367 (13,861) (26,006) 18,307 (101) (294) (3,225) (361) (345) 947 291 (3,148) (287) (294) (3,225) 692 66 (1,637) (309) (345) 25,198 (14,256) (29,937) 15,816 (4,739) (6,758) (6,494) 2,022 2,065 (4,736) (4,429) 23,314 18,704 (12,234) (27,872) 11,080 (9,168) (982) (3,739) 982 3,739 19 - - Profit/(loss) for the period 22,332 14,965 (11,252) (24,133) 11,080 (9,168) Attributable to: Equity holders of the parent Minority interest 20,710 1,622 13,302 1,663 (11,252) - (24,133) - 9,458 1,622 (10,831) 1,663 22,332 14,965 (11,252) (24,133) 11,080 (9,168) 21.1p 21.01p 15.51p 15.37p 9.64p 9.60p -12.63p -12.63p 22.1p 19.87p 9.64p -12.63p Earnings per share From continuing and discontinued operations Basic Diluted From continuing operations Basic The headline numbers have been adjusted for the following: • • • • Deemed remuneration charge and finance cost add back in respect of employment linked earn-out payments including LLP capital based payments. Add back of charges to the income statement in respect of loss on disposal of subsidiaries, amortisation of intangible assets, impairment of goodwill and costs relating to acquisition and restructuring. Add back results from businesses classed as discontinued operations by management, not meeting the requirements to be disclosed as discontinued for statutory purposes under the relevant accounting standard. These include Ex Nihilo Limited, Traffic Gmbh, VCCP Me, Rough Hill Limited, UTR Events Limited, Fast Track Agency Scotland Limited and Essentially Australia Rugby businesses ( 2013: MMK-Good Relations Group GmbH and Conduit Marketing Limited). 2013 has been restated for these businesses. The group was restructured in early 2015 and the segmental has been prepared to reflect changes in the way the group operates and the manner in which information in respect of decision making is presented. The Public Relations Divisions has been split with Good Relations reported as part of CSM. All other businesses previously within the Public Relations Division are now reported as part of Advertising Marketing Services. 2013 has been restated for this restructure. 7 Diluted 22.01p 19.69p 9.60p -12.63p Appendix - Reconciliation of Business Segments to adjusted results for the year ended 31 December 2014 Reported Segmental Headline Operating Note Income Adjustments 2013 Operating Income 2013 2013 2014 restated 2014 restated 2014 restated £’000 £’000 £’000 £’000 £’000 £’000 Sport & Entertainment 81,158 63,201 269 251 81,427 63,452 Advertising and Marketing Services 86,845 77,259 1,039 1,900 87,884 79,159 Healthcare 21,750 18,451 - - 21,750 18,451 9,102 9,067 - - 9,102 9,067 198,855 167,978 1,308 2,151 200,163 170,129 Insight & Engagement Headline Operating Profit Adjustments 2013 Operating Profit 2013 2013 2014 restated 2014 restated 2014 restated £’000 £’000 £’000 £’000 £’000 £’000 Sport & Entertainment 13,494 10,819 (8,520) (19, 781) 4,974 (8,962) Advertising and Marketing Services 12,359 9,508 (4,730) (4,451) 7,629 5,057 Healthcare 4,363 3,866 (294) (1,267) 4,069 2,599 Insight & Engagement 3,102 2,826 - (159) 3,102 2,667 33,318 27,019 (13,544) (25,658) 19,774 1,361 (317) (348) (1,467) (1,342) (13,861) (26,006) 18,307 19 Unallocated corporate expenses (1,150) Operating profit 32,168 Other gains and losses Share of results of associates Investment income Finance costs (994) 26,025 - - - (3,225) - (3,225) 1,048 1,053 (101) (361) 947 692 291 66 - - 291 66 (3,148) (1,637) - - (3,148) (1,637) (287) (309) - - (287) (309) Finance cost of deferred consideration Finance cost of deemed remuneration Profit/(loss) before tax - - (294) (345) (294) (345) 30,072 25,198 (14,256) (29,937) 15,816 (4,739) Headline Operating Profit Operating Profit Margin Margin 2013 2013 2014 restated 2014 restated % % % % Sport & Entertainment 16.6% 17.1% 6.1% Advertising and Marketing Services 14.2% 12.3% 8.7% 6.4% Healthcare 20.1% 21.0% 18.7% 14.1% Insight & Engagement 34.1% 31.2% 34.1% 29.4% 16.8% 16.1% 9.9% 0.8% - - Unallocated corporate expenses - - -14.1% The headline numbers have been adjusted for the following: • • • • Deemed remuneration charge and finance cost add back in respect of employment linked earn-out payments including LLP capital based payments. Add back of charges to the income statement in respect of loss on disposal of subsidiaries, amortisation of intangible assets, impairment of goodwill and costs relating to acquisition and restructuring. Add back results from businesses classed as discontinued operations by management, not meeting the requirements to be disclosed as discontinued for statutory purposes under the relevant accounting standard. These include Ex Nihilo Limited, Traffic Gmbh, VCCP Me, Rough Hill Limited, UTR Events Limited, Fast Track Agency Scotland Limited and Essentially Australia Rugby businesses ( 2013: MMK-Good Relations Group GmbH and Conduit Marketing Limited). 