OMB Uniform Guidance: Implementation and

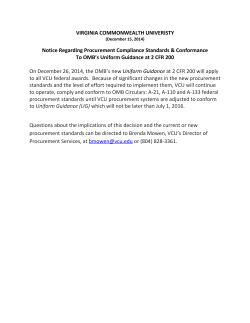

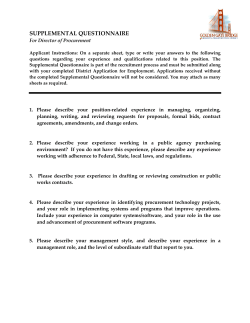

OMB U NIFORM GUIDANCE : Implementation and Lessons Learned to date March 24, 2015 What to Expect Panelists UG Recap and Highlights Implementation Strategies Communication Plans Tools and Tips Resources What’s in a Name? Objective To deliver on the promise of … government that is more efficient, effective and transparent … (OMB) is streamlining the Federal government's guidance on Administrative Requirements, Cost Principles, and Audit Requirements …[and is part] of a larger Federal effort to more effectively focus Federal resources on improving performance and outcomes while ensuring the financial integrity of taxpayer dollars in partnership with non-Federal stakeholders. This guidance provides a … framework for grants management [that will] strengthen program outcomes … while reducing the risk of waste, fraud and abuse. Source: https://www.federalregister.gov/articles/2013/12/26/2013-30465/uniform-administrative-requirements-cost-principles-and-audit-requirements-for-federal-awards UG Highlights Code of Federal Regulations Title 2, Part 200 consolidates and supersedes eight now defunct OMB Circulars (A-21, A-50, A-87, A102, A-110, A-122 and A-133). Effective Date: December 26, 2014* Funding Agency-Specific UG policy and rules, e.g., NSF’s PAPPG Single Audit Threshold from $500K to $750K de minimus F&A for NFEs = 10% Internal Controls and Standards (e.g. Green Book, COSO) Focus on Programmatic Performance Enhance Transparency and Accountability *Note Audits and Procurement Implementation Strategies First Things First: Who reads the regulations? Managing Change: The Goldilocks Challenge: One UG Size Fits All? Working Groups: Who gets a seat at the table? In Case of Tie: Who Decides? A Word or Two: Internal Controls. Communication Plans and Training Senior Management Administrators Faculty/Investigators Training (department and central administration) Tools and Tips Lessons Learned What Worked? Why? What Didn’t? Why not? What’s Next? Project Management Tools After Action Reviews Resources 2 CFR Part 200 A-D E F Acronyms & Definitions, General Provisions, Pre & Post Award Requirements Cost Principles Audit Requirements Crosswalk : CircularsUG Quick Comparison Charts Administrative Requirements Cost Principles Audit Requirements NCURA Harvard University’s UG Resource Site Background on Uniform Guidance What is the Uniform Guidance? Uniform Guidance is a combined “simplified” version of 8 circulars OMB Circular A-50 OMB Circular A-133 OMB Circular A-102 10 OMB Circular A-21 2 CFR 200 Uniform Guidance OMB Circular A-89 Subpart A: • Acronyms and Definitions Subpart B: • General Provisions OMB Circular A-87 OMB Circular A-122 OMB Circular A-110 Subpart C: • Pre-Award Requirements Subpart D: • Post Award Requirements Subpart E • Cost Principles Subpart F • Audit Requirements Appendices • Funding opportunities, F&A… UG Redacted Prior Approvals, see e.g.§200.308 Internal Controls §200.61 et.seq. Closeouts (90/120) §200.16, §200.434 Administrative/Clerical Salary Costs §200.413, §200.430 Programmatic Salary Costs §200.308 Conflict of Interest §200.112 Participant Support Costs §200.456 Cost Sharing §200.306 Computing Devices §200.331 Procurement §§200.317-200.326 Publications & Printing §200.461 Subawards, Subrecipient v. Vendor §200.201, §200.305, §200.330, §200.331, §200.332, §200.339 Visas §200.463 Dependent Travel Costs§200.474 PI Disengagement §200.308 Cost Principles / Cost Allocation Cost Principles / Cost Allocation OMB Circular A-21 Uniform Guidance • The tests of allowability of costs under these principles are: • they must be reasonable; • they must be allocable to sponsored agreements under the principles and methods provided herein; • they must be given consistent treatment through application of those generally accepted accounting principles appropriate to the circumstances; and • they must conform to any limitations or exclusions set forth in these principles or in the sponsored agreement as to types or amounts of cost items. • Except where otherwise authorized by statute, costs must meet the following general criteria in order to be allowable under Federal awards: • Be necessary and reasonable for the performance of the Federal award and be allocable thereto under these principles. • Conform to any limitations or exclusions set forth in these principles or in the Federal award as to types or amount of cost items. • Be consistent with policies and procedures that apply uniformly to both federallyfinanced and other activities of the nonFederal entity. • Be accorded consistent treatment. A cost may not be assigned to a Federal award as a direct cost if any other cost incurred for the same purpose in like circumstances has been allocated to the Federal award as an indirect cost. OMB Circular A-21, Section C2. Factors affecting allowability of costs (pages 