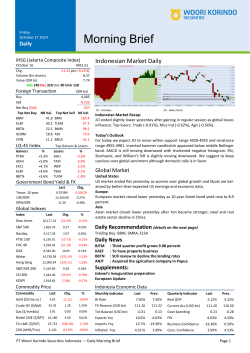

Morning Brief Indonesian Market Daily Daily IHSG (Jakarta Composite Index)

Wednesday October 15 2014 Morning Brief Daily IHSG (Jakarta Composite Index) October 14 4922.58 Chg +9.53 pts (+0.19%) Volume (bn shares) 3.96 Value (IDR tn) 4.23 Adv 149 Dec 288 Unc 111 Untr 149 Indonesian Market Daily Foreign Transaction Buy Sell Net Buy (Sell) Top Net Buy INDF LPPF SMGR BMTR MPPA NB Val. 33.2 29.5 17.5 14.8 11.9 LQ-45 Index Gainers WIKA WSKT ADHI INDF CPIN (IDR bn) 1,568 -2,058 -490 Top Net Sell NS Val. BBRI 144.7 BMRI 83.4 BBNI 40.4 TLKM 39.5 ASII 33.3 Top Gainers & Losers Losers % ITMG -2.8% JSMR -2.1% AKRA -2.0% BMTR -1.9% PTBA -1.6% % +3.3% +2.4% +2.3% +2.2% +2.2% Government Bond Yield & FX Tenor: 10 year USD/IDR KRW/IDR Last Chg. 8.4808 12,206.20 11.47 -0.0187% 0.04% 0.34% Global Indexes Index JCI - Intraday JCI - daily charts Indonesian Market Recap: Indonesian market rebound yesterday as construction sector is benefiting from fuel price hike planned by new government. Top gainers: Property (+0.94%), Consumer (+0.77%), Misc Ind (+0.69%). Today’s Outlook For today we expect JCI to have good sentiment for continuing increase with support range 4885-4905 and resistance range 4934-4958. Piercing line candlestick appeared above lower Bollinger band. MACD decreases with shortened negative histogram. RSI, Stochastic, William’s %R are halted from decline. Global Market United States US market ended mixed yesterday, halted three days losses, as investor considered positive earnings of banking and oil price decline. Europe European market surged yesterday as negative data from Euro zone was countered by positive earnings of US banks. Asia Asian market ended mixed yesterday as basic resources sector in Australia jumped, but China’s market dropped caused by weak property sector. Last Chg. % Dow Jones 16,315.19 (5.88) -0.04% S&P 500 1,877.70 2.96 0.16% Daily Recommendation (details on the next page) Nasdaq 4,227.17 13.51 0.32% Trading Buy: PGAS, INDF, MPPA FTSE 100 6,392.68 26.44 0.42% Daily News CAC 40 4,088.25 9.55 0.23% BBCA: Estimate growth at 12% this year PSAB: Plan to refinancing its debt PWON: Add recurring income after finished acquisition BSDE: Third quarter, marketing sales only grow 4% DAX 8,825.21 12.78 0.15% Nikkei 14,936.51 (364.04) -2.38% Hang Seng 23,047.97 (95.41) -0.41% S&P/ASX 200 5,207.43 51.93 1.01% Supplements: JK : New Government confirm to raise fuel price Global News CSI 300 2,446.56 (8.39) -0.34% KOSPI 1,929.25 2.04 0.11% Commodity Price Commodity Indonesia Economic Data Last Chg. % Gold ($/troy oz.) 3.83 (5.37) -0.43% BI Rate 7.50% 7.50% Real GDP 5.12% 5.22% Crude Oil ($/bbl) 82.86 (1.46) -1.73% FX Reserve (USD bn) 111.16 111.22 Current Acc (USD bn) 111.20 110.50 Gas ($/mmbtu) 3.83 (0.08) -2.05% Trd Balance (USD bn) -0.31 0.13 0.13 -0.28 Nickel LME ($/MT) 16,371 71.00 0.44% Exports Yoy 10.6% -6.03% Tin LME ($/MT) 20,160 63.00 0.31% Imports Yoy 13.7% -19.30% CPO (MYR/Ton) 2,167 1.99 0.09% Inflation Yoy 4.53.