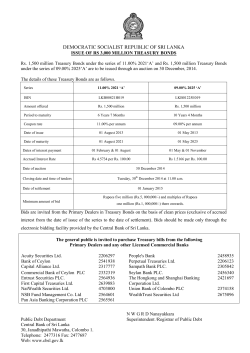

SamSon international PlC annual report 2013/14