2-8) Uniform Guidance, Subpart E – Cost Principles,, §200.403 Factors affecting allowability of costs 13 Cost Principles / Cost Allocation What costs are most scrutinized by federal auditors? •Clerical and Administrative Costs •Office Supplies •Computers and Software •Memberships •Postage Why is it a problem to charge these costs directly to sponsored programs? •Each of these cost categories are included in the Departmental Administration component of institutions’ F&A Rates (generally in large amounts) •Auditors recognize that economic factors may preclude doing the right thing •In all but “exceptional circumstances”, these costs benefit multiple activities, and therefore meet the definition of an F&A cost 14 Cost Principles / Cost Allocation This change includes the cost of certain computing devices as allowable direct cost supplies. • • 15 FINAL OMB UNIFORM GUIDANCE Computing devices are subject to the less burdensome administrative requirements of supplies (as opposed to equipment). The acquisition cost must be less than the lesser of the capitalization level established by the non-Federal entity for financial statement purposes or $5,000, regardless of the length of its useful life. • INSTITUTIONAL IMPACT AND IMPLICATIONS Computing devices not considered a depreciable asset by an institution’s capitalization policy may be charged and treated as supplies. • The burden of obtaining prior approval for such purchases is reduced. • However, institutions must follow the same practices for determining and documenting allocability (direct versus indirect use) when charging computing devices to sponsored awards. Cost Principles / Cost Allocation 16 • Salaries associated with normal administrative activity should be charged to general or other non-sponsored accounts • Proposal Preparation • Accounting • Purchasing • Data Entry • General office supplies (e.g., pencils, paper, staples, etc.) or general purpose computer supplies (e.g., paper, toner, general purpose software) should be charged to general or other non-sponsored accounts Administrative and Clerical Salaries Office Supplies • Regular postage should be charged to general or other non-sponsored accounts • Office telephone lines and individual cell phones are typically general-use and should be charged to general or other non-sponsored accounts. Postage Telephones Cost Principles / Cost Allocation The OMB Uniform Guidance clarifies that administrative and clerical support salaries can be charged directly to a sponsored project as an allowable cost. Pre-Uniform Guidance • Salaries for administrative and clerical support staff were treated as indirect costs on sponsored projects, unless they were specifically designated as a component of a “major project” or unlike circumstances prevailed. 17 Uniform Guidance Changes • If these costs are allocable, they can be directly charged, requiring no project designation • Prior approval must be obtained by the federal award agency or listed in the proposed budget • Burden for justifying direct costs as allocable to an award remains with the institution Overall Impact • Institutions can (still!) directly charge these costs to a federal award when it is appropriate and allocable. • This may better serve investigators, as their sponsored awards will likely benefit from the added skills and support of administrative and clerical staff. Cost Principles / Cost Allocation The following list includes common red flags related to cost allocations that signal compliance concerns to potential auditors. Transfers older than 90-120 days after original transaction Transfers in the last month of the award or after the award has expired Large numbers of cost allocations Grants or contracts with an exact zero balance at the end of the award Round numbers (may be an indicator of a plugged number) Paying summer/periodic salary late (e.g. in December) Labor distribution adjustments to previously verified effort 18 Cost Principles / Cost Allocation Keep cost allocations to a minimum Document, document, document! Be timely Transfer appropriately 19 • Charge the proper account initially - carefully double-check data entry • Monitor spending and balances on accounts and review with PIs at least quarterly • Document a complete explanation and justification (for example, use a “Cost Allocation Justification Form”) • Explanations such as “to correct an error” or “to transfer to correct project” generally are not sufficient • Process cost allocations within 90 days after discovering the need for one • Provide additional information when transfer is not made within the 90 day period • Verify with PIs that costs charged to an account actually benefit the award • Help PIs ensure charges are allowable, allocable, reasonable, and consistently treated across all awards for like charges Time & Effort Time & Effort OMB A-21 • 21 A-21 identified specific criteria for acceptable methods and provided examples of acceptable