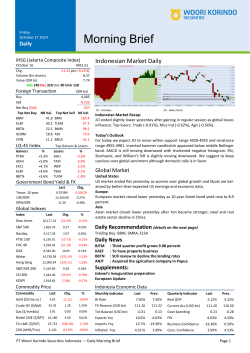

Morning Brief Indonesian Market Daily Daily IHSG (Jakarta Composite Index)

Thursday October 30 2014 Morning Brief Daily IHSG (Jakarta Composite Index) October 29 5074.06 Chg +72.75 pts (+1.46%) Volume (bn shares) 5.78 Value (IDR tn) 12.02 Adv 245 Dec 232 Unc 71 Untr 136 Indonesian Market Daily Foreign Transaction Buy Sell Net Buy (Sell) Top Net Buy BBRI ASII ADRO BBNI UNVR NB Val. 164.0 130.1 55.4 49.3 39.4 LQ-45 Index Gainers ADRO PTBA AALI LSIP UNVR (IDR bn) 9,389 -7,459 +1,930 Top Net Sell NS Val. TLKM 144.6 ELSA 23.3 WIKA 22.5 INCO 12.7 EXCL 11.0 Top Gainers & Losers Losers % EXCL -4.8% AKRA -0.8% ANTM -0.5% LPPF -0.3% HRUM 0.0% % +6.8% +5.7% +5.5% +4.2% +4.1% Government Bond Yield & FX Tenor: 10 year USD/IDR KRW/IDR Last Chg. 8.1645% 12,082.50 11.54 +0.0386 -0.71% -0.50% Global Indexes Index JCI - Intraday JCI - daily charts Indonesian Market Recap: JCI surged yesterday as coal and palm oil sector led the gain after commodities price rallied. Top gainers: Misc Ind (+2.66%), Mining (+2.58%), Agri (+2.56%). Today’s Outlook For today we anticipate JCI to move within support range 5010-5050 and resistance range 5085-5092. Ladder bottom candlestick appeared above middle Bollinger band. MACD tend to move upward with shortened negative histogram. RSI, Stochastic, and William’s %R is trying to move upward again. Technically JCI has opportunity to increase but we suggest updating with newest sentiment. Global Market United States US market fell last night as US Federal Reserve announced to end monthly bond purchases, know as quantitative easing (QE) and to keep interest rate low. Europe European market closed mixed yesterday as investor waited for US Federal Reserve decision and negative regional within European companies. Asia Asian market join global rally yesterday as US Federal Reserve’s policy was being watched in addition to rise in Japan’s industrial production. Last Chg. % Dow Jones 16,974.31 (31.44) -0.18% S&P 500 1,982.30 (2.75) -0.14% Daily Recommendation (details on the next page) Nasdaq 4,549.23 (15.06) -0.33% Trading Buy: ADRO, INTP, AALI FTSE 100 6,453.87 51.70 0.81% Daily News CAC 40 4,110.64 (2.03) -0.05% DAX 9,082.81 14.62 0.16% Nikkei 15,553.91 224.00 1.46% Hang Seng 23,819.87 299.51 1.27% AALI BBKP BORN KBLV S&P/ASX 200 5,447.68 (4.92) -0.09% Supplements: Fuel Price Increase by Government FOMC Statement CSI 300 2,451.38 34.73 1.44% KOSPI 1,961.17 35.49 1.84% Commodity Price Commodity : Has announced an increase in bank loans : high cost of interest, net profit fall : Net loss getting high : Has sold LINK, KBLV got the increase of net profit Indonesia Economic Data Last Chg. % Gold ($/troy oz.) 3.71 (14.92) -1.21% BI Rate 7.50% 7.50% Real GDP 5.12% 5.22% Crude Oil ($/bbl) 81.97 0.41 0.50% FX Reserve (USD bn) 111.16 111.22 Current Acc (USD bn) 111.20 110.50 Gas ($/mmbtu) 3.71 0.04 1.09% Trd Balance (USD bn) -0.31 0.13 0.13 -0.28 Nickel LME ($/MT) 14,650 14.00 0.10% Exports Yoy 10.6% -6.03% Tin LME ($/MT) 19,753 209.50 1.07% Imports Yoy 13.7% -19.30% CPO (MYR/Ton) 2,255 37.01 1.67% Inflation Yoy 4.53.