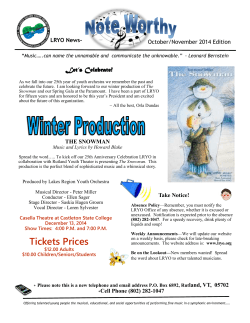

(hk) limited holdings limited