% 3.99% Monthly Indicator PT Woori Korindo Securities Indonesia — Daily Morning Brief Last Prev. Quarterly Indicator Govt Spending FDI Business Confidence Cons. Confidence Last Prev. -6.03% 4.50% -19.30% 0.50% 3.99% 4.53% Page 11 Stocks Recommendation PGAS Analysis Tweezer bottom candlestick pattern can maintained above lower Bollinger band. Price can maintained above 5700 supported by stochastic increase. Range 5650 - 5925 Action Maintained buy as price above 5750 INDF Analysis Separating lines candlestick appeared on middle Bollinger band area. RSI indicator is starting to move higher supported by momentum increase. Range 6750 - 7050 Action Maintained buy as price above 6925 MPPA Analysis Ladder bottom candlestick appeared above lower Bollinger band. After price can breakout and maintain above resistance 2795, now price is moving to next resistance. Range 2720 - 3100 Action Trading buy as price above 2985 Daily News BBCA: Estimate growth at 12% this year PT Bank Central Asia Tbk. (BBCA) is projecting will grow 12% by the end of this year, given the economic slowdown. According to BBCA, state-run business is still relatively good, but the Bank has not made the addition and improvement of business in the middle of an economic slowdown. PSAB: Plan to refinancing its debt PT J Resources Asia Pacific Tbk (PSAB) plans to seek external funds to refinancing their debt. PSAB will release bonds worth a maximum of US$300 million in December 2014. The bond would give the maximum fixed rate of 10% per year. The tenor of bond, planned maximum of five years since published. PWON: Add recurring income after finished acquisition The property developer, PT Pakuwon Jati Tbk. (PWON), believes could increase recurring revenue from its corporate action. PWON acquired PT Pakuwon Permai, where not consolidated affiliated companies financially. PWON acquired a 67,1% stake EEMF Asian Development BV in Pakuwon Permai worth Rp 2,34 trillion. Pakuwon Permai has a shopping mall in Surabaya and Jakarta BSDE: Third quarter, marketing sales only grow 4% PT Bumi Serpong Damai, Tbk recorded IDR 4.7 trilion of marketing sales on third quarter or grow 4% from last year. This achivement has realized 83% of its target for full year 2014. Largest contribution come from house unit sales, generating 41%. Majority of house unit sales come from BSD City Serpong that contribute 75 %. e2 Page 22 Stocks Technical Analysis Ticker Open IHSG 4,902 High 4,941 Low 4,900 Close 4,922 Prev ∆% 4,913 0.18% S1 S2 S3 4,892 4,875 4,851 Pivot 4,916 R1 R2 R3 4,933 4,957 4,974 Target YTD (%) PER (x) Spt Rst 4,892 4,957 15.16% 16.07 22,200 -13.15% 10.94 Agriculture AALI 21,900 22,100 21,800 21,800 21,900 -0.46% 21,700 21,600 21,400 21,900 22,000 22,200 22,300 21,700 LSIP 1,855 1,875 1,855 1,855 1,870 -0.80% 1,845 1,840 1,825 1,860 1,865 1,880 1,885 1,845 1,880 -3.89% 14.16 ADRO 995 1,025 990 1,010 1,010 0.00% 985 970 950 1,005 1,020 1,040 1,055 985 1,040 -7.34% 5.52 HRUM 1,690 1,715 1,680 1,690 1,690 0.00% 1,673 1,659 1,638 1,694 1,708 1,729 1,743 1,673 1,729 -38.55% 9.23 ITMG 22,900 23,075 22,275 22,300 22,950 -2.83% 22,200 21,838 21,400 22,638 23,000 23,438 23,800 22,200 23,438 -21.75% INCO 3,620 3,725 3,620 3,685 3,660 0.68% 3,600 3,558 3,495 3,663 3,705 3,768 3,810 3,600 3,768 39.06% 44.40 TINS 1,205 1,210 1,195 1,195 1,200 -0.42% 1,193 1,186 1,178 1,201 1,208 1,216 1,223 1,193 1,216 10.55% 17.32 Mining 5.74 Basic Industries CPIN 3,735 3,810 3,705 3,780 3,700 2.16% 3,705 3,653 3,600 3,758 3,810 3,863 3,915 3,705 3,863 12.00% 23.48 MAIN 3,175 3,215 3,160 3,190 3,155 1.11% 3,155 3,130 3,100 3,185 3,210 3,240 3,265 3,155 3,240 0.47% 24.54 JPFA 1,150 1,165 1,140 1,150 1,150 0.00% 1,138 1,126 1,113 1,151 1,163 1,176 1,188 1,138 1,176 -5.74% 