2013 has been restated for these businesses. The group was restructured in early 2015 and the segmental has been prepared to reflect changes in the way the group operates and the manner in which information in respect of decision making is presented. The Public Relations Divisions has been split with Good Relations reported as part of CSM. All other businesses previously within the Public Relations Division are now reported as part of Advertising Marketing Services. 2013 has been restated for this restructure. 8 16.2% 15.5% 9.1% 0.0% The headline numbers have been adjusted for the following: • • • • Deemed remuneration charge and finance cost add back in respect of employment linked earn-out payments including LLP capital based payments. Add back of charges to the income statement in respect of loss on disposal of subsidiaries, amortisation of intangible assets, impairment of goodwill and costs relating to acquisition and restructuring. Add back results from businesses classed as discontinued operations by management, not meeting the requirements to be disclosed as discontinued for statutory purposes under the relevant accounting standard. These include Ex Nihilo Limited, Traffic Gmbh, VCCP Me, Rough Hill Limited, UTR Events Limited, Fast Track Agency Scotland Limited and Essentially Australia Rugby businesses ( 2013: MMK-Good Relations Group GmbH and Conduit Marketing Limited). 2013 has been restated for these businesses. The group was restructured in early 2015 and the segmental has been prepared to reflect changes in the way the group operates and the manner in which information in respect of decision making is presented. The Public Relations Divisions has been split with Good Relations reported as part of CSM. All other businesses previously within the Public Relations Division are now reported as part of Advertising Marketing Services. 2013 has been restated for this restructure. 9 Consolidated Income Statement Year ended 31 December 2014 Notes Continuing operations Revenue Cost of sales 2014 £'000 2013 £'000 390,366 (190,203) 299,186 (129,057) Operating income 200,163 170,129 Operating expenses (181,856) (170,110) Operating profit 18,307 Other gains and losses Share of results of associates Investment income Finance costs Finance cost of deferred consideration Finance cost of deemed remuneration 947 291 (3,148) (287) (294) (3,225) 692 66 (1,637) (309) (345) Profit/(loss) before tax 15,816 (4,739) Tax (4,736) (4,429) Profit/(loss) for the year from continuing operations 11,080 (9,168) 9,458 1,622 (10,831) 1,663 11,080 (9,168) Attributable to: Equity holders of the parent Non-controlling interest Earnings per share (pence) From continuing and discontinued operations Basic Diluted 3 10 9.64p 9.60p 19 -12.63p -12.63p Consolidated Statement of Comprehensive Income Year ended 31 December 2014 2014 £'000 2013 £'000 11,080 (9,168) 93 1,123 160 (298) Total comprehensive income for the year 12,296 (9,306) Attributable to: Equity holders of the parent Non-controlling interest 10,683 1,613 (11,003) 1,697 12,296 (9,306) Profit for the year Items that may be reclassified subsequently to profit or loss: Profit on revaluation of available for sale investments Exchange differences on translation of foreign operations 11 Consolidated Balance Sheet as at 31 December 2014 Notes Non-current assets Goodwill Other intangible assets Property, plant and equipment Investments in associates Other investments Deferred consideration receivable Other financial assets Deferred tax asset 7 Current assets Work in progress Trade and other receivables Current tax receivable Cash and cash equivalents 2014 £'000 2013 £'000 224,347 19,253 10,274 6,975 607 245 400 2,810 264,911 227,810 7,038 9,837 6,089 514 282 100 3,510 255,180 6,216 92,806 20,274 119,296 8,196 