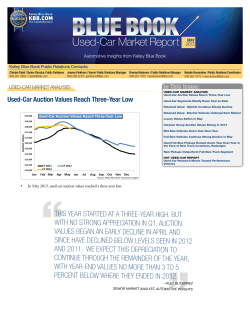

June 2013 Used Car Market Report - Kelley Blue Book

USED BLUE BOOK Market Report CAR EDITION JUNE 2013 Automotive Insights from Kelley Blue Book Kelley Blue Book Public Relations Contacts: Chintan Talati | Senior Director, Public Relations Joanna Pinkham | Senior Public Relations Manager 949.267.4855 | [email protected] 949.268.3079 | [email protected] Brenna Robinson | Public Relations Manager 949.267.4781 | [email protected] In This Issue: USED-CAR MARKET ANALYSIS: USED-CAR MARKET ANALYSIS Auction Values Ease into Typical Summer Decline Auction Values Ease into Typical Summer Decline Fuel Prices Remain Mostly Flat in May and June Compact Segment - Retained Value Auction Values Begin Summer Decline $19,000 Natalie Kumaratne | Public Relations Coordinator 949.267.4770 | [email protected] Consistent Declines in the Compact Segment $18,500 Imports Outperforming Most Full-Size Pickup Trucks in June $18,000 Auction Values $17,500 Mid-Size Pickup Trucks Trending Higher in 2013 Due to Diminished Supply $17,000 $16,500 Minivan Auction Values Drop During Last Four Weeks $16,000 SUV/Crossover Segment Declines in June $15,500 Mid-Size Vehicles Continue Decline in June $15,000 Full-Size Sedans Down Year-to-Date $14,500 CY 2011 CY 2012 Luxury Values See Small Declines in June CY 2013 $14,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Luxury Utility Vehicles Retaining Strong Values Dec Source: Kelley Blue Book Automotive Insights • • HOT USED-CAR REPORT Gas Prices and Fuel Efficiency Affect the Market Auction values declined a modest 1.2 percent in June led by declines in values of fuel-efficient small cars and alternative energy vehicles. Pickup trucks remain hot and were among the best performing segments overall with nearly no depreciation for the month. “Used-vehicle values should continue to decline at a pace of nearly 1 percent per month through summer, thanks to improving supply conditions at auction and enticing finance and lease offers on news cars,” said Alec Gutierrez, senior market analyst, Kelley Blue Book. Fuel Prices Remain Mostly Flat in May and June Fuel Prices Remain Flat May-June $4.50 Fuel Prices $4.00 • $3.50 Fuel prices remained mostly flat through May and early June relative to previous years where fuel price declines began in April and May. At the moment, fuel prices are a little more than $0.10 per gallon higher than during the same time last year. $3.00 $2.50 CY11 CY12 CY13 $2.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Source: U.S. Energy Information Administration “We expect a late seasonal trend to take effect starting mid-June, which will bring fuel prices down slightly going into summer months,” said Gutierrez. “With fuel prices expected to retreat, consumers should have no trouble getting a great deal on a used compact this summer.” USED-CAR MARKET ANALYSIS: continued Compact Segment - Retained Value MY12 Retained Value (Auction Value/MSRP) Retained Value, Compact Segment Veloster 82.0% Impreza 80.8% Civic 72.6% Elantra 72.5% Segment Average 69.5% Lancer 69.0% Corolla 67.5% MAZDA3 67.3% Cruze 67.1% Focus • In a segment where there is fierce competition among competitors, the 2012 Hyundai Veloster stands out as having the best retained value among the compact car segment. “The all-new for 2012 Veloster maintains the highest retained value within the compact car segment with an impressive 82 percent of its MSRP,” said Gutierrez. “The only other vehicle within the segment to hold above 80 percent of its retained value after one year is the completely redesigned for 2012 Subaru Impreza.” • Those looking for a great deal may want to consider the Mazda3, Chevrolet Cruze or Ford Focus, each of which are available for the fraction of a brand new model. 