Procurement Board Presentation - Maryland Health Benefit Exchange

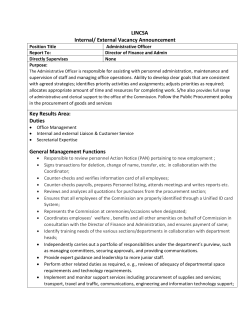

Procurement Board Presentation April 21, 2015 Allan I. Pack, Chief Financial Officer Subramanian Muniasamy, Chief Information Officer Andrew Ratner, Marketing and Outreach Director Jonathan Kromm, Deputy Executive Director A service of Maryland Health Benefit Exchange Scope of Presentation • Procurement Procedures • Procurement Calendar • IDIQ RFP • Marketing RFP 1 Four New Procurement Products 1. Procurement Decision Tree 2. Procurement Checklists to Accompany All New Procurements 3. Procurement Document Checklists 4. New Filing System 2 Procurement Decision Tree • Decision Tree (see attachment) will serve as a blueprint for prospective contract monitors on how to proceed with prospective procurements. • MHBE’s procurement policy is modeled largely on the Board of Public Works’ procurement policy and procedures, and the decision tree will help contract monitors ensure they are following all necessary steps and processing all necessary documents. • Next Steps: Fully implementing new system and updating decision tree and process to incorporate all procurement methods, e.g. intergovernmental cooperative purchasing agreements. 3 Bid & Proposal Checklists to Accompany all New Procurements • Bid & Proposal Checklists (see attachments) will prescribe for prospective contract monitors exactly how to proceed for each step of the procurement process • The procurement process will be broken into 5 distinct stages: • Pre-RFP Issuance • RFP Issuance & Post RFP Issuance • Bid & Proposal Evaluation Process • Pre-Board Approval Process • Post-Approval Process • The Checklist will not only serve as a blueprint but will also be required to be signed by executive management at various stages of the procurement process and retained in the procurement files, i.e. prior to Board submission. 4 Procurement Document Checklist • Document Checklists (see attachments) will prescribe for prospective contract monitors what documentation is required at each stage of the procurement, following the same 5 prong procurement process as laid out in the Bid & Proposal process (i.e. Pre-RFP Issuance, RFP Issuance & Post RFP Issuance, Bid & Proposal Evaluation Process, Pre-Board Approval Process, and the PostApproval Process) • The Document Checklist will also accompany the Bid & Proposals Checklist such that it will help substantiate the attainment of required signatures by executive management at various stages of the procurement process. All documentation, even documentation not required must be addressed. 5 New System Filing System • In order to make all documents relevant to a particular procurement easily and readily located and retrievable, MHBE will institute a more streamlined filing system. This new system will help facilitate and expedite the Agency’s fulfillment of reporting obligations, media requests, public information act requests, and basic inquiries. • The new filing system will be organized according to the original solicitation number and will follow the same structure as laid out in the Bid & Proposal and Document Checklist processes, namely Pre-RFP Issuance, RFP Issuance & Post RFP Issuance, Bid & Proposal Evaluation Process, Pre-Board Approval Process, and the Post-Approval Process). This will ensure uniformity in filing and that all aspects of the procurement process mirror one another. 