80,259 18,267 106,722 (88,899) (2,510) (73) (1,596) (6,138) (2,779) (101,995) (91,019) (2,180) (20) (171) (5,725) (1,671) (1,420) (102,206) Total assets Current liabilities Trade and other payables Current tax liabilities Obligations under finance leases Bank loans and overdrafts Deferred consideration Deemed remuneration Short-term provisions Net current assets 17,301 Non-current liabilities Bank loans payable after more than one year Deferred consideration Deemed remuneration Deferred tax liabilities Long-term provisions Total liabilities Net assets 12 4,516 (73,293) (10,976) (6,560) (991) (67) (91,887) (193,882) (57,852) (11,608) (4,880) (657) (652) (75,649) (177,855) 190,325 184,047 Consolidated Balance Sheet as at 31 December 2014 (continued) 2014 Equity Share capital Share premium account Own shares Translation reserve Accumulated profit Equity attributable to equity holders of the parent Written put option over non controlling interests Non-controlling interest Total equity 13 2013 £'000 £'000 25,040 127,769 (1,655) 976 37,882 190,012 (2,487) 2,800 190,325 24,529 122,939 (1,718) (156) 36,319 181,913 2,134 184,047 Consolidated Statement of Changes in Equity Balance at 1 January 2014 Total comprehensive income for the period Transactions with owners: Acquisition of subsidiaries Share placing Issued to staff under options Share issue costs Disposed on exercise of options Purchase of own shares Purchase of non- controlling interest Equity dividends Credit in relation to share based payments Tax on share based payment exercises Recycle purchase of non-controlling interest on disposal Disposal of subsidiary LLP partnership share Written put options over non-controlling interests Release of capital reduction reserve Balance at 31 December 2014 Share capital £'000 Share premium £'000 24,529 - 122,939 - 411 100 25,040 4,624 254 (48) 127,769 Own shares £'000 Translati on reserves £'000 (1,718) - (156) 1,132 Accumulated profit/ (loss) £'000 Total £'000 Written put options over noncontrollin g interests £,000 36,319 9,551 181,913 10,683 - 2,134 1,613 5,035 - 36 (1,055) - 717 (654) - - (714) (7,570) 918 (119) 354 (48) 3 (654) (7,570) 918 (119) (1,655) 976 (503) 37,882 (503) 190,012 14 (2,487) (2,487) Noncontrollin g interests £'000 Total £'000 184,047 12,296 72 2,800 5,035 354 (48) 3 (654) 36 (8,625) 918 (119) (503) (2,487) 72 190,325 Consolidated Cash Flow Statement Year ended 31 December 2014 Net cash from operating activities Investing activities Interest received Dividends received from investments and associates Proceeds on disposal of property, plant and equipment Purchases of property, plant and equipment Purchases of other intangible assets Acquisition of subsidiaries (net of cash acquired) Disposal of subsidiary/associate Deferred consideration received Net cash used in investing activities Financing activities Dividend paid Dividends paid to minorities Increase in borrowings Repayment of borrowings Repayment of obligations under finance leases Proceeds on issue of ordinary share capital Purchase of own shares Purchase of non-controlling interests Net cash used in financing activities Notes 2014 £'000 2013 £'000 5 10,807 3,146 271 80 164 (5,022) (504) (9,279) 38 (14,252) 56 320 19 (5,746) (379) (58,156) (134) 1,025 (62,995) (7,570) (1,055) 73,363 (58,022) (20) 306 (1,651) (468) 4,883 (6,289) (998) 57,977 (13,565) (117) 24,142 (164) (894) 60,092 Net increase in cash and cash equivalents Cash and cash equivalents at beginning of year Effect of foreign exchange rate changes Cash and cash equivalents at end of year 1,438 243 18,267 569 20,274 17,892 131 18,267 20,274 (73,366) (107) (53,199) 18,267 (58,023) (20) (809) (40,585) Cash and cash equivalents comprise cash at bank and loan note deposits less overdrafts. Net cash comprises: Cash and cash equivalents Bank loans Finance leases Loan notes outstanding Overall net cash 15 Notes: 1. Basis of preparation The financial information set out above does not constitute the company’s statutory accounts for the years ended 31 December 2014 or 2013. Statutory accounts for 2013 have been delivered to the Registrar of Companies and those for 2014 will be delivered following the company’s annual general meeting. The auditor’s reports on both the 2014 and 2013 accounts were unqualified, did not draw attention to any matters