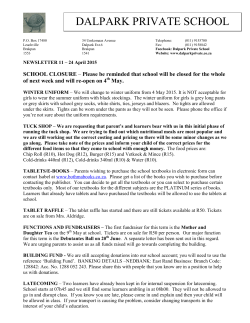

Paper