methods (e.g., Plan-Confirmation, After-the-Fact Activity Records) 2 CFR 200 (UG) • Less prescriptive • States that institutions must maintain high standards for internal controls over salaries and wages • Reasonably reflect the activities for which employees are compensated by the institution • Confirm that the distribution of activity represents a reasonable estimate of the work performed by the employee during the period Time & Effort As long as institutions comply with general principles of T&E, they can apply unique practices of maintenance, which will lessen the administrative burden. • 22 FINAL OMB UNIFORM GUIDANCE Non-Federal entities are required to maintain high standards for internal controls over salaries and wages but are provided additional flexibility on how to implement processes to meet those standards. • Reporting requirements are consolidated across entities and specific methodologies for IHEs are eliminated. • Different allowable and unallowable compensation activities are defined and include special considerations for different types of non-Federal entities. • • INSTITUTIONAL IMPACT AND IMPLICATIONS The general principles of time and effort still apply, but all institution types have the ability to implement independent practices for verifying payroll as long as they follow the Federal guidelines. The complex language and example methods have been eliminated. Time & Effort What does this mean? UG allows for additional flexibility in how entities implement processes to meet those standards. In general, the previous requirements for appropriate personal compensation still apply: 23 • Compensation for services provided must be in accordance with institutional policy and procedure and federal statute. • Institutional base salary (IBS) as a basis for salary for calculating payroll distributions with time and effort. • Summer salary on federal awards cannot exceed the IBS rate and sponsoring agencies may apply a salary cap that must be incorporated into IHE compensation. Time & Effort What does this mean? The Standards for Documentation of Personnel Expenses have been consolidated across institution types and contain many of the same basic elements of the previous requirements to ensure compensation charged to the federal award is accurate, allowable, and properly allocated: • Practices must comply with an institution’s documented policies and procedures. • 100% of an individual’s compensated effort must be accounted for in an institution’s documentation procedures. • Cost share salaries must be documented in the same manner as direct charged compensation. The revisions have removed formal reference to many elements of guidance, including specific examples of appropriate methodologies for monitoring effort, prescribed effort reporting time periods and specification on who must certify/document compensation costs. 24 Reference - Anatomy of Uniform Guidance for Personnel Compensation Uniform guidance addresses requirements across 9 sections 25 A General Allowability Requirements – compensation allowable if 1) consistently applied, 2) follows appointment, 3) documented according to standards in paragraph i B Reasonableness – amount charged should be consistent with similar types of work C Professional activities outside institution – encourages documented institutional guidance on what extent of allowable external professional activities D Unallowable costs –costs defined as unallowable elsewhere are still unallowable even if they fit within this compensation framework. Caps also may apply to some comp. E Special considerations for significant increases to federal awards as a result in change of federal policy F Incentive compensation may be allowable if agreed upon in advance of services with employees or based on established agreement G Nonprofits - compensation should be reasonable for actual personal services rendered H IHEs – defines IBS as a standard, requirements for allowability of extra service pay, rates for periods outside of academic year, allowability of sabbatical leave I Standards of documentation – after the fact confirmation, based on distribution of 100% activities, supported by institutional controls, options for alternate methods Subrecipient Monitoring Pass-through Entities The Uniform Guidance specifically outlines the elements required to be included in any subaward agreement, which must be clearly identified as such by the pass-through entity. Additionally, the Uniform Guidance includes audit responsibilities that were in A-133. The pass-through entity must: Include specific information in the subaward agreement, including indirect cost rate Conduct a risk assessment to determine appropriate subrecipient monitoring AND must monitor subrecipients Consider if specific subaward conditions are needed Verify subrecipients have audits in accordance with Subpart F Make any necessary adjustment to the pass-through entity’s records based on reviews and audits of subrecipients Consider actions to address subrecipient noncompliance 26 Subrecipient Monitoring The pass-through entity must evaluate each subrecipient’s risk of noncompliance with Federal statutes, regulations, and the terms and conditions of the subaward for the purpose of determining appropriate subrecipient monitoring. 