by way of emphasis and did not contain statements under s498(2) or (3) of Companies Act 2006. Whilst the financial information included in this preliminary announcement has been computed in accordance with International Financial Reporting Standards (IFRSs) this announcement does not in itself contain sufficient information to comply with IFRSs. The Company expects to publish full financial statements that comply with IFRSs in April 2014. The information in this preliminary announcement was approved by the Board on 25 March 2015. The consolidated income statement, consolidated balance sheet, consolidated statement of comprehensive income, consolidated statement of changes in equity and consolidated cash flow statement have been prepared on a basis consistent with the financial statements for the year ended 31 December 2014. Going Concern Basis The Group meets its day to day working capital requirements through a £5 million revolving credit overdraft facility and a committed facility of £125 million which matures in September 2019. In preparing forecasts the directors have taken into account the following key factors: • The rate of growth of the UK and global economy on the Group’s business during the economic recovery; • Key client account renewals; • Planned acquisitions and disposals; • Anticipated payments under deemed remuneration and deferred and contingent consideration; • The level of committed and variable costs; and • Current new business targets compared to levels achieved in previous years. The Group’s forecasts and projections, taking account of reasonably possible changes in trading performance, show that the Group should be able to operate within the level of its current facility and banking covenants. The directors have a reasonable expectation that the Company and the Group have adequate resources to continue in operational existence for the foreseeable future. Thus they continue to adopt the going concern basis of accounting in preparing the annual financial statements. Forward looking statements The preliminary announcement contains certain forward looking statements in respect of Chime Communications plc and the operation of its subsidiaries. These statements and forecasts involve risk and uncertainty because they relate to events and depend upon circumstances that may or may not occur in the future. There are a number of factors that could cause actual results or developments to differ materially from those expressed or implied by these forward looking statements and forecasts. Nothing in this announcement should be construed as a profit forecast. 16 2. Business Segments For management purposes the Group is organised into operating segments. At the end of 2014 the operational structure was amended as shown below. The principal activities in 2014 were as follows: Sport & Entertainment CSM Sport & Entertainment is a group of internationally recognised agencies, working together to put clients and people at the heart of the world’s greatest experiences in sport and entertainment. Working with brands, rights holders, governing bodies, governments and athletes across the globe, CSM specialises in strategic consultancy, rights sales, sponsorship activation, hospitality, branding and wayfinding, athlete management and communications across major sporting events. Advertising and Marketing Services (‘AMS’) The AMS division includes the VCCP Partnership and the Chime Specialist Group. VCCP operates in advertising and marketing services, direct marketing, digital communication, search relations, point of sale, sales promotion, data consultancy and technical design, multimedia content, youth marketing and experiential, marketing consulting, retail and shopper marketing and specialist media planning and buying. The Specialist Group includes agencies operating in niche markets; corporate responsibility and sustainability consultancy; for technology brands; providing customer reference and advocacy and; in professional and financial services. Insight & Engagement The Insight & Engagement division brings together researchers, technologists and insight specialists who deliver to clients, globally, in real time, actionable solutions. The Division has particular expertise in delivering clients in FMCG, financial services, utilities and retail with experience