65.5% Jetta 63.6% 0% 20% 40% 60% 80% 100% Source: Kelley Blue Book Automotive Insights Consistent Declines in the Compact Segment Average Auction Value, Compact Segment $17,050 $15,825 $14,342 $12,914 $12,807 $12,512 $12,329 $12,282 $12,223 $12,040 $11,846 $11,447 $11,439 $11,251 $11,234 $11,200 $11,196 $11,070 $11,065 $11,050 $10,350 $10,195 $9,772 $9,575 $9,125 $0 $5,000 $10,000 Kelley Blue Book Auction Value as of June 14, 2013 MY 2010-2012 $15,000 $20,000 $12,000 $10,000 Auction Values Buick Verano Hyundai Veloster Scion tC Kia Soul Chevrolet Cruze Honda Civic Subaru Impreza Scion xB Volkswagen Jetta Hyundai Elantra Segment Average Kia Forte Toyota Corolla Ford Focus Mazda Mazda3 Toyota Matrix Dodge Caliber Mitsubishi Lancer Scion xD Volkswagen Beetle Nissan Sentra Chevrolet HHR Nissan Cube Chrysler PT Cruiser Chevrolet Cobalt Compact Segment Continues Steady Decline $14,000 $8,000 $6,000 $4,000 $2,000 CY 2011 CY 2012 CY 2013 $0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Source: Kelley Blue Book Automotive Insights • Compact segment values remained at a steady decline throughout May and June, maintaining a segment average value slightly lower than in 2012. Source: Kelley Blue Book Automotive Insights “The average auction value for vehicles within the compact segment comes in at $11,846 with 16 vehicles falling within the $11,000 to $13,000 range,” said Gutierrez. “With such a large number of vehicles falling within a $2,000 range, it makes the compact segment one of the most competitive segments in the market.” • Values in the compact segment have been negatively impacted by falling fuel prices as well as low lease offers on new vehicles. 2 BLUE BOOK Used-Car Market Report JUNE 2013 USED-CAR MARKET ANALYSIS: continued Imports Outperforming Most Full-Size Pickup Trucks in June Four-Week Auction Value Change (%) Tundra 0.5% Titan 0.4% Ram Pickup 0.0% F-Series 0.0% Sierra • • -0.3% • Silverado -0.3% Ridgeline By mid-June, auction values for the Toyota Tundra and Nissan Titan were up 0.5 percent and 0.4 percent, respectively, from mid-May values. Interest in used domestic trucks like the GMC Sierra and Chevrolet Silverado may be waning as the redesigned 2014 models begin to show up on dealer lots. The Chevrolet Avalanche, discontinued after model-year 2013, was the hardest hit truck in June, dropping 0.8 percent month-over-month. -0.6% Avalanche -0.8% -1.0% -0.8% -0.6% -0.4% -0.2% 0.0% 0.2% June 14, 2013 vs. May 17, 2013 0.4% 0.6% Source: Kelley Blue Book Automotive Insights Mid-Size Pickup Trucks Trending Higher in 2013 Due to Diminished Supply Mid-Size Trucks Trend Higher $15,500 $15,000 • Auction Values $14,500 • $14,000 $13,500 “Higher values in 2013 are likely due to the end of production for several models like the Ford Ranger and Ram Dakota, decreasing the overall supply of used mid-size pickup trucks in the market,” said Gutierrez. “A decreased supply also greatly affects trucks with higher auction value retention, such as the Toyota Tacoma, by increasing their average market value.” $13,000 $12,500 $12,000 $11,500 CY 2011 $11,000 CY 2012 The average auction value for 1- to 3-year-old mid-size pickup trucks rose 0.3 percent in June from May values. Compared to June 2012, average auction values for used mid-size trucks in June 2013 are $596 or 4.2 percent higher. CY 2013 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Source: Kelley Blue Book Automotive Insights Minivan Auction Values Drop During Last Four Weeks Four-Week Auction Value Change (%) June 14, 2013 vs. May 17, 2013 Mazda5 0.5% Sienna Ram Cargo Van -0.9% Caravan • -0.9% Sedona • -1.4% Town & Country -1.4% Odyssey Routan • -0.2% • -1.7% • -2.2% Quest -2.3% -2.5% -2.0% -1.5% -1.0% -0.5% 0.0% 0.5% 1.0% Source: Kelley Blue Book Automotive Insights 3 BLUE BOOK Used-Car Market Report JUNE 2013 During the last four weeks, auction values of 1- to 3-year-old minivans fell 1.1 percent, which was slightly better than the market average, down 1.3 percent. Values for all vehicles in the segment have dropped, with the exception of the Mazda5 (0.5 percent increase). The volume of Mazda5 at the auction has decreased compared to last month (as well as last year), which may account for the increase in values. The Nissan Quest and Volkswagen Routan have had the biggest decreases. The auction values have dropped 2.3 percent and 2.2 percent respectively. Minivans have seen market share erode as consumers have opted for compact crossovers rather than minivans due to better available fuel economy. USED-CAR MARKET ANALYSIS: continued SUV/Crossover Segment Declines in June Segment Compact Crossover Mid-size SUV/Crossover Full-Size SUV/Crossover 13-May $16,378 $19,308 $24,883 13-Jun % Change $15,877 -3.10% $19,190 -0.60% $24,675 -0.80% Segment Luxury Compact Crossover Luxury Mid-size SUV/Crossover Luxury Full-size