27 Considerations for Subrecipient Monitoring (200.331(c)): Prior experience with the same or similar subawards Results of previous audits Whether new or substantially changed personnel or systems Extent and results of Federal awarding agency monitoring Subrecipient Monitoring The pass-through entity must evaluate each subrecipient’s risk of noncompliance with Federal statutes, regulations, and the terms and conditions of the subaward for the purpose of determining appropriate subrecipient monitoring. 28 Considerations for Subrecipient Monitoring (200.331(c)): Prior experience with the same or similar subawards Results of previous audits Whether new or substantially changed personnel or systems Extent and results of Federal awarding agency monitoring Subrecipient Monitoring 29 Requirements for Subrecipient Monitoring (200.331(d)) Review reports required by the pass-through entity Follow-up to ensure subrecipient takes appropriate action on all deficiencies pertaining to the subaward from the pass-through entity identified through audits, on-site reviews, and other means Issue a management decision for audit findings pertaining to subawards made by the pass-through entity Monitoring Tools (200.331(e)) Providing subrecipient training and technical assistance Performing on-site reviews Arranging for agreed-upon-procedures engagements No listed tool is required nor is the list of tools all inclusive Determination on which tools is a matter of judgment for the pass-through entity based upon its assessment of risk Subrecipient Monitoring 30 Fixed amount subawards (200.332) Permits a non-Federal entity to make subawards based on fixed amounts (in accordance with 200.201) not exceeding the Simplified Acquisition Threshold (currently $150,000) The prior written approval of the Federal awarding agency is required Procurement Procurement The procurement standards (in sections 200.317 through 200.326) are generally based on the requirements in A-102 for states, local governments and Indian tribes - with modifications 32 States use their own policies and procedures All other non-Federal entities, including subrecipients of a state, must have and follow written procurement procedures that reflect the procurement standards General Procurement Requirements: The non-Federal entity must maintain oversight to ensure that contractors perform in accordance with the terms, conditions, and specifications of the contract or purchase order The non-Federal entity is not required to maintain a contract administration system How the non-Federal entity maintains oversight is a matter of judgment for the non-Federal entity Procurement Regulation Description Procurement Conduct:entity must maintain written standards of conduct covering conflicts of 200.318(c)(1) Standards • The of non-Federal interest and governing the performance of its employees engaged in the selection, award, and administration of contracts 33 200.318(c)(2) • • New provision that covers organizational conflict of interest If the non-Federal entity has a parent, affiliate, or subsidiary organization (that is not a state, local government, or Indian tribe), the non-Federal entity must also maintain written standards of conduct covering organizational conflicts of interest 200.318(d) • The non-Federal entity’s procedures must avoid acquisition of unnecessary or duplicative items 200.318(e) • To foster greater economy and efficiency and to promote cost-effective use of shared services, the non-Federal entity is encouraged to enter into state and local intergovernmental agreements or inter-entity agreements where appropriate for procurement or use of common or shared goods and services 200.318(f) • The non-Federal entity is encouraged to use Federal excess and surplus property in lieu of purchasing new equipment and property when this is feasible and reduces project costs Procurement What is the Procurement “Bear Claw”? Stepwise procurement method requirements outlined in the Uniform Guidance. Cited from Frequently Asked Questions for the OMB Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards 34 Procurement The UG requires 5 distinct methods for procurement of goods and services 1. Micro-Purchases - $3,000 or less • Used for purchase of supplies or services if aggregate amount does not exceed $3,000 [New method] • Micropurchase may be awarded without soliciting competitive quotations if the non-Federal entity considers the price to be reasonable 2. Small Purchase Procedures – Greater than $3,000, Less than $150,000 3. Sealed Bids – Greater than $150,000 / Construction projects • Known as formal advertising 