How to get started

PERFORMANCE How to get started be no need for an Innovation Manager when there is no real strategic goal for significant growth. This means, the more the Innovation Manager digs into operational business, the higher the risk to get into conflict with Marketing / R&D activities. An Innovation Manager, however, is of particular value when the company strategy aims for a transformation like a second pillar of its business. This is the point where Innovation Management can add value because here the well established knowledge and expertise within the company reaches its boundaries. Following is one successful example from a mid-sized fast moving consumer business of how to get Innovation Management initiated. Establish an internal network Making an announcement and publishing innovation newletters is important but by far not sufficient. Innovation Management lives from a broad acceptance within an organisation. And this acceptance must be gained through visibility and involvement. In an organisation comprised of 15 departments, within eight months, innovation workshops have been held. The effect was that the participants felt to be part of the innovation process. There is a saying that companies do not know what they know. And there is no “tool” that can solve this for an organisation. These innovation workshops are one efficient step to practical knowledge management by talking about (old and new) ideas and build an actionable opinion about an idea or concept. The Profile of an Innovation Manager It seems more of an advantage, not being too much of an expert in the field, i.e. to come more as an “outsider”. The person responsible for Innovation at Villeroy & Boch AG is an attorney by education. At first sight it seems better to promote somebody who has grown in a company mostly through Marketing or R&D and knows the company inside out. But probably this person already knows too much to maintain the necessary curiosity and naivety. The ideal Innovation Manager should demonstrate an abundance of soft skills and business skills. (see graph) Soft skills Focus, patience, listening skills, communication skills at all levels, ability to deal with apparent contradictions, authenticity, represent a role model for innovation, professional maturity, natural curiosity, a high frustration tolerance, credibility, enthusiasm, an excellent team player Bring together creativity and structure Creativity alone is of no business value. Ideas have to be developed further in a way a company can deal with it. A structured innovation process is a necessity. Business skills Strategic thinking, customer mindedness, customer value orientation, ability to maintain an outside view, a sense to scent business opportunities Identify innovation talents Innovation Management must not be seen as an ivory tower within the organisation. It is critical to identifiy talents to multiply innovation efforts. These talents need to be “nurtured” through shared interest and empathy for their ideas. Monetary motivation alone may attract the “wrong” people. Communication on all levels Innovation has a lot to do with thinking, trying and opinion building. It is equally necessary to effectively communicate to senior management as well as to individuals at all levels in the organisation. Especially for innovation in distributed environments- communication or for that matter ‘knowledge Management’ is especially necessary. All in all, the ideal Innovation Manager should live and breathe the passion for innovation. The Pre-requisites for successful Innovation Management Performance and reward frameworks Tie up the performance and reward systems to the goals set for the program. It is not necessary to reward in monetary terms, as Abraham Maslow and Victor Vroom depict in their hierarchy of needs and theory of Motivation respectively- self actualisation facilitated in terms of involvement of individuals, recognition and the fact that their inputs are taken seriously are an even greater and meaningful reward! Innovation Management must go in-line with a clear commitment to innovation of Senior Management. If this is only lived half-heartedly, it does not make sense to establish an innovation management framework on the first place itself. Innovation Management is not an excuse for mediocre Corporate Management. It does not keep senior management free from making necessary entrepreneurial decisions that are associated with risk as well. If strategy and leadership are not right, a new post for Innovation Management also can not make it right! Pitfalls of Innovation Management It is not a one stop shop! Having Innovation Management 28 organised as a department can send misleading signals. You can not break silos creating yet another silo! It may be seen as “creativity has its place in the organisation with no further input necessary”. It rather should be organised as an open network with no formal reports. Teams with members from various departments should be formed as necessary until the project is done. It is a continuos process.Innovation must not be focused on the “big idea” only. Innovation has to be managed in a way that there is a contiuous stream of new ideas. For the acceptance of Innovation Management, smaller but rapidly applicable ideas (“low hanging fruit”, quick wins) are as important as the more ambitious, riskier and profitable ideas. smaller and greater ideas but it certainly takes time with many underlying activities. Thus, particularly mid-sized companies may lose patience and ultimately lose interest. It always requires a strong, visionary management to allow the development of Innovation Management. Outlook As mentioned above, too much knowledge in the specific business field may become contra-productive for the quality of output of Innovation Management. Probably, the best way to keep Innovation Managers “sharp” would be a concept of job rotation. This means, by keeping the methodical skills in-house, Innovation Managers should rotate every three years with another business unit. It is a marriage of structure and creativity! Hence, Innovation Management cannot “produce” output in a predictable way. As said, Innovation has to deliver Authors: Dr. Hans Günter Boldt, Gunjan Bhardwaj 29 PERFORMANCE 2.1REVENUE MANAGEMENT AT DEUTSCHE POST concept of Revenue Management is about building up robust process and system environments, ensuring that services or products are billed in