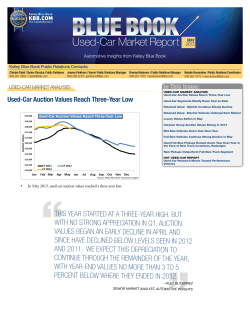

April 2015 Used Car Market Report: Kelley Blue Book Insights

USED BLUE BOOK Market Report CAR EDITION ARPIL 2015 Automotive Insights from Kelley Blue Book Kelley Blue Book Public Relations Contacts: Joanna Pinkham | Sr. Public Relations Manager 404.568.7135 | [email protected] Chintan Talati | Sr. Director, Public Relations 949.267.4855 | [email protected] Brenna Robinson | Sr. Public Relations Manager 949.267.4781 | [email protected] In This Issue: USED-CAR MARKET ANALYSIS: Fuel Prices Relatively Flat in April; Remain Low Year-Over-Year USED-CAR MARKET ANALYSIS Fuel Prices Relatively Flat in April; Remain Low YearOver-Year Sports Car Values Heat Up Prior to Summer Months, While Electric Vehicle Values Cool Fuel Prices $4.00 Chrysler, Buick Report Largest Gains on Strength of Popular Models in April Regular Conventional Retail $3.75 Samantha Hawkins | Marketing Coordinator 949.268.2760 | [email protected] $3.50 $3.26 Fuel Prices $3.25 • $3.00 • $2.75 $2.50 $2.39 $2.25 $2.23 $2.00 $1.75 CY 2013 $1.50 Jan CY 2014 Fuel prices in April remained relatively stable, increasing by 4 cents, or 1.9 percent, nationally. Year-to-date, the average price for a gallon of regular gasoline has increased 26 cents, or 12 percent; however, compared to April 2014, fuel prices are down $1.22, or 34 percent. CY 2015 Jan Feb March April May June July Aug Sept Oct Nov Dec Source: U.S. Energy Information Administration “Despite a 35 cent increase in fuel prices in February 2015, fuel prices are very low compared to this time last year,” said Sean Foyil, analyst for Kelley Blue Book. “Low fuel prices are continuing to drive down demand for the hybrid and electric vehicle segments, while making less fuel-efficient segments such as the trucks and full-size SUVs more attractive to shoppers.” Sports Car Values Heat Up Prior to Summer Months, While Electric Vehicle Values Cool • Segment Comparison April 24, 2015 vs. March 27, 2015 Four-Week Difference (%) Model Years 2012 - 2014 Sports Car 2.6% Full-Size SUV/Crossover 1.9% Minivan/Van 1.5% Full-Size Car 1.4% Mid-Size Car 1.4% Mid-Size SUV/Crossover 1.2% Compact SUV/Crossover 0.7% Full-Size Pickup Truck 0.7% Luxury Full-Size SUV/Crossover 0.5% Subcompact Car 0.3% Entry-Level Luxury Car 0.2% Mid-Size Pickup Truck 0.2% Luxury Compact SUV/Crossover 0.1% Compact Car -0.2% High Performance Car -0.6% Sporty Compact Car -1.0% Luxury Car -1.1% Hybrid/Alternative Energy Car -1.3% High-End Luxury Car -10% “The electric vehicle segment was the worst-performing segment in April, down 8.5 percent, or $1,300, due primarily to the Nissan LEAF and Mitsubishi i-MiEV, while the hybrid segment was down only 1.3 percent, or $187 dollars. Low fuel prices as well as increasing lease returns have been the largest contributing factors in pushing values for the Nissan LEAF lower” said Foyil. -0.4% Luxury Mid-Size SUV/Crossover Electric Vehicle • 1.1% Average -1.6% -8.5% -8% -6% -4% -2% In April, the sports car segment reported the largest gain of any segment, increasing an average of 2.6 percent, or $483 dollars. It is typical to see the sports car segment gain momentum prior to summer months, as consumers have more options to choose from due to warmer weather. A few popular vehicles within the sports car segment include the BMW Z4, Ford Mustang, Chevrolet Camaro, Dodge Challenger, Scion FR-S and Mazda Miata. Full-size SUV/crossovers, minivans, and full-size cars all appreciated in April above the segment average. Low fuel cost is a large contributor to this appreciation, and continues to help the full-size vehicle segments. 