SUV 13-May $27,987 $34,486 $35,991 13-Jun % Change $27,419 -2.00% $34,282 -0.60% $35,753 -0.70% • • • Source: Kelley Blue Book Automotive Insights • All SUV/crossover segments are decreasing in June with the biggest change being in compact and luxury compact. With so many redesigned and all-new entrants available to consumers such as the Toyota RAV4, Honda CR-V, Ford Escape and Mazda CX-5, it is only natural to see values of previous generation models take a hit. The biggest changes are the Mazda Tribute (down 8.5 percent), Mercury Mariner (down 7.3 percent), Suzuki Grand Vitara (down 5.7 percent) and Cadillac SRX (down 5.7 percent), which are all in the compact/luxury compact crossover segment. As we move into the summer months, Kelley Blue Book expects values to continue to decline. Mid-Size Vehicles Continue Decline in June Mid-Size Vehicles Continue Decline $15,000 • $14,500 • Auction Values $14,000 $13,500 $13,000 $12,500 $12,000 $11,500 CY 2011 CY 2012 CY 2013 Dec Dec Dec Nov Oct Nov Oct Sep Sep Aug Jul Aug Jul Jul Jun Jun May Apr May Apr Mar Feb Mar Jan Feb Jan Jan $11,000 Source: Kelley Blue Book Automotive Insights Mid-size sedans should end June more than 6 percent below prices paid last year. In June, mid-size sedans declined nearly 3 percent, about equal with the industry leading depreciation seen in the small car and alt energy segments. “Mid-size sedans have seen downward price pressure as consumers have been reluctant to pay top dollar for the current batch of late-model previous generation offerings when the latest generation new alternatives are available with affordable finance rates and low lease offers starting well below $300 per month,” said Gutierrez. Full-Size Sedans Down Year-to-Date • Full-Size Sedans Down YTD $17,000 $16,500 • $16,000 Auction Values $15,500 $15,000 $14,500 $14,000 Values of late-model used full-size sedan are trending near 5 percent below levels seen at this time last year. Used full-size sedans have seen a decline interest as consumers have gravitated towards better equipped and more fuel-efficient mid-size sedans as well as redesigned and significantly improved new full-size offerings such as the Chevrolet Impala, Hyundai Azera and Toyota Avalon. $13,500 $13,000 $12,500 CY 2011 CY 2012 CY 2013 4 BLUE BOOK Used-Car Market Report Dec Dec Dec Nov Nov Oct Oct Sep Sep Aug Aug Jul Jul Jul Jun Jun May May Apr Apr Mar Feb Mar Feb Jan Jan Jan $12,000 Source: Kelley Blue Book Automotive Insights JUNE 2013 “Overall, the peak occurred early in April this year and the values have been on a downward slope since then,” said Gutierrez. “The early peak and subsequent downturn in segment values can also be attributed to a jump in off-lease inventory hitting auctions in recent months.” USED-CAR MARKET ANALYSIS: continued Luxury Values See Small Declines in June Jun-13 $22,075 $48,845 $30,522 $27,419 $35,753 $34,282 $28,411 Entry-level Luxury Car High-end Luxury Car Luxury Car Luxury Compact SUV/Crossover Luxury Full-size SUV/Crossover Luxury Mid-size SUV/Crossover Average May-13 $22,230 $49,655 $30,595 $27,987 $35,991 $34,486 $28,641 % Chg -0.7% -1.6% -0.2% -2.0% -0.7% -0.6% -0.8% • • Auction values of 1-to 3-year-old luxury vehicles fell nearly 0.8 percent in June, outperforming the overall market average of 1.3 percent. Declines were at a similar pace as in May 2013. No luxury segment appreciated in June, while values of compact luxury SUV/ Crossovers dropped by an average of 2 percent, the most of any luxury segment. Source: Kelley Blue Book Automotive Insights “Through the first half of the year, luxury depreciation has been relatively mild,” said Gutierrez. “However, we may be due for a correction soon as we head into July. In July 2010, luxury values dropped 1.5 percent, while in July 2011, luxury cars fell 2.7 percent.” • Luxury values tend to fall during the summer months in anticipation of the new model year changeover, which starts in the late summer/early fall timeframe. Luxury Utility Vehicles Retaining Strong Values MY10- 12 Retained Value (Auction Value/MSRP) Luxury Utility Vehicles Retaining Value • Luxury Mid-size SUV/Crossover 72.4% Luxury Compact SUV/Crossover 72.4% Luxury Full-size SUV/Crossover 67.3% Luxury Car 62.8% Industry Average 62.5% Entry-level Luxury Car 62.1% 59.4% High-end Luxury Car 0% 20% 