performance improvement plans, mystery shopping programmes and advertising and brand tracking. The Insight & Engagement division includes leading specialist brands such as Watermelon - a specialist digital agency, CherryPicked a specialist recruitment agency, Facts International - a specialist fieldwork agency and full service agencies Opinion Leader and CIE. Healthcare OPEN Health is a healthcare communications and market access group. It comprises ten different specialist businesses that bring a breadth of expertise focussed principally on pharma, health device and diagnostic clients. OPEN Health’s companies cover most aspects of the communications mix including advertising, PR, medical communications, market access consulting, real world data collection, market research and patient engagement programmes. Reorganisation We have reorganised our operating segments reducing to four from five. The companies that previously made up the Public Relations Division, with the exception of Good Relations, have joined Teamspirit and Pure Media as the Chime Specialist Group and will operate alongside VCCP forming the Advertising and Marketing Services Segment. Good Relations has joined CSM and will report under the Sport and Entertainment Segment. The Insight and Engagement and Healthcare divisions remain unchanged. 17 2. Business Segments (continued) Revenue Sport & Entertainment Advertising and Marketing Services Healthcare Insight & Engagement 2014 £’000 £’000 £’000 £’000 174,003 176,648 26,096 13,619 390,366 120,333 146,122 21,661 11,070 299,186 81,427 87,884 21,750 9,102 200,163 63,452 79,159 18,451 9,067 170,129 Operating Profit 2013 2014 restated £’000 £’000 Unallocated corporate expenses Operating profit 4,974 7,629 4,069 3,102 19,774 (1,467) 18,307 (8,962) 5,057 2,599 2,667 1,361 (1,342) 19 Other gains and losses Share of results of associates Investment income Finance costs Finance cost of deferred consideration Finance cost of deemed remuneration (Loss)/Profit before tax 947 291 (3,148) (287) (294) 15,816 (3,225) 692 66 (1,637) (309) (345) (4,739) Sport & Entertainment Advertising and Marketing Services Healthcare Insight & Engagement 18 Operating Income 2013 2014 restated 2013 restated Operating Profit Margin 2013 2014 restated % 6.1% 8.7% 18.7% 34.1% 9.9% 9.1% % -14.1% 6.4% 14.1% 29.4% 0.8% 0.0% 3. Earnings per share Year ended 31 Dec 2014 Earnings from continuing and discontinued operations Basic Diluted Year ended 31 Dec 2013 9.64p 9.60p (12.63p) (12.63p) The calculation of the basic and diluted earnings per share is based on the following data: Earnings for the purposes of basic and diluted earnings per share being net Loss attributable to equity holders of the parent £’000 £’000 9,458 (10,831) Number Number Effect of dilutive potential ordinary shares: Deferred shares Share options 98,139,802 291,499 139,150 85,742,203 295,494 522,342 Weighted average number of ordinary shares for the purposes of diluted earnings per share 98,570,451 86,560,039 Weighted average number of ordinary shares for the purposes of basic earnings per share Diluted earnings per share is calculated on the profit for the year attributable to parent company shareholders divided by the weighted average number of ordinary shares outstanding during the year adjusted for the potentially dilutive impact of employee share incentive schemes and shares to be issued as part of deferred or contingent consideration on acquisitions of subsidiaries. Some share options that had a higher purchase price than the average market price of the shares for the year ended 31 December 2014 were outstanding. These options have been excluded from the calculation of diluted earnings per share as they would have been antidilutive. From continuing operations Earnings per share Basic Diluted Earnings Net profit/(loss) attributable to equity holder of the parent Earnings from continuing operations for the purpose of basic earnings per share being net profit attributable to the equity holders of the parent 9.64p 9.60p (12.63p) (12.63p) £’000 £’000 9,458 (10,831) 9,458 (10,831) The denominators used are the same as those detailed above for both basic and diluted earnings per share from continuing and discontinued operations. 