Macro Updates - Global IMF World Economic Outlook Oct 2014: Macro

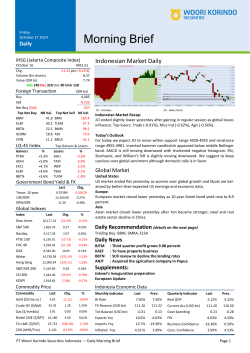

Wednesday October 8, 2014 Macro Macro Updates - Global IMF World Economic Outlook Oct 2014: ID, Bright Spot, amid the Gloomy Outlook IMF Downgraded GDP Growth Projection Chart—WEO Oct 14 GDP Growth Forecast Table Region / Countries Source: IMF, Woorisec Reseach Jul Forecast Oct Forecast 2014E 2015F 2014E 2015F World 3.4% 4.0% 3.3% 3.8% Advanced Economies 1.8% 2.4% 1.8% 2.3% Emerging Markets 4.6% 5.2% 4.4% 5.0% US 1.7% 3.0% 2.2% 3.1% Euro Area 1.1% 1.5% 0.8% 1.3% China 7.4% 7.1% 7.4% 7.1% Source: IMF, Woorisec Reseach On Tuesday (7/10), the IMF published their annual World Economic Outlook (WEO) Report with a somewhat gloomy outlook. The IMF had downgraded their 2015F global economic growth outlook, from the previous forecast at 4% on last July, down 20 bps to 3.8%. The figure however remain above the forecasted 2014E growth at 3.3%. The downward growth revision averaging at -0.02% for 2014E and -0.10% in 2015F (Specifically for World, Advanced Economies, Emerging Markets and Developing Economies, US, Euro Area, and China). The IMF stated that raising growth in emerging and advanced economies “must remain a priority,” in order to prevent a prolonged period of sluggish growth, a trend IMF's Christine Lagarde called the “New Mediocre.” The IMF medium term economic growth forecasts (2014E—2019F) are somewhat stable for the next 5 years, with the exception of slight future downturns in China and US (see the chart on the next page). The IMF Publication: World Economic Outlook—Oct 2014 Legacies, Clouds, Uncertainties Source: IMF Bagus Permadi Research Analyst [email protected] The report underlined that some financial markets pose increased overheating risks from the current near zero interest environment such as the one in the advanced economies. Other notable risks stem from the probability of worsening global geopolitical tensions. Stagnancy in the economic growth for developed countries, as well declining economic growth potential in the emerging market countries remain as major concerns in the medium term horizon. PT Woori Korindo Securities Indonesia — Macro Updates Page 11 Snapshot from the IMF—WEO Oct 2014 Indonesia and the Emerging Market Region The IMF views that the Emerging Market (EM) region is viewed to be right on track for a higher economic growths after the period of cooling down in 2014 which partly due to political uncertainty in countries such as in India, Thailand, and Indonesia. The subsequent rebounds are expected to occur around 2015 mid-year. The Southeast Asia (SEA) region among other, is expected to experienced a strong growth in 2014E-2015F, but the growth pace slow down and stabilize at 5.5% in 2019F. Among peers in the SEA, Indonesia stands out as the country with the biggest economic growth potential. The IMG expected a growth range of 80bps from 5.2% in 2014E steadily grow to 6.0% in 2017F. This gives a strong signal about how Indonesia high economic growth potential still being favored by the global financial stakeholders. IMF GDP Growth Forecast, 2014F-2015F Source: IMF, Woorisec Research US: Remain the Bright Spot The strong US job data (Unemployment Rate dropped to 5.9% in OCt3), as well as the recovery in the housing market turned the IMF to forecast a 2.2% growth in 2014E (+50 bps from July), and 3.1% in 2015F (+10 bps from July). The IMF also expecting the Fed interest hike take place around 2015 mid year. Euro Area The Euro Zone is forecasted to experience a slower growth in 2015F, down 20bps to 1.3% compare to July's estimate. Inflation is one of the highlighted issue that emphasize importance of the ECB asset purchasing program, the IMF also warn European officials to push the Euro upwards. Emerging Market and Developing Economies The growth trend in the Emerging Market will remain slower than the post global financial crisis in 2008 (gfc) due to the economic pressure along with lacks of improvements. The IMF is expecting China’s economic growth to slow down to 6.5% in 2016 from 7.4% this year after averaging nearly 10.5% before the crisis. The slight contraction is also expected in 2015F at 7.1% (down -30bps yoy). PT Woori Korindo Securities Indonesia — Macro Updates Page 22 Snapshot from the IMF—WEO Oct 2014 The Key Driver of Growth: Indonesia, SEA, and EM The key driver of growth will remain underpinned by the bounce back of robust domestic consumption supported by the growing middle-class, favorable financial condition, strong labor market due to demographic dividend, as well normalization from external foreign demand for the region export goods, here again Indonesia as the 4th largest population in the world, and large number of middle class again exceeded many of its peers. However all of these growth potentials are overshadowed by global oil price volatility spurred from the geopolitical tension which pose risks. Consumer Price Growth Forecasts (for the whole Year) Consumer Price Growth Forecasts (for the whole Year) Source: IMF, Woorisec Reseach Source: IMF, Woorisec Reseach IMF and Indonesia’s Inflation Forecast: Indonesian inflation estimate for the year 2014E and 2015F are at 6.0% and 6.7% respectively, above peers level, and the highest among EM countries. Inflations are estimated to remain high in the upcoming years due to the looming subsidized fuel price hike in order to free up some fiscal space in the 2015 state budget. The indirect inflation impact forecasted around 3.0%3.5% (higher than the direct inflation impact around 1.7%). But if we compare on the inflation growth rate from 2014-2015 (for the whole year inflation), Indonesia finish third after Malaysia, which inflation expected to grow by 1.2% up to next year, Malaysia is followed by Singapore at 1.1% expected inflation growth rate. PT Woori Korindo Securities Indonesia — Macro Updates Page 33 Disclaimer & Contacts Research Team: Reza Priyambada [email protected] Bagus Permadi [email protected] Agustini Hamid [email protected] Hendrik Panca [email protected] Raphon Prima [email protected] DISCLAIMER This report, and any electronic access to it, is restricted to and intended only for clients of PT Woori Korindo Securities Indonesia or a related entity to PT Woori Korindo Securities Indonesia. This document is for information only and for the use of the recipient. It is not to be reproduced or copied or made available to others. Under no circumstances is it to be considered as an offer to sell or solicitation to buy any security. Any recommendation contained in this report may not to be suitable for all investors. Moreover, although the information contained herein has been obtained from sources believed to be reliable, its accuracy, completeness and reliability cannot be guaranteed. We expressly disclaim any responsibility or liability (express or implied) of P.T. Woori Korindo Securities Indonesia, its affiliated companies and their respective employees and agents whatsoever and howsoever arising (including, without limitation for any claims, proceedings, action, suits, losses, expenses, damages or costs) which may be brought against or suffered by any person as a results of acting in reliance upon the whole or any part of the contents of this report and neither PT Woori Korindo Securities Indonesia, its affiliated companies or their respective employees or agents accepts liability for any errors, omissions or misstatements, negligent or otherwise, in the report and any liability in respect of the report or any inaccuracy therein or omission therefrom which might otherwise arise is hereby expresses disclaimed. All rights reserved by PT Woori Korindo Securities Indonesia PT. Woori Korindo Securities Indonesia Member of Indonesia Stock Exchange Head Office : Wisma Korindo 7th Floor Jl. M.T. Haryono Kav. 62 Pancoran, Jakarta 12780 Indonesia Telp: +62 21 7976202 Fax : +62 21 7976206 Branch Office Pluit: Jl. Pluit Kencana Raya Blok O No. 79 B-C, Pluit Penjaringan Jakarta 14450 Indonesia Telp : +62 21 66675088 Fax : +62 21 66675092 Branch Office Solo : Jl. Ronggowarsito No. 8 Kota Surakarta Jawa Tengah 57111 Indonesia Telp: +62 271 664763 Fax : +62 271 661623 A Member of NongHyup Financial Group Seoul | New York | London | Hong Kong | Singapore | Shanghai | Beijing | Hanoi | Ho Chi Minh City | Jakarta PT Woori Korindo Securities Indonesia — Macro Updates Page 44

© Copyright 2026