40% 60% 80% Source: Kelley Blue Book Automotive Insights • Compact and mid-size luxury utility vehicles are leading the industry in terms of retained value of MSRP at 72.4 percent. In fact, four out of six luxury segments have a higher retention than the industry average of 62.5 percent, as overall, the luxury market sits at 65.8 percent. Audi has two of the top five luxury models with the best retained value, the Q5 and Q7. It is worthy to note that the top five models are all crossover or sport utility vehicles. Model Retention Land Rover LR4 83.6% Audi Q7 81.2% Porsche Cayenne 80.5% Audi Q5 79.3% BMW X3 77.6% * Only models with at least 3 model years included Source: Kelley Blue Book Automotive Insights The statements set forth in this publication are the opinions of the authors and are subject to change without notice. This publication has been prepared for informational purposes only. Kelley Blue Book assumes no responsibility for errors or omissions. 5 BLUE BOOK Used-Car Market Report JUNE 2013 HOT USED-CAR REPORT: Gas Prices and Fuel Efficiency Affect the Market - Arthur Henry, manager of market intelligence and market analyst, Kelley Blue Book Kelley Blue Book’s Hot Used-Car Report captures monthly used-car shopper activity on KBB.com, including a list of the top and bottom movers in the same time period. Results are provided by the Kelley Blue Book Market Intelligence Team, in an effort to help dealers better understand which used vehicles consumers are looking at most each month. Monthly Used-Car Shopping Activity Growth Top/Bottom 10 Models 2011 MITSUBISHI OUTLANDER SPORT 2007 SAAB 9-3 32.5% Hybrid Car 28.4% Compact Crossover 25.2% 2008 PORSCHE 911 Monthly Used-Car Shopping Activity Growth Segments 4.1% 2.9% Subcompact Car 2.7% 17.7% Luxury Crossover 2010 INFINITI G 17.2% Premium Sports Car 2.0% 2010 TOYOTA RAV4 15.4% Compact Car 1.8% 2008 NISSAN SENTRA 13.0% 2008 TOYOTA CAMRY 2010 TOYOTA PRIUS 8.2% 2011 TOYOTA CAMRY 7.6% 7.5% 2010 NISSAN ALTIMA -7.0% 2007 CHEVROLET SILVERADO 1500 -8.6% 2008 CHEVROLET SILVERADO 1500 -15.1% 2007 CHEVROLET AVALANCHE -16.4% 2011 MERCEDES-BENZ C-CLASS -21.6% 2009 FORD TAURUS 2.0% High Performance 1.8% Mid -Size Car 1.0% Entry Luxury Car 0.5% Minivan 0.1% Compact Luxury Car -0.2% Luxury Sport Utility -0.6% Mid -Size Crossover -0.7% Luxury Car -1.0% Mid -Size Sport Utility -1.1% Van -1.3% 2011 MITSUBISHI ENDEAVOR -23.3% Sports Car -1.7% 2008 NISSAN QUEST -23.7% Full -Size Crossover -1.9% -24.1% Mid -Size Pickup Truck 2010 NISSAN TITAN -56.3% 2008 VOLVO V70 -66.2% 2009 VOLKSWAGEN GLI -200% -100% 0% 100% 200% % Change in Share Month-Over-Month Information based on 2011 to 2007 Model-Year Vehicles -2.1% Full -Size Sport Utility -2.7% Full -Size Car -3.1% Full -Size Pickup Truck -4.1% -5.1% Premium Luxury Car -20% -10% 0% 10% 20% % Change in Share Month-Over-Month Information based on 2011 to 2007 Model-Year Vehicles • • • The segments with the greatest increase in share are the hybrid car, compact crossover and subcompact car. These are the traditional gas savers in the consumer minds and tend to fluctuate with gas prices. Gas prices have been relatively stable, which has lowered the prices on used hybrid cars. The 2011 Mitsubishi Outlander Sport, a compact crossover, has received an increase interest shortly after information was released on the redesigned 2014 Outlander. About Kelley Blue Book (www.kbb.com) Founded in 1926, Kelley Blue Book, The Trusted Resource®, is the only vehicle valuation and information source trusted and relied upon by both consumers and the industry. Each week the company provides the most market-reflective values in the industry on its top-rated website www.kbb.com, including its famous Blue Book® Trade-In and Suggested Retail Values and Fair Purchase Price, which reports what others are paying for new cars this week. The company also provides vehicle pricing and values through various products and services available to car dealers, auto manufacturers, finance and insurance companies as well as governmental agencies. KBB.com provides consumer pricing and information on cars for sale, minivans, pickup trucks, sedan, hybrids, electric cars, and SUVs. Kelley Blue Book Co., Inc. is a wholly owned subsidiary of AutoTrader Group. 6 BLUE BOOK Used-Car Market Report JUNE 2013

© Copyright 2026