a complete, correct, timely and efficient way and cash is collected as fast as possible. Executive Summary Introduction How to improve corporate profitability in today’s highly competitive market environment when all opportunities of internal cost reduction have already been availed? Revenue Management has proven itself to be a beneficial concept to drive financial performance especially for companies with high transaction volumes which are seen to have leaking revenues to a significant extent. DHL LOGISTICS, one of the leading providers in logistic services and part of Deutsche Post World Net, initiated a global Revenue Management program. The general Companies with high transaction volumes such as telecommunications, airlines, logistics and parcel services face a high complexity of internal business processes and IT systems. The offer to cash process as a core process of a company often suffers from this complexity and lack of transparency. This results in services or products which have been rendered, not billed in a timely manner completely or correctly; adversely affecting the profitability and performance. Considering the fact that the costs of delivering services have already been 30 Talent Hits A Target No One Else Can Hit; Genius Hits A Target No One Else Can See. Case Studies – Arthur Schopenhauer German Philosopher incurred, so called “Revenue Leakages” have a direct negative impact on profit. Revenue Management aims at recovering those leakages in a sustainable manner. In conjunction with collecting billed debts as fast as possible, significant cash-flow increases can be realized. The concept of Revenue Management was invented by the telecommunications industry in the early 1990’s. Caused by the market pressure after deregulation in various countries, “telcos” had to maximize their profits but were hardly in the position to expand the customer base. It was observed that material amounts of cash were lost due to weaknesses in the processing of service data, inadequate processes and unreliable IT systems: data records got lost or were rated with lower tariffs than agreed. Following the “telcos”, internet service providers and airlines have also adopted Revenue Management concepts. Today Revenue Management gains importance across industries. A recent study of more than 150 German companies from various industries clearly states the potential: ● ● ● 70% of the companies estimate leakages up to 2% of yearly revenues; 80% of the companies confirm high benefit from conducted assessment of sub-processes and systems of the offer to cash process; Every 4th company is not satisfied with its internal level of Revenue Management. The aforementioned study confirms the trend by stating that 94% of respondents consider Revenue Management as business critical. Companies dealing with a high volume and low margin business simply cannot afford even small percentages of leaked revenues. The increase of the effective margin by fixing revenue leakages is tremendous for those businesses. 31 PERFORMANCE Downturn of Revenue and Margin Due to Revenue Leakages 10% All % 100% Attempted Events Opportunity Billable losses Events Potential Revenue Opportunity Cash Flow % 9% Billed Revenue 1% Services not Correct billed or Charge misbilled Adjustments Uncollectible Expense 1% 3% Allowance Adjustments Write-offs (Disputes) (Bad Debt) 1% Fraud 90% Collectible Revenue Typically cross-industry gap: 2 – 15% Standard services in logistics such as freight forwarding or warehousing have razor thin margins. Increasing number of error rates in invoicing results in lost revenues because the billing process in most companies is manual and/or non-standardized. “Especially in the contract logistics every site in every country is individual and the chances for lost revenues appear boundless. I am glad that we are in the right place at the right time to take up the challenge with our Revenue Management program.” Andreas Hespe, Senior Vice President and Head of Revenue Management DHL LOGISTICS. Revenue Management at DHL LOGISTICS The multi-phase Revenue Management program used at DHL LOGISTICS in cooperation with Ernst & Young started in 2005 with a profound analysis of the current business situation and the probabilistic assessment of revenue leakages. The focus was on process evaluation by walkthroughs of the complete offer to cash process and by system analysis based on mass data reconciliation. Key root causes for revenue leakages were identified through testing historic invoices. A selected sample of invoices was reconciled against the underlying agreements and services delivered. During the 5 months of assessment phase at the Company’s stations worldwide the gap between the potential and realized revenue was quantified and subsequently a business case for a global revenue management program was established. DHL is the global market leader in international express, overland transport and air freight. It is also the world’s number one in ocean freight and contract logistics. DHL offers a full range of customized solutions - from express document shipping to supply chain management. DHL LOGISTICS with its business units DHL Global Forwarding, providing road, air and ocean freight forwarding services and DHL Exel Supply Chain as a full service contract logistics provider is characterized by very complex and network driven operational processes. Massive customer base spread across the globe sets challenging demands on DHL’s service models. The variety of services ranges from in-plant supply activities at automotive factories to the management of customers’ web content management systems and sales support. On one hand, some services such as forwarding activities are time critical and require for real-time interaction between stations worldwide making standardized operations key to success. On the other hand, services like contract logistics with highly customized supply chain solutions jeopardize standardization. In general Revenue Management programs, in a very short time, can offset the efforts with additional revenues and hence have a very strong business case. To leverage the full potential at DHL LOGISTICS, it was decided to roll-out the process and systems improvements on a global level. The implementation in top-25 countries of the Company started in mid program. Continuously 32 In General Revenue Management Programs, In A Very Short Time, Can Offset The Efforts With Additional