57.50 INTP 22,000 22,425 21,900 22,150 22,000 0.68% 21,813 21,594 21,288 22,119 22,338 22,644 22,863 21,813 22,644 10.75% 18.05 SMCB 2,450 2,470 2,440 2,450 2,445 0.20% 2,435 2,423 2,405 2,453 2,465 2,483 2,495 2,435 2,483 7.69% 14.50 SMGR 15,000 15,125 14,950 15,100 15,100 0.00% 14,963 14,869 14,788 15,044 15,138 15,219 15,313 14,963 15,219 6.71% 17.18 WTON 1,050 1,085 1,040 1,075 1,050 2.38% 1,040 1,018 995 1,063 1,085 1,108 1,130 1,040 1,108 - 29.05 6,450 6,325 6,400 6,350 0.79% 6,313 6,256 6,188 6,381 6,438 6,506 6,563 6,313 6,506 -5.88% 13.70 Misc. Industries ASII 6,350 Consumer AISA 2,160 2,170 2,135 2,160 2,160 0.00% 2,143 2,121 2,108 2,156 2,178 2,191 2,213 2,143 2,191 51.05% 16.12 ICBP 11,000 11,125 11,000 11,025 11,025 0.00% 10,950 10,913 10,825 11,038 11,075 11,163 11,200 10,950 11,163 8.09% 23.36 INDF 6,850 6,975 6,800 6,950 6,800 2.21% 6,813 6,719 6,638 6,894 6,988 7,069 7,163 6,813 7,069 5.30% 11.10 ROTI 1,080 1,100 1,075 1,085 1,080 0.46% 1,070 1,060 1,045 1,085 1,095 1,110 1,120 1,070 1,110 6.37% 22.60 57,000 57,100 56,400 56,800 56,600 0.35% 56,550 56,125 55,850 56,825 57,250 57,525 57,950 56,550 57,525 35.24% 19.28 KLBF 1,615 1,625 1,605 1,605 1,615 -0.62% 1,600 1,593 1,580 1,613 1,620 1,633 1,640 1,600 1,633 28.40% 38.21 UNVR 30,500 31,150 30,500 30,925 30,500 1.39% 30,388 30,119 29,738 30,769 31,038 31,419 31,688 30,388 31,419 18.94% 43.37 ASRI 435 446 434 442 437 1.14% 433 427 421 439 445 451 457 433 451 2.79% 7.02 BEST 525 545 515 535 535 0.00% 515 500 485 530 545 560 575 515 560 20.22% 14.08 BSDE 1,435 1,455 1,420 1,455 1,435 1.39% 1,428 1,406 1,393 1,441 1,463 1,476 1,498 1,428 1,476 12.79% 13.73 CTRA 985 995 980 985 985 0.00% 978 971 963 986 993 1,001 1,008 978 1,001 31.33% 16.42 CTRP 705 705 700 700 705 -0.71% 700 698 695 703 705 708 710 700 708 12.90% 35.00 LPKR 970 980 950 965 970 -0.52% 953 936 923 966 983 996 1,013 953 996 6.04% 16.36 PWON 400 407 400 405 399 1.50% 399 396 392 403 406 410 413 399 410 50.00% 11.91 ADHI 2,325 2,425 2,320 2,405 2,350 2.34% 2,313 2,264 2,208 2,369 2,418 2,474 2,523 2,313 2,474 59.27% 66.81 PTPP 2,205 2,295 2,205 2,285 2,240 2.01% 2,200 2,158 2,110 2,248 2,290 2,338 2,380 2,200 2,338 96.98% 44.80 TOTL 850 895 850 885 850 4.12% 845 825 800 870 890 915 935 845 915 77.00% 20.11 WIKA 2,575 2,690 2,565 2,675 2,590 3.28% 2,563 2,501 2,438 2,626 2,688 2,751 2,813 2,563 2,751 69.30% 24.54 WSKT 835 865 835 855 835 2.40% 830 818 800 848 860 878 890 830 GGRM Property 878 111.11% 285.00 Infrastructure EXCL 5,800 5,850 5,725 5,800 5,825 -0.43% 5,738 5,669 5,613 5,794 5,863 5,919 5,988 5,738 5,919 11.54% TLKM 2,760 2,800 2,755 2,775 2,775 0.00% 2,745 2,728 2,700 2,773 2,790 2,818 2,835 2,745 2,818 29.07% 19.14 PGAS JSMR Finance BBCA BBNI BBRI BBTN BMRI Trade AKRA UNTR ACES ERAA LPPF MPPA TELE SCMA BHIT BMTR 5,700 6,075 5,800 6,075 5,700 5,925 5,800 5,950 5,700 1.75% 6,075 -2.06% 5,700 5,938 5,650 5,856 5,600 5,788 5,750 6,006 5,800 6,088 5,850 6,156 5,900 6,238 5,700 5,938 5,850 6,156 29.61% 25.93% 17.42 26.92 12,500 5,275 10,000 1,075 9,325 12,750 5,375 10,225 1,105 9,525 12,500 5,250 10,000 1,070 9,300 12,625 5,275 10,100 1,100 9,450 12,600 5,275 10,050 1,080 9,400 0.20% 0.00% 0.50% 1.85% 0.53% 12,438 5,213 9,938 1,070 9,275 12,344 5,169 9,856 1,053 9,175 12,188 5,088 9,713 1,035 9,050 12,594 5,294 10,081 1,088 9,400 12,688 5,338 10,163 1,105 9,500 12,844 5,419 10,306 1,123 9,625 