% 3.99% Monthly Indicator PT Woori Korindo Securities Indonesia — Daily Morning Brief Last Prev. Quarterly Indicator Govt Spending FDI Business Confidence Cons. Confidence Last Prev. +16.9% +16.9% -19.30% 0.50% 3.99% 4.53% Page 11 Stocks Recommendation ADRO Analysis Morning star candlestick appeared above middle Bollinger band. Momentum is increasing supported by buying volume increase. Range 1035 - 1145 Action Trading buy as price above 1090 INTP Analysis White marubozu candlestick appeared below upper Bollinger band. RoC is moving upward supported by parabolic SAR increase. Range 23800 - 24125 Action Trading buy as price above 24000 AALI Analysis Three inside up candlestick appeared on middle Bollinger band. Volume is increasing supported by RMI indicator increase. Range 20000-21150 Action Trading buy as price above 21000 Daily News AALI : Has announced an increase in bank loans PT Astra Agro Lestari Tbk. (AALI) announced an increase in bank loans amounting to Rp892 billion in Q3-14. In the consolidated financial statements as of September 30, 2014, total liabilities increased Rp2,26 trillion. The increase is mainly on account of a bank loan at Rp892 billion, accounts payable amounting to Rp425 billion, other liabilities account of Rp397 billion and Rp337 billion for accrual accounts. BBKP : high cost of interest, net profit fall PT Bank Bukopin Tbk. (BBKP) recorded a profit of Rp677 billion in Q3-14 or corrected by 8,30% compared to the same period last year. Despite positive growth in credit and deposits (DPK), income eroded due to the costs of funds. Until September 2014, the bank's retail lending up to Rp32,33 trillion, up 23,83% compared to the same period last year. BORN : Net loss getting high PT Borneo Lumbung Energi & Metal Tbk. (BORN) posted a net loss of up to US$ 170,13 million, equivalent to Rp2,04 trillion during the period January to June 2014. In the financial statement carrying, BORN losses continue to rise 53,15% from the same period last year of US $ 111,04 million . Net sales of BBKP recorded dropped sharply to US$ 69,24 million from US$ 153,5 million. KBLV : Has sold LINK, KBLV got the increase of net profit Divestment of PT First Media Tbk (KBLV) on 11% share in its subsidiary, PT Link Net Tbk (LINK) will change the structure of the company's profit. If using the assumption until 1H14 period of KBLV performance, the increase is up to tens of times. Net income after divestment reached Rp 8,04 trillion, an increase of 75 times compared to a net profit in 2014 first half of the Rp 107 billion. e2 Page 22 Stocks Technical Analysis Ticker Open IHSG 5,019 High 5,074 Low 5,018 Close 5,074 Prev 5,001 ∆% S1 S2 S3 1.46% 5,019 4,990 4,963 Pivot 5,046 R1 5,075 R2 5,102 Target R3 5,131 YTD (%) PER (x) Spt Rst 5,019 5,102 18.72% 16.56 21,631 -16.04% 10.57 Agriculture AALI 20,150 21,075 20,025 21,075 19,975 5.51% 20,088 19,531 19,038 20,581 21,138 21,631 22,188 20,088 LSIP 1,825 1,885 1,815 1,880 1,805 4.16% 1,818 1,781 1,748 1,851 1,888 1,921 1,958 1,818 1,921 -2.59% 14.35 ADRO 1,045 1,110 1,040 1,100 1,030 6.80% 1,038 1,004 968 1,074 1,108 1,144 1,178 1,038 1,144 0.92% 6.01 HRUM 1,505 1,570 1,500 1,500 1,500 0.00% 1,468 1,449 1,398 1,519 1,538 1,589 1,608 1,468 1,589 -45.45% ITMG 21,400 21,900 21,350 21,850 21,200 3.07% 21,350 21,075 20,800 21,625 21,900 22,175 22,450 21,350 22,175 -23.33% INCO 3,630 3,670 3,610 3,610 3,550 1.69% 3,590 3,570 3,530 3,630 3,650 3,690 3,710 3,590 3,690 36.23% 43.49 TINS 1,140 1,170 1,110 1,165 1,120 4.02% 1,123 1,086 1,063 1,146 1,183 1,206 1,243 1,123 1,206 7.77% 16.88 Mining 8.20 5.62 Basic