Revenues And Hence Have A Very Strong Business Case. 33 PERFORMANCE Typical Offer to Cash Process and Root Causes for Revenue Leakages Potential Revenue • • • • Service Definition Contractual Arrangement Incorrect data formats Inconsistent customer data Lack of error processing Incorrect presentation of customer and conditions hierarchy Customer Care • Interface problems • Surcharges are not applied • Errors in capturing service data • Manual calculation errors • Establishment of a contractual relationship not ensured Rating & Billing 2006. During the roll-out, the project team defined and implemented work streams to address weaknesses in different stages of the offer to cash process. Besides local improvements in the countries, global initiatives were initiated to cover areas of improvement within the network. Some of the examples of those initiatives include the description and definition of billing and documentation procedures, improvement of master data quality and set-up of information flow standards between origin and destination stations. The experience gained during the in-depth study of sub-processes and systems was taken into account in strategic considerations about standardization and centralization of parts of the billing processes. Efficiency aspects like increased manual or double work were another by-product having a mid- or long-term profitability potential. System Input Conditions Management Revenue Realized Capturing Service Data Also important is to have sound indicators to assess continuous improvements. Examples of those Key Performance Indicators (KPI) include the period of time to bill and bill to cash, number of unbilled shipments or number of invoices per FTE. Ideally, every sub-process of offer to cash should be equipped with a set of KPIs to identify deviations in the process from target values. In the DHL project, sustainability was addressed as one of the key elements of the overall Revenue Management program. Continuously fine-tuned follow-up activities on improvement have become a regular feature. Announcing a Revenue Management organization, DHL LOGISTICS finally put Revenue Management on the strategic agenda. Financial returns and internal efficiency are not the only gains: customers also recognize and appreciate billing transparency and accuracy. Revenue Management should not be considered as a oneshot activity. Changes in the service offerings, market or customer structure or in the IT environment demand an ongoing monitoring and assessment of possible revenue leakages. Hence full potential can be unleashed through a continuous and sustainable program. Hespe outlines: “Keeping in mind that the LOGISTICS division generates revenues of approx. 25 billion in 2007, a sustainable recovery of even a small revenue percentage results in significant financial benefits.” After a year of great efforts taken to roll-out the program towards a robust process framework, benefit and recovery calculations draw a clear picture. At a business of this The support of Executive Management is key to success and therefore a business case outlining the improvements and subsequent returns is a must. 34 size, program returns in the range of high double digit million Euro are achievable over the next two years. Amadou Diallo, CFO DHL LOGISTICS is convinced: “Revenue Management is real value-added to the business. We listen to the business needs and possible problems. The mindset changes from the operations to top management at all levels of the organization – a great leverage for DHL LOGISTICS.” Conclusion The showcase of DHL LOGISTICS has proven the valuable concept of Revenue Management. Developed as a management tool for telecommunication companies, it turns out today to be one of the most beneficial concepts to improve the financial performance, especially for the low margin and high volume industries. We believe that upcoming years will show considerable progress in embedding Revenue Management. Authors: Andreas Bonnard, Matthias Heintke. 35 PERFORMANCE 2.2POST-MERGER INTEGRATION: FINANCIAL STATEMENT CLOSE ASPECT IN ENEL developing a set of recommendations as well as a design of a program to support implementation. Slovenske elektrarne, the target company, was thus able to introduce a number of improvements into its finance and accounting processes and get prepared for new requirements. Information on transaction In summer 2005, the Italian company Enel S.p.A. (hereinafter - the Acquirer) was about to complete its acquisition of Slovenske elektrarne, the Slovak energy company (hereinafter - the Target). This acquisition was part of the Acquirer’s strategy to position itself firmly in the Central and Eastern European markets in its core business – power generation. Acquirer is Italy’s largest company in the power sector, and Europe’s third-largest listed utility by market capitalization. Listed on the Milan and New York stock Executive Summary Post Merger Integration activities are usually commenced after transactions are made. The Management of Enel decided to improve capabilities of its acquisition target in financial reporting before completing an upcoming transaction. All finance & accounting-related processes were reviewed in terms of accuracy, timeliness and compliance with IFRS. The review was followed by 36 The Pretension Is Nothing; The Performance, Everything. – Leigh Hunt English Poet and Essayist exchanges since 1999, Enel has the largest number of shareholders of any European company, at some 2.3 million and market capitalization of about EUR 50 billion. nuclear, hydro and thermal, which guarantees electricity generation at highly competitive costs. Integration of financial statement closing process On February 17th, 2005, the Government of the Slovak Republic signed an agreement on the sale of a 66% share in the Target to Acquirer (rest 34% is owned by the National Property Fund of the Slovak Republic (“FNM”). The closing of the transaction took place on April 27th, 2006 for a consideration of about €840 million. The project goal was to ensure that at the time of acquisition the Acquirer would be able to easily consolidate the Target using reliable IFRS financial statements in a timely manner. The focus of the multinational project team with Czech, Slovak and Italian team members was defined as to review, assess and recommend improvements in the area of accounting and reporting processes at Target. In total, 51 sub-processes