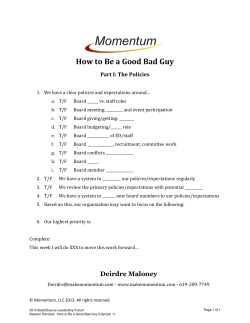

Document 311849