4. Competitive Proposals – Greater than $150,000 / Fixed price or cost reimbursement 5. Sole Source – Unique / Noncompetitive Proposals • Revised to clarify that solicitation of a sole source proposal may be used only when one of the following apply: • The item is available only from a single source • Public exigency/emergency for the requirement will not permit a delay resulting from competitive solicitation • The Federal awarding agency (or pass-through entity) expressly authorizes this method in response to a written request from the nonFederal entity • After solicitation of a number of sources, competition is determined inadequate 35 Procurement Upon request of the Federal awarding agency (or pass-through entity), the non-Federal entity must make the procurement documents available (e.g., requests for proposals, invitations for bids, or independent cost estimates) for pre-procurement review when: The non-Federal entity’s procurement procedures or operations fail to comply with the procurement standards in Part 200 The procurement is expected to exceed the Simplified Acquisition Threshold [currently $150,000], and 36 The procurement is to be awarded without competition or only one bid/offer is received in response to a solicitation The procurement specifies a ‘‘brand name’’ product The proposed contract is to be awarded to other than the apparent low bidder under a sealed bid procurement A proposed contract modification changes the scope of a contract or increases the contract amount by more than the Simplified Acquisition Threshold. Procurement The Uniform Guidance is more prescriptive on standards for an organization’s procurement processes, requiring: • Documented policies • Necessity of items procured on federal projects • Full and open competition • Mitigation and management processes for Conflict of Interest • Minimum documentation • Cost and price analysis • Vendor selection 37 Procurement With the implementation of the UG, organizations with federally sponsored projects must adjust their policies related to the threshold for small purchases. Pre-Uniform Guidance •Organizations could make decisions on appropriate procurement methods as long as minimum assurances were in place 38 Uniform Guidance Impact •Organizations must request rate quotations for purchases in the $3K $150K range Key Issues • Will this limit/eliminate some of the efficiencies gained with Pcard use? • How will rate quotations be documented if P-Cards or other local procurement processes are used? • How do Uniform Guidance requirements impact state requirements for public institutions? Procurement Organizations should take the following steps to implement the Uniform Guidance changes related to procurement into their research administration enterprise. Determine documentation requirements to demonstrate c compliance with procurement requirements Educate central procurement staff, as well as departmental administration staff and investigators/ project c directors, on the new federal procurement requirements c c 39 Review and update policies and procedures to allow for federal compliance • c Will different procedures be implemented for non-federal procurement actions? Develop internal audit processes to verify you are in compliance with new federal requirements – and can c demonstrate it! Procurement Equipment There is a $5,000 threshold for an allowable maximum residual inventory of unused supplies that may be retained by the institution. • • 40 FINAL OMB UNIFORM GUIDANCE If there is a residual inventory of unused supplies exceeding $5,000 upon completion of the project and the supplies are not needed for any other Federal award, the non-Federal entity retains the supplies for use on other activities, but must compensate the federal government for its share. Supplies can be sold but the Federal government must be compensated for its share. • INSTITUTIONAL IMPACT AND IMPLICATIONS Simplifies the award closeout process for addressing remaining inventory, appropriate disposal and re-expensing of unused inventory. Procurement Institutions will have additional procurement standards such as required competition and equipment screening requirements. FINAL OMB UNIFORM GUIDANCE 41 INSTITUTIONAL IMPACT AND IMPLICATIONS • A “bearclaw” of procurement method requirements is outlined. • • The threshold for small purchase procedures is raised to $150,000 to be consistent with the simplified acquisition threshold in the Federal Acquisition Regulation (FAR). The cost or price analysis threshold, set in accordance with the simplified acquisition threshold, will streamline institutional procurement processes. • However, other actions will require additional administration in procurement areas, such as inter-entity agreements for shared services. • Institutional P-Card policies, especially for purchases over $3,000 may be in conflict with Federal requirements. • Non-Federal entities are required to avoid duplicative purchases and