were identified for review and analysis. These were categorized into 9 major finance & accounting related processes. The transaction marks Acquirer largest international acquisition of generation capacity. Target is the major power generating company in Slovakia (83% of the domestic market) and one of the largest in the Central and Eastern Europe, with approximately 7,000 Megawatt capacity. Its well balanced asset portfolio includes 37 FSCP Process Improvement Priorities Higher importance but possible to change Higher importance but difficult to change High G. Enhancing the IFRS Adoption process A. IT Performance improvements F. Accounting principles & procedures (How) D. Competencies review (Who, what) Importance C. Data processing improvements E. Accounting processes set-up & Mgmt (When) B. IT Governance Low H. Other Low to medium importance and difficult to change quickly Low Low to medium importance and possible to change in short-term Readiness to change Project teams worked within the first 5 weeks to understand the processes that were to be improved. The analysis was influenced by the fact that the Target’s operations were spread across the country and significant part of the information needed had to be gathered from decentralised locations. High The next phase of the project focused on identifying the redundancies and shortcomings in processes. Based on identified issues, recommendations for improvement with special attention to on-time delivery of reliable financial information were developed. In early September 2005, the recommendations were presented to and approved by the Steering Committee. Specific model for prioritisation of initiatives was developed in order to enable effective implementation: The analysis included numerous structured discussions with key personnel, review of the existing documentation, assessment of the relevant IT systems and comparison of the current situation with leading practices. At the end of the analysis phase, the team reviewed and described relevant processes including document flows, responsibilities of involved departments and respectful timelines. Recommendations addressed a range of redundancies related to the processes/procedures execution, allocation of responsibilities as well as information systems. All of the recommendations corresponded to a short- or midterm time horizon. The approach used was based on the current thinking on process–based improvements in corporate performance. Left is an illustration of one of the processes of the Target 39 PERFORMANCE The set of recommendations was discussed with the management of the Target and a detailed implementation plan was prepared. Most of the implementation efforts were then executed by the Target’s management. In late December 2005 and January 2006 project was reviewed to assess progress achieved in several critical areas. Conclusion As a result of the project, Target was able to fulfil the consolidation requirements of the Acquirer. The project faced numerous intercultural interactions (Italian, Slovak and Czech) and required cooperation of teams from various countries. The project was a good learning experience for the Acquirer in terms of integration of financial and accounting processes in event of a merger. Implementing such a project before the transaction allowed the Company to save a lot of time and resources on one hand and on the other hand considerably reduce the risks of non-compliance with reporting requirements of the joint company. Author: Csaba Kiraly 40 41 PERFORMANCE 2.3BEST OPERATIONAL PRACTICES production, internal effectiveness and resource utilization. UC RUSAL started a process of identification of the best operational management practices, in order to expand it over all business units. Introduction Exploring and expanding best operational practices for operating units of United Company RUSAL United Company RUSAL, the world’s largest producer of primary aluminium and alumina, was established in March 2007 following the merger of assets of three companies: RUSAL, previously the third largest global aluminium company; SUAL, one of the world’s top ten players in the aluminium business; and the alumina assets of Glencore, Switzerland; which had a wide range of products and a big scope and geographical coverage of activities. The Company has divisional structure by groups of products produced: Alumina, Aluminium and others. Allocation of operational business units of large global corporations in different countries often results in lack of standardization of business processes. Some of the biggest challenges are the operational, administrative and technological management. This leads to differences in the level of effectiveness of different business units. Those having better practices and processes are ahead of others in terms of important parameters of 42 Some Of The Biggest Challenges Are The Operational, Administrative And Technological Management. United Company RUSAL produces 4 million tons of aluminium and 11.3 million tons of alumina every year. It accounts for almost 12% of entire global output of primary aluminium and 15% of the world’s alumina production. Spread across 19 countries in 5 continents, the operations and offices of the Company employ 100,000 people. United Company RUSAL’s assets include bauxite and nepheline ore mines, alumina refineries, aluminium smelters, casting business for alloys production, aluminium foil mills and production of aluminium packaging materials as well as powergenerating assets. United Company RUSAL is comprised of 14 aluminium smelters, 10 alumina refineries, 4 bauxite mines and 3 foil mills. business units of Alumina Division were taken for analysis: Nikolaev Alumina Refinery and Guinea Company Refinery, Guinea Republic. Nikolaev Alumina Refinery (hereinafter - NGZ) situated in Ukraine is one of the largest alumina producers in Europe. Commissioned in July 1980, NGZ was producing 1 million tones of alumina annually. Today, the refinery has expanded its production capacity to 1.4 million tons per annum. NGZ is supplied with bauxites from Australia, Brazil, Guyana, Guinea, India and uses Bayer process technology to refine alumina from bauxites. The management of the Alumina Company de Guinea (hereinafter - ACG) was taken over by RUSAL in 2002. In April 2006, RUSAL and the Government of Guinea reached an agreement on privatization of the refinery. The estimated capacity of this refinery