Industries CPIN 4,200 4,240 4,195 4,240 4,120 2.91% 4,198 4,174 4,153 4,219 4,243 4,264 4,288 4,198 4,264 25.63% 26.34 MAIN 3,255 3,260 3,235 3,240 3,245 -0.15% 3,235 3,223 3,210 3,248 3,260 3,273 3,285 3,235 3,273 2.05% 24.92 JPFA 1,195 1,210 1,185 1,195 1,180 1.27% 1,183 1,171 1,158 1,196 1,208 1,221 1,233 1,183 1,221 -2.05% 59.75 INTP 23,850 24,025 23,825 24,025 23,600 1.80% 23,838 23,731 23,638 23,931 24,038 24,131 24,238 23,838 24,131 20.13% 19.58 SMCB 2,415 2,455 2,415 2,425 2,410 0.62% 2,400 2,388 2,360 2,428 2,440 2,468 2,480 2,400 2,468 6.59% 14.35 SMGR 15,775 16,025 15,700 16,025 15,575 2.89% 15,738 15,556 15,413 15,881 16,063 16,206 16,388 15,738 16,206 13.25% 18.23 WTON 1,150 1,170 1,145 1,170 1,140 2.63% 1,148 1,134 1,123 1,159 1,173 1,184 1,198 1,148 1,184 - 31.62 6,900 6,675 6,875 6,650 3.38% 6,675 6,563 6,450 6,788 6,900 7,013 7,125 6,675 7,013 1.10% 14.72 Misc. Industries ASII 6,700 Consumer AISA 2,200 2,220 2,190 2,190 2,190 0.00% 2,180 2,170 2,150 2,200 2,210 2,230 2,240 2,180 2,230 53.15% 16.34 ICBP 11,000 11,100 10,950 11,050 10,900 1.38% 10,950 10,875 10,800 11,025 11,100 11,175 11,250 10,950 11,175 8.33% 23.41 INDF 6,425 6,600 6,425 6,575 6,400 2.73% 6,413 6,331 6,238 6,506 6,588 6,681 6,763 6,413 6,681 -0.38% 10.50 ROTI 1,205 1,230 1,190 1,225 1,195 2.51% 1,195 1,173 1,155 1,213 1,235 1,253 1,275 1,195 1,253 20.10% 25.52 56,700 57,050 56,500 56,925 56,225 1.24% 56,538 56,244 55,988 56,794 57,088 57,344 57,638 56,538 57,344 35.54% 19.32 KLBF 1,680 1,705 1,675 1,705 1,680 1.49% 1,678 1,661 1,648 1,691 1,708 1,721 1,738 1,678 1,721 36.40% 40.60 UNVR 29,950 31,100 29,950 31,100 29,875 4.10% 29,950 29,375 28,800 30,525 31,100 31,675 32,250 29,950 31,675 19.62% 43.62 ASRI 457 463 455 458 456 0.44% 454 450 446 458 462 466 470 454 466 6.51% 7.27 BEST 605 610 580 580 600 -3.33% 578 564 548 594 608 624 638 578 624 30.34% 15.26 BSDE 1,530 1,565 1,530 1,565 1,520 2.96% 1,530 1,513 1,495 1,548 1,565 1,583 1,600 1,530 1,583 21.32% 14.76 CTRA 1,090 1,115 1,085 1,100 1,075 2.33% 1,080 1,068 1,050 1,098 1,110 1,128 1,140 1,080 1,128 46.67% 18.33 CTRP 750 760 750 760 745 2.01% 750 745 740 755 760 765 770 750 765 22.58% 38.00 LPKR 1,045 1,065 1,040 1,060 1,040 1.92% 1,040 1,028 1,015 1,053 1,065 1,078 1,090 1,040 1,078 16.48% 17.97 444 447 443 444 440 0.91% 442 441 438 445 446 449 450 442 449 64.44% 13.06 ADHI 2,710 2,745 2,695 2,730 2,680 1.87% 2,695 2,670 2,645 2,720 2,745 2,770 2,795 2,695 2,770 80.79% 75.83 PTPP 2,510 2,575 2,500 2,570 2,500 2.80% 2,503 2,464 2,428 2,539 2,578 2,614 2,653 2,503 2,614 121.55% 50.39 TOTL 930 945 920 925 925 0.00% 915 905 890 930 940 955 965 915 955 85.00% 21.02 WIKA 2,855 2,910 2,855 2,900 2,855 1.58% 2,850 2,825 2,795 2,880 2,905 2,935 2,960 2,850 2,935 83.54% 26.61 WSKT 945 970 940 965 935 3.21% 940 925 910 955 970 985 1,000 940 GGRM Property PWON 985 138.27% 321.67 Infrastructure EXCL 5,500 5,675 5,400 5,475 5,750 -4.78% 5,350 5,238 5,075 5,513 5,625 5,788 5,900 5,350 5,788 5.29% TLKM 2,700 2,730 2,690 2,720 2,685 1.30% 2,690 2,670 2,650 2,710 2,730 2,750 2,770 2,690 2,750 26.51% 18.76 PGAS JSMR Finance BBCA BBNI BBRI BBTN BMRI Trade AKRA UNTR ACES ERAA LPPF MPPA TELE SCMA BHIT BMTR 5,850 6,225 5,950 6,275 5,825 6,175 5,925 6,275 5,850 6,175 1.28% 1.62% 5,825 6,200 5,763 6,138 5,700 6,100 5,888 6,238 5,950 6,300 6,013 6,338 6,075 6,400 5,825 6,200 