6 Procurement Calendar Contract Name Vendor Name Dollar Amount Period of Period of Options Performance Performance - End Date -Start Date PMO Standard Contract Extension Arkenstone Technologies $362,000.00 1/1/2015 12/31/2015 Yes PMO Staff Augmentation Support for MHBE (IDIQ) $500,000.00 7/10/2014 6/30/2015 Yes $43,967,081.00 4/2/2014 6/30/2015 No $14,140,428.73 $15,334,289.00 6/4/2014 11/12/2014 6/4/2017 6/30/2016 No No $1,673,838.00 $2,665,545.85 $5,863,225.13 6/27/2014 12/21/2012 1/1/2015 10/31/2018 12/31/2017 6/16/2015 No No No $500,000.00 7/10/2014 6/30/2015 Yes $8,400.00 3/28/2014 3/27/2016 No $1,315,800.00 1/1/2015 12/31/2015 Yes Cognizant Technology Solutions, Inc. Gap Analysis & Transfer HBX Deloitte Consulting, LLP Solution Software Licenses Deloitte Consulting, LLP Task Order 3a - M&O & Level I & II Deloitte Consulting, LLP Support Task Order 2a - Deloitte Lease Consent To Sublease Training Curriculum and Delivery 3rd Contract Mod Deloitte Consulting, LLP Exelon Business Service GP Strategies (No Cost Extension) PMO Staff Augmentation Support for MHBE (IDIQ) Infojini, Inc. Three Party Escrow Service Agreement Iron Mountain PMO Contract Extension Mod 2 J. Cain & Company., LLC 7 Procurement Calendar Cont. Contract Name PMO Staff Augmentation Support for MHBE (IDIQ) PMO Staff Augmentation Support for MHBE (IDIQ) PMO Staff Augmentation Support for MHBE (IDIQ) Consolidated Service Center Enterprise Content Management System Service Services Contract PMO Consulting Services Contract Extension Mod 2 Customer Relationship Software Vendor Name Koniag Services, Inc. Period of Period of Performance - Performance - End Start Date Date $500,000.00 7/10/2014 6/30/2015 Libertas Consulting LLC $500,000.00 7/10/2014 6/30/2015 Yes Matrix Ssystems & Technologies, Inc. Maximus Health Services, Inc. Maximus Health Services, Inc. $500,000.00 7/10/2014 6/30/2015 Yes $68,579,855.67 $2,392,891.00 6/3/2013 9/27/2013 12/31/2017 9/30/2016 No No $5,242,000.00 1/1/2015 12/31/2015 Yes $1,562,220.00 7/17/2013 7/16/2018 No $850,000.00 7/15/2014 7/14/2015 No $810,000.00 7/14/2014 7/13/2015 No $298,200.00 1/1/2015 12/31/2015 Yes $4,394,039.00 7/1/2014 6/30/2015 No $30,232,338.65 6/1/2014 5/31/2019 Yes Navigators Management Partners Oracle America, Inc. MD HBX System and Workflow Scan-Optics Development Outsourced Printing and Mailing Sir Speedy Services System and Data Security Services TMI Support Consultant - MOD 5 Full Service Communications and Weber Shandwick Marketing Services to Supports the MHBE Contract Mod 5 Production Data Center Hosting Xerox State and Local Solutions, LLC Dollar Amount Options Yes 8 What is the IDIQ Contract? • Indefinite Delivery, Indefinite Quantity • Used when the precise quantity of services cannot be determined • Allows for a selected group of bidders to provide resources at pre-determined rates, as needed • Services or resources are procured via task orders using very prescriptive and precise requirements for a specific period of time • Only utilize the contract when specific needs arise • Attracts Minority Business and Women-owned Business Enterprises • Limited to $500,000 Not to Exceed (NTE) annually 9 Scope of Services • The services performed by IDIQ would include the following – IT Support • QA Testing • Data Analysis • System Development • Security/Network • Training Specialist • Project Management – Operations Support • Data Matching • Process Improvement • Escalated Case processing 10 What Positions Have We Procured So Far? 11 What are the Benefits? • IDIQ contracts are cost-effective, as they are used ondemand only. • IDIQ contracts can quickly staff positions on a short-term, immediate basis at a pre-determined cost, creating tight spending controls. • IDIQ contracts are specifically defined with fixed durations and rates / cost limits. • IDIQ contracts attract a variety of consulting firms, of all sizes and designations, including local MBE / WBE entities. This variety drives costs lower for the Exchange, resulting in high quality resources at affordable rates. 