is 780,000 tons In the end of 2006, Alumina division of RUSAL started the initiative on raising internal effectiveness of its operating units – Alumina refineries. Two operating 43 PERFORMANCE of alumina and 2.8 million tons of bauxite per annum. ACG is one of the largest employers in Guinea with 1,099 people. ACG also uses the Bayer process to refine alumina from bauxite. Both plants use the same process technology of alumina production and their technological and production processes seemed to be similar. The plants have similar types of equipment, however the productivity was observed to be different: Parameter Production volume, tons 000 Number of production staff Tons per production worker NGZ 1 440 376 3.83 One of the popular productivity indicators of the operating unit is the output quantity of a product per production worker. Two main groups of factors influencing the number of production workers were identified: Equipment Local business practices Other Other detailed analysis of each job position of production staff personnel in terms of regular activities performed. ● Basic types and number of equipment units used in each sub-process; ● Number of production staff for each of the sub-processes. As a result of the second phase the following conclusions were made: Production management system ● There were differences in the set of subprocesses for each plant related to the specifics of technological approach to production; ● For several sub-processes, production equipment used was incomparable in terms of activities performed to serve that equipment. To prepare for the following project phase, all differences related to incomparable processes and sub-processes were summarised. Before a more detailed analysis on activity level in next phase, the project team developed the list of factors seriously influencing the number of production staff of plants: Qualification of personnel Division Management decided to determine the influence of factors on the number of production staff, in order to raise productivity. Another goal was to start the process of distribution of the leading operational management practices among different operating business units. In order to achieve the objectives, a special approach was developed based on the analysis of the processes, subprocesses and activities performed by production staff of both plants: ● ● During the second phase, the project team moved further with the analysis. The elements of analysis were the sub-processes of processes which existed on both of the plants, in order to identify the following elements: Raw materials Local legislation analysis of sub-processes for comparable high level processes; In order to complete the first phase, the project team analyzed the production schemes of both plants and discussed them with the management to verify the conclusions made on the set of processes for each plant. Results of the first phase showed that despite the similarity of the overall approach to technology, there are differences in the set of processes: one plant had several processes that did not exist in the second.That allowed to identify the first differences in the number of production personnel. ACG 640 153 4.18 Technology ● ● Specifics of labour legislation of both the countries, i.e. requirements to specific job positions that should exist on the plant in addition to the operational business needs (for example, special positions related to job safety and security); ● Specifics of ecological norms and requirements both countries; ● Technical control systems of equipments. During the final phase, a detailed analysis was made of activities performed by each job position involved in high level analysis and comparison of production processes and areas for each of the plant; 44 comparable sub-processes. The results also included a list of non-value adding activities and proposed changes for manual operations with special technological equipment. improvement for both plants were outlined: ● Re-allocation of responsibilities between owners of processes and sub-processes; ● Broadening of the area of responsibilities for the production middle-management; ● Changes to the structure of production divisions related to centralization of support functions; ● Changes to the systems of communication between production and support functions. ● Changes in Learning and Development system of personnel. Based on the results of the final phase. the project team has identified the following additional factors and conclusions: ● Specifics of raw materials required to perform more activities on one of the plants which needed additional production personnel; ● Two main functions of both plants – management of technology and production – have different levels of integration. That led to the need of additional activities related to communication between personnel of the functions and resulted in additional staff required; ● Differences in distribution of activities between job positions formed different approaches to the level of qualification required; ● Learning and Education systems of the plants were not the same due to different requirements to job qualifications; ● Extensive use of outsourcing for support functions such as cleaning, maintenance and repairs used on one of the plants resulted in serious advantages in productivity. Based on the results of the areas identified, an action plan was developed, including initiatives related to changes in management structures of the plants, broadening areas of responsibilities for middle-management, changes in operation modes and internal outsourcing of several support functions. To avoid possible risks of fall in production, risk factors and possible ways to their mitigation were determined as well. Specific KPIs were developed for the managers of both plants in order to align the action plan with the company’s strategy. Conclusions Companies with several business units operating in different environment (country, region) and using the same technology often have areas of potential improvement of productivity. Those areas are related to specific business practices used in management of operations within business units. The amount of productivity reserves can be estimated at about 20% depending on the set of external and internal factors involved (see Figure 2). The results of final analysis of differences in the number of personnel with respect to influencing factors were as