6,013 6,338 32.40% 32.80% 17.79 28.39 13,325 5,700 10,600 1,105 10,050 13,400 5,775 10,825 1,125 10,175 13,250 5,650 10,575 1,100 10,025 13,375 5,725 10,825 1,110 10,175 13,325 5,625 10,500 1,105 10,000 0.38% 1.78% 3.10% 0.45% 1.75% 13,275 5,650 10,588 1,095 10,038 13,188 5,588 10,456 1,085 9,956 13,125 5,525 10,338 1,070 9,888 13,338 5,713 10,706 1,110 10,106 13,425 5,775 10,838 1,120 10,188 13,488 5,838 10,956 1,135 10,256 13,575 5,900 11,088 1,145 10,338 13,275 5,650 10,588 1,095 10,038 13,488 5,838 10,956 1,135 10,256 39.32% 44.94% 49.31% 27.59% 29.62% 22.48 11.16 11.25 8.60 12.06 4,815 17,100 800 990 15,200 3,300 940 3,370 317 1,900 4,840 17,725 810 1,005 15,450 3,325 950 3,445 335 1,940 4,745 16,875 790 985 15,100 3,220 935 3,355 317 1,900 4,765 17,675 795 1,000 15,150 3,230 940 3,400 331 1,940 4,805 17,050 795 985 15,200 3,295 940 3,390 317 1,900 -0.83% 3.67% 0.00% 1.52% -0.33% -1.97% 0.00% 0.29% 4.42% 2.11% 4,743 16,963 788 985 15,000 3,213 933 3,340 315 1,900 4,696 16,494 779 975 14,875 3,164 926 3,303 307 1,880 4,648 16,113 768 965 14,650 3,108 918 3,250 297 1,860 4,791 17,344 799 995 15,225 3,269 941 3,393 325 1,920 4,838 17,813 808 1,005 15,350 3,318 948 3,430 333 1,940 4,886 18,194 819 1,015 15,575 3,374 956 3,483 343 1,960 4,933 18,663 828 1,025 15,700 3,423 963 3,520 351 1,980 4,743 16,963 788 985 15,000 3,213 933 3,340 315 1,900 4,886 18,194 819 1,015 15,575 3,374 956 3,483 343 1,960 8.91% -6.97% 34.75% 0.00% 37.73% 66.49% 51.61% 29.52% -2.65% 2.11% 25.76 10.46 24.84 9.09 89.64 85.00 24.74 39.08 7.70 22.56 e3 30.76 Page 33 Global Economic Calendar Monday 27-Oct GER GER Hour Event Jakarta 27th-2nd Retail Sales 4:00 PM German Ifo Business Climate Tuesday 28-Oct USA USA 7:30 PM Core Durable Goods Orders 9:00 PM CB Consumer Confidence m/m Index Sep Oct -0.20% 94.5 0.50% 87.4 0.40% 86 Wednesday 29-Oct JPN USA 6:50 AM Prelim Industrial Production 9:30 PM Crude Oil Inventories m/m w/w Sep w4 Oct 2.7% 2.1 2.30% 3.3 -1.50% 7.1 Thursday 30-Oct USA USA AUS GER USA USA 1:00 AM 1:00 AM Tentative All Day 7:30 PM 7:30 PM FOMC Statement Federal Funds Rate Mid-Year Economic and Fiscal Outlook Preliminary CPI Advance GDP Unemployment Claims JPY Europe Europe USA Tentative 5:00 PM 5:00 PM 8:55 PM BoJ - Monetary Policy Statement CPI Flash Estimate Unemployment Rate Revised UoM Consumer Sentiment Date Friday 31-Oct Saturday 1-Nov Country CHN 8:00 AM Manufacturing PMI Period Actual Consensus m/m Index Sep Oct 103.2 104.6 2.50% 104.7 Prev < 0.25% < 0.25% < 0.25% Annual m/m q/q w/w Oct 3Q 14 w4 Oct -0.10% 3.10% 277 0.00% 4.60% m/m m/m m/m Oct Sep Oct 0.40% 11.50% 86.4 0.30% 11.50% m/m Oct 51.1 51.1 Supplement: Global & Local Events Fuel Price Increase by Government The planned to increase the price of subsidized fuel in early November 2014 by President Joko Widodo considered not affect the rise in prices in the market. Although the planned of increase in fuel price has been widely reported by the media, but the market still seems to be to wait and see whether the certainty on 1 November 2014 and the new government Joko Widodo and Jusuf Kalla realize the plan or not. Nevertheless, it should be prevented hoarding basic commodities or other economic materials for the economic interests so as not to cause turmoil. FOMC Statement The Federal Reserve said it sees further improvement in the labor market while