19 4. Dividends Amounts recognised as distributions to equity holders in the year: Final dividend for the year ended 31 December 2013 of 5.14p per share (2012: 5.14p) Interim dividend for the year ended 31 December 2014 of 2.53p per share (2013: 2.20p per share) Proposed final dividend for the year ended 31 December 2014 of 5.87p per share (2013: 5.14p per share) Year ended 31 Dec 2014 £’000 Year ended 31 Dec 2013 £’000 5,065 4,402 2,505 7,570 1,887 6,289 5,879 5,043 The proposed final dividend is subject to approval by shareholders at the Annual General Meeting and has not been included as a liability in these financial statements. The dividend will be paid on 12 June 2015 to those shareholders on the register at 22 May 2015. The ex-dividend date is 21 May 2015. Under an arrangement dated 3 April 1996, The Chime Communications Employee Trust which holds 731,790 ordinary shares representing 0.7% of the Company’s called-up share capital, has agreed to waive dividends over 191,316 shares (0.2% of the company’s called up share capital), the difference being those shares held under the deferred share scheme. 5. Notes to the cash flow statement Operating profit Adjustments for: Share based payment expense Deemed remuneration Changes to deferred consideration Translation differences Depreciation of property, plant and equipment Amortisation of intangible fixed assets Loss on disposal of property, plant and equipment (Decrease)/increase in provisions Operating cash flows before movements in working capital (Increase)/decrease in work in progress Increase in receivables Increase/(decrease) in payables Cash generated from operations Income taxes paid Interest paid Net cash from operating activities 20 Year ended 31 Dec 2014 £’000 Year ended 31 Dec 2013 £’000 18,307 19 918 8,165 (2,107) (1,234) 4,382 5,139 169 (1,713) (128) 7,800 3,229 (553) 3,320 5,280 117 (598) 32,026 2,160 (10,738) (3,289) 20,159 (6,459) (2,893) 18,486 (4,052) (8,141) 4,573 10,866 (6,395) (1,325) 10,807 3,146 6. Business combinations In 2014, the Group made a number of acquisitions in order to grow the business. The Sport and Entertainment division made 3 main acquisitions as follows: • The Blaze Agency Pty Ltd, a Rugby player management and marketing agency, based in Australia. The acquisition will further enhance the geographical coverage of CSM Sport and Entertainment’s activities within the Asia Pacific market; and • ABC Sports Management Limited, one of the UK’s top athlete management businesses, with particular strength in rugby union. It will further enhance CSM’s Essentially, a leading sponsorship and athlete management agency; and • SJX Business, a sports and entertainment marketing business based in Connecticut, United States. The acquisition will significantly expand CSM Sport and Entertainment’s business in the United States. . 21 6. Business combinations (continued) The Blaze Agency Pty Ltd On 5 March 2014 the group acquired 100% of The Blaze Agency Pty Ltd (“Blaze”), a company incorporated in Australia, for initial consideration of AUD$2,000,000 (£1,076,000), which was paid in cash. Additional consideration is payable contingent on the results of the business, capped at the maximum of AUD$2,000,000 (£1,070,000) (undiscounted). Deemed remuneration of £7,597 has been provided, which has been discounted for financing costs. The deemed remuneration is expected to be paid in 2016 and 2019. The total maximum consideration and deemed remuneration payable for Blaze is AUD$4,000,000 (£2,146,000). Blaze was acquired by Chime’s Sport and Entertainment division. The fair value of the net assets acquired is detailed below. Intangible fixed assets Debtors and other current assets Cash at bank Creditors Net assets Goodwill Provisional Book value £’000 Fair value adjustments £’000 Provisional fair values £’000 15 79 (92) 2 577 (173) 404 577 (158) 79 (92) 406 670 Fair value of consideration 1,076 Cash consideration Cash acquired Cash outflow arising on acquisition 1,076 (79) 997 The adjustment to intangible fixed assets is to recognise £577,000 of intangibles relating to customer contracts and relationships. The adjustment to other current assets is the recognition of a deferred tax asset on intangible assets. Acquisition related costs amounting to £135,000 have been expensed during the period and are included in operating expenses. Goodwill represents the specialist skills held by Blaze. Blaze contributed revenue of £271,797 and an operating profit of £64,159 (after deemed remuneration charge of £7,597) to the results of the Group since acquisition. If the acquisition had been completed at the beginning of the period, management estimate that its contribution to Group revenue for the period would have been £332,774 and its contribution to Group operating result would have been a profit of £61,623. 