12,938 5,463 10,388 1,140 9,725 12,438 5,213 9,938 1,070 9,275 12,844 5,419 10,306 1,123 9,625 31.51% 33.54% 39.31% 26.44% 20.38% 21.22 10.28 10.50 8.53 11.20 4,780 18,125 815 970 15,000 2,725 940 3,360 333 1,775 4,800 18,225 820 990 15,125 3,030 950 3,420 338 1,825 4,700 18,000 800 965 14,875 2,725 930 3,350 333 1,745 4,705 18,000 805 990 15,000 3,000 945 3,370 336 1,765 4,800 18,200 815 975 15,125 2,725 940 3,420 338 1,800 -1.98% -1.10% -1.23% 1.54% -0.83% 10.09% 0.53% -1.46% -0.59% -1.94% 4,693 17,950 800 968 14,875 2,710 933 3,330 332 1,730 4,646 17,863 790 954 14,750 2,565 921 3,305 330 1,698 4,593 17,725 780 943 14,625 2,405 913 3,260 327 1,650 4,746 18,088 810 979 15,000 2,870 941 3,375 335 1,778 4,793 18,175 820 993 15,125 3,015 953 3,400 337 1,810 4,846 18,313 830 1,004 15,250 3,175 961 3,445 340 1,858 4,893 18,400 840 1,018 15,375 3,320 973 3,470 342 1,890 4,693 17,950 800 968 14,875 2,710 933 3,330 332 1,730 4,846 18,313 830 1,004 15,250 3,175 961 3,445 340 1,858 7.54% -5.26% 36.44% -1.00% 36.36% 54.64% 52.42% 28.38% -1.18% -7.11% 25.43 10.65 25.16 9.00 88.76 78.95 24.87 38.74 7.81 20.52 e3 32.58 Page 33 Global Economic Calendar Date Country Hour Event Jakarta Tentative Trade Balance (in USD bn) Period Actual m/m Sep 31.0 5 1.2% -3.6 -1.8% Consensus 41.2 Prev Monday 13-Oct CHN Tuesday 14-Oct AUS GBR GER Europe 7:30 AM 3:30 PM 4:00 PM 4:00 PM NAB Business Confidence CPI German ZEW Economic Sentiment Industrial Production Index y/y Index m/m Sep Sep Oct Aug Wednesday 15-Oct CHN GBR GBR USA USA USA USA 8:30 AM 3:30 PM 3:30 PM 7:30 PM 7:30 PM 7:30 PM 7:30 PM CPI Average Earnings Index Claimant Count Change (in '000) Core Retail Sales PPI Retail Sales Empire State Manufacturing Index y/y 3m/y m/m m/m m/m m/m Index Sep Aug Sep Sep Sep Sep Oct 2.00% 0.60% -37.2 0.30% 0.00% 0.60% 27.5 Thursday 16-Oct USA USA USA 1:00 AM The Fed - Beige Book 7:30 PM Unemployment Claims 9:00 PM Philly Fed Manufacturing Index w/w Index w1 Oct Oct 22.5 USA USA USA 7:30 PM Building Permits (in mn) 7:30 PM Housing Starts (in mn) 7:30 PM Prelim UoM Consumer Sentiment m/m m/m Index Sep Sep Oct Friday 16-Oct 1.4% 0.2 -1.5% 49.8 7 1.50% 6.9 0.90% 1 0.96 Supplement: Global & Local Events JK : New Government confirm to raise fuel price In the meeting with 50 CEO and financial institution leaders, Jusuf Kalla, vice president elected, stated that the next government led by Joko Widodo, will faster to take a decision, including to raise fuel subsidized price. This topic is one of most significant thing that really concerned by the market. Jokowi-JK will raise fuel price in order to reduce current account deficit and give healthy state budget. Jusuf Kalla estimated that it needs two to three weeks after the inauguration to raise fuel price due to administration process. He also stated that this policy should be taken immediately because subsidy cost has achieved IDR 1 trillion per day. In addition, Jusuf Kalla also stated that it was decided that 7 economic related minister will chosen from professional background, not from political party. These minister such as economic coordinating minister, finance minister, energy and natural resources minister, state enterprise minister, and agriculture minister. Global News President Barack Obama will try to shore up a coalition against Islamic State forces today as airstrikes have failed to stop the extremist