confirming it will end an asset-purchase program that has added $1,66 trillion to its balance sheet. “Labor market conditions improved somewhat further, with solid job gains and a lower unemployment rate”, the Federal Open Market Committee said today in a statement in Washington. A range of labor market indicators suggests that underutilization of labor resources is gradually diminishing, modifying earlier language that referred to “significant underutilization” of labor resources. Policy makers maintained a pledge to keep interest rates low for a “considerable time.” While saying inflation in the near term will probably be held down by lower energy prices, they repeated language from their September statement that the likelihood of inflation running persistently below 2% has diminished somewhat. e4 Page 44 Disclaimer & Contacts Research Team: Reza Priyambada [email protected] Bagus Permadi [email protected] Agustini Hamid [email protected] Hendrik Panca [email protected] Raphon Prima [email protected] DISCLAIMER This report, and any electronic access to it, is restricted to and intended only for clients of PT Woori Korindo Securities Indonesia or a related entity to PT Woori Korindo Securities Indonesia. This document is for information only and for the use of the recipient. It is not to be reproduced or copied or made available to others. Under no circumstances is it to be considered as an offer to sell or solicitation to buy any security. Any recommendation contained in this report may not to be suitable for all investors. Moreover, although the information contained herein has been obtained from sources believed to be reliable, its accuracy, completeness and reliability cannot be guaranteed. We expressly disclaim any responsibility or liability (express or implied) of P.T. Woori Korindo Securities Indonesia, its affiliated companies and their respective employees and agents whatsoever and howsoever arising (including, without limitation for any claims, proceedings, action, suits, losses, expenses, damages or costs) which may be brought against or suffered by any person as a results of acting in reliance upon the whole or any part of the contents of this report and neither PT Woori Korindo Securities Indonesia, its affiliated companies or their respective employees or agents accepts liability for any errors, omissions or misstatements, negligent or otherwise, in the report and any liability in respect of the report or any inaccuracy therein or omission therefrom which might otherwise arise is hereby expresses disclaimed. All rights reserved by PT Woori Korindo Securities Indonesia PT. Woori Korindo Securities Indonesia Member of Indonesia Stock Exchange Head Office : Wisma Korindo 7th Floor Jl. M.T. Haryono Kav. 62 Pancoran, Jakarta 12780 Indonesia Telp: +62 21 7976202 Fax : +62 21 7976206 Branch Office Pluit: Jl. Pluit Kencana Raya Blok O No. 79 B-C, Pluit Penjaringan Jakarta 14450 Indonesia Telp : +62 21 66675088 Fax : +62 21 66675092 Branch Office Solo : Jl. Ronggowarsito No. 8 Kota Surakarta Jawa Tengah 57111 Indonesia Telp: +62 271 664763 Fax : +62 271 661623 A Member of NongHyup Financial Group Seoul | New York | London | Hong Kong | Singapore | Shanghai | Beijing | Hanoi | Ho Chi Minh City | Jakarta PT Woori Korindo Securities Indonesia — Daily Morning Brief Page 55

© Copyright 2026