encouraged to enter into agreements for shared goods and services. • All A-110 language on procurement is replaced by A-102 section .36. • Minor clarification to language requires non-Federal entities to maintain “oversight” rather than a “system” that ensures contractor performance. Audit Requirements Audit Requirements Institutions subject to audit are reduced due to higher threshold requirement. • 43 FINAL OMB UNIFORM GUIDANCE The Single Audit (“A-133”) threshold is increased to $750,000 in Federal spending, maintaining coverage over 99% of the Federal dollars. • The threshold is clarified to reference a non-Federal entity’s fiscal year. • Language allows for exceptions to criteria for a low-risk auditee where state law requires otherwise. • INSTITUTIONAL IMPACT AND IMPLICATIONS The pool of audited entities is reduced and audits focus audit attention the highest risk areas of program oversight. • Exceptions are included for state law requirements. Overview of Uniform Guidance & Institutional Impact Administrative Requirements – Cost Sharing Establishes positive cost sharing policy, which limits when cost sharing can be required as well as eliminates cost share as a factor during the review of an application. • 44 FINAL OMB UNIFORM GUIDANCE Cost sharing can only be required when clearly defined in the funding opportunity notice. • Voluntary committed cost sharing should not be used as a factor in the review of applications. • Voluntary committed cost sharing is prohibited for Federal project proposals except where otherwise required by statute. • • INSTITUTIONAL IMPACT AND IMPLICATIONS Federally required institutional cost share will be limited. Institutions will have additional regulations-based support to discourage voluntary cost share commitments. Post-Award Impact The prime awardee sets requirements and leads subcontract monitoring. • • Pass-through entities must honor either a negotiated or minimum 10% of MTDC indirect cost rate for sub-recipients. • Subrecipient monitoring via the review of performance and financial reports is limited to what the pass-through entity has deemed necessary to meet their own requirements under the Federal award. • 45 FINAL OMB UNIFORM GUIDANCE Subrecipient monitoring tools currently in the Compliance Supplement are integrated. Only when findings pertain to Federal award funds provided to the subrecipient by the pass-through entity does the passthrough entity have to follow up, ensure corrective action, and issue management decisions on weaknesses. • INSTITUTIONAL IMPACT AND IMPLICATIONS 10% MTDC minimum rate facilitates collaboration with subrecipients. • Prime awardee institutions decide what is necessary for monitoring subrecipients, including the review of financial and programmatic reports, in order to meet their own obligations under Federal awards. • Only when findings pertain to federal funds provided to sub-recipients, must the pass-through entity manage corrective actions. Award Close-Out Award Close-Out Financial reports must be submitted within 90 days of the award’s Project Period End Date. (May be extended to 120 Days) • 47 FINAL OMB UNIFORM GUIDANCE Awardees must submit, no later than 90 calendar days after the end date of the period of performance, all financial, performance, and other reports as required by or the T&C’s of the Federal award. • The Federal awarding agency or pass-through entity may approve extensions when requested by the non-Federal entity. • Unless the Federal awarding agency or pass-through entity authorizes an extension, awardees must liquidate all obligations incurred under the Federal award not later than 90 calendar days after the end date of the period of performance. • Annual and final fiscal reports or vouchers requesting payment under the agreements must include a signed certification • • INSTITUTIONAL IMPACT AND IMPLICATIONS COGR is working with appropriate federal officials and the FDP to explore opportunities to establish a new closeout model that provides necessary flexibilities to ensure the most efficient and accurate closeout practices by institutions, and at the same time, provides Federal agencies with a process that ensures their compliance with new standards to closeout awards in a timely fashion. Flexibility is built into the UG (agency authorized extensions, closeout actions completed within one year of receiving final reports) to allow institutions to implement this requirement in a manner that maximizes PI/project productivity. Cost Sharing Cost Sharing 49 OMB A-21 Uniform Guidance • No prohibition on cost sharing included in merit review of proposals • NSF implemented similar guidance to Uniform Guidance effective January 18, 2011 • January 5, 2001 Clarification on Voluntary Uncommitted Cost Sharing effective and references OMB A-21 • Cost sharing cannot be used during the merit review of proposals, unless specified in a notice of funding opportunity • January 5, 2001 Clarification on Voluntary Uncommitted Cost Sharing referenced in recent clarification • Only mandatory cost sharing or cost sharing committed specifically in the project budget should be included in the organized research base. Salary over cap need not be included in the organized research base Cost Sharing The portion of project costs not born by the sponsor. These costs are either born by the organization or potentially a third party. 