Sunni group from gaining territory in Iraq and Syria. With questions growing about a plan that lacks effective ground forces, Obama and the top U.S. military officer will meet with defense ministers from more than 20 allied countries to bolster support for a strategy that even former administration officials say is foundering. Scores of Hong Kong police officers moved in on pro-democracy protesters who blockaded a road near the city government’s headquarters early this morning, using pepper spray and taking away some demonstrators. The clashes are the most serious since the police used tear gas two weeks ago as they tried to disperse crowds that are occupying key roads in the city. A group of more than 100 demonstrators had seized the Lung Wo Road underpass yesterday evening, initially forcing outnumbered police to retreat. e4 Page 44 Disclaimer & Contacts Research Team: Reza Priyambada [email protected] Bagus Permadi [email protected] Agustini Hamid [email protected] Hendrik Panca [email protected] Raphon Prima [email protected] DISCLAIMER This report, and any electronic access to it, is restricted to and intended only for clients of PT Woori Korindo Securities Indonesia or a related entity to PT Woori Korindo Securities Indonesia. This document is for information only and for the use of the recipient. It is not to be reproduced or copied or made available to others. Under no circumstances is it to be considered as an offer to sell or solicitation to buy any security. Any recommendation contained in this report may not to be suitable for all investors. Moreover, although the information contained herein has been obtained from sources believed to be reliable, its accuracy, completeness and reliability cannot be guaranteed. We expressly disclaim any responsibility or liability (express or implied) of P.T. Woori Korindo Securities Indonesia, its affiliated companies and their respective employees and agents whatsoever and howsoever arising (including, without limitation for any claims, proceedings, action, suits, losses, expenses, damages or costs) which may be brought against or suffered by any person as a results of acting in reliance upon the whole or any part of the contents of this report and neither PT Woori Korindo Securities Indonesia, its affiliated companies or their respective employees or agents accepts liability for any errors, omissions or misstatements, negligent or otherwise, in the report and any liability in respect of the report or any inaccuracy therein or omission therefrom which might otherwise arise is hereby expresses disclaimed. All rights reserved by PT Woori Korindo Securities Indonesia PT. Woori Korindo Securities Indonesia Member of Indonesia Stock Exchange Head Office : Wisma Korindo 7th Floor Jl. M.T. Haryono Kav. 62 Pancoran, Jakarta 12780 Indonesia Telp: +62 21 7976202 Fax : +62 21 7976206 Branch Office Pluit: Jl. Pluit Kencana Raya Blok O No. 79 B-C, Pluit Penjaringan Jakarta 14450 Indonesia Telp : +62 21 66675088 Fax : +62 21 66675092 Branch Office Solo : Jl. Ronggowarsito No. 8 Kota Surakarta Jawa Tengah 57111 Indonesia Telp: +62 271 664763 Fax : +62 271 661623 A Member of NongHyup Financial Group Seoul | New York | London | Hong Kong | Singapore | Shanghai | Beijing | Hanoi | Ho Chi Minh City | Jakarta PT Woori Korindo Securities Indonesia — Daily Morning Brief Page 55

© Copyright 2026