12 Next Steps 13 Original Guiding Principles for MHC Marketing Plan 1. Bring Everyone Along: Although not everyone in the State is affected by health reform, every opinion matters. The campaign’s core efforts will focus on enrollment of the key target audiences, while opinion leaders, elected officials, media and the general public also must be educated and their support cultivated 2. Leverage the Power of Partnerships: Maximize education and enrollment by leveraging existing resources, networks and channels; identify opportunities for collaboration and partnerships with common visions and missions 3. Segment Audiences and Customize Communications: Develop marketing and communications tactics based on research and evidence of how different populations can best be reached and encouraged to enroll and retain coverage; ensure materials are culturally and linguistically appropriate 4. Educate to Ensure Delivery of the Consumer Experience: Comprehensive information and education is necessary for assisters and partners to provide a seamless consumer experience 5. Evaluate and Adjust Campaign Strategies: Monitor and modify based on feedback from stakeholders, partners, ongoing research, program metrics and national indicators 14 Additional Guiding Principles for MHC Marketing Plan 6. Reaching the Hard-To-Reach: Maryland has enrolled about 25% of the potential market, ranking 10th of the 14 state exchanges. (* “Now the Hard Part: The Rate of Health Care Enrollment Seems Set to Slow,” New York Times, March 23, 2015) 7. Retaining Customers: Communications and outreach are vital to help retain customers already served through MarylandHealthConnection.gov, in part by improving information such as what to do “After You Enroll,” so consumers know how to use their policies to improve their health. 15 OE2: Campaign Highlights ● 289,000 enrolled 11/15/14 to 2/28/15 ● 122,000 in private Qualified Health Plans (double the total a year earlier, 10/1/13 to 3/31/15) ● 1.7 million unique visitors to website during OE2. 500,000 users of enrollment application on website ● New website -- faster, easier to use, more functional. New pages highlighted availability of financial help, post-enrollment information ● Designed to appeal to consumers ages 18 to 35 with greater integration of growing social channels ● Advertising strategy was centered on promoting 23 major enrollment events across Maryland with local cable, broadcast, print media 16 OE2: Public Relations “The second year of Maryland’s health insurance marketplace was much more successful than its first.” “The turnaround in Maryland since the last time may be even more striking than the improvements to HealthCare.gov.” “Maryland redeemed itself ... the ‘Comeback Kid.’” “The exchange's improvements this year extend to its data collection and analysis.” “If there was a most-improved public HIX award, Maryland Health Connection certainly would be in the running for such an honor. “Maryland increases QHP enrollments by 89% over 2014 ... Holy Smokes ... This broke not only the HHS Dept's official target for Maryland (88K) as well as my own original target (105K), but even my recently upgraded target (115K).” 17 OE2: Digital Retargeting ● Retargeting (also known as behavioral remarketing or behavioral retargeting) is a form of online advertising aimed at consumers based on their previous Internet actions that earlier did not result in a sale or conversion. ● Helped drive key constituencies such as Females 34-65 (potential enrollees and their moms), Asians, Latinos, uninsured African Americans to click into the enrollment application, sometimes days or even weeks after they first visited the website at rates 3 or 4 times higher than typically seen in the overall insurance industry. ● 65% watched MHC testimonial videos on YouTube completely to concluding tagline -- more than triple industry standard of 20%. ● Online ad that was most successful in leading African Americans and Hispanics to click "Enroll Now" depicted a black woman and her grown son with a "budgetfriendly" message -- affordability is key. ● Helped drive 41,601 to “Enroll Now” button on website, 8% of total 539,654 who opened web enrollment application. 