22 6. Business combinations (continued) ABC Sports Management Limited On 24 September 2014 the group acquired 100% of ABC Sports Management Limited (“ABC”), a company incorporated in the United Kingdom, for initial consideration of £810,000, of which £585,000 was paid in cash and £225,000 was paid in shares. Additional consideration is payable contingent on the results of the business, capped at the maximum of £650,000 (undiscounted). Deferred consideration of £100,000 has been provided for and expected to be paid in 2015. Deemed remuneration of £24,357 has been provided, which has been discounted for financing costs. The deemed remuneration is expected to be paid in 2017 and 2020. The total maximum consideration and deemed remuneration payable for ABC is £1,560,000. ABC was acquired by Chime’s Sport and Entertainment division. The fair value of the net assets acquired is detailed below. Intangible fixed assets Property, plant and equipment Debtors and other current assets Cash at bank Creditors Net assets Goodwill Provisional Book value £’000 Fair value adjustments £’000 Provisional fair values £’000 1 410 155 (162) 404 308 (1) (11) (509) (213) 308 399 155 (671) 191 719 Fair value of consideration 910 Fair value of initial consideration Fair value of deferred consideration 810 100 Cash consideration Cash acquired Cash outflow arising on acquisition 585 (155) 430 The adjustment to intangible fixed assets is to recognise £308,000 of intangibles relating to customer contracts and relationships. The adjustment to other current assets is the recognition of a deferred tax asset on intangible assets. Acquisition related costs amounting to £182,000 have been expensed during the period and are included in operating expenses. Goodwill represents the specialist skills held by ABC. ABC contributed revenue of £267,380 and an operating profit of £77,373 (after deemed remuneration charge of £24,357) to the results of the Group since acquisition. If the acquisition had been completed at the beginning of the period, management estimate that its contribution to Group revenue for the period would have been £681,933 and its contribution to Group operating result would have been a loss of £68,665. 23 6. Business combinations (continued) SJX Business On 27 October 2014 the group acquired a 100% of the business and assets of the SJX Business (“SJX”), a business based in the United States, for initial consideration of USD$8,490,000 (£5,303,000), of which USD$5,590,000 (£3,719,000) was paid in cash and USD$2,540,000 (£1,584,000) was paid in shares. Additional consideration is payable contingent on the results of the business, capped at the maximum of USD$19,510,000 (£12,168,000) (undiscounted). Deferred consideration of £2,515,183 has been provided for and deemed remuneration of £373,502 has been provided, which have been discounted for financing costs. The deferred consideration and deemed remuneration is expected to be paid in 2016, 2018 and 2020. The total maximum consideration and deemed remuneration payable for SJX is USD$28,000,000 (£17,463,000). SJX was acquired by Chime’s Sport and Entertainment division. The fair value of the net assets acquired is detailed below Intangible fixed assets Goodwill Debtors and other current assets Cash at bank Creditors Net assets Goodwill Provisional Book value £’000 Fair value adjustments £’000 Provisional fair values £’000 158 533 31 (722) - 2,595 2,595 2,595 158 533 31 (722) 2,595 5,223 Fair value of consideration 7,818 Fair value of initial consideration Fair value of deferred consideration 5,303 2,515 Cash consideration Cash acquired Cash outflow arising on acquisition 3,719 (31) 3,688 The adjustment to intangible fixed assets is to recognise £2,595,000 of intangibles relating to customer contracts and relationships. Goodwill represents the specialist skills held by SJX. A tax deduction is available in the United States for the goodwill acquired. Acquisition related costs amounting to £467,000 have been expensed during the period and are included in operating expenses. SJX contributed revenue of £854,433 and an operating loss of £207,532 (after deemed remuneration charge of £373,502) to the results of the Group since acquisition. If the acquisition had been completed at the beginning of the year, management estimate that its contribution to Group revenue for the period would have been £3,647,000 and its contribution to Group operating result would have been a profit of £2,191,000. 