presented: Principal differences in processes and used production equipment Manual operations used instead of technology Differences in the controlling zones and set of activities performed by personnel Special set of equipment served separately in one of the plants Different approaches to calculations of workforce reserves Factors related to differences in the number of production staff for similar plants can be found only after detailed analysis of the approach to management of production and support functions of each plant. In most cases the analysis should be performed on an activity level. In order to receive the best cost/benefit output ratio from the described projects, project teams should consist of professionals in the area of business process analysis supported by industry specialists. Other factors Potential productivity reserves are also seen within the processes that were incomparable due to principal differences in production. However, identification of those reserves would require much more time resources than comparative analysis of comparable processes. Author: Sergey Zaborov Information from official site of RUSAL company - http://www.rusal.com/index.php?lang=eng &topic=1&subtopic=204 As a result of the project, the areas for potential 45 PERFORMANCE 2.4 MIGRATION OF HR SERVICES study, these objectives will be referred to as improving efficiency and effectiveness. Due to several reasons not all migration projects and Shared Service Centers achieve their original objectives. In this case study, the important role of process descriptions will be demonstrated. Besides a project approach and plan, process descriptions are essential for success. Describing current processes can be a solid basis for a successful migration project, as it contributes to all the different stages of such a project. Both the product of describing the processes, the process descriptions, as well as describing the processes itself, are beneficial in a migration project. Migration of a Multinationals’ HR Services: The role of detailed process descriptions Introduction During recent years, a lot of multinationals have moved various processes and activities to Shared Service Centers all over the globe. The objective of this is twofold in most cases. Firstly, moving processes and activities to Shared Service Centers enables companies to lower the costs involved. Secondly, it improves the quality of the processes by driving out inefficiencies. In the remainder of this case This case will show the steps that need to be undertaken in moving forward from the current state processes to designing future (to be) processes. As such, it will show 46 A Lot Of Multinationals Have Moved Various Processes And Activities To Shared Service Centers All Over The Globe. the benefits of describing and documenting processes in a migration project. To show these benefits, a real life case of a multinational will be discussed. This multinational decided to move its HR Services to existing Finance Shared Service Centers. In this case HR Services includes all operational processes related to the expatriation of employees. as well as the product of process mapping and analysis is a solid basis for migrating processes and activities to a Shared Service Center. As such, process descriptions of both current and future states contribute to making the migration project a success. Section 2 provides further background on the decision of this multinational to migrate HR Services. This will give insight into the strategy of HR Services as well as the strategic drivers for migrating HR Services. Section 3 describes the “as is” situation (the current state at the start of the project) and the approach of the project. Section 4 will discuss the different steps in the project of constructing ‘to be’ processes (future state) and highlights the benefits of each step. After reading this case study it should be clear to the reader that the process The executive decision to offshore The HR Services department of this multinational is part of the corporate HR structure within the Group. HR Services provides all services other than personnel services to all employees (100.000+) of the Group. The department also manages all organizational activities regarding expatriation. The processes differ from post-recruitment on boarding to payroll and from Visa management and children’s educational assistance to repatriation. HR services used to deliver all these Background 47 PERFORMANCE (remote) services from four different locations with satellite offices in specific countries. The subject of the migration, International Mobility services, relates directly to all Expatriate related activities. The end-toend expatriation process requires intensive interaction between country HR in both the sending and the receiving country, the line management in both countries, and the HR Services teams involved. Next to this HR services interacts with external providers e.g. movers, embassies, consulates, real estate agents etc. There are a lot of laws and regulations that impact the expatriation process which differ per country and sometimes per individual case. Performance Indicators. These KPI’s were created by the business, because the Shared Service Center would deliver services to the business and charge the costs to them. Finally the migration also facilitated an improvement of risk management and compliance by introducing tighter (management-) controls and more robust processes. Non value adding controls are eliminated. The as is situation and project approach The as is situation In deriving a project approach for migrating processes and activities to a Shared Services Centers it is key to take into account the current state of the organization and the processes as well as the barriers to overcome. At the time the executive decision to offshore was made, within HR Services multiple departments in different locations were performing the same tasks. Little documentation on processes as well as working procedures were in place and the level of standardization was low. In 2006, the HR executive board member of this multinational created a strategic roadmap for improvement of all main HR functions including HR Services. For HR Services the objective was set to improve both efficiency and effectiveness. HR Services composed an improvement plan that included the restructuring and regrouping of a large part of its activities. As a