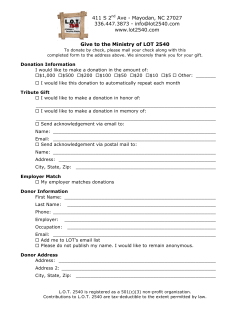

Payroll Withholding Donation Form

ARIZONA PRIVATE EDUCATION SCHOLARSHIP FUND, INC. Payroll Withholding Donation Form Yes, I would like to redirect my Arizona state income taxes to benefit private school students in the state of Arizona by making a donation from payroll withholdings to the Arizona Private Education Scholarship Fund, Inc. Donor Information Name (First & Last): Address: City: Email: Phone: Last 4 digits of SS#: Tax Filing Status: State: Zip: State: Zip: Details of Payroll Tax Withholding Redirect Tax Year of Withholding Redirect: Redirect Amount Currently Being Withheld: ☐ Yes ☐ No, redirect $ Employer Name: Contact Name: Contact Title: Employer Address: Phone Number: City: Email Address: Please send this completed form to APESF by mail, email or fax: Arizona Private Education Scholarship Fund, Inc. 6909 E. Greenway Parkway, Suite 240 Scottsdale, AZ 85254 Phone: Fax: Email: 480.699.8911 480.646.3196 [email protected] APESF will send you a confirmation of your donation as well as Arizona Form A-4C, Request for Reduced Withholding to Designate for Tax Credits, to sign and give to your employer. Recommendation Recommended Student: Recommended School: A.R.S. § 43-1089 NO TICE: A school tuition organization cannot award, restrict or reserve scholarships solely on the basis of donor recommendation. A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent.

© Copyright 2026