24 6. Business combinations (continued) Just Marketing Inc. On 20 November 2013 the group acquired 100% of Just Marketing Inc. (“JMI”) a company incorporated in the United States of America and determined provisional fair values at the date of acquisition. These fair values have been adjusted, with a corresponding impact on goodwill as detailed below. Provisional fair value at 31 December 2013 £’000 13 Intangible assets Property, Plant & Equipment Debtors and other current assets Creditors Cash at bank Long-term liabilities Fair value at Fair value 31 December adjustments 2014 £’000 £’000 544 11,818 (11,631) 484 (760) 455 44,002 44,457 Goodwill Total consideration 12,929 (2,950) 9,979 (9,979) - 12,929 544 8,868 (11,631) 484 (760) 10,434 34,023 44,457 The fair value adjustments arise as a result of recognition of intangible assets relating to customer contracts and relationships and brand name. The adjustment to other current assets is recognition of deferred tax liability on intangible assets. The intangible assets recognised were Brand name of £2,746,103 and Customer contracts and relationships of £10,182,949. A tax deduction is available in the United States for the goodwill acquired. Cash flow on acquisitions Total deferred consideration and deemed remuneration of £5,302,000 (2013: £11,498,000) was settled in cash during the year in respect of acquisitions made in previous and current year. 7. Goodwill Carrying amount at 1 January Impairment of goodwill Exchange differences Recognised on acquisition of subsidiaries Other changes in respect of prior year acquisitions Disposal of subsidiary At 31 December 2014 £’000 2013 £’000 227,810 (126) 6,771 (9,979) (129) 224,347 178,109 (1,712) (483) 54,881 58 (3,043) 227,810 Other changes in respect of prior year acquisitions predominantly include: • Changes in respect of prior year acquisitions include revisions to the estimate of deferred consideration payable relating to acquisitions completed under IFRS (2004) and to the intangible calculation on JMI Inc. 25 8. Related party transactions Transactions between the Company and its subsidiaries, which are related parties, have been eliminated on consolidation and are not disclosed in this note. Transactions between the Group and its associates are disclosed below. Trading transactions During the year, Group companies entered into the following transactions with related parties who are not members of the Group. 2014 Sales of services £’000 Associates Bell Pottinger Private Limited Bell Pottinger Public Relations Limited Bell Pottinger Sans Frontiers Pelham Bell Pottinger The Brand Marketing Team Limited Naked Eye Research Limited Rare Corporate Design Limited StratAgile Limited The Agency of Someone Limited 2013 1,218 5 4 10 12 37 14 1 Sales of services £’000 Associates Bell Pottinger Private Limited Bell Pottinger Public Affairs Limited Bell Pottinger Public Relations Limited Bell Pottinger Sans Frontiers Pelham Bell Pottinger The Brand Marketing Team Limited Naked Eye Research Limited Rare Corporate Design Limited StratAgile Limited The Agency of Someone Limited X&Y Communications Limited 2,898 25 68 34 53 198 8 53 5 6 41 Purchase of service £’000 287 95 2 95 69 676 Purchase of service £’000 178 35 466 85 155 2 - Amounts owed by related parties £’000 371 3 5 30 Amounts owed to related parties £’000 54 6 2 3 395 Amounts owed by related parties £’000 Amounts owed to related parties £’000 34 68 5 - 273 3 24 8 18 44 1 4 5 - Sales of goods to related parties were made on an arm’s length basis. The amounts outstanding are unsecured and will be settled in cash. No guarantees have been given or received. No provisions have been made for doubtful debts in respect of the amounts owed by related parties. 26

© Copyright 2026