18 OE2: Social Advertising • Paid social media advertising on Facebook and Twitter helped reach a large audience of young invincibles and their parents. • Drove more than 25,000 clicks to the website (September to April) • Communicated major deadlines and updates • Provided key info on using your health coverage 19 OE2: Adam Jones radio ad ● Collaboration with the Maryland Citizens' Health Initiative Education Fund ● Positive media coverage in Baltimore Sun, WBAL-TV, WJZ-TV, WMAR-TV, Baltimore Business Journal ● Visitors to website the 1/31/15 weekend of Jones ad/press conference increased by 2,000, or 14%, over prior weekend. ● Website conversions from MHC ad on Pandora spiked after Oriole ad began to 1,193, up from 228 the day prior. Adam Jones retweet (left) to his 170,000 Twitter folllowers 20 OE3: Data Mapping The State Health Access Data Assistance Center (SHADAC) at the University of Minnesota, DHMH and MHBE map and data professionals are analyzing enrollment and demographic data and other indices such as Maryland Health Enterprise Zones to help MHC more precisely target outreach for OE3. 21 How Maryland’s Uninsured Consume Media • • • • • • • • • Listen to Pandora: 95.7% Heavy exposure to Internet: 180+ minutes a day Mobile Internet: 87.7% Home Internet: 51.2% Smartphone owners: 86% Cell phone texting: 86% Don’t read the newspaper: 72.1% Listen to weekday radio: 70.8% Watch TV between 6-8 p.m.: 64.8% (Source: The Media Audit, Weber Shandwick, 2013) 22 OE3: Proposed Changes in Scope CATEGORIES IN ORIGINAL CONTRACT CHANGES FOR OE3 CONTRACT 1. MARKETING & COMMUNICATIONS STRATEGY SUPPORT Contract would run through June 30, 2016 with the option for an additional two-year extension. 2. ADVERTISING CREATIVE SERVICES Reusing TV Creative with some retagging as needed; Cut focus groups from 6 to 3 3. MEDIA PLANNING AND BUYING Smaller general media buy Targeted to align with hard-to-reach strategy 4. PUBLIC RELATIONS Cut; brought in-house 5. ONLINE MARKETING/DIGITAL DESIGN More video and graphics produced in-house 6. SOCIAL MEDIA Large reductions in contract; added staff position and production capabilities in-house 7. EDUCATION AND OUTREACH -- CORPORATE AND COMMUNITY OUTREACH PROGRAMS Will work closely with in-house outreach coordinator to focus on the implementation of a statewide plan 8. COLLATERAL DEVELOPMENT Reuse basic designs from OE1 and OE2 wherever possible so less agency creative time is logged. Printing and Production not included, as before. 23 OE3: Reuse/Repurpose OE2 Creative Campaign 24 OE3: Challenges / Opportunities Continued lack of awareness and confusion among the general public, especially in hard-to-reach geographies in the state farther from prime media markets. Need for a taxrelated special enrollment period both in Maryland and throughout most of the country after the close of open enrollment was one symptom of that. The remaining market has great potential. But the cost and difficulty in reaching the next group will be greater than the earlier open enrollments where people in need were most hungry for the coverage opportunity. Create/build awareness for the SHOP marketplace for employers. 25 OE3: Bridging Awareness Gap According to the Urban Institute and the Robert Wood Johnson Foundation, in a December 2014 phone survey conducted across the country of uninsured adults, ages 18 to 64, with family incomes above 100 percent of the federal poverty level (FPL) who were most likely to be subject to a penalty for lacking health coverage, 25% said they had heard nothing about a penalty. According to focus groups conducted in fall 2014 for the Maryland Citizens' Health Initiative Education Fund, awareness of MHC varied greatly. Focus groups in Easton and Suburban Baltimore exhibited “absolutely no awareness of Maryland Health Connection – nor of the impending open enrollment on Nov. 15. They did have a high awareness of the Affordable Care Act, and most were aware of their obligations to enroll in coverage or face a penalty.” In an August 2014 telephone survey of 800 Maryland residents by KRC Research for Maryland Health Connection, only 37% responded they were very or somewhat familiar with the Maryland health insurance marketplace. Respondents who said they were unfamiliar ranged as high as 54% in Western Maryland. 26

© Copyright 2026