result of this approach, the project to setup regional HR shared services centers (off-shoring) was started. In June 2006, it was decided that the International Mobility activities would migrate as a pilot project to the two regional Shared Services Centers in Eastern Europe and South-East Asia. Important barriers to overcome were motivation and commitment of existing staff. Their knowledge and experience was crucial in this project, especially because there was little documentation about processes and working procedures. Strategic drivers for the decision There were various strategic drivers for off-shoring HR Services which all boil down to reaching the objective of an increase in both efficiency and effectiveness. Firstly, this multinational already had a number of regional Shared Service Centers for the finance function around the globe. Adding other functions, including HR, to these Shared Service Centers enabled the multinational to make good use of these investments (eg. infrastructure, office space). This would contribute to the objective of increasing cost efficiency, without all the investments needed for building a new Shared Service Center. Secondly, a Shared Service Center forced a review of the operating model. The new operating model facilitated the centralization of functions and promoted scalability. Centralization of processes provided the opportunity to standardize processes and to improve knowledge sharing. The bundling of processes and activities would create the environment for specialized skills and thereby encouraging the development of advanced processes. By doing both, efficiency and effectiveness would be increased. Other risks that had to be taken into account were those related to recruiting and training new people, language as well as cultural barriers and the integration into the Finance Shared Service Center. The project approach Based on the current status of documentation of processes and inefficiencies, the approach was chosen to first document, analyze and start quick-fixing processes. The second step would be to change them to future state (new design) and move them to a Shared Service Center. The approach chosen was to go from as-is to to-be with one intermediate state. Advantages of an intermediate state are improved understanding of the processes by the current staff, the creation of a shared vision on how to make this all happen, increased awareness of process logic and steps and, last but not least, the immediate integration of best practices already in the intermediate state of process design and implementation. To overcome the barrier of all knowledge and experience resting only in the heads of the current employees, a few employees became change agents for the migration. Their knowledge and experience was used to map the processes and train the new employees. Furthermore, raising a Shared Service Center creates the opportunity to increase performance by introducing measured Service Level Agreements and Key 48 Describing the processes enables identifying quick wins As a result of good communication and understanding of the need of process descriptions, a very useful phenomenon was triggered. The interviews and questions on why current processes were formed like this made the teams aware of the actual shortcomings of the current processes. The fact that there was no description for a number of processes and the fact that knowledge and experience had to be transferred immediately improved the readiness to help setting up such a description. In addition, a list of improvements, the so called quick wins, was created and prioritized (filtered out and ranked in accordance to the high level future state design and best practice). These quick wins were almost all fairly simple adjustments to the existing processes making them more logical and closer to best practice. In order to improve the process performance controllability and measurability, controls were integrated in the descriptions of new processes. There was a strong differentiation between business controls and process controls. Business controls are content driven whereas process controls are referring to process quality parameters (eg. speed, throughput time) Finally, in the new process design a lot of attention was given to the connections and interfaces between headquarters and the Shared Service Centers. These connections and interfaces were described in detail and agreed upon. This process of communication and mutual agreement on the content of the processes was the key to the success of this project. The project Creating an intermediate ‘as is’ to discuss current processes The changes brought to the table by the different teams during the workshops made it clear that a big gap would exist between as-is and to-be. This would entail two major challenges: Introduction Above, the approach chosen for the project was explained. In the following sub-section, different steps in the process from “as is” towards “to be” as well as their benefits for the migration are described. As noted earlier, the awareness around processes themselves as well as the products of process mapping contribute to the success of the overall project in different stages. This sub-section describes these steps chronologically and is meant to show how the process of describing processes as well as the product (process descriptions) play a role in a migration project. Starting up the project creates a shared vision and common language As already discussed, the basis for this international project was a proven methodology. One element of the project methodology documentation is specific attention to the logic of the plan. Logic crosses borders and improves understanding. The fact that a single document was created and approved by the senior management created both a shared vision and the use of a common language. A specific chapter, including analysis and improvement, was dedicated to the process description and the roadmap to the future state design. The roadmap ensured the commitment of the team and understanding of all the work to be executed. By agreeing on conventions in describing processes, a common language regarding processes was created and communicated, which enabled everybody to interpret the process design in an identical way. The process descriptions consisted of a detailed description of process steps, information input and output, systems used and controls. 