0% 2% Source: Kelley Blue Book Automotive Insights 4% USED-CAR MARKET ANALYSIS: continued Chrysler, Buick Report Largest Gains on Strength of Popular Models in April • Manufacturer Comparison April 24, 2015 vs. March 27, 2015 Model Years 2012 - 2014 3.2% 2.6% 2.4% 1.8% 1.7% 1.6% 1.5% 1.5% 1.1% 1.1% 1.1% 1.0% 1.0% 0.8% 0.8% 0.8% 0.7% 0.6% 0.6% 0.3% 0.3% 0.3% 0.1% 0.0% Four-Week Difference (%) Chrysler Buick Dodge Subaru Chevrolet GMC Jeep Lincoln Scion Suzuki Ram Honda Mitsubishi Cadillac Ford Mazda Average Kia Hyundai FIAT Toyota Porsche Audi Infiniti Land Rover Acura Volkswagen Nissan Lexus MINI Volvo Mercedes-Benz Jaguar BMW Smart -1.7% -5.7% -7% -6% -5% -4% -3% 0.0% -0.1% -0.2% -0.4% -0.5% -0.7% -0.9% -1.0% -1.1% -2% -1% 0% 1% 2% 3% Source: Kelley Blue Book Automotive Insights • • Chrysler saw the largest appreciation in April 2015, with an average increase of 3.2 percent across its lineup. This increase is largely due to a 4.8 percent increase in the outgoing generation Chrysler 200. Buick also saw a large uptick in values throughout the month of April, increasing overall by 2.6 percent due largely to the Regal, which saw an average increase of 5.2 percent across the 2012-2014 model years. Overall, the average manufacturer saw an increase of 0.7 percent in April 2015. 4% Appendix Top Five Performing Segments: Bottom Five Performing Segments: SEGMENT 4-Week (%) Sports Car 2.6% Full-Size SUV/Crossover 1.9% Minivan/Van 1.5% Full-Size Car 1.4% Mid-Size Car 1.4% MY 2012-2014, Kelley Blue Book Auction Value Top 10 Performing Models: MAKE MODEL Dodge Dart Ram C/V Ford E350 Super Duty Passenger Buick Regal Chrysler 200 Cadillac CTS Subaru Legacy Chevrolet Malibu Audi A3 GMC Savana 2500 Cargo MY 2012-2014, Kelley Blue Book Auction Value 4-Week (%) 7.2% 6.1% 5.6% 5.2% 4.8% 4.6% 4.4% 4.3% 4.2% 4.1% SEGMENT 4-Week (%) Electric Vehicle -8.5% High-End Luxury Car -1.6% Hybrid/Alternative Energy Car -1.3% Luxury Car -1.1% Sporty Compact Car -1.0% MY 2011-2013, Kelley Blue Book Auction Value Bottom 10 Performing Models: MAKE MODEL Nissan LEAF Mitsubishi i-MiEV Smart fortwo Mercedes-Benz CLA-Class Toyota Yaris Mercedes-Benz CL-Class Jaguar F-TYPE Lexus LS Acura ILX BMW 7 Series MY 2012-2014, Kelley Blue Book Auction Value 4-Week (%) -16.2% -15.2% -5.7% -4.3% -3.5% -3.4% -3.4% -3.2% -3.2% -2.9% The statements set forth in this publication are the opinions of the authors and are subject to change without notice. This publication has been prepared for informational purposes only. Kelley Blue Book assumes no responsibility for errors or omissions. About Kelley Blue Book (www.kbb.com) Founded in 1926, Kelley Blue Book, The Trusted Resource®, is the only vehicle valuation and information source trusted and relied upon by both consumers and the automotive industry. Each week the company provides the most market-reflective values in the industry on its top-rated website KBB.com, including its famous Blue Book® Trade-In Values and Fair Purchase Price, which reports what others are paying for new and used cars this week. The company also provides vehicle pricing and values through various products and services available to car dealers, auto manufacturers, finance and insurance companies, and governmental agencies. Kelley Blue Book’s KBB.com ranked highest in its category for brand equity by the 2014 Harris Poll EquiTrend® study and has been named Online Auto Shopping Brand of the Year for three consecutive years. Kelley Blue Book Co., Inc. is a Cox Automotive company. For more information and news from Kelley Blue Book’s KBB.com, visit www.kbb.com/media/. 2 BLUE BOOK Used-Car Market Report APRIL 2015

© Copyright 2026