50 • Can be direct costs or indirect costs (with agency approval) • Must be necessary and reasonable • Must meet criteria for allowable project costs, as outlined in the award notice • Not reimbursed by the sponsor and, therefore, must be supported by internal or external funds Cost Sharing Mandatory Cost Sharing •Required by sponsor as a condition of receiving the award •Quantified in the proposal stage of the award Voluntary Committed Cost Sharing Uncommitted Cost Sharing •Not formally required by sponsor but proposed by the organization in addition to any awarded funds •Represents additional effort or costs expended on the project that was not required by the sponsor •Cost sharing that is documented and quantified in the proposal •May be payroll or nonpayroll •This form of cost share may also be listed in the Award Notice Both mandatory and voluntary committed cost sharing must be internally tracked and documented 51 Cost Sharing Strong organizational cost sharing controls include aspects from policies, procedures and additional forms of support: Policy • Organizational position on cost sharing • Guidance on seeking agency approval • Required internal approvals • Procedures for tracking and monitoring • Required documentation and monitoring of third-party cost sharing • Criteria for cost sharing • Disallowed cost sharing within the organization 52 Procedures • Description of forms for completion Additional Support • Role expectations • Definitions of terms within organizational setting • FAQs for application • Contact information Miscellaneous Miscellaneous Institutions are required to relate financial data to award and/or program management and accomplishments. • 54 FINAL OMB UNIFORM GUIDANCE Award recipients will be required to relate award financial data to performance accomplishments and provide cost information to demonstrate cost effective practices (e.g., through unit cost data). • Clarifications were made that this requirement will be met through use of current government wide standard information collections forms (i.e. RPPR). • New language was not a change from existing policy. • • INSTITUTIONAL IMPACT AND IMPLICATIONS Institutions will be accountable to the Federal government to demonstrate responsible procurement and costing practices. There will be no additional requirements of institutions where standard information collection forms for performance already exist, even if the current forms do not necessarily relate financial information to performance data (i.e. RPPR). Miscellaneous Funding agencies must decide on the optimal mechanism to provide funding via the use of grant agreements (including fixed amount), cooperative agreements, or contracts. • 55 FINAL OMB UNIFORM GUIDANCE New language has been added to the guidance so accountability for “fixed amount” awards will rely on performance. • The Federal awarding agency or pass-through entity must decide on the appropriate instrument/mechanism for the funding (i.e., grant agreement, cooperative agreement, or contract) in accordance with the Federal Grant and Cooperative Agreement Act (31 U.S.C. 6301-08). • Federal awarding agencies, or pass-through entities, may use fixed amount awards to provide funding in specific circumstances. • INSTITUTIONAL IMPACT AND IMPLICATIONS Historically, a high percentage of cost reimbursement awards have been structured as cost reimbursable. There appears to be a new emphasis on a fixed amount award, shifting award and amount focus achieving certain performance milestones as opposed to cost necessarily incurred. Miscellaneous Institutions have the option to use a de minimis F&A rate in lieu of a negotiated rate. • 56 FINAL OMB UNIFORM GUIDANCE Federal agencies and pass-through entities must accept negotiated indirect cost rates unless an exception is required by statute or regulation or approved by a Federal awarding agency head based on public documentation. • Non-Federal entities can accept a de minimis indirect cost rate of 10% of MTDC if they have never had a negotiated indirect cost rate. *As of the date of these slides (2/2/15), NIH had not committed to 10% and may retain its prior 8%. • Institutions may extend a negotiated rate up to four years. • • INSTITUTIONAL IMPACT AND IMPLICATIONS F&A rates can be extended up to four years reducing the frequency of rate calculations and negotiations between an institution and its cognizant agency. Institutions willing to accept a flat indirect rate of 10% do not need to conduct a rate calculation.

© Copyright 2026