1. The training materials based on the ‘to be’ would require extensive preparation of the trainers. The trainers being the current top performers in the teams would not be able to bridge that gap. 2. During the shadow and parallel working phase this gap would create huge alignment issues. 3. Therefore it was decided that an intermediate state would be implemented which was close enough to the ‘as-is’ for people to stay connected but also structured and improved enough to close the gap significantly between the intermediate state and the ‘to-be’ state. In the intermediate state the identified quick wins were implied. Designing new processes In designing new processes the as-is processes were extremely useful. Putting them all together made it possible to see the relationships between the processes so that inefficiencies could easily be identified. Examples of existing efficiencies were doubling of tasks, lack of controls and non value adding controls. As there were doubling of tasks sometimes best practices were identified regarding certain processes. In order to make the process performance better controllable and measurable, controls were integrated 49 PERFORMANCE in the description of new processes. Regarding controls there was a differentiation between business controls and process controls. Business controls are content driven, process controls are referring to process quality parameters (eg. speed, throughput time). Furthermore, in the new process design a lot of attention was given to the connections and interfaces between the headquarter and the Shared Service Centers. In some processes the central headquarters played an active role as well. The connections and interfaces were well described and agreed upon. Training new staff Another objective of describing the processes, besides identifying potential improvements, was to document current work processes in order to produce training material for future employees. In order to achieve this, description of the processes was done in a very detailed manner. All processes were described following the same conventions, so that as a consequence there was one ‘language’ in describing the processes. Once all the processes were documented, workshops were organized to analyze the processes and its redesign. This way, doubling of tasks became clear and could be removed. Best practices were chosen and controls were optimized. Other benefits Besides the benefits named above, detailed process descriptions (including IT systems used) can be beneficial in creating a new IT architecture and defining required skill sets for the recruitment of new staff. Conclusion With this case study it is intended to show the different benefits of describing processes in a migration project. The product of describing processes as well as the process of describing processes will help such a project to be successful. The products of describing the processes are uniform and detailed process descriptions which serve various purposes in different stages of a migration project. Firstly, in preparing the descriptions a shared vision and common language is raised. Secondly, describing processes make quick wins visible. Furthermore, they serve as a solid basis to redesign processes and produce training materials for new staff. As such they can make an important contribution to a successful migration of processes and activities to a Shared Service Center. Author: Esther de Graaf 50 Markus Heinen is Leader of Business Advisory Services of E&Y for Germany and Central European Area Daniel Gonzalez Mueller is a member of the Performance Thought Leadership Group of E&Y Germany Iris Neundorf-lida coordinates the Performance Thought Leadership Group of E&Y Austria Frans Roozen is a Professor in Vrije University of Amsterdam Bert Steens is a Professor in Vrije University of Amsterdam and the Leader of Business Advisory Services of E&Y in Netherlands Gunjan Bhardwaj is the coordinator of the Performance Thought Leadership Group for Central European Area for E&Y Hans Guenter-Boldt has held management positions in R&D, Marketing and Innovation Management with Procter & Gamble, Kimberly-Clark, Melitta Haushaltsprodukte and Nanogate AG. He is now Innovation Director at Deutsche SiSi-Werke GmbH & Co. Betriebs KG Andreas Bonnard is a Partner in Business Advisory Services in the Frankfurt office of E&Y and an expert on Revenue Management Matthias Heintke is a Manager in Business Advisory Services in the Frankfurt office of E&Y Csaba Kiraly is the coordinator for the Performance Thought Leadership Group in E&Y for Czech, Slovakia, Croatia, Slovenia and Hungary Sergey Zaborov is the coordinator of the Performance Thought Leadership Group in E&Y for CIS Esther de Graaf is a Senior Advisor in the Rotterdam office of E&Y 51 Chief Patron: Markus Heinen Chief Editor: Bert Steens Editors: Gunjan Bhardwaj Sergey Zaborov Design, Layout & Style: Swati Singh Arjun Kariyal If you wish to contribute with Articles on Business Performance or comment your views on the Articles published, please contact: Germany Gunjan Bhardwaj Mittlerer Pfad 15, 70499 Stuttgart, Germany Tel: +49 (711) 9881 21732 Fax: +49 (711) 9881 15550 Mobile: +49 (160) 939 21732 Email: [email protected] Website: www.de.ey.com Baltics Ilana Ekbauma Kronvalda bulv. 3-5 LV-1010 Riga, Latvia Tel: +371 6 704-3834 Fax: +371 6 704-3802 Mobile: +371 2 9447-997 Email: [email protected] Website: www.ey.com/lv Austria Iris Neundorf-Iida A-1220 Wien, Wagramer Str. 19 Austria Tel: +43 1 21170-1184 Fax: +43 1 2162077 Mobile: +43 699 1888 1184 Email: [email protected] Website: www.ey.com/austria Czech, Slovak and Hungary Csaba Kiraly Karlovo nam. 10, 120 00 Praha 2 Czech Republic Tel: +420 225 335 573 Fax: +420 225 335 222 Mobile: +420 731627266 Email: [email protected] Website: www.cz.ey.com CIS Sergey Zaborov Sadovnicheskaya nab., 77, Building 1 115035 Moscow, Russia Tel: +7 495 641 2924 Fax: +7 495 755 9710 Mobile: +7 495 760 5710 Email: [email protected] Website: www.ru.ey.com Switzerland Christian Gasplmayr Brandschenkestrasse 100 8000 Zürich, Switzerland Tel: +41 58 286 32 16 Fax: +41 58 286 42 18 Mobile: +41 58 289 32 16 Email: [email protected] Website:www.ch.ey.com ERNST & YOUNG Netherlands Astrid Ros Boompjes 258 3011 XZ Rotterdam The Netherlands Tel: +31 (0)10 406 8178 Fax: +31 (0)10 406 8274 Mobile: +31 (0)6 2908 4855 Email: [email protected] Website:www.ey.nl

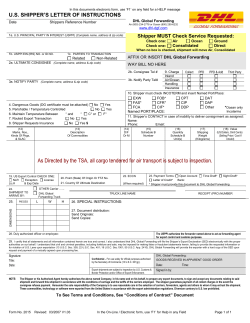

© Copyright 2026